Michigan Car Insurance Guide 2025: Stay Covered & Save in the Great Lakes State

Published on July 16, 2025

🚗 Michigan Car Insurance Guide 2025: Stay Covered & Save in the Great Lakes State

Introduction

Michigan’s harsh winters, crowded freeways in Detroit, and unique no-fault insurance system make understanding car insurance in Michigan essential. With rising claims from snow storms and a high uninsured motorist rate, choosing the right coverage not only keeps you compliant but also protects your budget.

In this comprehensive guide, we’ll explain Michigan’s no-fault PIP requirements, analyze average premiums by city, and share proven methods to find cheap car insurance in Michigan without sacrificing critical protections.

1. Michigan’s No-Fault Insurance Essentials

Michigan drivers operate under a no-fault system, meaning your Personal Injury Protection (PIP) covers medical costs regardless of fault. Required coverages include:

- Personal Injury Protection (PIP): Choose from unlimited lifetime benefits or preset levels (e.g., $500K cap)

- Residual Bodily Injury (BI): Minimum $50,000/$100,000 liability for third-party injuries

- Property Protection (PPI): $1 million coverage for damage to others’ property, including guardrails and parked vehicles

- Uninsured/Underinsured Motorist (UM/UIM): Optional but critical given Michigan’s high rate of uninsured drivers

Selecting the right PIP level and adding UM/UIM coverage can shield you from sky-high medical bills and lawsuits.

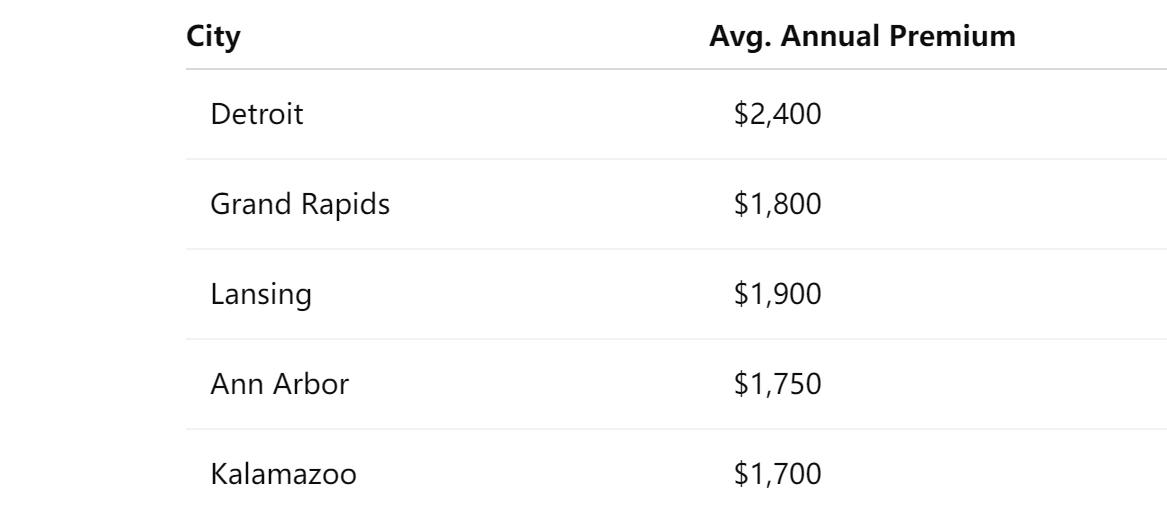

2. City-by-City Premium Breakdown

Your ZIP code heavily influences your Michigan auto insurance rates. Here’s what drivers pay on average for full coverage in 2025:

Urban areas face steeper rates due to denser traffic, theft, and winter accident claims, while smaller cities enjoy more affordable premiums.

3. Major Rate Drivers in Michigan

Your Michigan car insurance premium is shaped by several variables:

- PIP benefit level: Unlimited PIP costs up to 25% more than capped options

- Driving history: Tickets or accidents can increase rates by up to 50%

- Credit-based insurance score: Good credit unlocks lower premiums

- Vehicle type and usage: Insuring an SUV or sports car costs more than a sedan

- Annual mileage: Commuters pay higher premiums than occasional drivers

Understanding these elements helps you compare and refine Michigan car insurance quotes effectively.

4. Four Steps to Find Cheap Car Insurance in Michigan

- Compare multiple quotes: Use online tools to gather rates from GEICO, Progressive, Auto-Owners, and Frankenmuth Insurance.

- Adjust your PIP choice: Opt for a PIP level that balances cost with medical coverage needs.

- Bundle policies: Combining auto with homeowners or renters insurance often yields up to 20% savings.

- Leverage usage-based discounts: Telematics programs like Progressive Snapshot reward safe drivers with up to 30% off.

Regularly shopping for Michigan auto insurance quotes ensures you capture the best deals available.

5. Essential Add-Ons for Michigan Drivers

To protect against winter-related and other risks, consider these optional coverages:

- Collision coverage: Covers repair costs after at-fault crashes.

- Comprehensive coverage: Protects against hail, flood, and vandalism—key for Great Lakes weather.

- UM/UIM coverage: Critical protection when the other driver can’t cover damages.

- Roadside assistance & rental reimbursement: Ideal during cold-weather breakdowns and extended repairs.

Incorporating these options creates full coverage car insurance in Michigan tailored to your needs.

6. Top Michigan Auto Insurers for 2025

Highly rated providers offering strong service and competitive rates include:

- Auto-Owners Insurance: Known for exceptional claims service and customizable policies.

- GEICO: Competitive pricing and user-friendly digital platform.

- Progressive: Flexible options for high-risk drivers and telematics discounts.

- Frankenmuth Insurance: Local expertise with member benefits.

- State Farm: Comprehensive agent network and loyalty perks.

Evaluate each company’s PIP options, discount programs, and claims satisfaction when selecting your Michigan car insurance provider.

Conclusion

Finding the right car insurance in Michigan involves balancing no-fault PIP rules with your personal risk profile and budget. By reviewing PIP levels, comparing regional rates, and leveraging targeted discounts, you can secure both compliance and cost savings in 2025.

Stay proactive: revisit your policy annually, shop around for quotes, and adjust coverages to match your driving habits and location.