North Carolina Car Insurance Guide 2025: Smart Coverage & Savings on Tar Heel Roads

Published on July 16, 2025

🚗 North Carolina Car Insurance Guide 2025: Smart Coverage & Savings on Tar Heel Roads

Introduction

Whether you’re merging onto I-40 in Raleigh or cruising downtown Charlotte, finding the right car insurance in North Carolina makes all the difference. With varied weather—from coastal storms to winter ice—and a no-fault-inspired liability system, understanding how North Carolina auto insurance rates are calculated helps you secure coverage that fits both your needs and your budget.

In this guide, we’ll cover North Carolina’s 30/60/25 liability requirements, reveal average premiums by region, and share proven strategies to get cheap car insurance in North Carolina without sacrificing critical protections.

1. North Carolina’s Mandatory 30/60/25 Liability Limits

State law requires every driver to carry minimum liability coverage of:

- $30,000 bodily injury per person

- $60,000 bodily injury per accident

- $25,000 property damage per accident

These 30/60/25 liability limits meet legal standards, but a serious crash can exceed these amounts. Adding collision and comprehensive coverage—components of full coverage auto insurance in North Carolina—helps pay for repairs after hailstorms, floods, or at-fault collisions.

2. Regional Premium Snapshot: Raleigh vs. Charlotte

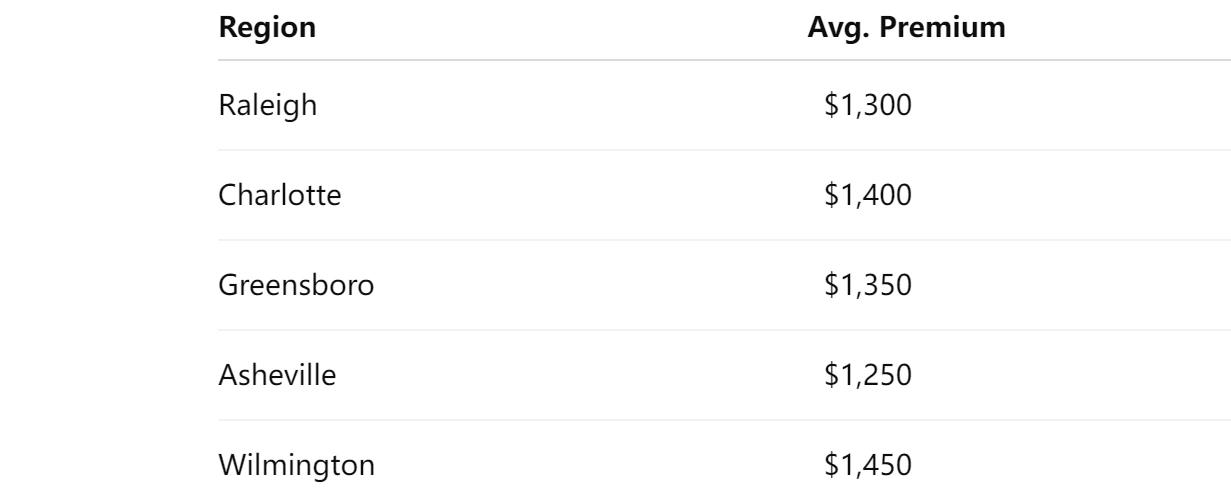

Your ZIP code impacts your North Carolina auto insurance premium. In 2025, average annual full-coverage rates are:

Charlotte’s dense traffic and higher theft rates drive premiums up, while Asheville’s lower claim frequency offers more savings opportunities when you compare North Carolina car insurance quotes.

3. Top Factors Driving Your North Carolina Premium

Knowing what influences your rate lets you target savings:

- Driving record: Accidents or tickets can hike rates by 30–50%.

- Credit-based pricing: North Carolina allows credit scores to affect premiums—improving your score can reduce your rate.

- Vehicle type and age: SUVs and performance cars can cost 20–40% more to insure.

- Annual mileage: Commuters typically pay higher premiums than low-mileage drivers.

- Local weather risks: Coastal areas face flood and storm claims; mountain regions see higher comprehensive claims from snow and ice.

Focusing on these elements will help you refine your auto insurance coverage in North Carolina.

4. Five Strategies to Score Cheap Car Insurance in North Carolina

- Compare multiple quotes: Check rates from national carriers (GEICO, Progressive) and local providers (Nationwide, Farm Bureau).

- Bundle policies: Combining auto and home or renters insurance can yield multi-policy discounts up to 25%.

- Raise your deductibles: Opt for a $1,000 deductible to slash your premium by 10–15%, if you have emergency savings.

- Enroll in usage-based plans: Programs like Progressive Snapshot or Allstate Drivewise reward safe driving with discounts up to 30%.

- Maximize all discounts: Good student, safe driver courses, low-mileage, multi-car, and safety feature credits add extra savings.

By proactively finding cheap car insurance in North Carolina, you’ll uncover the best deals each renewal cycle.

5. Essential Optional Coverages for Fuller Protection

Consider these add-ons to shield yourself from common North Carolina risks:

- Comprehensive coverage: Covers theft, vandalism, and weather-related damage like floods and hail.

- Collision coverage: Pays for repairs after you’re at fault in an accident.

- Uninsured/Underinsured Motorist (UM/UIM): Protects you when the other driver lacks adequate insurance.

- Roadside assistance & rental reimbursement: Provides peace of mind during breakdowns or when your car is being repaired.

Incorporating these options ensures your auto insurance in North Carolina keeps you covered through storms, traffic, and unexpected incidents.

6. Top-Rated Car Insurance Providers in North Carolina

Here are some of the best insurers for North Carolina drivers in 2025:

- GEICO: Known for low online rates and robust discount programs.

- State Farm: Offers a large agent network and comprehensive bundling perks.

- Progressive: Ideal for usage-based discounts and drivers with nonstandard profiles.

- Nationwide: Strong local presence and customizable policy options.

- Farm Bureau Insurance: Provides tailored coverage and member-exclusive benefits.

Evaluate each company’s claims satisfaction scores and policy options to pick the best North Carolina auto insurance provider for your needs.

Conclusion

Securing the right car insurance in North Carolina means balancing legal requirements with customized coverages that reflect your driving habits and regional risks. By understanding 30/60/25 liability limits, comparing rates across cities, and leveraging strategic discounts, you can drive confidently without overpaying.