Georgia Car Insurance Guide 2025: Drive Smart & Save Big in the Peach State

Published on July 16, 2025

🚗 Georgia Car Insurance Guide 2025: Drive Smart & Save Big in the Peach State

Introduction

Whether you’re navigating Atlanta’s busy interstates or cruising scenic byways around Savannah, the right car insurance in Georgia protects both your vehicle and your wallet. In 2025, Georgia drivers face higher premiums due to severe weather events, coastal hurricane risks, and a significant uninsured motorist population.

This guide covers Georgia’s 25/50/25 minimum liability requirements, compares average rates in major cities, and reveals proven strategies for scoring cheap car insurance in Georgia—without sacrificing crucial coverage.

1. Georgia’s Required Car Insurance: 25/50/25 Liability

Georgia law requires every driver to carry at least:

- $25,000 bodily injury coverage per person

- $50,000 bodily injury coverage per accident

- $25,000 property damage liability per accident

While these minimum liability limits satisfy legal mandates, adding collision and comprehensive coverage helps cover repair costs from hailstorms, floods, and at-fault collisions—key for true full coverage auto insurance in Georgia.

2. City-by-City Premium Snapshot

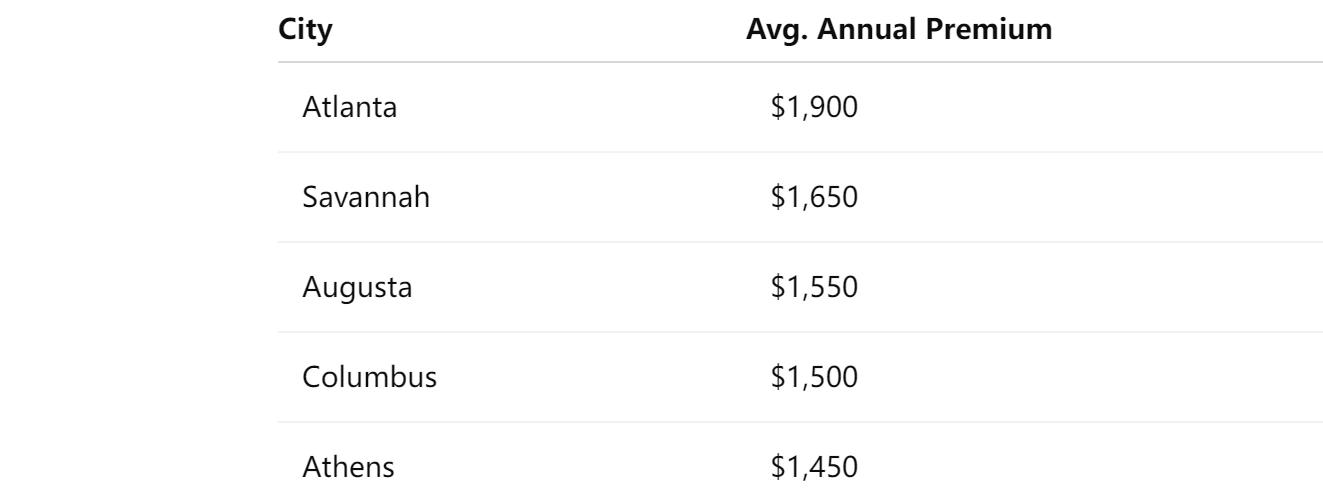

Your ZIP code heavily influences your Georgia auto insurance rates. Here’s what 2025 premiums look like for full coverage:

Urban drivers often see 20–30% higher rates due to traffic density and claim frequency, while smaller cities benefit from lower-risk roads.

3. What Drives Your Georgia Premium?

Understanding these factors lets you target your savings:

- Location risk: Coastal areas face more hurricane damage claims

- Driving record: Tickets or accidents can raise rates by 30% or more

- Credit-based pricing: Georgia allows credit scores to impact premiums

- Vehicle factors: Insuring SUVs or high-performance cars costs up to 40% more

- Mileage and usage: Commuters pay more than occasional drivers

By managing these elements, you can refine your Georgia car insurance quotes for the best rate.

4. Strategies to Secure Cheap Car Insurance in Georgia

Take these actionable steps to trim your premium:

- Compare quotes from GEICO, State Farm, Progressive, and local carriers like Georgia Farm Bureau.

- Bundle policies: Combine auto with home or renters insurance for up to 20% off.

- Raise your deductible: Opt for a $1,000 deductible to cut premiums by 10–15%, if you have emergency savings.

- Join telematics programs: Usage-based plans (e.g., Allstate Drivewise) reward safe driving with up to 30% discounts.

- Maximize discounts: Good student, multi-car, mature driver, and vehicle safety feature credits add more savings.

Regularly shopping for Georgia auto insurance quotes ensures you capture new promotional rates and discounts.

5. Optional Coverages for Peach State Protection

Enhance your basic policy with these important add-ons:

- Comprehensive coverage: Protects against theft, vandalism, hail, and flood damage.

- Collision coverage: Pays to repair your vehicle after an at-fault accident.

- Uninsured/Underinsured Motorist (UM/UIM): Essential given Georgia’s uninsured driver rates.

- Roadside assistance & rental reimbursement: Peace of mind during emergencies or extended repairs.

Tailoring these options builds robust auto insurance coverage in Georgia that fits your lifestyle.

6. Top-Rated Georgia Auto Insurers for 2025

Consider these carriers for a balance of value and service:

- GEICO – Competitive quotes and easy digital management.

- State Farm – Strong agent network and loyalty perks.

- Progressive – Flexible policies for high-risk drivers and solid usage-based discounts.

- Georgia Farm Bureau – Local insights with member-exclusive benefits.

- Allstate – Extensive bundling options and safe driving rewards.

Review each insurer’s claim satisfaction and price when comparing Georgia car insurance providers.

Conclusion

Locking in the right car insurance in Georgia is about more than meeting minimum liability requirements—it’s about customizing your coverage to manage regional risks and reduce your out-of-pocket costs. Use this guide to explore your options, compare multiple insurers, and apply targeted savings strategies in 2025.