Illinois Life Insurance Guide 2025: Secure Your Prairie State Legacy

Published on July 23, 2025

🏙️ Illinois Life Insurance Guide 2025: Secure Your Prairie State Legacy

Introduction

From Chicago’s urban sprawl to the rolling hills of downstate Illinois, having the right life insurance in Illinois ensures your family’s financial stability. Whether you’re exploring cost-effective term life insurance Illinois, guaranteed whole life policies, or flexible universal life coverage, this guide provides regional insights, premium benchmarks, and actionable tactics for Keystone State residents.

You’ll discover how to:

- Evaluate term, whole, and universal life insurance benefits and costs

- Analyze average Illinois life insurance rates for a 35-year-old male in major cities

- Enhance your policy with key riders & add-ons tailored to Illinois needs

- Deploy five proven strategies to lower your Illinois life insurance premiums

- Streamline the process of obtaining and comparing Illinois life insurance quotes online

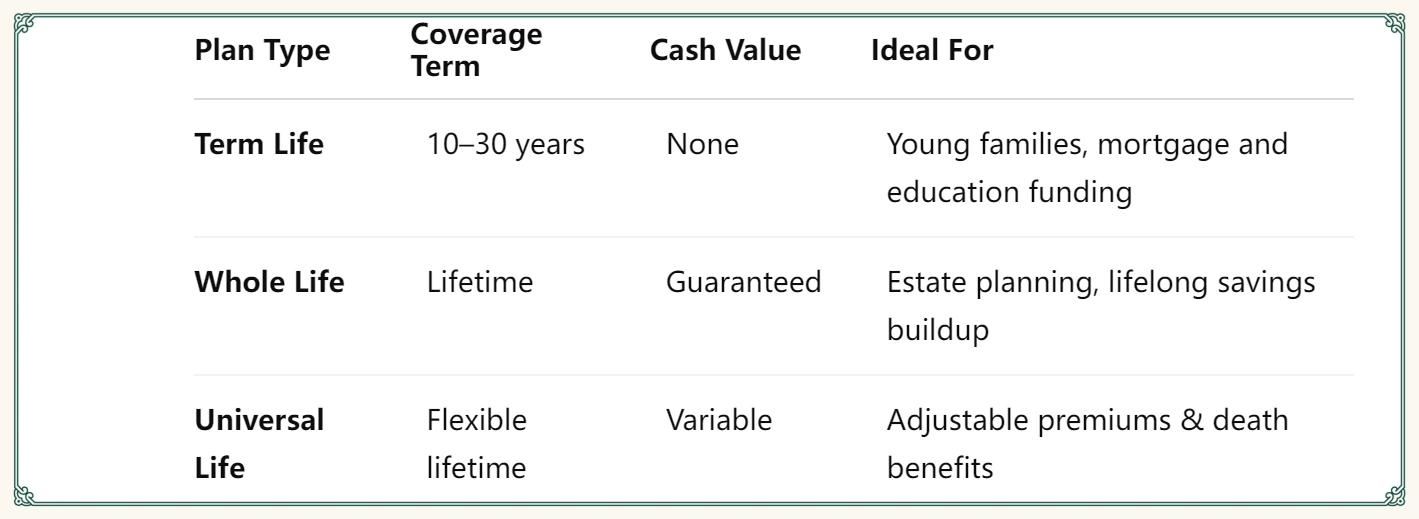

1. Policy Options: Term vs. Whole vs. Universal Life

- Term life insurance Illinois offers the most affordable premiums for temporary needs, perfect for suburban homeowners in Aurora.

- Whole life locks in premiums and builds guaranteed cash value—ideal for estate planning in Evanston.

- Universal life lets you adjust coverage as your career evolves in Chicago’s financial district.

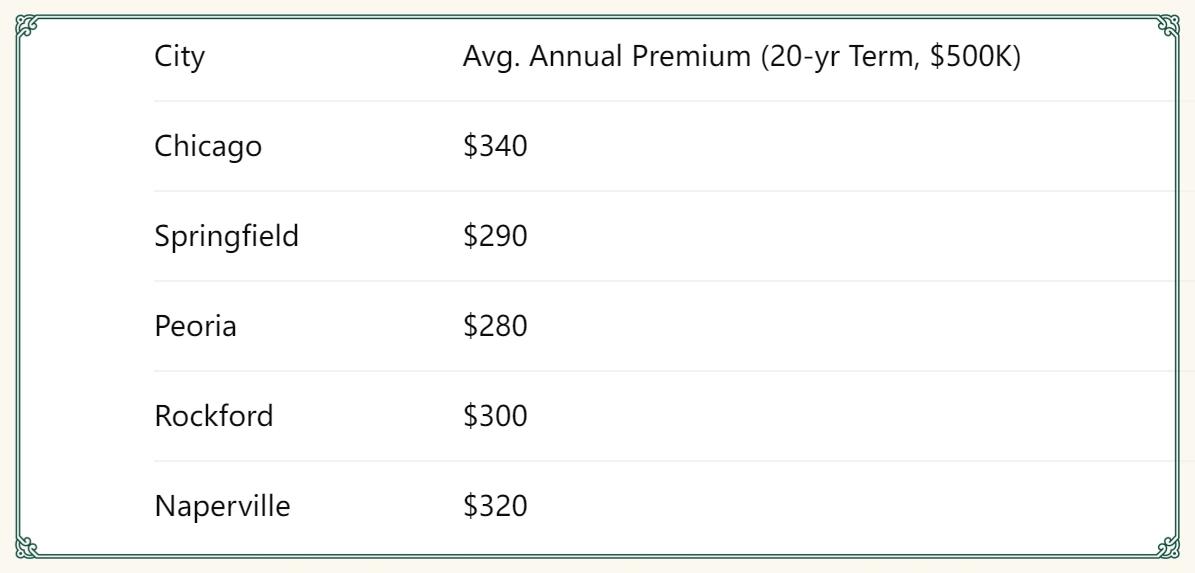

2. Premium Snapshot: Key Illinois Markets

- Chicago life insurance rates reflect higher living costs and underwriting classifications.

- Peoria’s premiums benefit from lower risk profiles and regional cost advantages.

Tip: Enter your ZIP code on our platform to get tailored Illinois life insurance quotes instantly.

3. Essential Riders & Add‑Ons for Illinois Residents

Customize your coverage with these popular additions:

- Accelerated Death Benefit: Access part of your death benefit if diagnosed with a terminal illness—helpful for families facing medical expenses in Peoria.

- Waiver of Premium: Keeps your policy active without payments if you become disabled—valuable in areas with high workplace risks.

- Child Term Rider: Adds term coverage for minor children under one policy—ideal for new parents in Naperville.

- Return of Premium (ROP): Retrieves paid premiums if you outlive the term, blending term coverage with a savings component.

These riders tailor life insurance in Illinois to your personal and regional needs.

4. Five Strategies to Reduce Your Premiums

- Buy Early: Secure lower rates by applying before age 40 to maximize savings over the policy term.

- Maintain a Healthy Lifestyle: Non-smokers and policyholders with healthy BMI often qualify for 30–50% preferred discounts.

- Choose Level Term: Guarantee fixed premiums throughout your term to avoid unexpected increases.

- Shop Multiple Insurers: Compare at least five carriers, including Illinois-based providers like Country Financial and national insurers such as Prudential, for the best value.

- Preserve No-Claim Benefits: Handle minor incidents without filing claims to maintain preferred rates and no-claim discounts.

Implementing these tactics helps you discover cheap life insurance in Illinois without sacrificing coverage quality.

5. Streamlined Quote Comparison Process

- Input Key Data: Age, health profile, coverage amount, and ZIP code.

- Use Our Quote Tool: Retrieve and compare multiple Illinois life insurance quotes side by side.

- Review Insurer Credentials: Check AM Best ratings, customer satisfaction scores, and claim turnaround times.

- Consult a Specialist: For complex whole or universal life needs, get personalized advice from Illinois insurance experts.

Pro Tip: Reevaluate your plan every 3–5 years or after significant life events—home purchase, career change—to capture emerging savings opportunities.

Conclusion

Choosing the right life insurance in Illinois for 2025 means aligning your policy with your financial goals and regional factors. By comparing policy types, analyzing local premium trends, leveraging riders, and deploying cost-saving strategies, you can secure a plan that protects your Prairie State family and wallet.