Florida Life Insurance Guide 2025: Secure Your Sunshine State Family’s Future

Published on July 21, 2025

🌴 Florida Life Insurance Guide 2025: Secure Your Sunshine State Family’s Future

Introduction

From shielding families in Miami’s coastal neighborhoods to safeguarding retirement assets in Orlando’s suburbs, Florida life insurance offers essential financial protection. Whether you need affordable term life insurance in Florida or a permanent whole life policy, understanding local rate drivers and discount opportunities helps you select the best coverage for your Sunshine State lifestyle.

In this guide, you’ll learn how to:

- Distinguish term, whole, and universal life insurance

- Compare average premiums for a 35-year-old in Miami, Tampa, and Orlando

- Implement four tactics to lower your Florida life insurance premiums

- Enhance your plan with key riders & add-ons

- Efficiently compare Florida life insurance quotes online

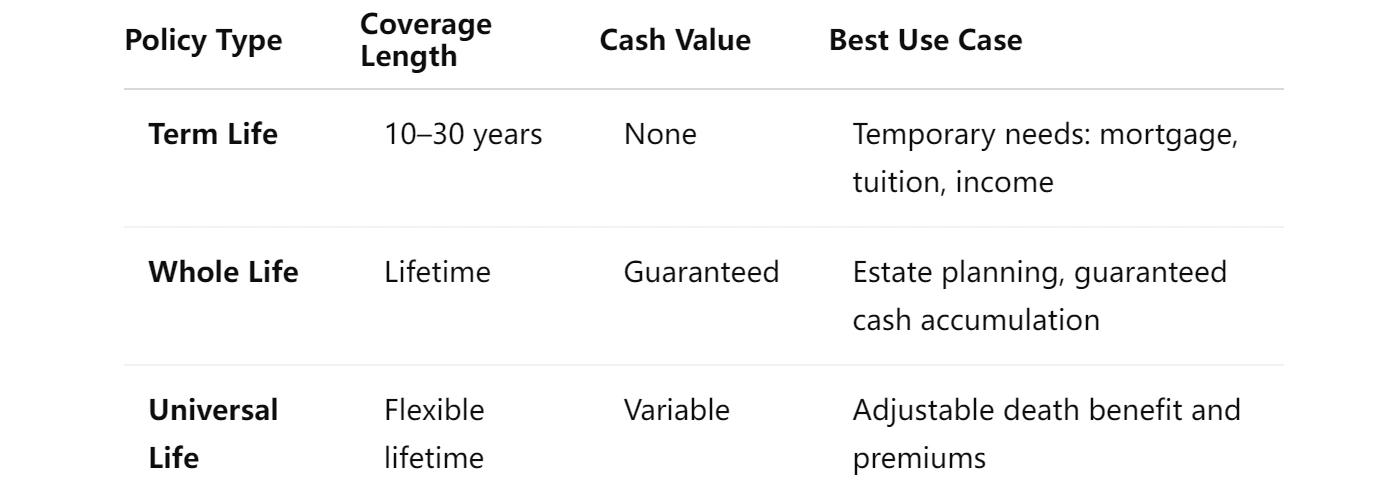

1. Policy Types: Term vs. Whole vs. Universal Life

- Term life insurance Florida: Lowest initial premiums, ideal for families needing high coverage on a budget.

- Whole life: Fixed premiums and cash value growth—excellent for lifelong protection and legacy planning.

- Universal life: Flexibility to adjust coverage and payments as life circumstances change.

Long-tail keywords: compare term life insurance Florida, Florida universal life policy, permanent life insurance in Florida

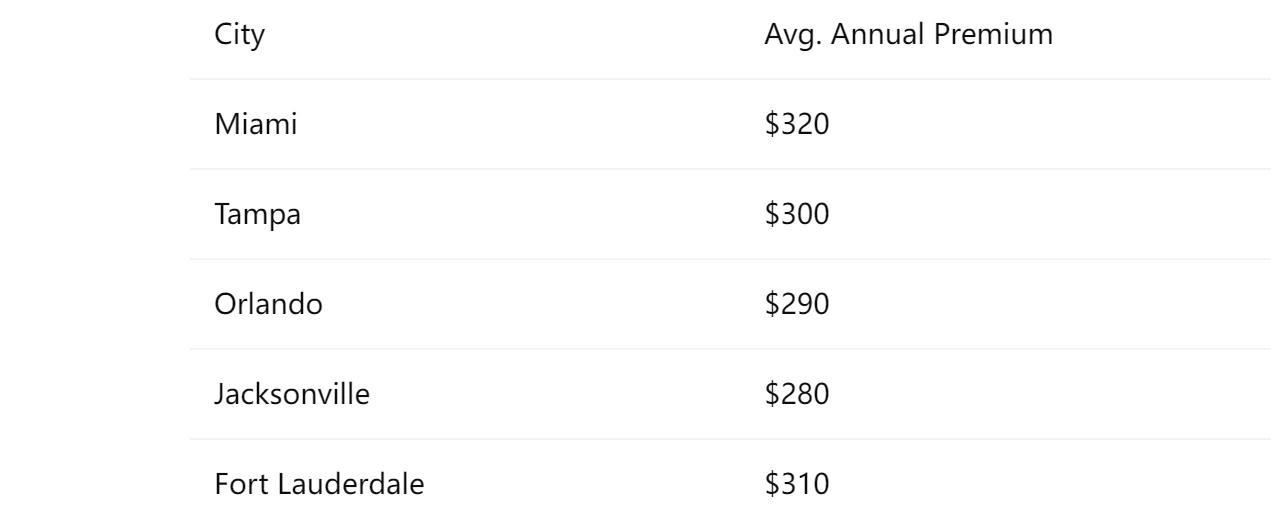

2. Premium Snapshot by City (35‑Year‑Old Male, $500K/20‑Year Term)

- Miami’s Coastal Risk and urban demographics drive higher rates.

- Orlando’s Moderate Rates reflect a balanced risk profile.

Actionable Tip: Enter your ZIP code in a quote tool to receive precise Florida life insurance quotes based on local underwriting tables.

3. Four Tactics to Lower Your Premium

- Lock in Coverage Young: Secure a policy before age 40 to maximize lower underwriting classes.

- Maintain Optimal Health: Nonsmokers with healthy BMI enjoy 30–50% discounts—small lifestyle changes can yield big savings.

- Choose Level-Term Policies: Guarantees fixed premiums throughout the term, protecting against mid-policy rate hikes.

- Compare Multiple Carriers: Request quotes from at least five companies including Florida specialists (Florida Blue, Foresters) and national insurers (Prudential, New York Life).

Consistently applying these strategies ensures cheap life insurance in Florida without sacrificing coverage.

4. Key Riders & Add‑Ons

Enhance your base policy to fit Florida’s unique needs:

- Accelerated Death Benefit: Access part of the death benefit if diagnosed with a terminal illness.

- Waiver of Premium: Premiums waived if you become totally disabled.

- Child Term Rider: Adds coverage for minor children at a low cost.

- Return of Premium: Recoup paid premiums if you outlive the term, turning term insurance into a savings vehicle.

These options extend your Florida life insurance policy with flexibility and extra protection.

5. Streamlined Steps to Compare Quotes

- Gather Your Info: Age, ZIP code, coverage amount, and health history.

- Use Online Quote Engines: Input your details to compare Florida life insurance quotes side by side.

- Evaluate Insurer Strength: Review AM Best ratings, customer feedback, and claim settlement ratios.

- Consult an Advisor: For whole and universal life policies in Florida, professional guidance ensures your plan aligns with long-term goals.

Pro Tip: Re-shop your policy every 3–5 years or after major life events (marriage, home purchase) to lock in new savings.

Conclusion

Finding the right Florida life insurance requires balancing cost, coverage type, and long-term objectives. By understanding policy differences, analyzing city-specific premium trends, and leveraging discount strategies, you can secure comprehensive, affordable protection for your Florida family in 2025.