Texas Life Insurance Guide 2025: Protect Your Lone Star Legacy

Published on July 21, 2025

🤠 Texas Life Insurance Guide 2025: Protect Your Lone Star Legacy

Introduction

Whether you’re raising a family in Frisco or planning retirement on the Gulf Coast, the right life insurance in Texas ensures your loved ones’ financial security. From cost-effective term life insurance in Texas to permanent whole life coverage, knowing local underwriting factors and discount opportunities helps you choose a policy that fits your Lone Star lifestyle and budget.

In this guide, you’ll discover how to:

- Compare term life, whole life, and universal life insurance options

- Examine average premiums for a 35-year-old in Houston, Dallas, and Austin

- Apply four proven tactics to reduce your Texas life insurance premiums

- Enhance protection with key Riders & Add-Ons like accelerated benefits and waiver of premium

- Effortlessly compare Texas life insurance quotes online

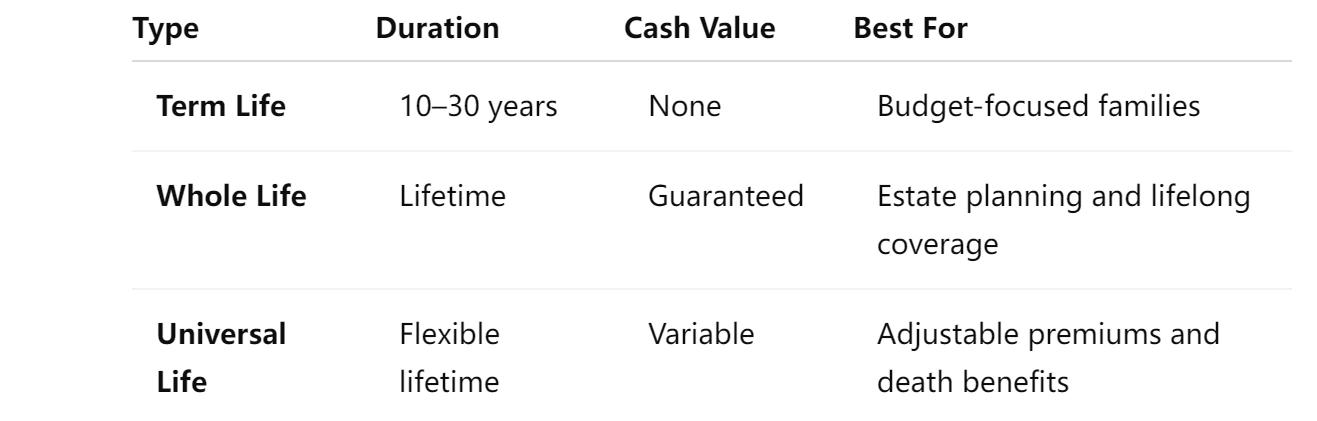

1. Policy Types: Term Life vs. Whole Life vs. Universal Life

- Term life insurance Texas provides the lowest premium per death benefit dollar—ideal for covering mortgages or children’s education costs.

- Whole life builds guaranteed cash value, ensuring level premiums and a lifelong death benefit.

- Universal life offers premium and death benefit flexibility, letting you adapt coverage as needs evolve.

Long-tail keywords: compare term life insurance Texas, Texas whole life policy, universal life insurance Texas

2. Premium Snapshot by City

Underwriting classes and ZIP code risk profiles influence Texas life insurance rates. Here’s 2025 average annual cost for a healthy 35-year-old male seeking $500,000 of 20-year term life insurance:

Austin’s younger population and lower risk classification yield slightly lower rates, while Dallas’s underwriting profiles drive higher costs.

Actionable Tip: Enter your ZIP code in a quote tool to receive precise Texas life insurance quotes reflecting your location’s unique factors.

3. Four Tactics to Lower Your Premium

- Secure coverage early: Rates increase with age—locking in a policy before age 40 can save up to 30% over a lifetime.

- Adopt healthy habits: Nonsmokers and those with optimal BMI often qualify for 30–50% discounts.

- Choose level term: Fixed premiums prevent mid-term rate increases, maintaining budget predictability.

- Compare multiple carriers: Gather quotes from at least five insurers, including Texas-focused companies like Texas Life and national providers like Prudential.

Implementing these strategies ensures you find affordable life insurance in Texas without sacrificing coverage.

4. Strategic Riders & Add-Ons

Customize your base policy with these Riders & Add-Ons:

- Accelerated Death Benefit: Access part of the death benefit upon terminal illness diagnosis.

- Waiver of Premium: Waives premiums if you become totally disabled.

- Child Rider: Adds coverage for children under your policy at minimal cost.

- Return of Premium: Refunds paid premiums if you outlive the term period.

These enhancements allow you to tailor your Texas life insurance policy to evolving family needs.

5. Streamlined Steps to Compare Quotes

- Gather details: Age, health status, coverage amount, and ZIP code.

- Use online tools: Enter data to receive personalized Texas life insurance quotes.

- Evaluate insurers: Compare financial ratings (AM Best), customer reviews, and underwriting speed.

- Consult an advisor: Especially for permanent policies or complex estate planning needs.

Pro Tip: Re-evaluate your coverage every 3–5 years or after major life events to maintain competitive rates.

Conclusion

Choosing the right life insurance in Texas requires balancing cost, coverage type, and long-term goals. By comparing term vs. whole vs. universal life, analyzing city-based premiums, and leveraging discount strategies, you can protect your Lone Star family with confidence in 2025.