Texas Health Insurance Guide 2025: Coverage Tailored for the Lone Star State

Published on July 22, 2025

🤠 Texas Health Insurance Guide 2025: Coverage Tailored for the Lone Star State

Introduction

Texas’s vast geography—from Houston’s coastal cities to West Texas plains—demands flexible health insurance in Texas. This guide helps you choose the right plan, whether through the ACA Marketplace, Medicaid, temporary short-term insurance, or an employer-sponsored package with HSAs.

Learn how to:

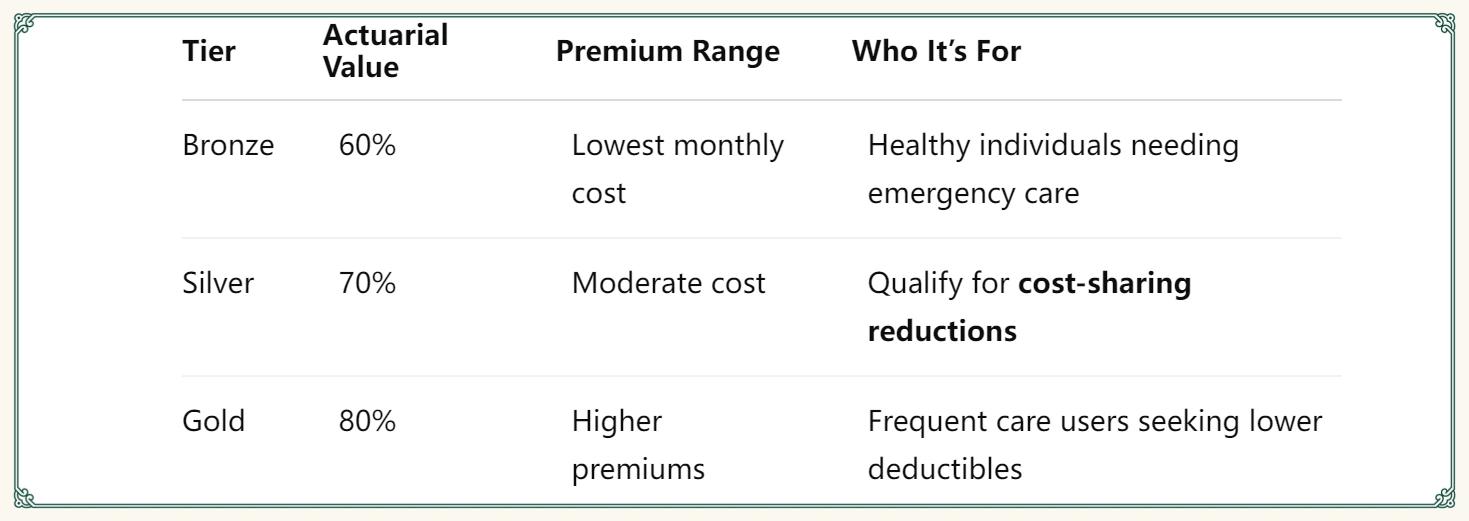

- Compare Marketplace Bronze/Silver/Gold tiers and subsidies

- Navigate Texas Medicaid qualifications and application

- Bridge coverage with short-term health plans or COBRA continuation

- Maximize your HDHP & HSA benefits under employer plans

- Implement five cost-saving tactics for cheap health insurance in Texas

1. ACA Marketplace Plans: Bronze, Silver & Gold

- Silver plans: Extra savings if your income is 100–250% of the Federal Poverty Level.

- Enrollment: November 1, 2024 – January 31, 2025.

Action: Use HealthCare.gov to get customized Texas ACA Marketplace quotes and subsidy estimates.

2. Texas Medicaid: Eligibility & Enrollment

- Adult Medicaid: Covers up to 138% FPL (~$20,000/year for singles).

- Children & Low-Income Parents: Up to 211% FPL.

- Programs: STAR, STAR+PLUS for seniors/disabled, Texas CHIP for kids.

- Apply: Online at YourTexasBenefits.com or local HHSC offices.

Tip: Verify annual income changes to avoid coverage gaps and maintain Florida Medicaid–style continuity in Texas.

3. Short-Term vs. COBRA Coverage

- Short-term plans: Ideal for gaps under 12 months; may exclude pre-existing conditions and preventive services.

- COBRA: Continue your employer’s plan at 102% of premium.

Keyword: short-term health insurance Texas, Texas COBRA coverage

4. Employer-Sponsored HDHP & HSA Strategies

- Plan types: PPO, HMO, HDHP paired with HSAs.

- HSA advantages: Pre-tax contributions, tax-free growth, tax-free withdrawals for qualified care.

- 2025 HSA limits: $4,150 individual; $8,300 family.

Action: Fund your HSA early to maximize your tax savings and build a healthcare nest egg.

5. Five Proven Cost-Saving Tactics

- Maximize ACA Subsidies: Precisely report income to lock in top tax credits.

- Shop Early & Compare: Review networks and benefits before enrollment closes.

- Use In-Network Providers: Save on copays and allow negotiated rates.

- Leverage Telehealth: Many plans offer $0 telehealth visits for routine care.

- Bundle Add-Ons: Combine dental and vision for multi-policy discounts.

Executing these strategies delivers cheap health insurance in Texas without sacrificing essential care.

Conclusion

Choosing health insurance in Texas for 2025 requires balancing cost, coverage level, and provider networks. By exploring Marketplace tiers, verifying Medicaid eligibility, bridging gaps with short-term or COBRA, and optimizing HDHP & HSA plans, you can secure comprehensive, budget-friendly coverage.