What Is Home Insurance and How Does It Work in the U.S.?

Published on July 2, 2025

Homeowners insurance protects your home and belongings from unexpected damage or loss. Discover how it works, what it covers, and how to choose the best policy for your property and location.

Introduction

Your home is more than just four walls — it’s where your life happens. For most Americans, buying a home is their largest investment, and home insurance is how you protect that investment from risk. Whether it’s a fire, burglary, or storm damage, homeowners insurance ensures you won’t bear the full financial burden alone.

In this guide, we’ll explain how home insurance works, what’s covered, the major policy types like HO-3 and HO-5, and how to choose the right coverage based on your location, property value, and risk exposure.

What Is Home Insurance?

Home insurance — also called homeowners insurance — is a contract that protects you financially when your house or belongings are damaged, stolen, or destroyed. It also includes liability coverage in case someone is injured on your property.

A typical home insurance policy includes:

- Dwelling coverage: Pays to repair or rebuild your home after covered events

- Personal property coverage: Covers items like furniture, appliances, and clothing

- Liability protection: Helps cover legal and medical expenses if you're found responsible for injury or damage

- Loss of use (ALE): Covers hotel bills and living expenses if your home becomes uninhabitable due to a covered peril

Most mortgage lenders require homeowners insurance before approving a home loan.

What Does Home Insurance Cover?

Standard homeowners insurance (especially HO-3 and HO-5 policies) covers your home against a variety of named perils.

Commonly Covered Events:

- Fire and smoke damage

- Theft or vandalism

- Hail and windstorms

- Water damage from plumbing or HVAC failure

- Lightning strikes and explosions

- Falling objects (e.g. tree branches)

Events Typically Not Covered:

- Flood damage (requires separate flood insurance)

- Earthquake damage (needs a special rider or policy)

- Termite or pest infestations

- General wear and tear or lack of maintenance

Always read your policy to understand what's excluded.

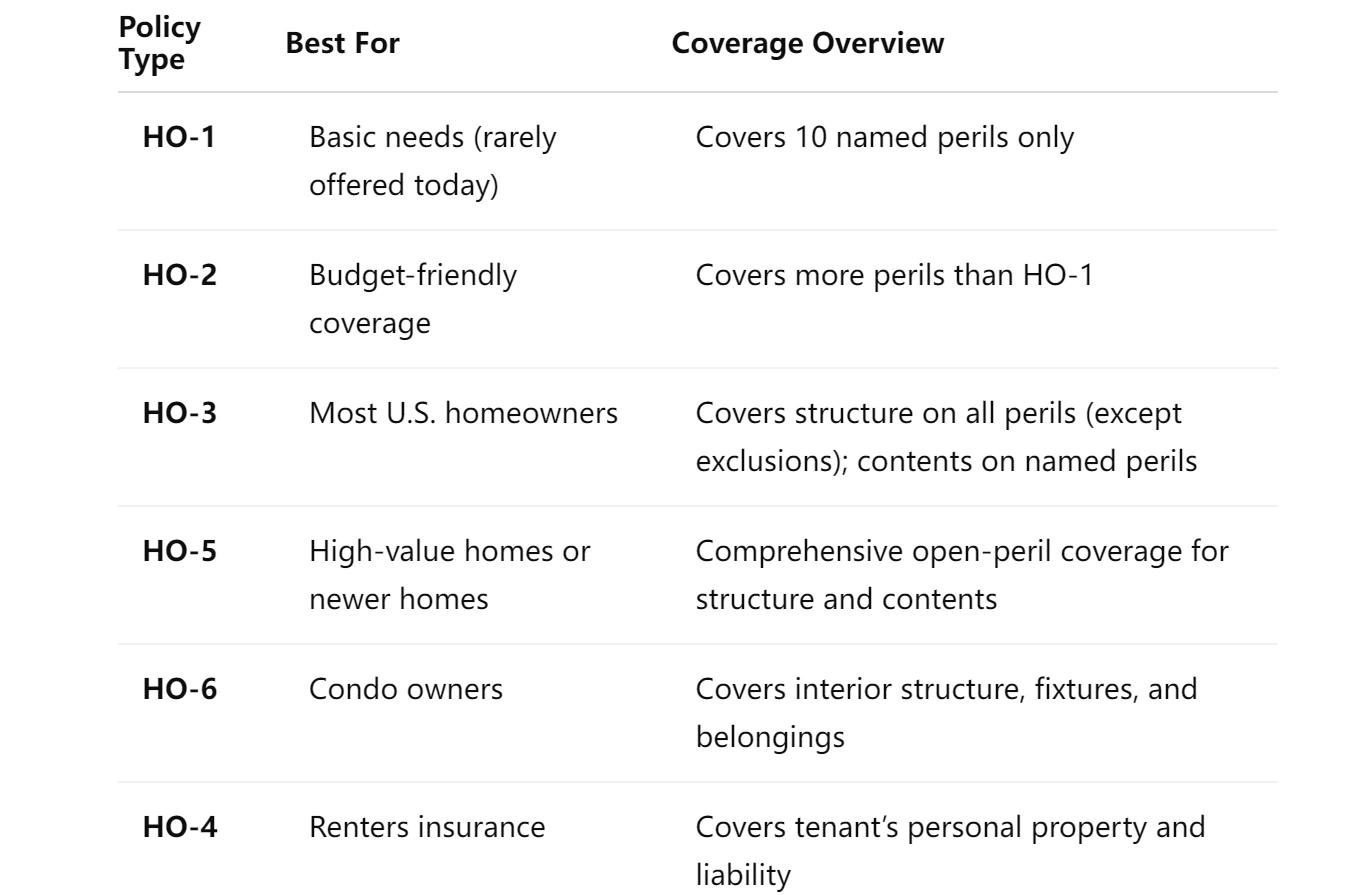

Types of Homeowners Insurance Policies

There are several policy types, but here are the most common:

Pro tip: If you own a single-family home, you likely have an HO-3 or HO-5 policy. Compare carefully.

How Does Home Insurance Work?

- Purchase a Policy: You choose your deductible and coverage limits based on your home's value and local risks.

- Pay Premiums: These are monthly or annual payments based on location, dwelling value, and coverage level.

- Experience a Loss: If your home is damaged or robbed, document the loss with photos and file a claim.

- Claim Evaluation: The insurer sends an adjuster to assess damages.

- Payout Issued: You receive reimbursement minus your deductible.

Example:

If a kitchen fire causes $15,000 in damage and your deductible is $1,000, the insurer pays $14,000.

How Much Does Home Insurance Cost?

The average homeowners insurance premium in the U.S. is around $1,300/year, or roughly $110/month. Rates vary widely based on:

- ZIP code and weather risk (e.g., hurricane zones, wildfire areas)

- Reconstruction cost (not market value)

- Age and materials of the home

- Security systems and safety features

- Claims history and credit score

Ways to Save:

- Bundle home and auto insurance

- Increase your deductible (but make sure it’s affordable)

- Install fire alarms and burglary systems

- Ask about loyalty or claims-free discounts

How to Choose the Best Home Insurance for Your Needs

Here’s what to look for when comparing home insurance quotes:

- Coverage Amounts: Make sure your dwelling limit covers the cost to rebuild your home, not just its market price.

- Personal Property Protection: Inventory your belongings to ensure they’re fully covered.

- Liability Coverage: Choose at least $300,000 to protect against lawsuits.

- Loss of Use: Check daily or monthly reimbursement limits.

- Endorsements and Add-Ons: Need flood coverage? Jewelry protection? Consider extras.

Also look at the company’s customer service ratings and claim processing speed.

Frequently Asked Questions (FAQs)

❓ Is homeowners insurance mandatory?

It’s not required by law, but your mortgage lender will almost always require proof of home insurance before closing.

❓ Does home insurance cover roof replacement?

Yes — but only if the damage is caused by a covered peril (like a storm or falling tree). Wear-and-tear is excluded.

❓ Can I get coverage if I live in a wildfire or hurricane zone?

Yes, though premiums may be higher. You might need to buy state-sponsored or surplus lines insurance.

❓ What’s the difference between replacement cost and actual cash value?

- Replacement cost pays what it takes to rebuild or replace, with no depreciation.

- Actual cash value subtracts depreciation, leading to lower payouts.

❓ Does homeowners insurance cover mold?

Only if mold is caused by a sudden and accidental event, like a burst pipe. Mold from humidity or slow leaks is usually excluded.

Conclusion

A comprehensive home insurance policy doesn’t just protect your home — it protects your lifestyle, your savings, and your peace of mind. From windstorms to liability lawsuits, the right coverage can prevent financial disaster.

Make sure you review your policy annually, especially after renovations, life changes, or weather events. Choosing the best home insurance isn’t just about price — it’s about getting the protection you need.