Illinois Car Insurance Guide 2025: Smart Tips for Prairie State Drivers

Published on July 15, 2025

🚗 Illinois Car Insurance Guide 2025: Smart Tips for Prairie State Drivers

Introduction

Whether you’re commuting through Chicago’s downtown gridlock or cruising rural highways around Springfield, having the right car insurance in Illinois is crucial. From unpredictable Midwest hailstorms to a high uninsured motorist rate, the Prairie State presents unique risks that affect your premium.

In this 2025 guide, we’ll break down Illinois auto insurance requirements, show you average premiums by region, and share proven strategies to secure cheap car insurance in Illinois while maintaining strong coverage.

1. Illinois Minimum Liability Coverage Requirements

Illinois mandates these minimum liability limits, often called 25/50/20:

- $25,000 bodily injury per person

- $50,000 bodily injury per accident

- $20,000 property damage per accident

While these limits satisfy Illinois car insurance laws, they may not cover the full cost of an accident. Adding full coverage—collision and comprehensive—guards you against vehicle repair bills from hail damage, theft, or at-fault crashes.

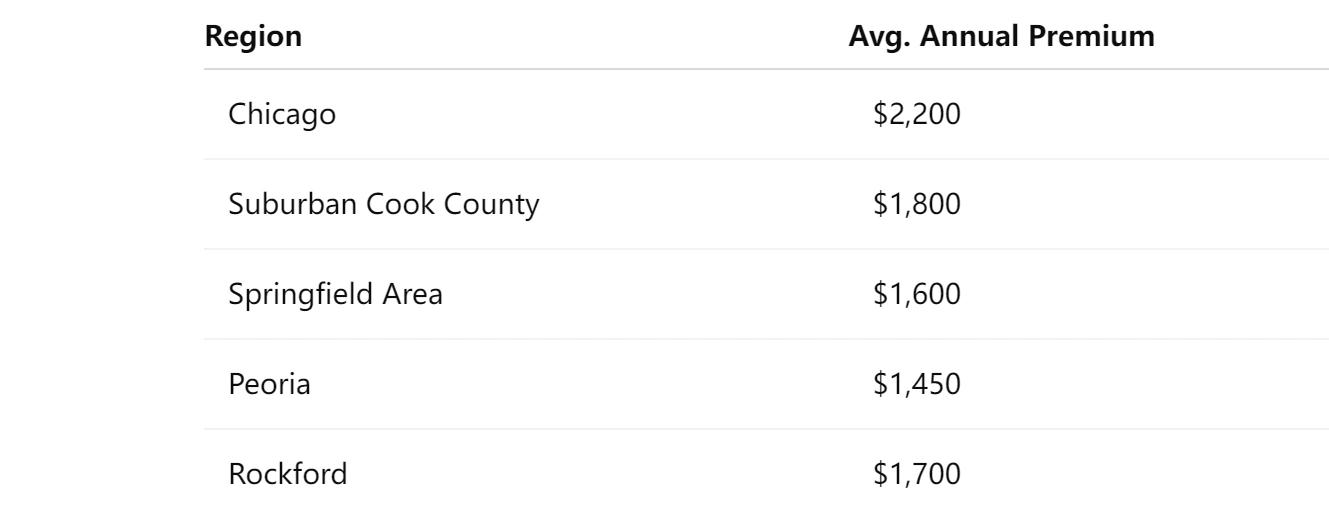

2. Regional Premium Insights: Chicago vs. Upstate

Your ZIP code can make a big difference. Here’s a snapshot of full coverage car insurance in Illinois for 2025:

City drivers face higher rates due to traffic density and theft risk, while rural rates drop thanks to lower accident frequencies.

3. Key Factors Driving Your Illinois Premium

Understanding what insurers look at helps you target savings:

- Driving record: Tickets or accidents can inflate your rate by 30–50%

- Credit-based insurance score: Illinois allows credit to influence premiums, so strong credit can lead to better rates

- Vehicle choice: Sporty cars and luxury models often cost 20–40% more to insure than sedans

- Seasonal weather: Midwest hailstorms spike comprehensive claims, especially in central Illinois

- Annual mileage: High-mileage commuters typically pay more than occasional drivers

Focusing on these areas can help you customize and compare Illinois car insurance quotes effectively.

4. How to Secure Cheap Car Insurance in Illinois

Ready to lower your premium? Try these proven tactics:

- Compare quotes from national options (GEICO, Progressive) and Illinois-based insurers (Country Financial, State Farm).

- Bundle policies: Combine auto with home or renters insurance for up to 25% off.

- Raise deductibles: Switching from a $500 to a $1,000 deductible can cut your premium by up to 15%, if you have emergency savings.

- Join telematics programs: Usage-based plans like Allstate Drivewise reward smooth braking and low mileage with discounts up to 30%.

- Ask for all available discounts: Good student, safe driver courses, multi-car households, and vehicle safety features can unlock extra savings.

By regularly comparing Illinois auto insurance quotes, you’ll ensure you’re not missing new deals.

5. Must-Have Optional Coverages for Illinois Drivers

Consider these enhancements to cover gaps in the basic policy:

- Comprehensive coverage: Protects against hail, vandalism, and flood damage—critical after spring storms.

- Collision coverage: Pays for repairs after an at-fault accident.

- Uninsured/Underinsured Motorist (UM/UIM): Essential protection when other drivers can’t cover damages.

- Roadside assistance and rental reimbursement: Provides peace of mind if your car is disabled or in for repairs.

These add-ons turn minimum compliance into robust auto insurance coverage in Illinois.

6. Top-Rated Providers for 2025

Here are some highly recommended insurers based on price and service:

- Country Financial: Local expertise with personalized service.

- State Farm: Expansive agent network and loyalty perks.

- GEICO: Strong online quotes and discounts.

- Progressive: Flexible underwriting and telematics incentives.

- Allstate: Comprehensive add-on packages and safety rewards.

When choosing an Illinois auto insurance provider, prioritize claims handling reputation and coverage options that best fit your driving profile.

Conclusion

Finding the right car insurance in Illinois involves balancing state-mandated requirements with personal risk factors. By understanding 25/50/20 liability rules, comparing regional premiums, and employing targeted savings strategies, you can secure affordable, reliable coverage in 2025.

Stay proactive: review your policy annually, shop around, and adjust coverages to match your evolving needs.