California Health Insurance Guide 2025: Your Roadmap to Comprehensive, Affordable Coverage

Published on July 22, 2025

🌴 California Health Insurance Guide 2025: Your Roadmap to Comprehensive, Affordable Coverage

Introduction

From Silicon Valley startups to Central Valley farms, Californians face unique healthcare challenges—coastal weather events, high living costs, and vast rural areas. Securing the right health insurance in California ensures you and your family stay protected without breaking the bank.

In this guide, you’ll discover how to:

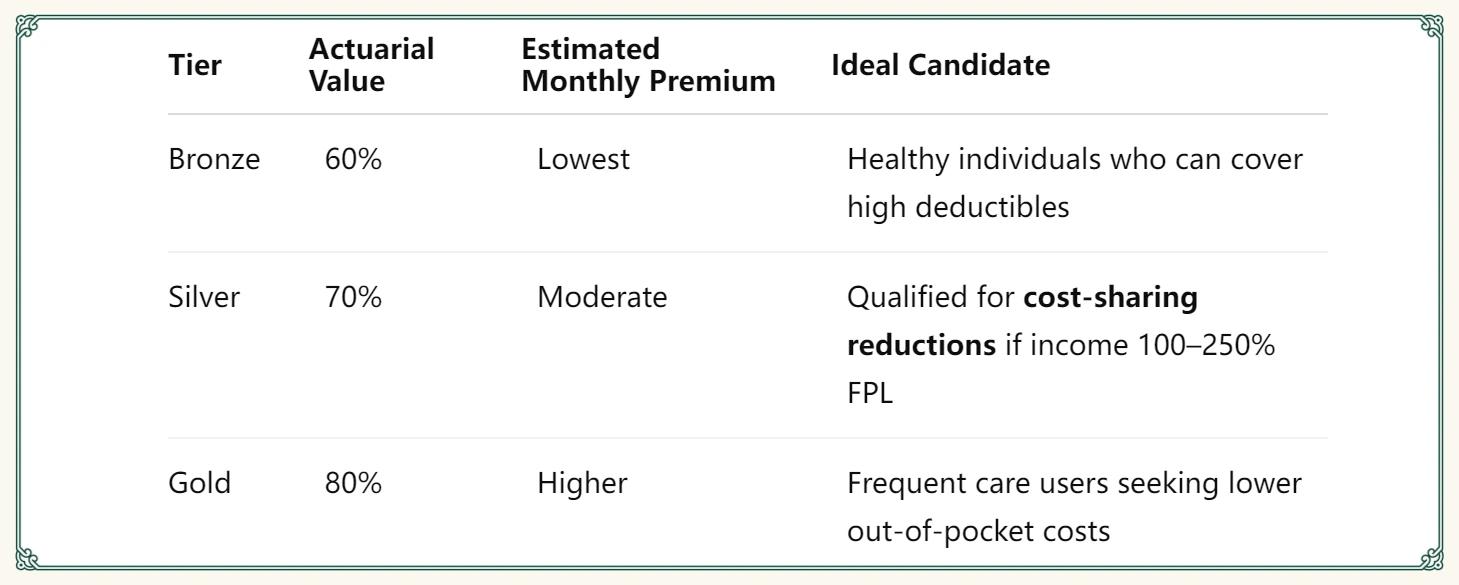

- Choose the best Covered California plan tier (Bronze, Silver, Gold)

- Confirm Medi‑Cal eligibility and streamline enrollment

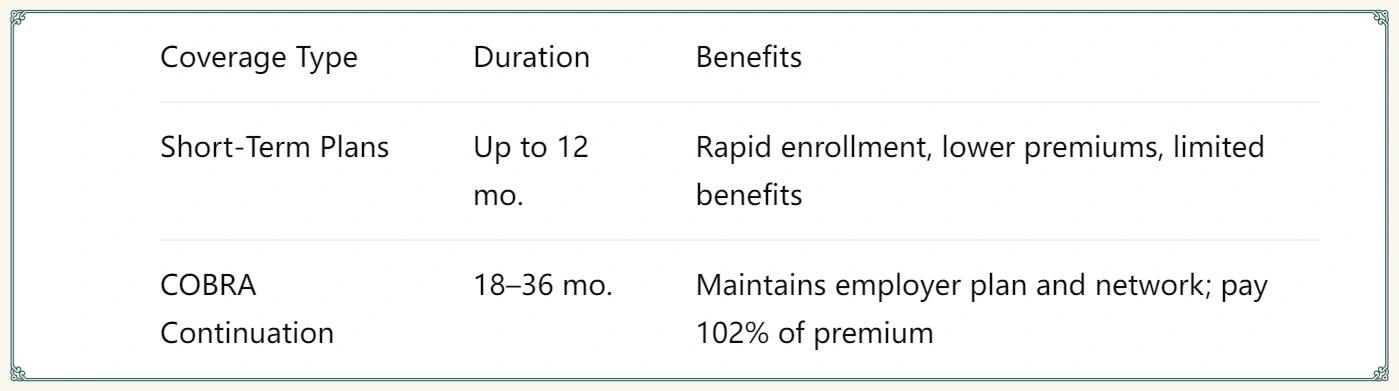

- Bridge gaps with short‑term health insurance or COBRA continuation

- Maximize HDHP & HSA benefits through employer‑sponsored plans

- Deploy five actionable tactics to reduce California health insurance costs

1. Covered California Plan Tiers: Finding Your Fit

- Silver plans: Unlock extra savings—up to 94% cost‑sharing reduction—when your income falls within 100–250% of the Federal Poverty Level.

- Enrollment window: November 1, 2024 – January 31, 2025 for 2025 coverage.

Action Step: Visit CoveredCA.com to compare California ACA health insurance quotes and preview your subsidy.

2. Medi‑Cal: California’s Medicaid Program Simplified

- Income limits: Adults up to 138% FPL (~$20,120/year for single adults); children & pregnant women up to 266% FPL.

- Managed Care options: Select from county‑specific Medi‑Cal plans (e.g., LA Care, Kaiser).

- How to enroll: Apply online at CoveredCA.com or through county social services.

Pro‑Tip: Use your Covered California account to check for Medi‑Cal expansion pilots offering additional benefits like dental and vision in select regions.

3. Short‑Term vs. COBRA: Coverage When You Need It Most

- Short‑term health insurance fills gaps quickly but may exclude pre‑existing conditions and wellness coverage.

- COBRA allows you to keep your employer’s network and benefits; you cover full premium plus a 2% admin fee.

Long‑tail keywords: California short‑term health insurance, COBRA coverage California

4. Employer‑Sponsored Plans & HSA Optimization

- Plan types: PPO, HMO, and High‑Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs).

- HSA benefits: Triple tax advantage—pre‑tax contributions, tax‑free growth, tax‑free withdrawals for qualified medical expenses.

- 2025 HSA limits: $4,150 individual; $8,300 family.

Actionable Tip: Contribute the maximum HSA amount early in the year to maximize tax savings and build a healthcare nest egg.

5. Five Tactics to Lower Your California Health Insurance Costs

- Maximize ACA Subsidies: Accurately report your income to capture the full premium tax credit.

- Shop Early & Compare: Review networks, benefits, and prices on CoveredCA.com before enrollment deadlines.

- Stay In‑Network: Use in‑network providers to minimize copays and avoid balance billing.

- Use Telehealth Services: Leverage $0 telehealth visits for routine consultations and minor ailments.

- Bundle & Bundle: Combine health, dental, and vision plans for multi-policy discounts.

Implement these strategies to secure affordable health insurance in California without sacrificing essential care.

Conclusion

Choosing the right health insurance in California means balancing cost, coverage, and provider access. By understanding Covered California tiers, verifying Medi‑Cal eligibility, bridging gaps with short‑term or COBRA, and optimizing HSAs, you can create a robust, budget-friendly health plan for 2025.