North Carolina Life Insurance Guide 2025: Secure Your Tar Heel Legacy

Published on July 24, 2025

🏞️ North Carolina Life Insurance Guide 2025: Secure Your Tar Heel Legacy

Introduction

From Charlotte’s skyline to the mountains of Asheville, the right life insurance in North Carolina provides peace of mind and financial protection. Whether you need budget-friendly term life insurance North Carolina for family security, permanent whole life policies for wealth accumulation, or flexible universal life coverage to adjust with life changes, this guide equips you to:

- Understand policy differences and choose the best fit

- Analyze local premium benchmarks

- Enhance coverage with targeted riders & add‑ons

- Implement five cost-saving tactics

- Quickly compare and apply for North Carolina life insurance quotes online

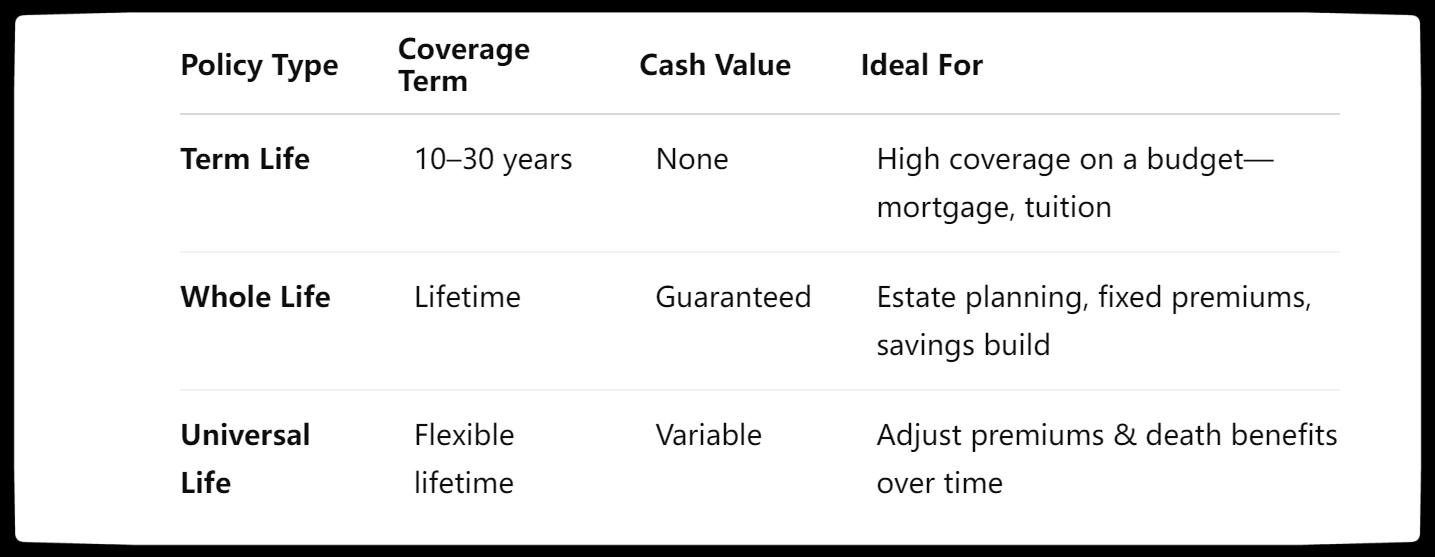

1. Policy Options: Term, Whole & Universal Life Explained

- Term life insurance North Carolina offers the lowest premiums per dollar of coverage, ideal for covering college costs in Raleigh.

- Whole life locks in premiums and builds cash value—perfect for legacy planning in Wilmington.

- Universal life provides premium flexibility, matching your career growth in Charlotte’s financial district.

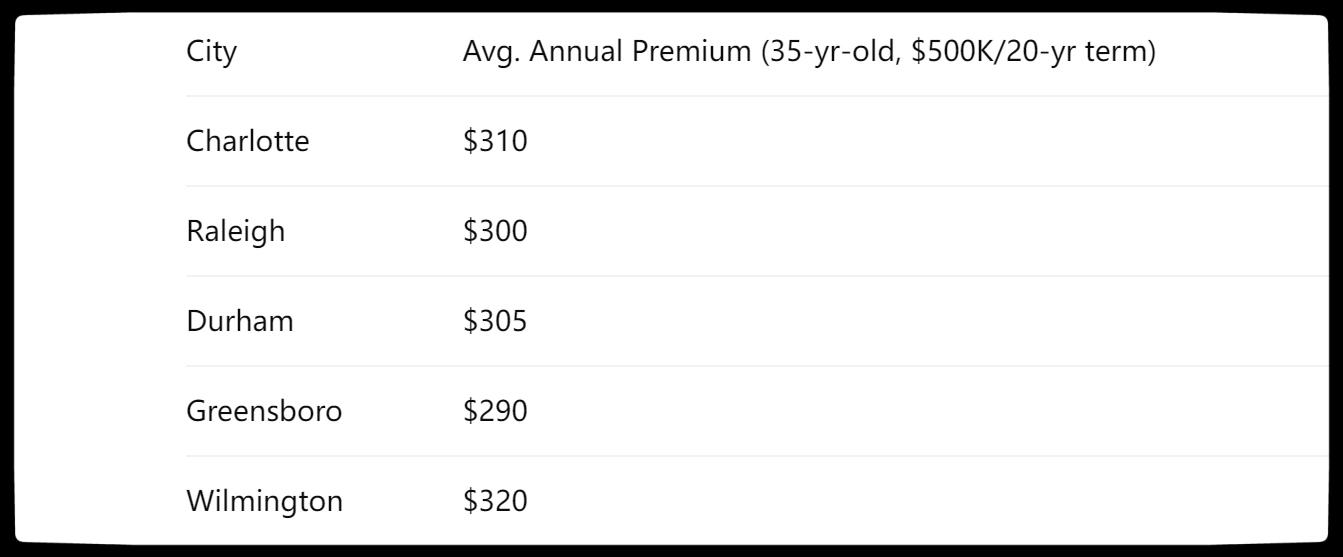

2. Premium Snapshot: Charlotte, Raleigh & Durham

- Charlotte life insurance rates mirror urban living costs and underwriting tiers.

- Greensboro’s competitive premiums result from favorable regional risk profiles.

Action: Enter your ZIP code into our quote tool to receive precise North Carolina life insurance quotes.

3. Enhance Your Coverage: Key Riders & Add‑Ons

Elevate your policy with these essential options:

- Accelerated Death Benefit: Access part of your death benefit if diagnosed with a terminal condition—helps manage medical expenses in Durham.

- Waiver of Premium: Keeps your policy active without payments if you become disabled.

- Child Term Rider: Provides low-cost coverage for minor children, ideal for growing families in Raleigh.

- Return of Premium (ROP): Recoups all paid premiums if you outlive the term—combines term protection with savings.

Choosing the right riders tailors life insurance in North Carolina to your family’s evolving needs.

4. Five Proven Strategies to Lower Your Premiums

- Buy Early: Secure coverage before age 40 to access lower underwriting classes and lock in better rates.

- Healthy Lifestyle Discounts: Non-smokers with healthy BMI can save 30–50% on premiums—ideal for active lifestyles in Asheville.

- Level-Term Policies: Guarantees fixed premiums throughout the term, avoiding mid-policy increases.

- Compare Multiple Carriers: Request quotes from at least five insurers—both national and North Carolina-based carriers—to find the best value.

- Minimize Claims: Handle minor expenses yourself to preserve no-claim discounts and preferred rates.

Implement these tactics to find affordable life insurance in North Carolina without sacrificing coverage.

5. Efficient Quote Comparison & Application

- Compile Your Details: Age, health status, desired coverage, and ZIP code.

- Use Our Online Platform: Input your information to compare North Carolina life insurance quotes side by side.

- Evaluate Insurers: Review AM Best ratings, customer testimonials, and claims processing speeds.

- Get Expert Advice: Consult our North Carolina life insurance specialists for personalized recommendations.

Pro Tip: Reassess and re-quote your policy every 3–5 years or after significant life events—marriage, home purchase—to maximize savings.

Conclusion

Choosing life insurance in North Carolina for 2025 means balancing policy type, regional premiums, and savings strategies. By leveraging targeted riders and proven tactics, you can protect your Tar Heel family confidently and affordably.

You Might Also Like:

Life Insurance in 2025: A Smart Buyer’s Guide

6 Smart Ways to Save on Life Insurance in 2025

Term Life vs No-Exam Life Insurance: Which Is Better for You?