New Jersey Life Insurance Guide 2025: Secure Your Garden State Future

Published on July 23, 2025

🏙️ New Jersey Life Insurance Guide 2025: Secure Your Garden State Future

Introduction

From the historic brownstones of Newark to coastal living along the Jersey Shore, life insurance in New Jersey offers your family financial peace of mind. Whether you’re exploring term life insurance New Jersey for a growing family or permanent whole life policies for estate planning, this guide provides regional insights, premium comparisons, and actionable tactics to find cheap life insurance in NJ without sacrificing coverage.

You’ll learn how to:

- Evaluate term, whole, and universal life insurance options tailored to New Jersey needs

- Compare average premiums for a 35-year-old male in Newark, Jersey City, and Trenton

- Enhance your plan with riders & add-ons like accelerated death benefits and waiver of premium

- Deploy five proven strategies to lower your New Jersey life insurance premiums

- Streamline the process of collecting and comparing New Jersey life insurance quotes online

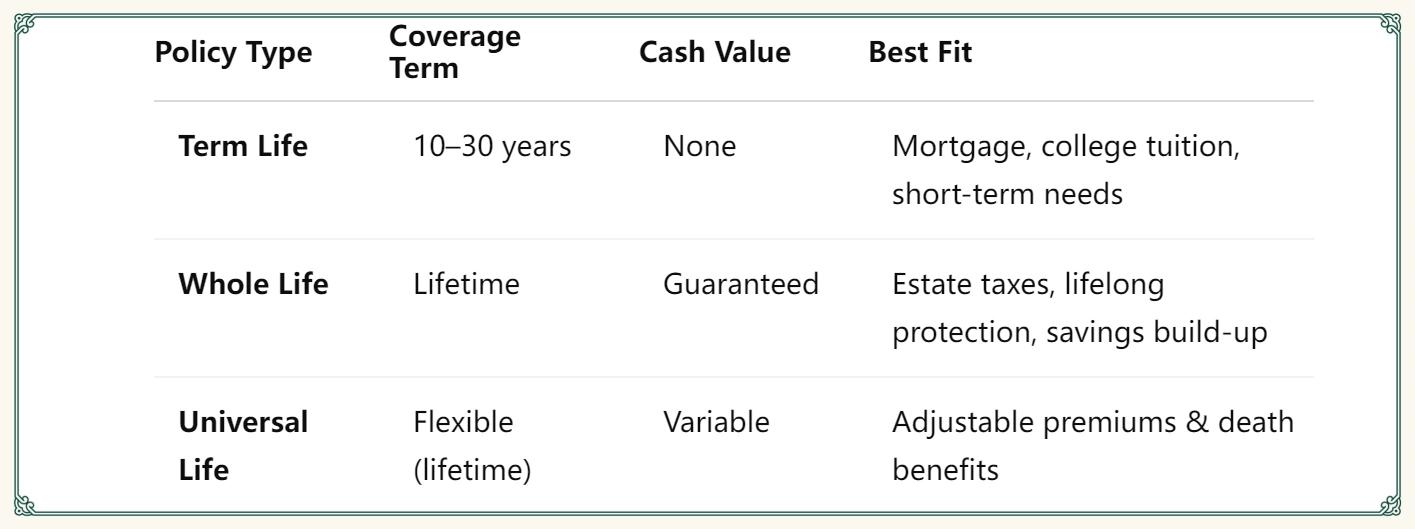

1. Policy Options: Term vs. Whole vs. Universal Life

- Term life insurance New Jersey: Lowest cost per coverage dollar, ideal for young families in Camden and Newark.

- Whole life: Fixed premiums and cash value growth—perfect for high-net-worth residents in Summit and Short Hills.

- Universal life: Modify your coverage as your career in Jersey City evolves.

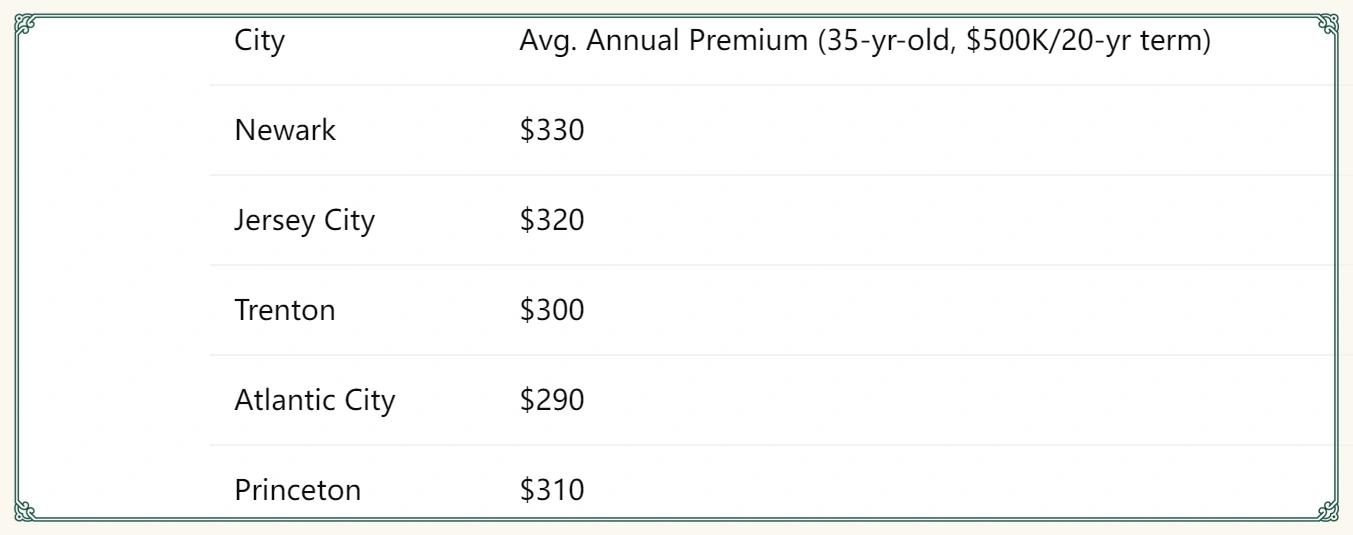

2. Premium Snapshot: Newark, Jersey City & Trenton

- Newark’s higher rates reflect urban risk factors and higher living costs.

- Trenton and Atlantic City offer more competitive premiums due to lower property values.

Actionable: Enter your ZIP code into our quote tool to get precise New Jersey life insurance quotes from top carriers.

3. Key Riders & Add‑Ons for NJ Residents

- Accelerated Death Benefit: Access part of your death benefit early in the event of terminal illness—crucial for high-medical-cost areas like Edison.

- Waiver of Premium: Protects your policy if you face disability, particularly valuable for service workers in Atlantic City.

- Child Term Rider: Ensures coverage for children at minimal cost, important for families in Cherry Hill.

- Return of Premium: Recoup paid premiums if you outlive your term, aligning term insurance with savings goals.

Riders let you tailor life insurance in New Jersey to your family’s lifestyle and financial objectives.

4. Five Strategies to Lower Your Premiums

- Lock in Early: Apply before age 40 to secure the best underwriting class and lowest rates.

- Embrace Healthy Living: Nonsmokers and those with healthy BMI can save 30–50% on rates—beneficial for active lifestyles in Montclair.

- Level Term Selection: Choose level-term to guarantee fixed premiums across your chosen term.

- Multi‑Carrier Shopping: Compare quotes from at least five insurers including Prudential, New York Life, and NJ-based Penn Mutual.

- Claims‑Free Record: Handle minor expenses out-of-pocket to preserve preferred rates and no-claim discounts.

Executing these tactics uncovers cheap life insurance in NJ options with robust protection.

5. Effortless Quote Comparison

- Collect Essentials: Age, gender, health status, coverage amount, and ZIP code.

- Use Online Tools: Input data into our platform for instant New Jersey life insurance quotes comparisons.

- Evaluate Financial Strength: Check AM Best ratings and customer reviews.

- Get Expert Guidance: Consult our NJ life insurance specialists to align your choice with long-term goals.

Pro Tip: Re‑shop every 3–5 years or after major life events (marriage, home purchase) to leverage shifting market rates.

Conclusion

Securing life insurance in New Jersey for 2025 means matching policy type to your goals, understanding local premium trends, and applying savvy cost-saving tactics. With tailored riders and a strategic approach, you can protect your Garden State loved ones confidently and affordably.