Nevada Car Insurance Guide 2025: Expert Tips for Silver State Drivers

Published on July 16, 2025

🚗 Nevada Car Insurance Guide 2025: Expert Tips for Silver State Drivers

Introduction

Whether you’re navigating Las Vegas’ bustling Strip or tackling I-80 through the Sierra, having tailored car insurance in Nevada ensures you stay protected and legal. Between blistering summer heat that damages engines and sudden flash floods, the Silver State demands coverage that adapts to every driving scenario.

In this guide, you’ll learn Nevada’s 15/30/10 liability requirements, see how Nevada auto insurance rates stack up between major cities, and get practical strategies for scoring cheap car insurance in Nevada without sacrificing vital protection.

1. Nevada’s Mandatory 15/30/10 Liability Limits

By law, Nevada drivers must carry at least:

- $15,000 bodily injury per person

- $30,000 bodily injury per accident

- $10,000 property damage per accident

While these 15/30/10 liability limits satisfy the state’s minimum car insurance requirements, they fall short if you’re responsible for a serious accident. Enhancing your policy with collision and comprehensive coverage—essential for guarding against hail damage and at-fault repair costs—ensures more complete full coverage auto insurance in Nevada.

2. City Premium Breakdown: Las Vegas vs. Reno

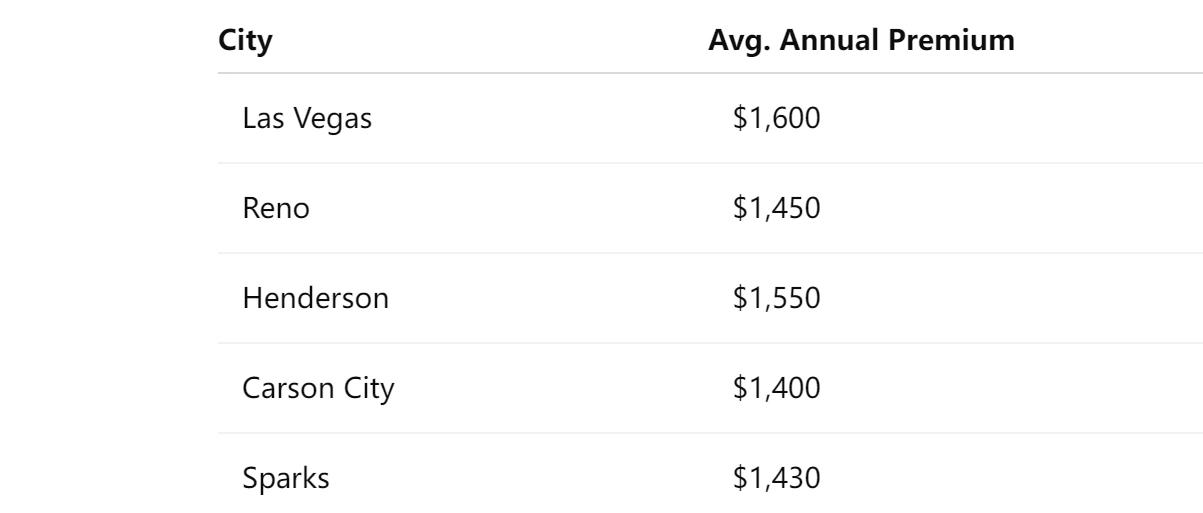

Your ZIP code significantly influences your Nevada auto insurance premiums. Here’s the 2025 average for drivers seeking full coverage:

High traffic volume and theft rates in Las Vegas push rates above state averages, while smaller cities like Reno benefit from fewer claims and lower premiums when you compare Nevada car insurance quotes.

3. Core Factors Driving Your Nevada Premium

Understanding what insurers consider helps you target savings:

- Driving record: A clean history can lower rates by up to 30%; accidents or violations may increase premiums by 50%

- Credit-based pricing: Nevada permits credit score impact on rates—maintaining good credit is key to securing lower premiums

- Vehicle choice: Insuring a luxury SUV can cost 20–40% more than a standard sedan

- Annual mileage: Frequent commuters pay more than low-mileage drivers; tracking mileage could qualify you for discounts

- Local climate risks: Areas prone to flash floods and hailstorms see higher comprehensive claims, driving up rates

Focusing on these elements can optimize your auto insurance coverage in Nevada.

4. Proven Strategies to Secure Cheap Car Insurance in Nevada

- Shop around frequently: Compare quotes from national insurers (GEICO, Progressive) and local carriers (Western National, Liberty Mutual) for the best rates.

- Bundle your policies: Combining auto with renters or homeowners insurance often delivers multi-policy discounts up to 20%.

- Increase deductibles wisely: Opt for a $1,000 deductible to trim premiums by 10–15%, provided you have emergency funds.

- Enroll in usage-based programs: Telematics tools like Progressive Snapshot reward safe driving with savings up to 30%.

- Maximize available discounts: Ask about good student, safe driver course, and anti-theft device credits to stack additional savings.

- Maintain a spotless driving history: Avoiding tickets and accidents ensures continual safe driver discounts.

Regularly comparing Nevada car insurance quotes keeps you ahead of premium increases and ensures you capitalize on new discounts.

5. Essential Optional Coverages for Silver State Challenges

Nevada’s unique risks call for specialized add-ons:

- Comprehensive coverage: Covers hail, flood, and vandalism—critical in desert and mountain regions.

- Collision coverage: Pays for repairs after at-fault accidents.

- Uninsured/Underinsured Motorist: Protects you when the other driver can’t cover damages.

- Roadside assistance & rental reimbursement: Offers peace of mind during long drives through remote areas.

Incorporating these options transforms basic compliance into robust full coverage car insurance in Nevada, tailored to your environment.

6. Top Car Insurance Providers in Nevada for 2025

Here are some highly rated companies for 2025:

- GEICO: Known for low rates, digital tools, and strong discount programs.

- Progressive: Flexible telematics options and competitive rates for high-risk profiles.

- Western National: Local carrier with personalized service and targeted discounts.

- Liberty Mutual: Innovates with deductible savings and broad policy customization.

- State Farm: Offers extensive agent network and loyalty perks.

When choosing an auto insurance provider in Nevada, examine each carrier’s claims satisfaction scores, discount eligibility, and policy flexibility.

Conclusion

Securing the right car insurance in Nevada involves more than meeting minimum liability limits. By understanding 15/30/10 requirements, comparing city premium differences, and leveraging targeted savings strategies, you can drive confidently and affordably across the Silver State in 2025.

Stay proactive: review your policy annually, shop around often, and adjust your coverage to match your changing driving habits and local climate risks.