Florida Health Insurance Guide 2025: Stay Covered in the Sunshine State

Published on July 22, 2025

🌴 Florida Health Insurance Guide 2025: Stay Covered in the Sunshine State

Introduction

In Florida’s ever-changing climate—from hurricane season to humid summers—having the right health insurance in Florida is critical. Whether you’re selecting an ACA Marketplace plan, enrolling in Florida Medicaid, bridging gaps with short-term insurance, or maximizing employer-sponsored coverage, this guide empowers you to secure comprehensive, cost-effective care.

You’ll learn how to:

- Navigate Marketplace plan tiers and subsidy opportunities

- Confirm Florida Medicaid qualifications and benefits

- Decide between short-term policies and COBRA continuation

- Enhance employer plans with HSAs and preventive benefits

- Apply five proven tactics to reduce your Florida health insurance costs

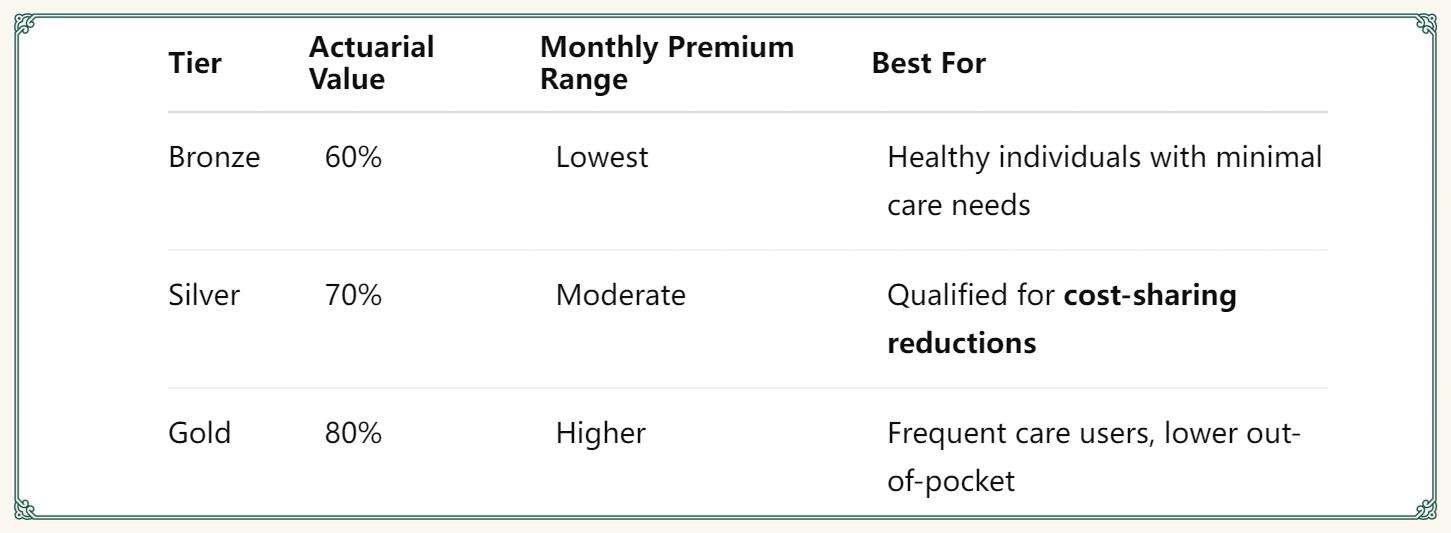

1. ACA Marketplace Plans: Bronze, Silver & Gold

- Silver plans: Eligible for deeper subsidies and reduced deductibles if your income is 100–250% of the Federal Poverty Level.

- Enrollment window: November 1, 2024 – January 31, 2025 for 2025 coverage.

Action Step: Use HealthCare.gov to compare Florida ACA health insurance quotes and preview your subsidy.

2. Florida Medicaid: Expanded Access & Enrollment

- Eligibility thresholds: Adults up to 138% FPL (~$20,000/year/single); children/parents up to 211% FPL.

- Medicaid Managed Care: Choose from AHCA-authorized plans like Florida Healthy Kids.

- Enrollment channels: Apply online at ACCESS Florida or through local human services offices.

Pro Tip: Check for pilot programs offering dental and vision add-ons in select counties.

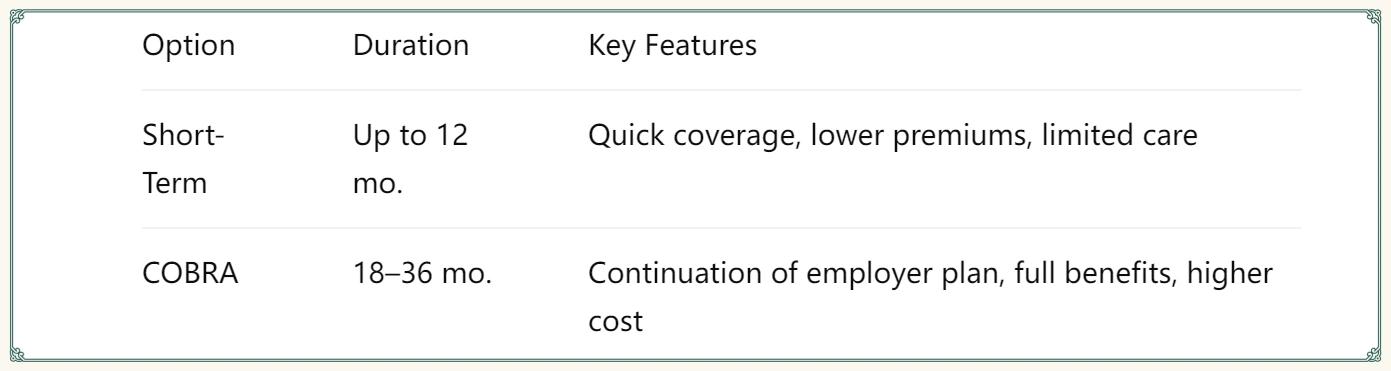

3. Short-Term Health Insurance vs. COBRA

- Short-term plans: Ideal for gap coverage but often exclude pre-existing conditions and preventive care.

- COBRA: Maintains identical coverage but requires you to pay full premiums plus a 2% fee.

Tip: Use short-term only for emergencies; plan for COBRA if you need comprehensive benefits.

4. Employer-Sponsored Plans & HSAs

- Plan types: PPO, HMO, and High-Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs).

- HSA advantages: Triple tax benefit—pre-tax contributions, tax-free growth, and tax-free withdrawals for qualified care.

- 2025 HSA limits: $4,150 individual; $8,300 family.

Action Step: Maximize HSA contributions early in the year to capitalize on tax savings.

5. Five Tactics to Lower Your Florida Health Insurance Costs

- Maximize Subsidies: Accurately report household income to secure the largest ACA tax credits.

- Shop Early: Compare plans before open enrollment ends to lock in the best rates and networks.

- Use In-Network Providers: Save on copays and coinsurance by staying within plan networks.

- Leverage Telehealth: Many plans offer $0 telehealth visits—use virtual care for routine consultations.

- Bundle Coverage: Combine health, dental, and vision for multi-line discounts.

Implement these strategies to achieve cheap health insurance in Florida without sacrificing quality.

Conclusion

Selecting the right health insurance in Florida means understanding your options—from Marketplace tiers and Medicaid to short-term and employer-sponsored plans. By leveraging subsidies, HSAs, telehealth, and smart shopping tactics, you can secure affordable, comprehensive coverage in 2025.