Term Life vs No-Exam Life Insurance: Which Is Better for You?

Published on July 7, 2025

Introduction

When buying life insurance, two common options you'll encounter are term life insurance and no-exam life insurance. Both offer essential financial protection, but they cater to different life situations and health profiles.

Whether you're looking for affordable life insurance for young families or simplified life insurance without a medical exam, understanding these policies will help you make a confident and informed decision.

What Is Term Life Insurance?

Term life insurance provides protection for a set number of years — typically 10, 20, or 30 years. If the policyholder passes away within the term, the beneficiaries receive a tax-free death benefit.

✅ Key Benefits:

- Lower monthly premiums than other life insurance types

- High coverage amounts available (ideal for mortgage or income protection)

- Customizable term lengths to match your financial goals

⚠️ Drawbacks:

- Requires a medical exam in most cases

- No benefit if you outlive the term (unless converted or renewed)

- No cash value or investment component

This is best for healthy individuals seeking affordable term life insurance for income replacement or to cover debts like mortgages and student loans.

Relevant Long-Tail Keywords:

- best term life insurance for families

- affordable life insurance with high coverage

- term life insurance with medical exam

What Is No-Exam Life Insurance?

No-exam life insurance eliminates the need for a physical exam and relies on digital health records or a brief questionnaire. It appeals to those looking for fast life insurance approval or individuals with minor to moderate health conditions.

Types:

- Simplified Issue: Requires health questions, offers moderate coverage

- Guaranteed Issue: No health questions, typically for seniors or high-risk applicants

✅ Key Benefits:

- Faster approval times (often same-day or within 3 days)

- Ideal for people with preexisting conditions

- No blood tests or medical appointments required

⚠️ Drawbacks:

- Higher premiums per dollar of coverage

- Coverage typically limited to $25,000–$250,000

- May have graded death benefits in the first few years

Relevant Long-Tail Keywords:

- no-exam life insurance for seniors

- life insurance without medical exam

- best no-medical exam life insurance companies

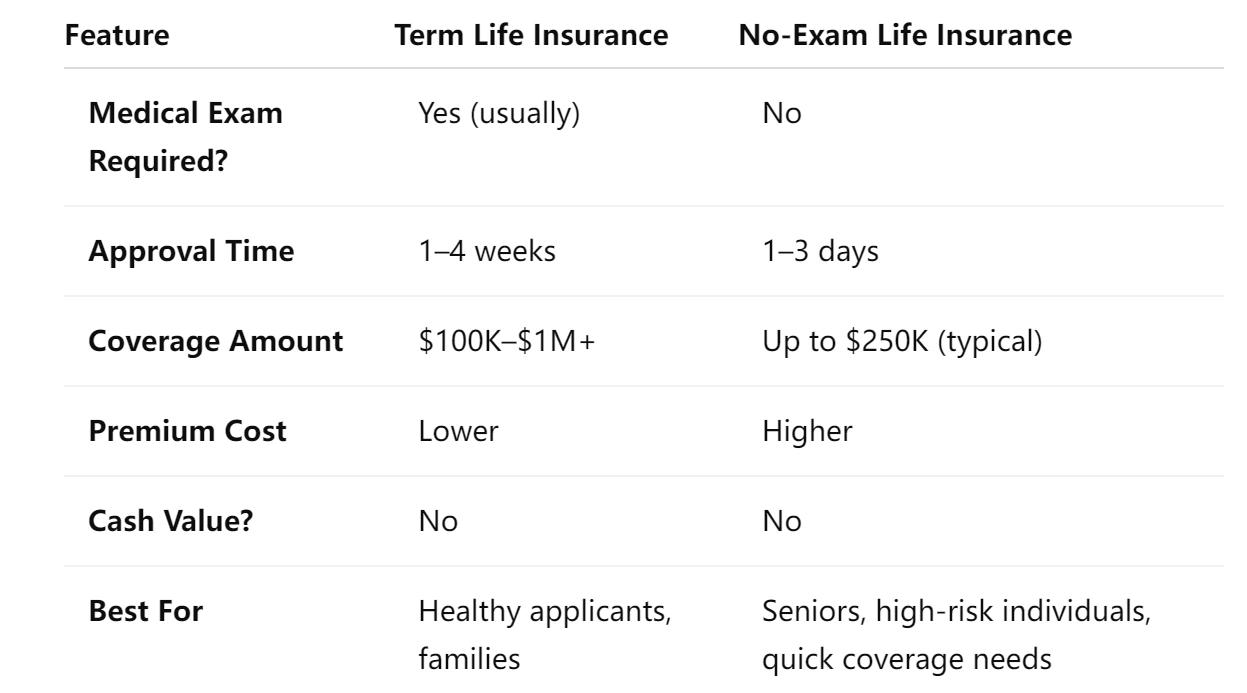

Side-by-Side Comparison

Feather-Insurance. (2025, July 4). Top Life Insurance Statistics, Trends & Facts (2025). Retrieved July 4, 2025.

This comparison helps users searching for:

- term life vs no medical exam comparison

- life insurance policy without health questions

Which Life Insurance Option Is Right for You?

Choose Term Life Insurance if:

- You’re young, healthy, and want affordable, long-term coverage

- You need a large death benefit to replace income or protect your family

- You're comfortable undergoing a brief medical screening

Choose No-Exam Life Insurance if:

- You need life insurance quickly and can't wait for a full underwriting process

- You have health concerns or are over age 50

- You want a simplified application process with minimal hassle

Scenario Example:

A 35-year-old parent in good health might choose a 20-year term policy for $500,000 to protect their mortgage and children's education. A 62-year-old with diabetes may prefer a no-exam policy offering $50,000 in final expense coverage without underwriting delays.

FAQs

❓ Is no-exam life insurance legitimate?

Yes. It’s offered by trusted insurers like Haven Life, Ethos, and Bestow. These policies are real and backed by licensed providers — just underwritten differently.

❓ Can I switch from no-exam to term life later?

Yes, but you’ll need to undergo a new application and potentially a medical exam. Many people start with no-exam coverage and upgrade later.

❓ How much more expensive is no-exam life insurance?

Premiums can be 20%–40% higher than fully underwritten term life policies for the same amount of coverage.

❓ Who offers the best no-exam life insurance?

Top-rated companies include Bestow, Ladder, and Mutual of Omaha, depending on age and coverage needs.

Conclusion

Both term life insurance and no-exam life insurance offer meaningful protection, but your health status, age, budget, and urgency will determine the best fit.

- Choose term life if you want long-term, low-cost protection and qualify for full underwriting.

- Choose no-exam if you need fast life insurance approval or have health concerns.

Whichever route you choose, comparing quotes and policy options can save you money and help you find the best plan for your future.