Georgia Health Insurance Guide 2025: Your Peach State Coverage Playbook

Published on July 22, 2025

🍑 Georgia Health Insurance Guide 2025: Your Peach State Coverage Playbook

Introduction

In Georgia—from Atlanta’s cityscape to the rural Blue Ridge foothills—access to reliable, cost‑effective care is vital. This guide cuts through the complexity of health insurance in Georgia to help you secure coverage that fits your budget, health needs, and lifestyle.

You’ll learn how to:

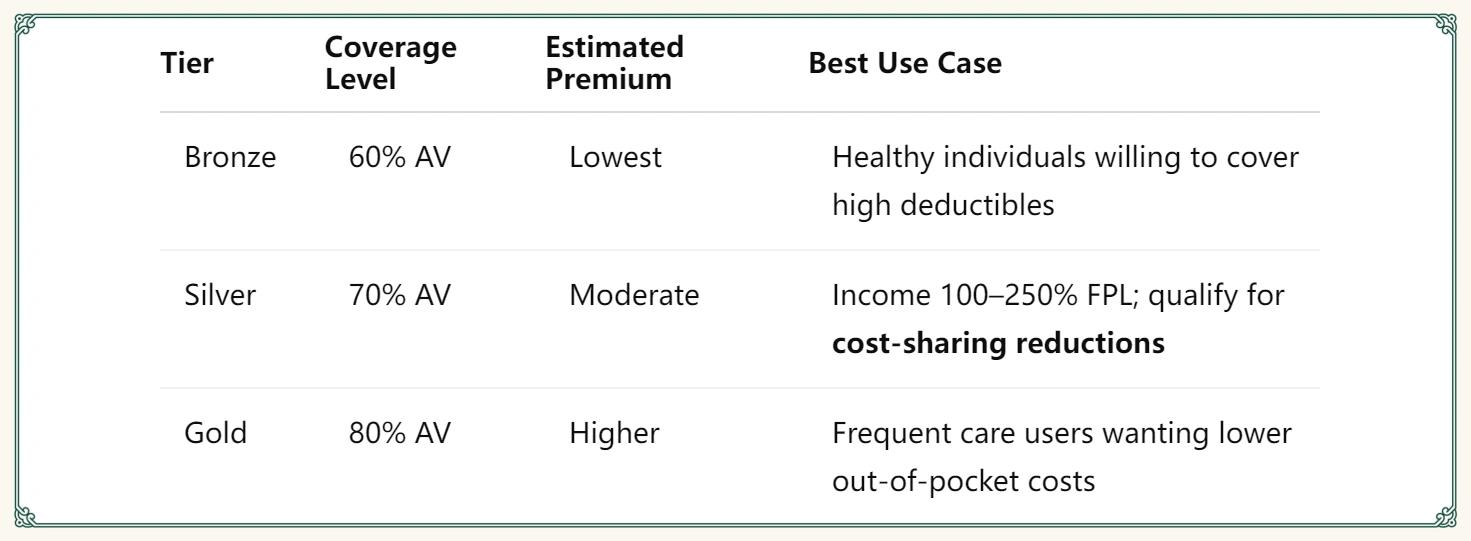

- Select the right Covered Georgia plan tier (Bronze, Silver, Gold)

- Verify Georgia Medicaid eligibility and streamline your application

- Bridge coverage with short‑term health insurance or COBRA continuation

- Maximize savings with HDHP & HSA employer plans

- Implement five proven tactics to lower your Georgia health insurance costs

1. Covered Georgia Marketplace Plans: Bronze, Silver & Gold

- Silver plans: If your income falls between 100–250% of the Federal Poverty Level, you can get significant out‑of‑pocket discounts.

- Open enrollment runs November 1, 2024 through January 31, 2025 for 2025 coverage.

Action Step: Head to HealthCare.gov to get tailored Georgia ACA health insurance quotes and see your subsidy estimate.

2. Georgia Medicaid & PeachCare for Kids®

- Adult Medicaid eligibility: Adults up to 138% FPL (~$20,120/year for a single adult).

- PeachCare for Kids®: Covers children in families up to 247% FPL.

- How to apply: Use Gateway.ga.gov or visit your local DFCS office; most applications process within 30 days.

Tip: Report income or household changes promptly to avoid gaps in your Georgia Medicaid coverage.

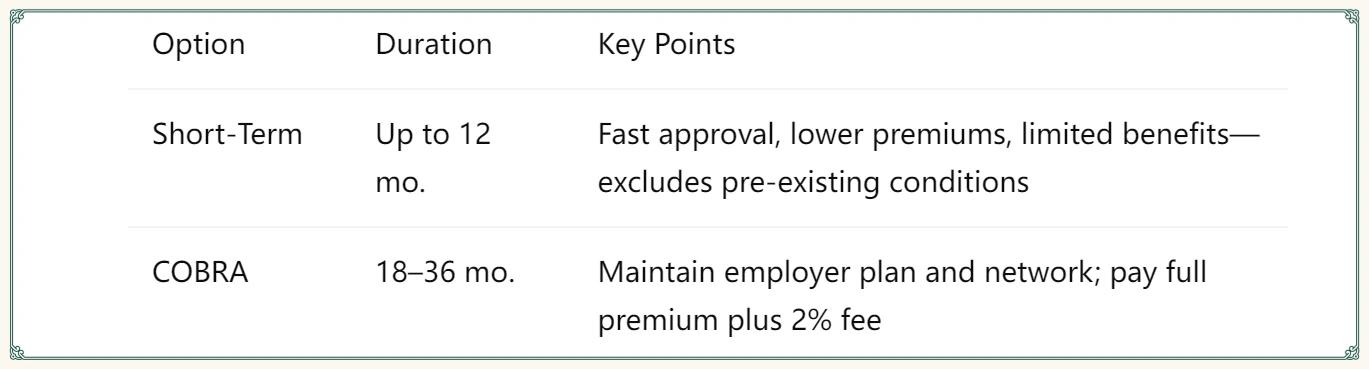

3. Short‑Term Insurance vs. COBRA: Filling Coverage Gaps

- Short‑term plans are best for temporary needs but lack preventive and pre‑existing condition coverage.

- COBRA continuation is pricier but preserves your existing network and benefits.

Keyword Focus: short‑term health insurance Georgia, Georgia COBRA coverage

4. Employer‑Sponsored HDHP & HSA Savings Strategy

- HDHP options paired with HSAs let you pay lower premiums while saving pre‑tax dollars.

- HSA benefits: Triple tax savings—pre‑tax contributions, tax‑free growth, tax‑free qualified withdrawals.

- 2025 HSA limits: $4,150 individual; $8,300 family.

Pro Tip: Automate HSA payroll contributions to fully leverage your tax‑advantaged account and build healthcare savings throughout the year.

5. Five Tactics to Reduce Your Georgia Health Insurance Costs

- Maximize Subsidies: Accurately project your 2025 income to lock in the maximum premium tax credit.

- Shop Early: Compare provider networks, benefits, and prices before open enrollment ends.

- Stay In‑Network: Choose in‑network providers to minimize copays and avoid balance billing.

- Use Telehealth: Take advantage of $0 telehealth visits for minor ailments and routine care.

- Bundle Coverage: Combine health with dental and vision for multi-policy discounts.

Applying these steps ensures you find affordable health insurance in Georgia without sacrificing care.

Conclusion

Navigating health insurance in Georgia for 2025 means understanding your options—Marketplace tiers, Georgia Medicaid, gap‑coverage solutions, and employer benefits. Use this guide to secure comprehensive, budget‑friendly coverage that fits your Peach State needs.