New York Car Insurance Guide 2025: Essential Advice for Empire State Drivers

Published on July 15, 2025

🚗 New York Car Insurance Guide 2025: Essential Advice for Empire State Drivers

Introduction

Navigating New York’s roads—from Manhattan’s gridlock to scenic Hudson Valley highways—requires more than just skillful driving. With one of the highest auto insurance costs nationwide, securing the right car insurance in New York is crucial for both legal compliance and protecting your wallet.

In this updated 2025 guide, we break down everything you need: New York auto insurance requirements, average premiums by region, and proven methods to score cheap car insurance in New York while ensuring you have comprehensive coverage.

1. Meet New York’s Mandatory Car Insurance Requirements

As a no-fault state, New York drivers must carry Personal Injury Protection (PIP). Here are the minimum limits:

- $25,000 bodily injury per person / $50,000 per accident

- $10,000 property damage liability per accident

- $50,000 Personal Injury Protection (PIP)

- $25,000/$50,000 uninsured motorist bodily injury (in most counties)

While these numbers satisfy state law, many drivers upgrade to higher liability limits or add collision and comprehensive for true full coverage car insurance in New York.

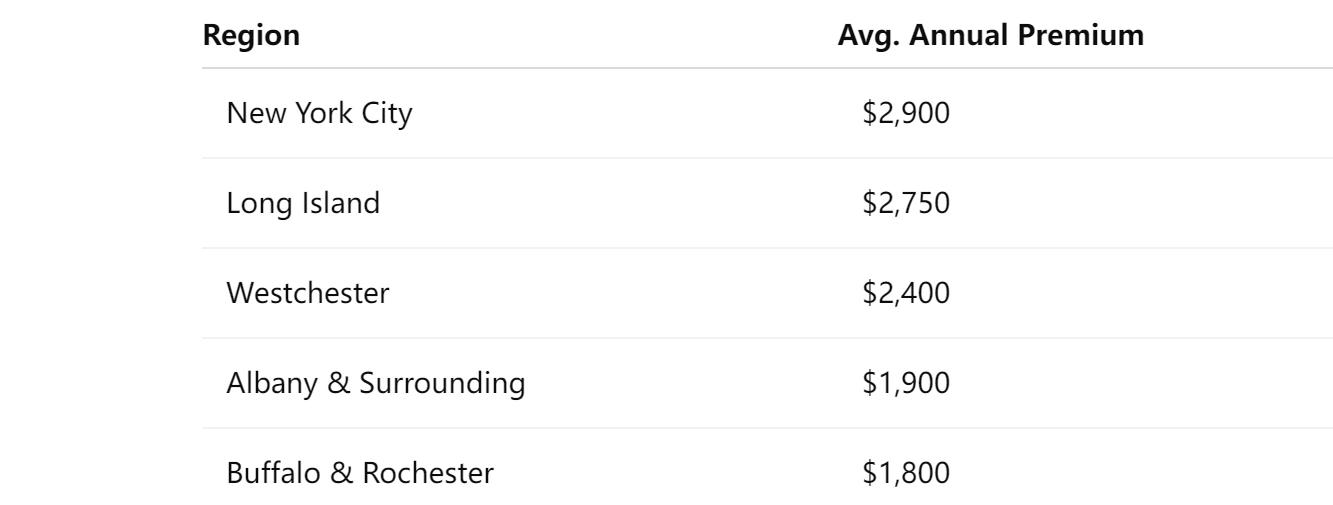

2. Average Car Insurance Premiums Across New York Regions

Premiums can vary drastically depending on where you drive:

Factors such as traffic density, theft rates, and claim frequency drive New York auto insurance rates higher in downstate areas.

3. What Shapes Your New York Car Insurance Rates?

Understanding the key pricing factors helps you better manage costs:

- Location-based risk: High-density urban zip codes see more accidents and claims

- Driving record: Accidents or tickets can spike your rate by 30–50%

- Vehicle choice: Insuring a luxury or high-performance car often costs 20–40% more

- Credit score restrictions lifted: Unlike many states, New York prohibits credit-based pricing, focusing instead on driving history and location

- Coverage selection and deductibles: Higher limits and lower deductibles increase your premium

By focusing on these elements, you can target areas to optimize when comparing New York car insurance quotes.

4. Strategies to Find Affordable Car Insurance in New York

To secure the best deals on New York car insurance, try these steps:

- Compare multiple quotes: Include national carriers (GEICO, Progressive) and regional insurers (NYCM Insurance, The Hartford)

- Bundle policies: Pair auto with home or renters insurance for multi-policy discounts

- Complete an approved defensive driving course: Many insurers offer up to 10% off for safe driver certification

- Opt into usage-based programs: Apps like Progressive Snapshot and Allstate Drivewise reward safe driving behaviors with up to 30% savings

- Ask for every discount: Good student, low-mileage, multi-car, and professional affiliations (teachers, healthcare workers) can all yield extra reductions

Consistently comparing New York car insurance quotes ensures you uncover the most competitive premiums.

5. Coverage Options to Consider Beyond the Minimum

In addition to mandatory PIP and liability, consider these add-ons for comprehensive protection:

- Collision Coverage: Pays for repairs after an at-fault accident

- Comprehensive Coverage: Covers theft, vandalism, and natural disasters—key in upstate snow and downstate flood zones

- Uninsured/Underinsured Motorist (UM/UIM): Protects you if the other driver can’t pay

- Rental Reimbursement & Roadside Assistance: Ensures you aren’t stranded after a breakdown in rural areas

Adding these options transforms basic compliance into robust auto insurance coverage in New York.

6. Recommended Car Insurance Providers in New York for 2025

Top-rated companies offering value and service in the Empire State include:

- GEICO – Known for low rates and a strong mobile app experience

- Progressive – Ideal for high-risk drivers and flexible payment plans

- Allstate – Offers robust bundling options and local agent support

- NYCM Insurance – Regional expertise with customized coverages for upstate residents

- State Farm – Wide network of agents and good loyalty discounts

When evaluating New York auto insurance providers, dive into claim satisfaction scores and local agent availability.

Conclusion

Securing the right car insurance in New York means balancing state requirements with your personal risk profile and budget. By boosting your liability limits, exploring optional coverages, and leveraging discounts, you can reduce costs—even in expensive markets like New York City.

Stay proactive: review your coverage annually, shop around before renewal, and tailor your policy to your driving habits and location for the best protection in 2025.