PPO vs HMO: Which Health Insurance Plan Is Right for You?

Published on July 8, 2025

Alex Thompson

Insurance Data Analyst & Content Strategist

Alex Thompson analyzes insurer data and market trends to produce objective rate comparisons, annual cost studies, and interactive saving guides.

Introduction

When shopping for health insurance, one of the first choices you'll face is deciding between a PPO and an HMO. These two plan types dominate the U.S. private insurance market — but they offer very different benefits, restrictions, and price points.

This guide breaks down the differences between PPO and HMO health insurance plans to help you make an informed, cost-effective choice.

What Is an HMO (Health Maintenance Organization)?

HMO plans require members to:

- Choose a primary care physician (PCP)

- Get referrals for specialist visits

- Use doctors and hospitals within the plan’s network only

Pros of HMO:

- Lower monthly premiums

- Lower out-of-pocket costs

- Coordinated care through your PCP

Cons of HMO:

- Less provider flexibility

- No out-of-network coverage (except emergencies)

- Must get referrals for most specialist visits

What Is a PPO (Preferred Provider Organization)?

PPO plans offer more freedom and flexibility. With a PPO, you can:

- See any provider, including out-of-network (at higher cost)

- Skip referrals to see a specialist

- Use both in-network and out-of-network providers

Pros of PPO:

- Greater choice of doctors and specialists

- No referral needed

- Ideal for people who travel often or need specialized care

Cons of PPO:

- Higher premiums

- Higher deductibles and out-of-pocket costs

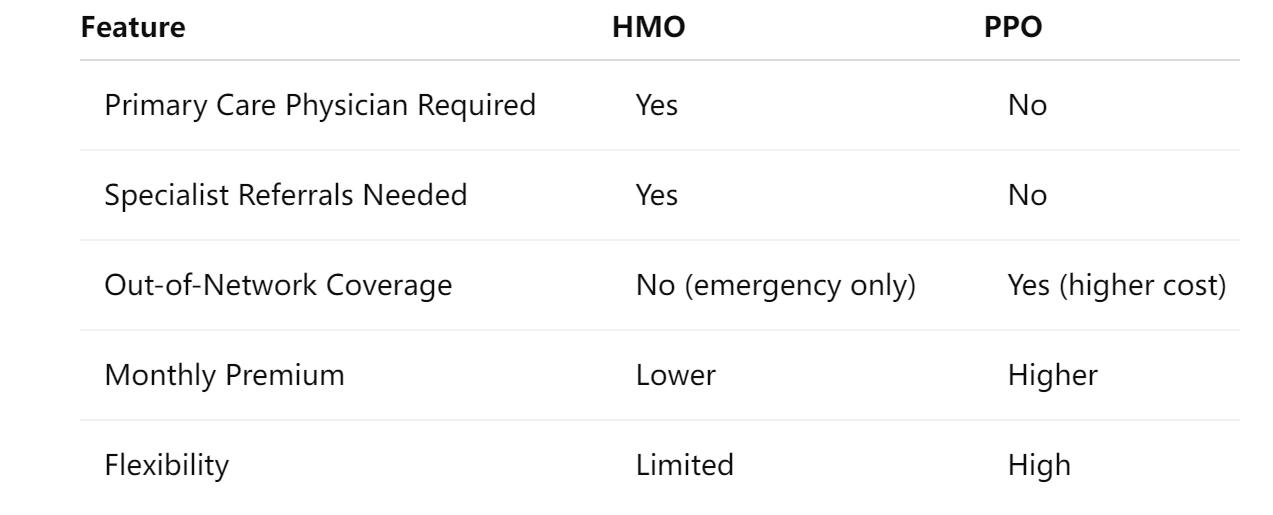

Key Differences: PPO vs HMO

Kaiser Family Foundation. (2025, July 11). Americans’ Challenges with Health Care Costs. Retrieved July 11, 2025.

Which Plan Is Right for You?

Choose an HMO if you:

- Want lower monthly premiums

- Prefer coordinated care through one doctor

- Are okay with limited provider choices

Choose a PPO if you:

- Want to see any doctor without a referral

- Need access to a wide range of specialists

- Travel frequently or live in multiple locations

FAQs

❓ Is a PPO better than an HMO?

Not necessarily. PPOs offer more flexibility but cost more. HMOs are more affordable but more restrictive.

❓ Can I switch between PPO and HMO?

Yes, usually during your insurance plan’s Open Enrollment period or if you have a qualifying life event.

❓ Do both plans cover preventive care?

Yes. Under the ACA, both PPO and HMO plans must cover preventive services at no cost when in-network.

Final Thoughts

There is no one-size-fits-all answer when choosing between PPO and HMO plans. The best choice depends on your medical needs, preferred providers, and budget.

Understanding the core differences between PPO and HMO plans is the first step toward choosing health coverage that works for you — not against you.

You Might Also Like

2025 Shocking Truth: What is a Deductible in Health Insurance?

Jul 31, 2025How the "One Big Beautiful Bill Act" Transforms ACA Health Insurance in 2025

Jul 20, 2025Health Insurance in 2025: What You Need to Know Before You Enroll

Jul 10, 20257 Smart Tips to Save Money on Health Insurance in 2025

Jul 8, 2025What Is Health Insurance and How Does It Work in the U.S.?

Jul 2, 2025