Car Insurance for Luxury Cars 2025: Best Coverage & Cost-Saving Tips

Published on August 15, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

Introduction: Why Luxury Car Insurance Matters in 2025

Owning a luxury car in 2025 isn’t just about driving in style — it’s about protecting a significant financial investment. High-end vehicles come with advanced technology, expensive parts, and exceptional performance, all of which require specialized insurance coverage. Without the right policy, a single accident or theft could mean substantial financial loss.

The Rise in Luxury Car Ownership

Luxury car sales have increased globally, with brands like Mercedes-Benz, BMW, Tesla, and Porsche reporting record demand in 2024. In 2025, more drivers are purchasing high-performance electric models, which also changes insurance requirements.

Why Luxury Car Insurance Is Different

Insuring a luxury car isn’t the same as insuring a standard sedan. Repair costs are higher, technology is more complex, and the risk of theft is greater. Many standard policies aren’t enough to fully cover these vehicles, making specialized policies essential.

What Counts as a Luxury Car in 2025?

Popular Luxury Brands and Models

Some of the top luxury cars in 2025 include:

- Tesla Model S Plaid

- Porsche Taycan

- BMW 7 Series

- Mercedes-Benz S-Class

- Lexus LS

- Audi A8

High-Performance vs. Ultra-Luxury Vehicles

While high-performance sports cars like the Ferrari Roma focus on speed, ultra-luxury cars like the Rolls-Royce Ghost emphasize comfort and exclusivity — both require premium insurance solutions.

Why Luxury Cars Cost More to Insure

Higher Repair and Replacement Costs

Luxury cars use custom parts and advanced materials like carbon fiber, making repairs more expensive.

Advanced Technology and Custom Parts

Features like autonomous driving systems and advanced infotainment add repair complexity.

Increased Theft Risk

Luxury vehicles are frequent targets for theft, especially in urban areas.

Coverage Options for Luxury Vehicles

Comprehensive Coverage

Protects against theft, vandalism, and natural disasters.

Collision Coverage

Covers repair or replacement after an accident, regardless of fault.

Gap Insurance

Covers the difference between the vehicle’s loan balance and its market value after a total loss.

Agreed Value Coverage

Ensures you get the full agreed-upon value of your car if it’s totaled, not just depreciated value.

Best Insurance Companies for Luxury Cars in 2025

Nationwide

Known for high-limit policies and flexible coverage options.

Chubb

Offers agreed value and worldwide coverage for exotic cars.

Progressive

Good for tech-savvy drivers with telematics discounts.

Specialty Luxury Insurers

Companies like Hagerty and AIG focus on high-value vehicles.

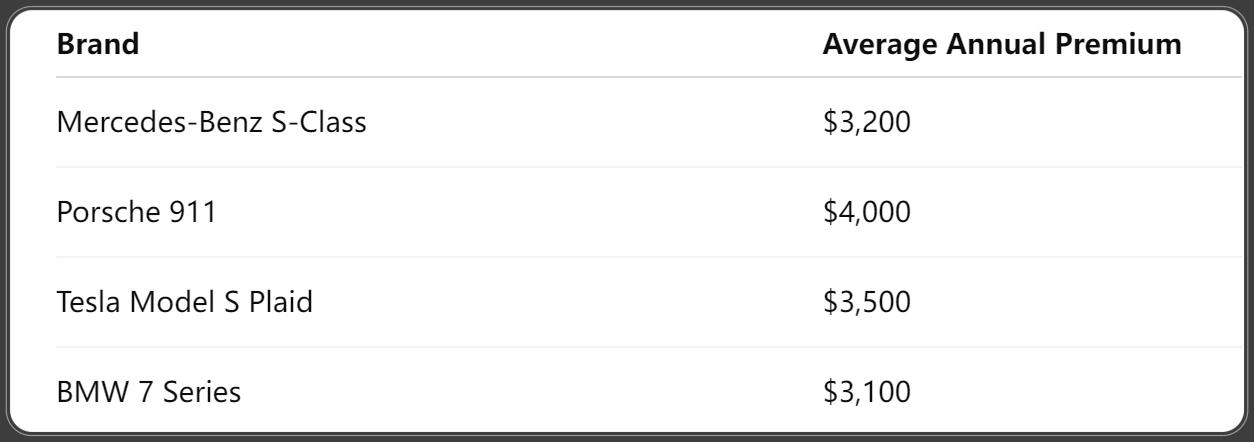

Cost of Insuring a Luxury Car in 2025

Average Premiums by Car Brand

ValuePenguin (LendingTree). (2025, July 8). State of Auto Insurance in 2025 [Web report].

How Driving History Affects Rates

Clean driving records can save thousands annually.

Geographic Location Impact

Urban areas often have higher premiums due to theft and accident rates.

Ways to Lower Luxury Car Insurance Premiums

Using Telematics and Safe Driving Programs

Insurers reward low-risk driving habits with discounts.

Bundling Insurance Policies

Combine home and auto policies for multi-policy discounts.

Choosing Higher Deductibles

Paying more out-of-pocket in a claim can lower monthly premiums.

Special Considerations for Electric and Hybrid Luxury Cars

Battery Replacement Costs

Electric vehicle batteries can cost $10,000+ to replace.

Specialized Repair Shops

Not all repair shops can handle advanced EV technology.

Insurance Discounts for Green Vehicles

Some insurers offer discounts for eco-friendly cars.

Luxury Car Insurance in Different States

States with the Highest Premiums

- California

- New York

- Florida

States with the Lowest Premiums

- Idaho

- Ohio

- Vermont

Common Mistakes Luxury Car Owners Make When Buying Insurance

Underinsuring High-Value Cars

A standard policy may not cover the full value.

Not Choosing Agreed Value Policies

Cash value payouts may not replace your car.

Ignoring Specialty Coverage

Standard insurers may overlook unique risks.

Frequently Asked Questions: Car Insurance for Luxury Cars 2025

1. Is luxury car insurance always more expensive?

Yes, due to higher repair costs and risk factors.

2. Can I get discounts on luxury car insurance?

Yes — safe driving, bundling, and telematics can lower costs.

3. Which insurer is best for exotic cars?

Chubb and AIG are leaders in exotic vehicle coverage.

4. Does luxury car insurance cover international driving?

Some policies, like Chubb’s, offer worldwide coverage.

5. Should I get gap insurance for my luxury car?

Yes — it protects you if your car is totaled early in ownership.

6. How does owning an electric luxury car affect insurance?

It can raise premiums due to battery replacement costs.

Conclusion: Protecting Your Investment in 2025

In 2025, car insurance for luxury cars is more than a legal requirement — it’s essential for safeguarding your investment. By choosing specialized coverage, comparing providers, and using cost-saving strategies, you can enjoy your high-end ride without financial worries.

For more information, check the Insurance Information Institute for updated luxury car insurance trends.

You Might Also Like

Car Insurance for Rideshare Drivers 2025: Best Policies & Savings Tips

Aug 15, 2025Car Insurance for Salvage Titles 2025: Everything You Need to Know

Aug 15, 2025Car Insurance for Snowbirds 2025: Seasonal Driver’s Guide to Coverage

Aug 12, 2025Car Insurance for Immigrants 2025: Complete Guide to Getting Covered in the U.S.

Aug 12, 2025Car Insurance for DUI Drivers 2025: How to Get Coverage After a Conviction

Aug 12, 2025