Florida Home Insurance Guide 2025: Protect Your Sunshine State Home

Published on July 17, 2025

🏠 Florida Home Insurance Guide 2025: Protect Your Sunshine State Home

Introduction

Living in Florida means enjoying sun-soaked beaches—but also facing frequent hurricanes, tropical storms, and flood risks. The right homeowners insurance in Florida ensures your home and belongings are covered when extreme weather strikes.

In this 2025 guide, you’ll discover how to choose between HO-3 and HO-5 policies, evaluate average home insurance premiums across Miami, Orlando, and Tampa, and implement proven strategies to lower your Florida home insurance premium without sacrificing vital protection.

1. HO-3 vs. HO-5: Picking the Best Policy Type

HO-3 (Special Form) is the most common choice:

- Named-peril coverage for your structure (fire, windstorm, theft)

- Named-peril coverage for personal property

- Cost-effective for typical single-family homes

HO-5 (Comprehensive Form) offers broader protection:

- Open-peril coverage for home and belongings

- Higher limits for personal property

- Premiums 25–35% above HO-3 but reduce claim denials

When to choose HO-5: If you own a high-value home, expensive belongings, or live in high-risk hurricane areas like Miami-Dade.

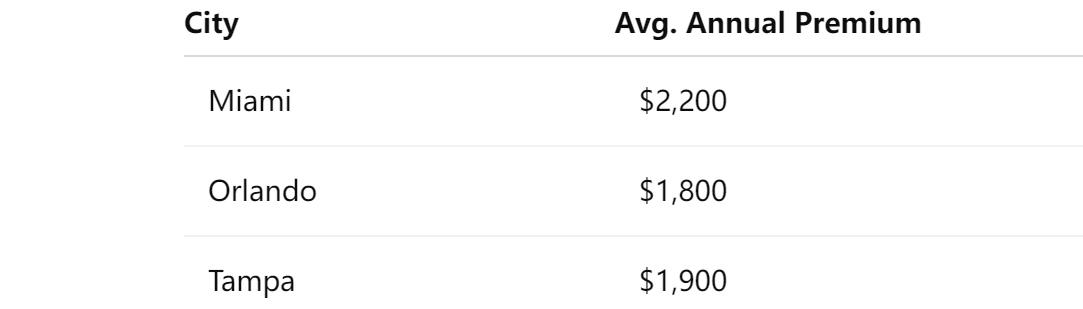

2. City Premium Snapshot: Miami, Orlando, and Tampa

Your ZIP code significantly affects what you pay. Here are 2025 averages for a 2,000 sq ft home with $500,000 dwelling coverage:

- Miami faces the highest rates due to coastal storm exposure and high rebuild costs.

- Orlando sits lower thanks to inland location, despite tourist-season demands.

- Tampa balances coastal risk with competitive premiums when you compare Florida homeowners insurance quotes.

3. Essential Coverage Elements

A comprehensive policy should include:

- Dwelling Coverage: Pays to rebuild your home after covered perils

- Personal Property: Covers belongings like electronics, furniture, and clothing

- Liability Protection: Safeguards you if someone is injured on your property

- Loss of Use (ALE): Funds temporary living expenses if your home is uninhabitable

Also consider windstorm or hurricane deductibles, which can differ from your standard deductible and significantly affect your Florida home insurance costs.

4. Five Ways to Lower Your Florida Home Insurance Premium

- Hurricane mitigation: Install impact-resistant windows, reinforced roofs, and storm shutters to earn up to 20% off.

- Bundle and save: Combine home and auto policies with the same insurer for multi-policy discounts (often 10–25%).

- Raise your deductible: Opt for a $2,500–$5,000 deductible if you have emergency savings—this can reduce your premium by 15–20%.

- Maintain a claims-free record: Pay small repair costs out of pocket to keep your history clean and avoid premium surges.

- Shop and compare annually: Use online tools to evaluate at least five quotes, including specialized Florida carriers like Universal and Citizens, and national insurers like State Farm.

Implementing just two of these tactics can lead to substantial savings on your Florida homeowners insurance.

5. Critical Endorsements and Add-Ons

Standard policies often exclude key risks—add these endorsements for complete coverage:

- Hurricane/Windstorm: Mandatory in many coastal counties; covers wind-related damage.

- Flood Insurance: Available through NFIP or private flood policies, essential in low-lying areas.

- Sinkhole Coverage: Protects against ground collapse in susceptible regions.

- Equipment Breakdown: Covers AC units and electrical systems damaged by power surges or storms.

Review endorsements carefully to ensure your homeowners insurance in Florida addresses all major perils.

6. Top Florida Home Insurance Providers for 2025

Highly rated insurers with strong Florida offerings include:

- CSAA (AAA Northern CA) – Specialized wind and hurricane expertise in South Florida.

- State Farm – Extensive agent network and bundling discounts.

- Allstate – Comprehensive digital tools and add-on options.

- Farmers – Custom endorsements for sinkhole and windstorm risks.

- USAA – Premier service and rates for military families.

When choosing a Florida home insurance provider, consider each carrier’s claims process, response times, and financial strength ratings.

Conclusion

Protecting your Florida home in 2025 means balancing premium costs with comprehensive coverage for hurricanes, floods, and other state-specific risks. By comparing HO-3 vs. HO-5 policies, analyzing city-specific premiums, and adopting targeted savings strategies, you can secure affordable, reliable homeowners insurance in Florida.