Life Insurance

New York Life Insurance Guide 2025: Protect Your Empire State Family

Published on July 21, 2025

🗽 New York Life Insurance Guide 2025: Protect Your Empire State Family

Introduction

Whether you’re raising kids in Brooklyn or retiring upstate, the right life insurance in New York secures your loved ones’ future. Knowing the nuances of term life insurance New York, permanent whole life policies, and flexible universal life coverage helps you tailor a plan that fits your budget and estate goals.

In this guide, discover how to:

- Evaluate term vs. whole vs. universal life policies

- Benchmark average premiums in New York City, Buffalo, and Albany

- Apply four proven tactics to lower your New York life insurance premiums

- Add key riders like accelerated death benefits and premium waivers

- Compare New York life insurance quotes efficiently

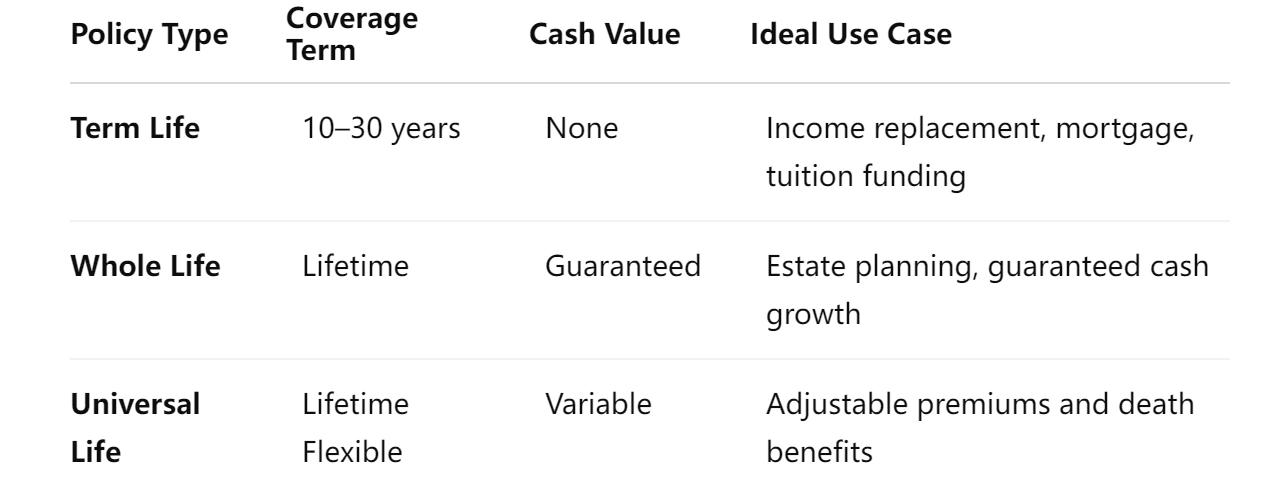

1. Policy Comparison: Term, Whole & Universal Life

- Term life insurance New York offers the most affordable coverage for specified durations.

- Whole life ensures level premiums and builds cash value for lifelong security.

- Universal life combines flexibility in premium payments with cash value accumulation.

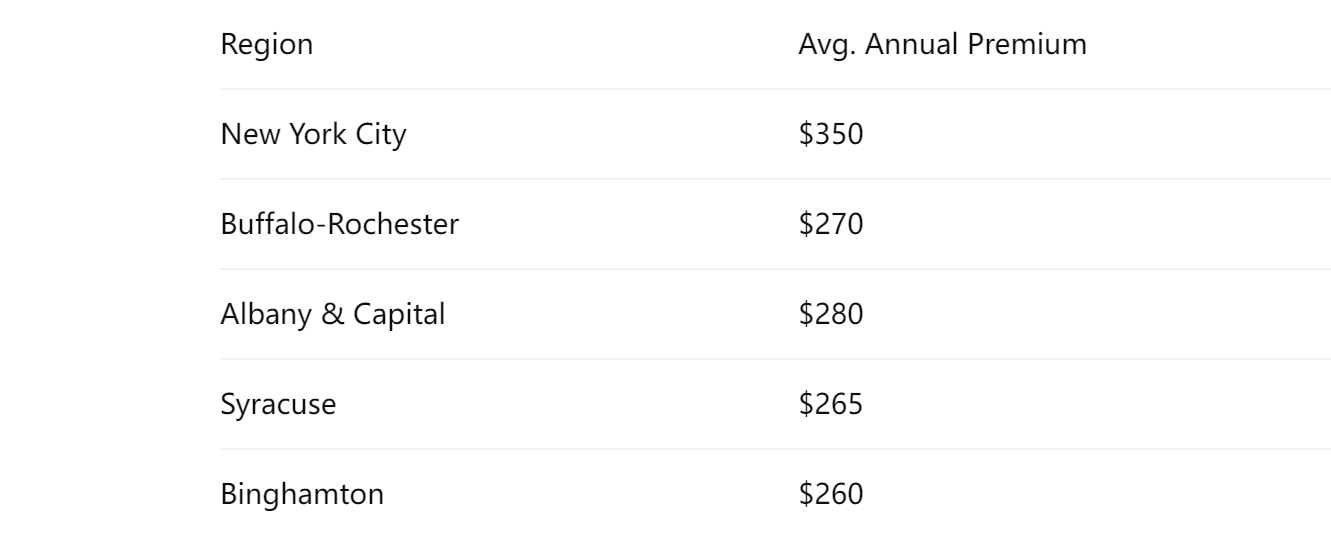

2. Premium Snapshot by Region (35‑Year‑Old Male, $500K/20‑Year Term)

- NYC life insurance rates are highest due to dense urban risk factors.

- Upstate markets like Buffalo and Binghamton offer more competitive premiums.

3. Four Tactics to Lower Your Premium

- Buy early: Lock in lower rates before age 40 to maximize savings.

- Maintain health: Nonsmokers with ideal BMI can unlock 30–50% discounts.

- Choose level-term: Guarantees fixed premiums, avoiding mid-term increases.

- Shop multiple carriers: Compare at least five insurers—national (MetLife, Northwestern Mutual) and local (Guardian, MassMutual).

4. Essential Riders & Add‑Ons

Add precision and flexibility with:

- Accelerated Death Benefit: Access part of the death benefit upon terminal illness diagnosis.

- Waiver of Premium: Waive premiums if you become disabled.

- Child Term Rider: Covers minor children under your policy.

- Return of Premium: Refunds premiums if you outlive the term period.

5. Streamlined Quote Comparison

- Gather info: Age, health status, coverage amount, and ZIP code.

- Use online tools: Enter details to retrieve New York life insurance quotes side by side.

- Evaluate carriers: Check AM Best ratings, customer reviews, and claim response times.

- Consult an advisor: For complex whole or universal policies, get expert guidance.

Conclusion

Securing New York life insurance means balancing price, coverage type, and long-term goals. By leveraging policy comparisons, regional premium insights, discount strategies, and customizable riders, you can protect your Empire State family with confidence in 2025.