2025 SR‑22 Car Insurance Explained: Requirements, Costs, and Expert Tips

Published on July 28, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

2025 SR‑22 Car Insurance Explained: Requirements, Costs, and Expert Tips

Introduction

An SR‑22 is a Certificate of Financial Responsibility your insurer files with the DMV to reinstate driving privileges after serious violations. If you’ve had a DUI, driven uninsured, or accumulated multiple infractions, you’ll need SR‑22 insurance to:

- Prove you meet state-mandated liability minimums

- Keep your license active and avoid further penalties

- Obtain or maintain auto registration

In this comprehensive 2025 guide, we’ll cover:

- What SR‑22 insurance is and who must carry it

- State-by-state SR‑22 requirements and liability limits

- Typical SR‑22 car insurance costs and premium drivers

- The step-by-step SR‑22 filing process and maintenance tips

- Five proven strategies to lower your SR‑22 insurance rates

1. Understanding SR‑22 Insurance

- SR‑22 is not a standalone policy but an add-on to your liability coverage.

- Coverage includes: bodily injury and property damage liability; optional medical payments or PIP where required.

- Who needs it: drivers convicted of DUI/DWI, driving without insurance, at-fault uninsured accidents, or multiple major violations.

2. State-Specific Filing Requirements

National Association of Insurance Commissioners. (2025). Auto Insurance Database Average Premium Supplement for 2025 [Press release].

- BI: bodily injury per person/accident; PD: property damage.

- Verify your state’s exact liability thresholds and SR‑22 duration with your DMV.

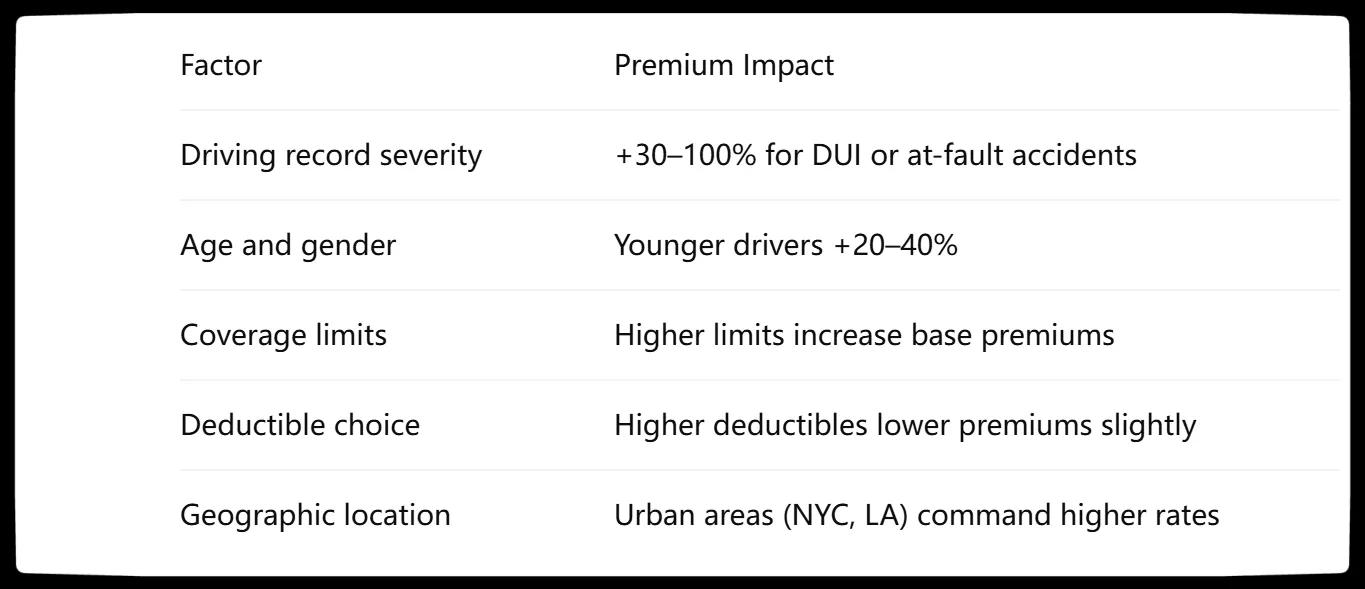

3. SR‑22 Insurance Costs & Premium Influencers

ValuePenguin (LendingTree). (2025, January 7). The State of Auto Insurance in 2025: Rate increases are slowing down in 2025 [Press release].

- SR‑22 endorsement: expect an additional $100–$400/year on top of base liability premium.

- High-risk status can triple standard rates; shopping insurers is crucial.

4. Filing & Maintaining Your SR‑22

- Contact your insurer: Confirm they support SR‑22 filings in your state.

- Add SR‑22 to your policy: Pay filing fee ($15–$60) and any premium surcharge.

- Meet state liability minimums: Adjust your policy to comply with state requirements.

- Ensure continuous coverage: Lapses lead to license suspension and additional penalties.

- Renew on schedule: Maintain SR‑22 status for the required period (commonly 3 years).

Tip: Set auto-pay for your SR‑22 policy to avoid unintentional lapses and keep your driving privileges intact.

5. Five Expert Tips to Lower SR‑22 Premiums

- Take defensive driving courses: May reduce points and qualify you for insurer discounts.

- Increase your liability limits strategically: Higher coverage can sometimes lower per-dollar costs.

- Bundle policies: Combine with renters, homeowners, or umbrella insurance for multi-policy discounts.

- Opt for higher deductibles: Shifts costs to you for minor claims and lowers monthly premiums.

- Compare high-risk specialists: Seek quotes from niche insurers known for competitive SR‑22 rates (e.g., Dairyland, SafeAuto).

Implement these tactics to find the best SR‑22 car insurance rates without sacrificing required coverage.

Conclusion

SR‑22 insurance is your pathway back to legal driving after serious violations. By understanding state requirements, managing costs, and leveraging expert strategies, you can secure affordable, compliant coverage and regain peace of mind.

You Might Also Like

Compare Car Insurance: A Step‑by‑Step Guide to Finding the Right Policy (Expert 2025 Update)

Jul 29, 2025Maximize Your Savings: 17 Car Insurance Discounts and How to Qualify in 2025

Jul 28, 20252025 How to Find the Best Car Insurance Near You

Jul 28, 20252025 Car Insurance Guide for Young Drivers: Actionable Tips to Lower Your Rates

Jul 28, 2025Understanding Non‑Owner Car Insurance in the US: An Ultimate Guide

Jul 28, 2025