Georgia Home Insurance Guide 2025: Secure Your Peach State Home

Published on July 17, 2025

🏠 Georgia Home Insurance Guide 2025: Secure Your Peach State Home

Introduction

From Atlanta’s suburbs to Savannah’s historic squares, Georgia homeowners face risks ranging from coastal hurricanes to inland hailstorms and liability claims. The right homeowners insurance in Georgia not only protects your property but also ensures your peace of mind when severe weather or legal issues arise.

In this 2025 guide, you’ll learn how to:

- Choose between HO-3 and HO-5 policies based on your home’s value and risk profile

- Compare average home insurance premiums in Atlanta, Savannah, and Athens

- Implement actionable tactics to reduce your Georgia home insurance premium

- Select essential endorsements like windstorm, hail, flood, and equipment breakdown coverage

1. HO-3 vs. HO-5: Tailor Coverage to Georgia’s Hazards

HO-3 (Special Form)

- Named-peril protection: Covers your dwelling and personal property against listed risks (fire, windstorm, hail, theft)

- Budget-friendly: Premiums typically 15–20% lower than comprehensive forms

- Ideal for: Homes in moderate-risk areas away from the coast or hail hotspots

HO-5 (Comprehensive Form)

- Open-peril coverage: Protects against all risks except those explicitly excluded

- Enhanced property limits: Better for high-value belongings and custom-built homes

- Premium considerations: About 25–35% higher, reducing claim disputes and out-of-pocket expenses

Recommendation: If your home’s rebuild cost or contents value exceeds $350,000 or you’re in hurricane/hail-prone regions, HO-5 offers broader protection. Otherwise, HO-3 balances cost and coverage.

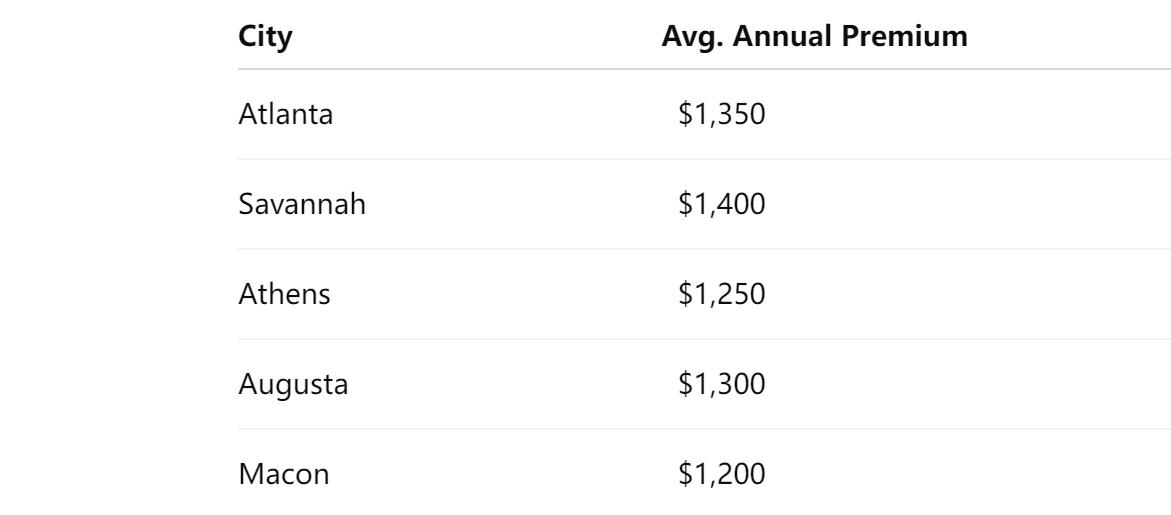

2. Premium Snapshot: Atlanta vs. Savannah vs. Athens

Location drives your Georgia home insurance rates. In 2025, average premiums for a 1,800 sq ft home with $300,000 dwelling coverage are:

- Savannah’s higher rates reflect coastal storm exposure and flood risk.

- Athens’ lower premiums benefit from inland location and fewer severe weather events.

To find localized savings, always compare Georgia home insurance quotes across multiple carriers using your ZIP code.

3. Core Coverage Essentials

Your policy should include:

- Dwelling Coverage: Covers rebuild or repair costs for your home’s structure

- Personal Property: Replaces damaged or stolen belongings

- Liability Protection: Pays legal and medical costs if someone is injured on your property

- Additional Living Expenses (ALE): Covers temporary housing and essentials if your home is uninhabitable

Pro Tip: Review and update your Replacement Cost Value (RCV) annually to reflect rising construction costs in your area.

4. Four Strategies to Lower Your Premium

- Fortify Your Home: Install impact-resistant windows, reinforced roofing, and storm shutters for up to 20% mitigation credits.

- Bundle Policies: Combine home and auto insurance to unlock multi-policy discounts of 10–25%.

- Raise Your Deductible: Choose a $2,000–$5,000 deductible if you have emergency savings, reducing premiums by 10–20%.

- Preserve Your Claims-Free Status: Handle minor repairs out-of-pocket to maintain your no-claims discount and avoid rate spikes.

Applying these tactics consistently helps secure cheap homeowners insurance in Georgia without compromising essential protection.

5. Essential Endorsements and Add-Ons

To address Georgia’s specific risks, consider adding:

- Windstorm & Hail Coverage: Covers damage from tropical storms and hail; often requires a separate deductible (2–5% of dwelling coverage).

- Flood Insurance: Purchase through NFIP or private carriers for coastal and riverine properties.

- Equipment Breakdown: Insures HVAC, electrical, and plumbing systems damaged by storms.

- Extended Replacement Cost: Provides extra coverage if rebuild costs exceed policy limits.

These endorsements transform a standard policy into full coverage homeowners insurance in Georgia tailored to your needs.

6. Top Home Insurance Providers in Georgia for 2025

Consider these carriers for their local expertise and competitive offerings:

- State Farm: Broad agent network, storm mitigation credits, and bundling perks.

- Allstate: Flexible add-ons, digital tools, and proactive claims handling.

- Georgia Farm Bureau: Local focus with farm and rural endorsements.

- USAA: Exceptional rates and service for military families.

- Farmers Insurance: Custom hail and windstorm endorsements and loyalty discounts.

Evaluate each provider’s claims satisfaction ratings and financial strength to choose the best homeowners insurance provider in Georgia.

Conclusion

Securing the right homeowners insurance in Georgia means balancing premium savings with robust protection against hurricanes, hailstorms, and liability risks. By comparing HO-3 vs HO-5 policies, analyzing regional premiums, and implementing targeted savings strategies, you can protect your Peach State home and budget in 2025.