California Life Insurance Guide 2025: Secure Your Golden State Family’s Future

Published on July 21, 2025

🌴 California Life Insurance Guide 2025: Secure Your Golden State Family’s Future

Introduction

Whether you’re growing your family in Sacramento or planning retirement in Malibu, California life insurance ensures financial security for your loved ones. From affordable term life insurance in California to permanent whole life policies, understanding local rate factors, policy features, and discount opportunities helps you choose the optimal plan.

In this guide, you’ll learn how to:

- Differentiate term life vs. whole life vs. universal life insurance

- Analyze annual premiums for a 35-year-old in Los Angeles, San Francisco, and San Diego

- Implement four strategies to reduce your California life insurance premiums

- Enhance coverage with key riders like accelerated death benefits and waiver of premium

- Efficiently compare California life insurance quotes online

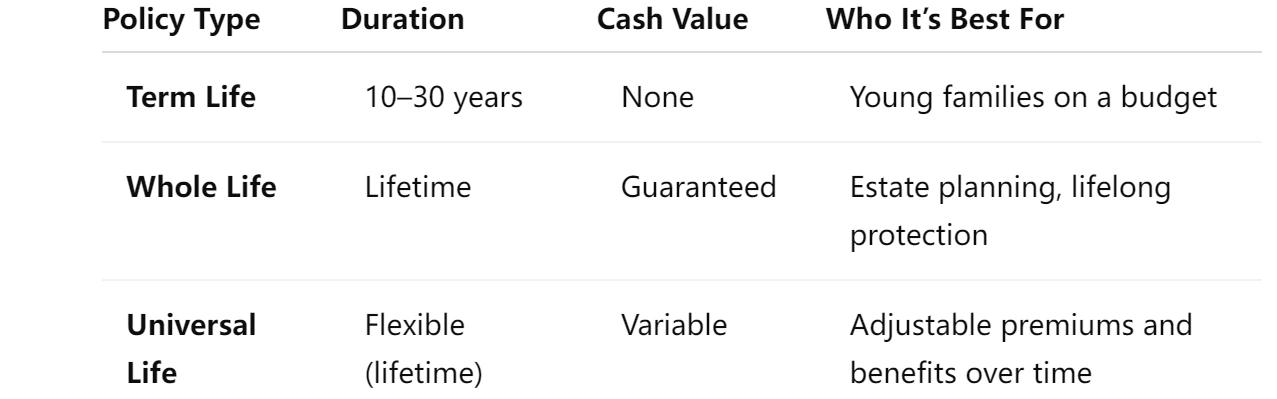

1. Comparing Policy Types: Term, Whole, and Universal Life

- Term life insurance California: Lowest cost per dollar of coverage, ideal for mortgage or college planning.

- Whole life: Higher premiums but builds guaranteed cash value and offers level premiums.

- Universal life: Flexibility to adjust your death benefit and premium payments as needs evolve.

Long-tail keywords: compare term life insurance California, California universal life policy, permanent life insurance in California

2. Premium Snapshot by City (35-Year-Old Male, $500K 20-Year Term)

Insurance costs vary by ZIP code and underwriting classification:

Coastal metros like San Francisco life insurance rates trend higher due to cost-of-living and risk assessments.

Actionable Tip: Enter your ZIP code into multiple quote tools to get accurate California life insurance quotes.

3. Four Strategies to Lower Your California Premium

- Lock in early: Secure rates before age 40 when premiums are lowest.

- Healthy lifestyle discounts: Non-smokers with good BMI and clean medical history can save 30–50%.

- Choose level term: Fixed premiums over the term period prevent mid-term rate increases.

- Shop and compare: Obtain quotes from at least five carriers—national (State Farm, New York Life) and California specialists (Pacific Life).

By proactively applying these tactics, you’ll find affordable life insurance in California without compromising coverage.

4. Key Riders & Add-Ons to Tailor Your Policy

Customize your base coverage with essential riders:

- Accelerated Death Benefit: Access a portion of your death benefit if diagnosed with a terminal illness.

- Waiver of Premium: Waives payments if you become totally disabled.

- Child Term Rider: Provides term coverage for children under your policy.

- Return of Premium (ROP): Refunds premiums if you outlive the term period.

These options enhance your California life insurance policy and ensure flexibility.

5. Streamlined Steps to Compare Quotes

- Gather personal details: Age, health status, coverage amount, and ZIP code.

- Use online comparison tools: Enter your data to retrieve multiple California life insurance quotes tailored to your area.

- Evaluate carriers: Compare AM Best ratings, customer reviews, and underwriting speed.

- Consult experts: For whole life and universal life in California, leverage adviser guidance to match complex needs.

Pro Tip: Reassess your policy every 3–5 years or after major life events to ensure competitive pricing.

Conclusion

Choosing the right California life insurance involves weighing policy types, comparing city-specific premiums, and leveraging discount strategies. By following these best practices and using reliable California life insurance quotes, you can secure the most cost-effective coverage for your family’s future.