Pennsylvania Life Insurance Guide 2025: Safeguard Your Keystone State Family

Published on July 21, 2025

🐴 Pennsylvania Life Insurance Guide 2025: Safeguard Your Keystone State Family

Introduction

Whether you call the Liberty Bell City home or live among the rolling hills of Lancaster, the right life insurance in Pennsylvania protects your loved ones’ financial future. Knowing how to navigate term life insurance Pennsylvania rates, permanent whole life policies, and flexible universal life options ensures you secure coverage that aligns with your budget and legacy planning.

In this guide, we’ll help you:

- Distinguish term vs. whole vs. universal life insurance benefits

- Analyze city-specific premiums for key markets: Philadelphia, Pittsburgh, and Harrisburg

- Implement four proven strategies to lower your Pennsylvania premiums

- Choose riders & add-ons tailored to Keystone State needs

- Seamlessly compare Pennsylvania life insurance quotes online

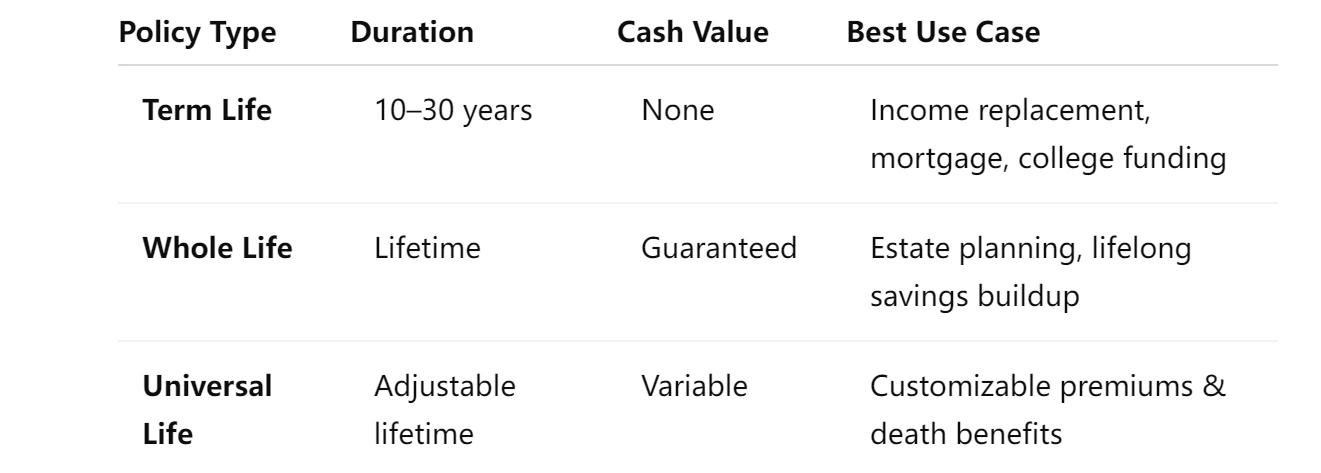

1. Policy Types: Term, Whole & Universal Life Explained

- Term life insurance Pennsylvania offers the lowest initial premiums per coverage dollar — ideal for young families and mortgage holders.

- Whole life ensures fixed premiums and builds cash value, supporting estate and legacy objectives.

- Universal life provides premium flexibility and adjustable death benefits to meet changing needs.

Tip: Match coverage length to your financial commitments — choose a 20-year term for college expenses or a lifetime policy for estate liquidity.

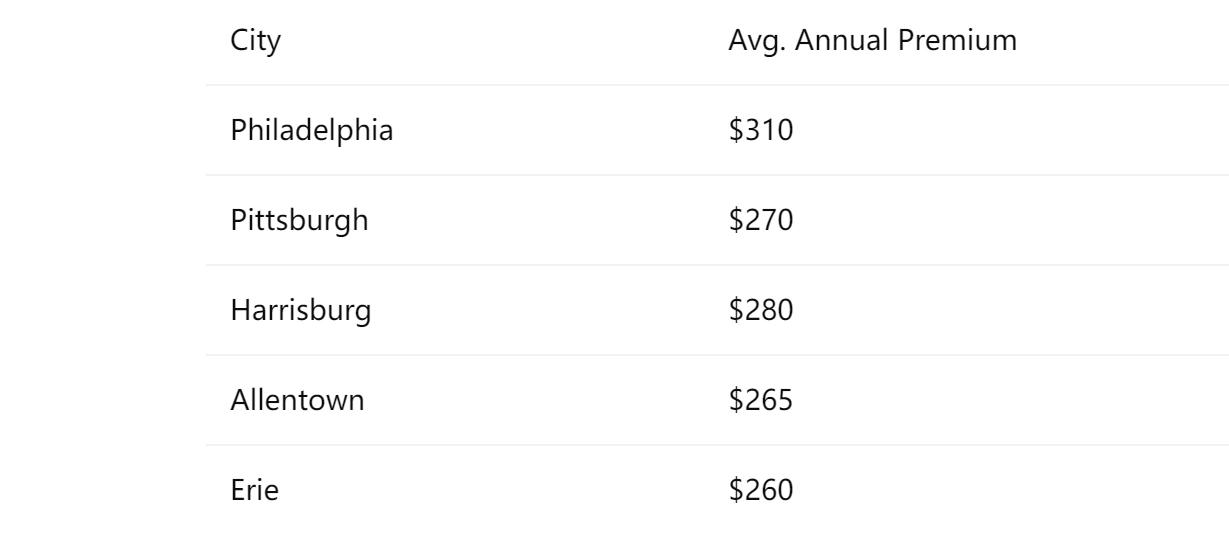

2. Premium Snapshot: Philadelphia, Pittsburgh & Harrisburg

Understanding local underwriting makes a big difference. Here are average annual premiums for a healthy 35-year-old male seeking $500,000 of 20-year term life:

- Philadelphia life insurance rates are highest due to urban density and underwriting evaluations.

- Erie’s lower costs reflect regional risk profiles and lower living expenses.

Actionable: Enter your ZIP code into our quote engine to see precise Pennsylvania life insurance quotes tailored to your locale.

3. Four Strategies to Reduce Your Premium

- Lock in rates early: Secure coverage before age 40 to capitalize on lower underwriting classes.

- Embrace healthy lifestyle discounts: Non-smokers with optimal BMI often save 30–50%.

- Select level-term policies: Guarantees fixed premiums throughout the term, protecting against mid-policy hikes.

- Compare multiple insurers: Obtain quotes from at least five carriers, including regional favorites (Penn Mutual, Erie Insurance) and national brands (New York Life, MassMutual).

Pro Tip: Reassess your policy after major life events (marriage, home purchase) to capture new discount opportunities.

4. Essential Riders & Add‑Ons for Keystone Risks

Enhance your base policy with these valuable riders:

- Accelerated Death Benefit: Access part of the death benefit if diagnosed with a terminal illness.

- Waiver of Premium: Premium payments suspended if you become totally disabled.

- Child Term Rider: Extends coverage to minor children under your policy.

- Return of Premium (ROP): Refunds all paid premiums if you outlive the term — combining term coverage with a savings component.

These add-ons tailor your Pennsylvania life insurance policy to address evolving family needs.

5. Effortless Quote Comparison Process

- Gather personal details: Age, health status, desired coverage, and ZIP code.

- Use our online tool: Enter information to instantly compare Pennsylvania life insurance quotes from top carriers.

- Assess insurer strength: Review AM Best ratings, policy reviews, and claims processing times.

- Consult an expert: For whole or universal life options, work with an advisor to align policy design with long-term goals.

Outcome: Easily identify the best balance of premium, coverage, and insurer reliability.

Conclusion

Securing the right life insurance in Pennsylvania means aligning your policy with your financial obligations and family legacy. By understanding policy types, regional premium differences, cost-saving tactics, and essential riders, you’ll confidently choose coverage that protects your Keystone State family today and tomorrow.