Pay Per Mile Car Insurance Pros and Cons 2025: The Complete Guide

Published on August 11, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

Introduction to Pay Per Mile Car Insurance in 2025

The auto insurance industry is undergoing a quiet revolution, and pay per mile car insurance is at the center of it. As more drivers shift to remote work, adopt eco-friendly habits, and use smart technology, the idea of paying for car insurance based on how much you actually drive is gaining traction.

In 2025, advancements in telematics, artificial intelligence, and real-time data tracking have made mileage-based insurance more accurate, accessible, and appealing than ever. But like any financial product, it’s not one-size-fits-all. Understanding both the advantages and potential drawbacks will help you make an informed decision.

What is Pay Per Mile Car Insurance?

At its core, pay per mile car insurance—also known as usage-based or mileage-based insurance—charges you a base monthly rate plus a per-mile fee. Your actual driving distance is tracked via a plug-in device, mobile app, or your car’s built-in GPS system.

This approach replaces flat-rate premiums with a usage model, much like paying for electricity or mobile data. If you drive less, you pay less.

How it Differs from Traditional Auto Insurance

Traditional insurance premiums are calculated based on a combination of factors such as age, driving history, location, and estimated annual mileage. But “estimated” mileage is often just a guess, meaning low-mileage drivers can end up overpaying.

Pay per mile removes that guesswork. Your premium is dynamically adjusted according to actual miles driven—providing a fairer pricing model for people who don’t spend much time behind the wheel.

Why 2025 is a Pivotal Year for Mileage-Based Policies

Three major shifts are making 2025 a turning point:

- Remote work normalization – Fewer people commute daily.

- Environmental awareness – Reducing unnecessary driving cuts carbon emissions.

- Tech maturity – Telematics devices are now smaller, more accurate, and less intrusive.

Together, these trends are fueling rapid adoption of mileage-based coverage.

How Pay Per Mile Car Insurance Works

Understanding the mechanics behind pay per mile car insurance in 2025 is key to determining if it fits your lifestyle. While different providers have unique approaches, most follow a similar framework.

The Role of Mileage Tracking Technology

Mileage-based insurance depends on accurately tracking how far you drive. This is usually done through:

- Plug-in devices inserted into your car’s OBD-II port.

- Mobile apps connected to your vehicle’s Bluetooth or GPS.

- Built-in telematics in newer models, transmitting data directly to the insurer.

These systems log mileage, time of day, and sometimes driving habits like acceleration and braking. While the primary focus is distance, additional data can help insurers adjust rates or offer safe-driver discounts.

Pricing Structure: Base Rate + Per Mile Rate

Most pay per mile policies combine:

- Base rate – A fixed monthly cost covering factors like your age, driving record, and location.

- Per mile rate – A few cents for each mile you drive.

For example, a policy might cost $30 per month plus $0.05 per mile. If you drive 500 miles, you’d pay $55 total for that month.

Types of Vehicles and Drivers Best Suited

Pay per mile insurance is ideal for:

- Second cars that see minimal use.

- Electric vehicles (EVs) often driven less than gasoline cars.

- Occasional drivers like retirees or urban residents with strong public transport access.

The Pros of Pay Per Mile Car Insurance in 2025

Mileage-based policies offer a variety of benefits—especially for the right type of driver.

Cost Savings for Low-Mileage Drivers

If you drive less than 6,000–8,000 miles annually, you could save hundreds compared to a traditional flat-rate premium. The savings can be even greater for city dwellers who only use their vehicles for weekend trips.

Encourages Reduced Driving and Environmental Benefits

Driving less not only saves money but also reduces carbon emissions and traffic congestion. In 2025, eco-conscious consumers are increasingly drawn to insurance models that reward greener habits.

Flexible and Transparent Billing

Instead of paying a flat annual premium, you get monthly bills that clearly show your mileage and cost. This transparency allows for easy budgeting and control.

Integration with Smart Car and Mobile Apps

Many insurers now offer mobile dashboards showing your daily mileage, driving trends, and estimated monthly costs in real-time—making it easier to adjust habits and manage expenses.

The Cons of Pay Per Mile Car Insurance in 2025

No insurance model is perfect, and pay per mile has its share of limitations.

Not Ideal for High-Mileage Drivers

If you commute long distances or drive frequently for work, per-mile fees can quickly outweigh any base rate savings, making a traditional plan more cost-effective.

Privacy Concerns with GPS Tracking

Mileage tracking devices often collect location and driving behavior data. While most insurers have privacy policies, some drivers remain uneasy about continuous tracking.

Potential for Higher Costs During Emergencies

Unexpected events—such as needing to drive cross-country for a family emergency—can lead to a sudden spike in monthly insurance costs.

Limited Availability in Certain States or Regions

While coverage is expanding in 2025, some rural or less-regulated states may have few or no providers offering mileage-based plans.

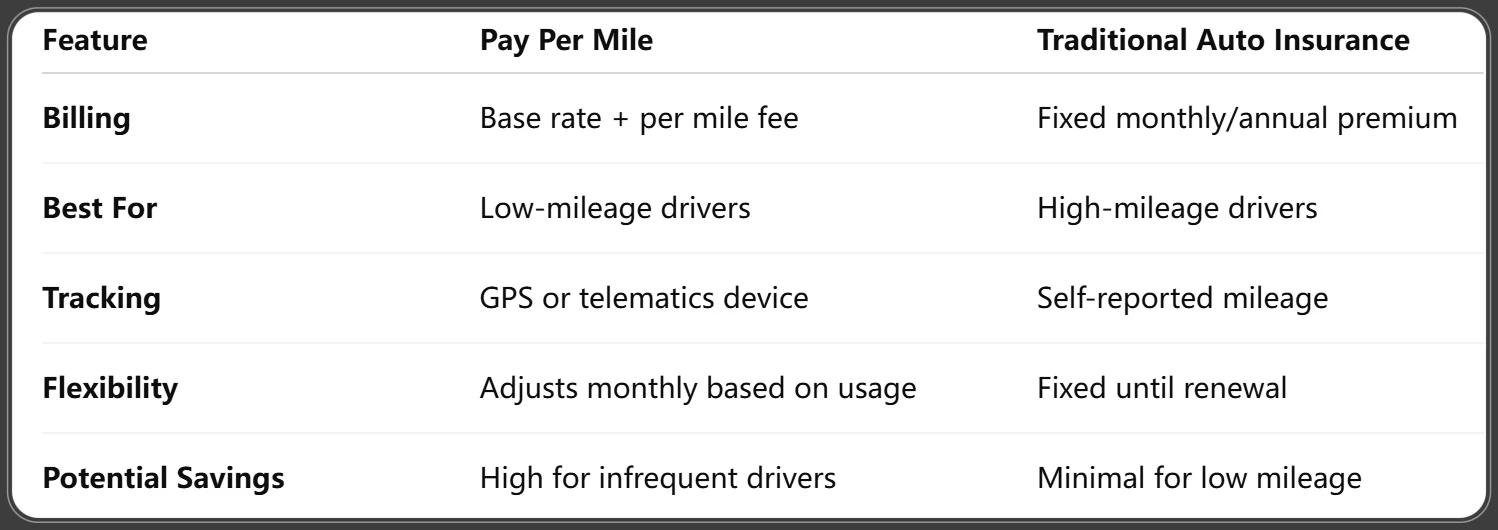

Pay Per Mile Car Insurance vs. Traditional Auto Insurance

Understanding the differences can help you decide which model fits your needs.

PropertyCasualty360. (2025, April 14). NAIC: Top auto insurers of 2025 [Web article].

Who Should Consider Pay Per Mile Car Insurance in 2025?

Urban and City Drivers

If you live in a metropolitan area with public transport and drive only occasionally, pay per mile insurance is often the most cost-efficient choice.

Remote Workers and Work-from-Home Professionals

With daily commuting largely eliminated, these drivers often see the greatest savings.

Seniors and Occasional Drivers

Retirees who only drive locally for errands or social visits benefit from lower costs and simpler billing.

Latest Trends in Mileage-Based Insurance for 2025

The pay per mile insurance market is evolving rapidly, with technology and consumer habits shaping its future.

AI and Predictive Analytics in Policy Pricing

Insurers now use artificial intelligence to predict driving behavior, seasonal mileage patterns, and even potential accident risks. This allows for more personalized pricing that rewards safe, low-mileage drivers with extra discounts.

Partnerships Between Insurers and Automakers

Many automakers, especially those producing EVs, are partnering with insurance companies to offer built-in mileage-based coverage at the point of sale. This reduces setup hassles and integrates the policy directly into the car’s connected systems.

Growing Popularity Among Electric Vehicle Owners

EV owners tend to drive fewer miles annually, making them prime candidates for per-mile coverage. Some insurers also offer eco-discounts for electric or hybrid vehicles, further lowering costs.

Major Insurance Companies Offering Pay Per Mile Policies

Nationwide Providers

- Metromile – A pioneer in mileage-based insurance, now expanding coverage to more states in 2025.

- Allstate Milewise – Offers flexible daily caps to prevent extreme monthly costs.

- Progressive SmartMiles – Integrates telematics with safe-driving rewards.

Regional and Start-up Insurers

- Smaller, tech-driven insurers are entering niche markets, offering competitive rates for urban drivers.

- Some regional providers offer pay per mile only in states with strong telematics infrastructure.

How to Compare and Choose the Right Plan

When shopping for a policy:

- Compare base rates and per mile rates.

- Check maximum daily mileage caps.

- Review coverage limits to ensure they match traditional policies.

- Evaluate the ease of mileage tracking—apps vs. devices.

Cost Comparison: Pay Per Mile vs. Standard Plans in 2025

Case Study: Low-Mileage Driver

- Drives 300 miles/month.

- Base rate: $25. Per mile: $0.06.

- Total monthly cost: $43.

- Equivalent traditional plan: $95/month → Savings: $52/month.

Case Study: High-Mileage Driver

- Drives 2,000 miles/month.

- Base rate: $25. Per mile: $0.06.

- Total monthly cost: $145.

- Equivalent traditional plan: $110/month → Extra cost: $35/month.

Break-Even Mileage Threshold

For most drivers, the break-even point in 2025 is between 800–1,000 miles/month. Drive less than that, and you’re likely to save; drive more, and a standard plan may be cheaper.

How to Sign Up for Pay Per Mile Car Insurance

Step-by-Step Enrollment Process

- Request quotes from multiple insurers.

- Submit personal and vehicle details including make, model, and year.

- Agree to mileage tracking via app or device.

- Receive your device (if applicable) and install it in your car.

Required Documents and Mileage Verification

- Driver’s license

- Vehicle registration

- Current odometer reading (may be verified via photo or device data)

Setting Up Your Mileage Tracker

Most devices are plug-and-play, connecting to your car’s OBD-II port. Mobile apps require location permissions and may need Bluetooth enabled.

Frequently Asked Questions About Pay Per Mile Car Insurance

Is Pay Per Mile Insurance More Expensive in the Long Run?

Not for low-mileage drivers. However, frequent drivers may pay more due to cumulative per-mile charges.

What Happens if You Exceed Your Estimated Mileage?

Your premium automatically adjusts; some plans have daily caps to prevent runaway costs.

Can I Switch from Traditional to Pay Per Mile Mid-Year?

Yes, most insurers allow you to switch, though cancellation fees may apply depending on your provider.

Is My Data Secure?

Reputable insurers encrypt all telematics data, but always review a company’s privacy policy before enrolling.

Does It Cover Accidents the Same Way as Regular Insurance?

Yes—coverage terms for liability, collision, and comprehensive are similar to standard policies.

Is It Available for Commercial Vehicles?

Most pay per mile plans are for personal use only, though some insurers are piloting commercial fleet programs.

Conclusion: Is Pay Per Mile Car Insurance Right for You in 2025?

Pay per mile car insurance in 2025 is a smart, fair, and tech-friendly alternative for drivers who don’t rack up thousands of miles each month.

It offers significant savings, environmental benefits, and billing transparency—but it’s not ideal for everyone, particularly high-mileage commuters.

If you drive less than 1,000 miles per month, value data-driven fairness, and are comfortable with GPS-based tracking, this insurance model may be your best bet.

For those considering the switch, start by comparing quotes, checking your average monthly mileage, and reviewing privacy policies. With the right plan, you could enjoy both lower costs and a greener footprint in 2025.

You Might Also Like

Car Insurance for Snowbirds 2025: Seasonal Driver’s Guide to Coverage

Aug 12, 2025Car Insurance for Immigrants 2025: Complete Guide to Getting Covered in the U.S.

Aug 12, 2025Car Insurance for DUI Drivers 2025: How to Get Coverage After a Conviction

Aug 12, 2025Car Insurance for Classic Cars Value Based Policies 2025

Aug 11, 2025How to Cancel Car Insurance Policy Without Penalty 2025: Expert Guide

Aug 11, 2025