New York Health Insurance Guide 2025: Your Empire State Coverage Blueprint

Published on July 22, 2025

🗽 New York Health Insurance Guide 2025: Your Empire State Coverage Blueprint

Introduction

Whether you reside in Manhattan’s skyscrapers or the Hudson Valley countryside, securing the right health insurance in New York helps you manage costs and access quality care. This guide arms you with the knowledge to navigate NY State of Health plans, enroll in Medicaid/Child Health Plus®, bridge coverage gaps, and leverage employer benefits.

You’ll learn how to:

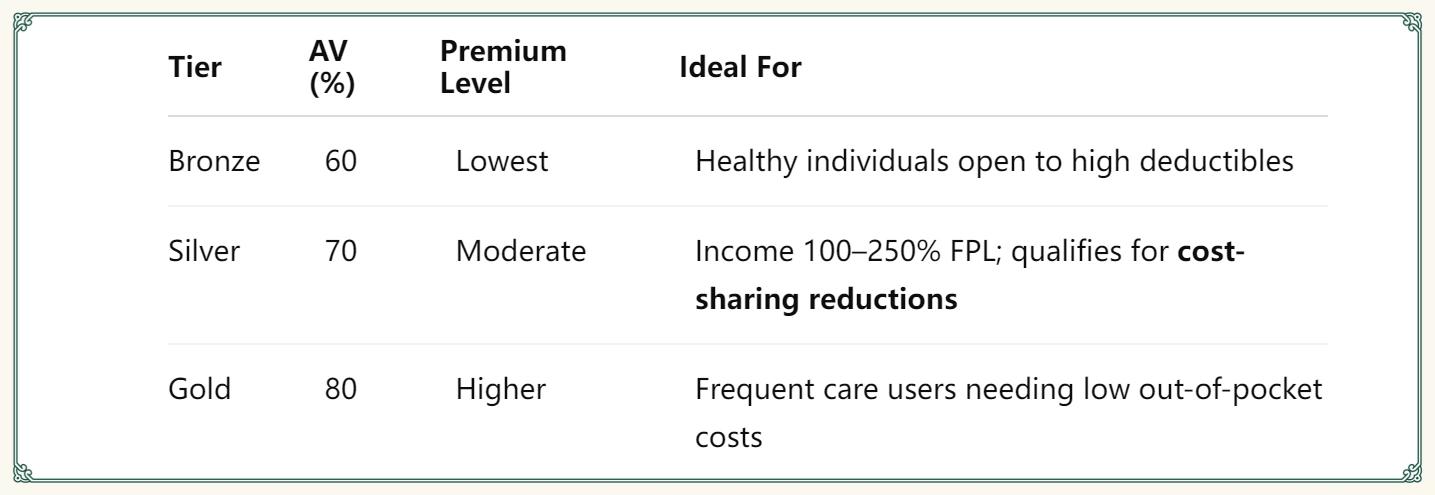

- Compare Bronze, Silver & Gold plans and subsidy eligibility

- Confirm Medicaid and Child Health Plus® enrollment steps

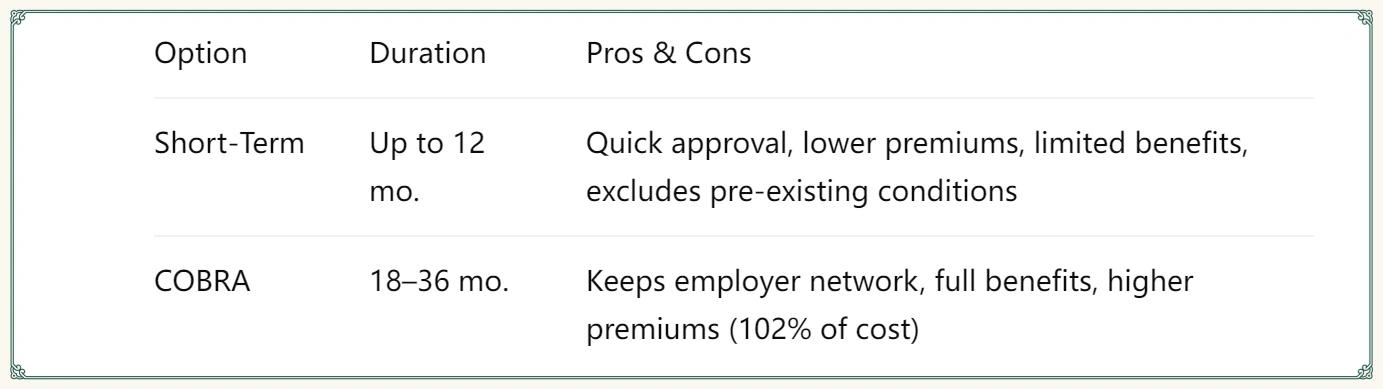

- Evaluate short-term health insurance vs. COBRA continuation

- Maximize savings with HDHP & HSA employer plans

- Use five proven cost-saving tactics to lower your New York health insurance expenses

1. Marketplace Plan Tiers & Subsidies

- Cost‑sharing reductions on Silver plans can lower your deductibles and copays if your income is 100–250% of the Federal Poverty Level.

- Enrollment window: November 1, 2024 – January 31, 2025.

2. Medicaid & Child Health Plus®

- Medicaid eligibility: Adults up to 138% FPL (~$20,120/year for a single adult).

- Child Health Plus®: Covers children in families up to 400% FPL, filling gaps above Medicaid limits.

- Apply: Online via NY State of Health portal or at your local Department of Social Services.

Pro Tip: Regularly update income and household data to prevent coverage interruptions and maintain Medicaid benefits.

3. Short‑Term Insurance vs. COBRA

- Short‑term plans: Ideal for temporary gaps but lack preventive and pre-existing condition coverage.

- COBRA: Best for continuity of care; you pay full premium plus a 2% administrative fee.

Keyword Focus: New York short‑term health insurance, New York COBRA coverage

4. Employer‑Sponsored HDHP & HSA Strategies

- Plan types: PPO, HMO, and HDHP paired with HSA.

- HSA advantages: Pre-tax contributions, tax-free interest growth, tax-free withdrawals for qualified medical expenses.

- 2025 HSA limits: $4,150 individual; $8,300 family.

Actionable Tip: Automate HSA contributions through payroll to maximize tax savings and build a medical emergency fund early in the year.

5. Five Cost‑Saving Tactics

- Lock in Subsidies: Estimate your household income accurately to maximize premium tax credits.

- Compare Early: Review networks, benefits, and pricing before enrollment deadlines.

- Stay In‑Network: Minimize out-of-pocket costs by using in-network providers.

- Embrace Telehealth: Utilize $0 telehealth visits for routine consultations and minor conditions.

- Multi‑line Discounts: Bundle health with dental and vision for discounted rates.

Applying these tactics helps you secure affordable health insurance in New York without compromising quality.

Conclusion

Choosing health insurance in New York in 2025 involves understanding Marketplace tiers, enrolling in Medicaid/Child Health Plus®, bridging gaps with short‑term or COBRA, and optimizing employer benefits with HSAs. Use this blueprint to craft a cost-effective, comprehensive coverage plan that meets your Empire State needs.