2025 Car Insurance Guide for Young Drivers: Actionable Tips to Lower Your Rates

Published on July 28, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

2025 Car Insurance Guide for Young Drivers: Actionable Tips to Lower Your Rates

Introduction

If you’re under 25, insurers categorize you as higher risk—driving up your car insurance for young drivers rates. But smart choices and strategic planning can cut costs without sacrificing coverage. In this guide, you’ll learn how to:

- Understand key factors driving young driver premiums

- Meet or exceed your state’s minimum liability requirements

- Stack multiple discounts for maximum savings

- Employ seven proven strategies to shrink your young driver premiums

- Choose the ideal insurer and program for your unique profile

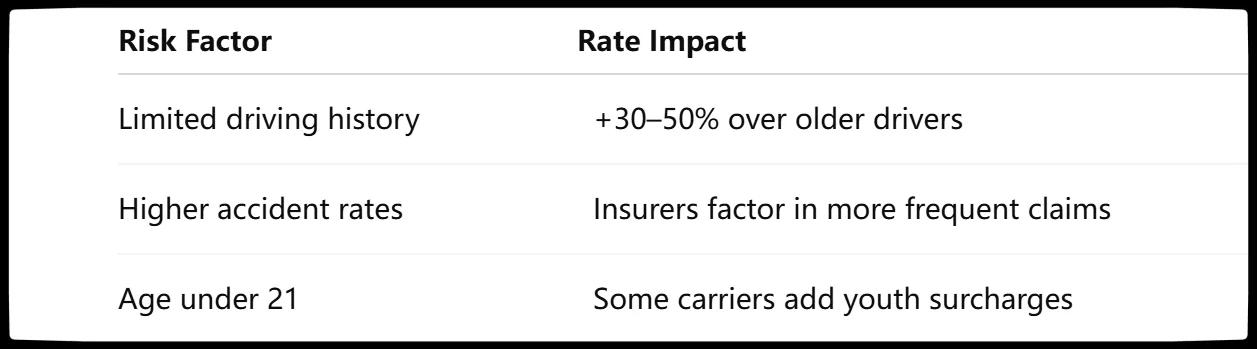

1. Why Young Drivers Face Higher Premiums

NAIC. (2025). Insurance Industry Snapshots and Analysis Reports – Industry Snapshots 2025 [Webpage].

Tip: Build driving experience in low-risk scenarios—practice in empty lots or through supervised programs to gradually reduce your risk profile.

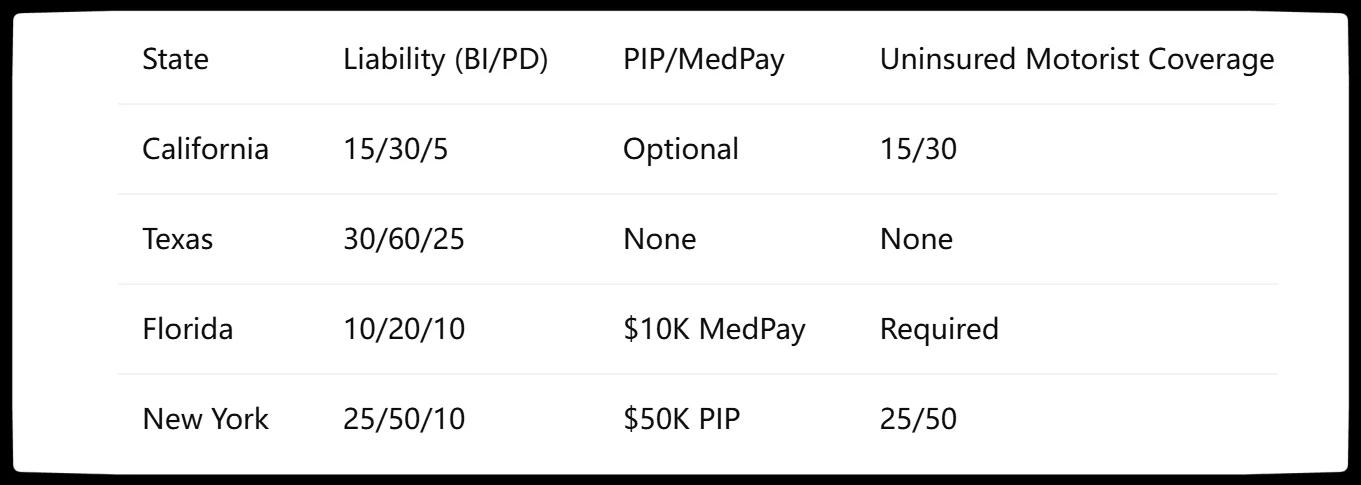

2. State-Mandated Coverage Minimums

NAIC. (2025, February 14). Advancing State-Based Regulation at Home and Abroad: NAIC Announces 2025 Initiatives [News release].

Action: Always purchase at least 25% more coverage—higher limits can mean lower per-dollar cost and better protection if you’re at fault.

3. Top Discounts to Stack

- Good Student: 15–25% off for maintaining a B average or higher

- Driver Education: Up to 10% off after completing an approved safety course

- Telematics Programs: Save up to 30% with usage-based apps (e.g., DriveEasy by GEICO)

- Multi-Policy Bundling: Combine auto with renters or life insurance for 5–15% savings

- Low Mileage: Blue-light discounts for less than 10,000 miles/year

- Vehicle Safety Features: Anti-lock brakes, airbags, and anti-theft devices can trim 5–12%

- Family Plan: Stay on a parent’s multi-car policy to leverage group rates

Tip: Confirm eligibility for each discount annually; some require ongoing proof (e.g., good grades).

4. Seven Proven Strategies to Lower Your Premiums

- Raise Your Deductibles: Opt for $1,000–$1,500 to cut 10–20% off your premium

- Maintain a Clean Record: One ticket can hike rates by 10–20%; defensive driving courses can remove points

- Opt for Telematics: Enroll in safe-driving programs to earn monthly rate reductions

- Choose a Safe Vehicle: Select IIHS Top Safety Pick models; they qualify for lower risk ratings

- Limit Modifications: Avoid aftermarket rims or performance parts that signal higher risk

- Shop Around Annually: Compare quotes from at least five insurers—rates fluctuate more for young drivers

- Pay Annually: One-time payments often come with a 5–10% discount compared to monthly installments

Implement these steps together to create compounding savings—small changes add up to significant rate reductions on your car insurance for young drivers.

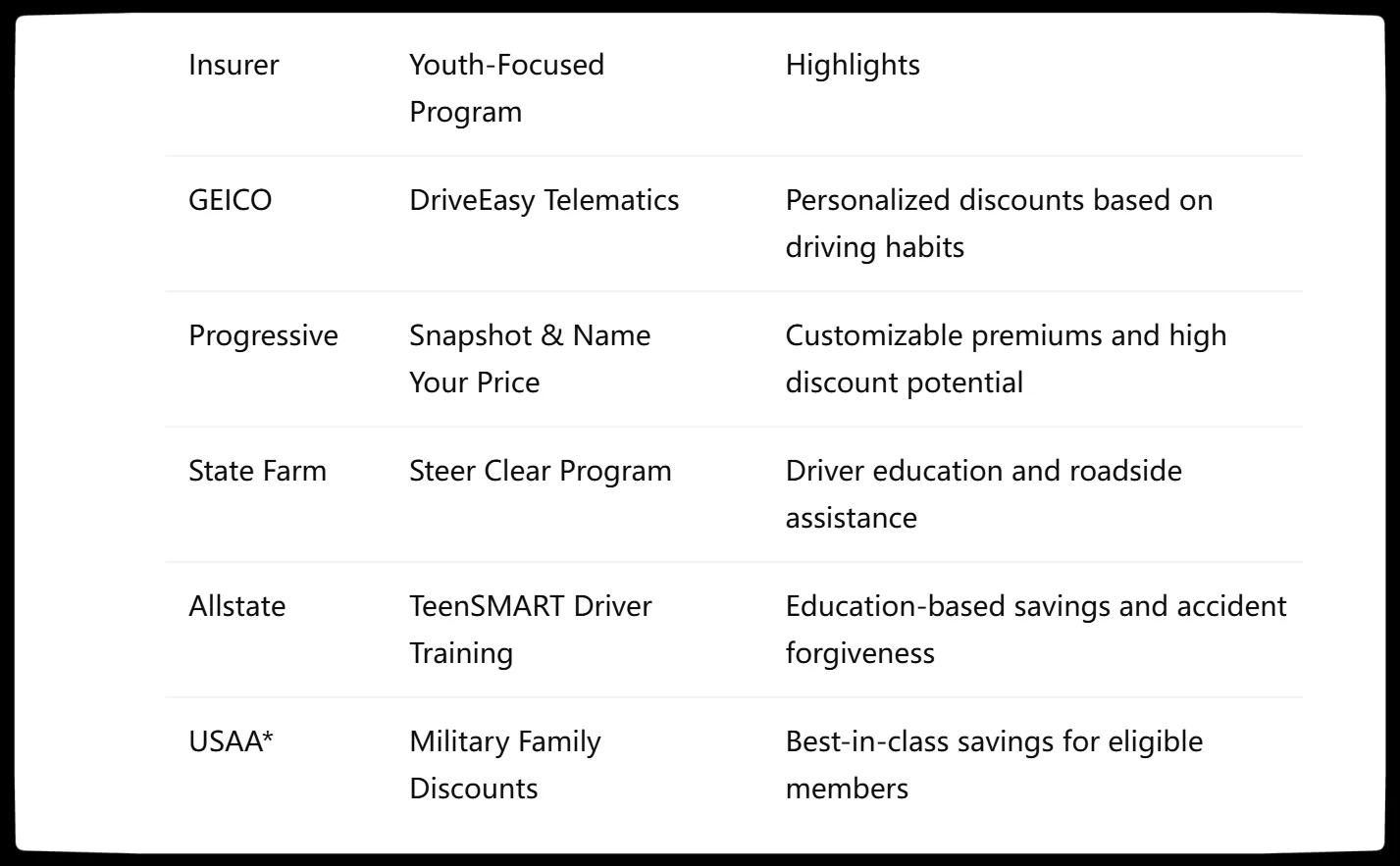

5. Choosing the Right Insurer & Program

NAIC. (2025). Publications – Statistical and Forecasting Tools for Insurance Industry [Webpage].

Action: Request customized quotes emphasizing telematics and good-student discounts to find your lowest possible rate.

Conclusion

Lowering your car insurance for young drivers rates in 2025 starts with understanding risk factors, meeting state requirements, leveraging discounts, and choosing the right insurer. By applying these actionable strategies, you can secure comprehensive coverage that fits both your lifestyle and budget.

You Might Also Like

Compare Car Insurance: A Step‑by‑Step Guide to Finding the Right Policy (Expert 2025 Update)

Jul 29, 2025Maximize Your Savings: 17 Car Insurance Discounts and How to Qualify in 2025

Jul 28, 20252025 How to Find the Best Car Insurance Near You

Jul 28, 20252025 SR‑22 Car Insurance Explained: Requirements, Costs, and Expert Tips

Jul 28, 2025Understanding Non‑Owner Car Insurance in the US: An Ultimate Guide

Jul 28, 2025