Car Insurance for Rideshare Drivers 2025: Best Policies & Savings Tips

Published on August 15, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

Introduction: Why Rideshare Drivers Need Special Insurance in 2025

In 2025, driving for Uber, Lyft, or other rideshare platforms is a great way to earn extra income. But if you think your personal car insurance has you fully covered — think again. Rideshare driving involves unique risks, and standard policies often leave gaps that could cost thousands in an accident.

Specialized rideshare insurance ensures you’re protected before, during, and after passenger trips, covering the times when your personal and platform-provided policies may fall short.

The Growth of Ridesharing in 2025

The rideshare market has grown significantly, with more electric and hybrid vehicles entering the mix. Demand for safe, reliable, and insured drivers has never been higher. However, the rise in traffic congestion and accident rates has made comprehensive coverage more essential than ever.

How Rideshare Insurance Differs from Regular Auto Insurance

Personal policies generally cover private driving, not commercial activity. Once you activate your rideshare app, many insurers consider that business use — and without the right add-on coverage, you might be driving uninsured.

When Standard Car Insurance Isn’t Enough

Coverage Gaps with Personal Policies

Most personal auto policies exclude coverage during rideshare periods, meaning you could be left paying out of pocket for damages.

Insurance Requirements from Uber, Lyft, and Other Platforms

Uber and Lyft provide limited liability coverage, but this only applies during certain periods and often doesn’t cover your vehicle’s repairs.

Types of Rideshare Insurance Coverage

Insurance for rideshare drivers is typically divided into three periods:

Period 1: App On, Waiting for a Ride

Liability coverage from the platform applies but is limited — you’ll need gap coverage for personal injury and property damage.

Period 2: Ride Accepted, En Route to Passenger

Full liability coverage is active, but your personal collision coverage may not apply unless you have a rideshare add-on.

Period 3: Passenger in Vehicle

Most platforms provide higher liability limits, but comprehensive and collision may still need to come from your own policy.

Top Insurance Providers for Rideshare Drivers in 2025

State Farm

Offers rideshare driver add-ons that extend personal coverage into all rideshare periods.

GEICO

Known for flexible hybrid policies that combine personal and commercial coverage.

Progressive

Offers competitive rates and a Smart Haul® program for safe driving discounts.

Allstate

Provides Ride for Hire® coverage that fills platform insurance gaps affordably.

Cost of Rideshare Insurance in 2025

Factors Affecting Premiums

- Driving history

- City vs. rural driving

- Vehicle type and age

- Annual rideshare mileage

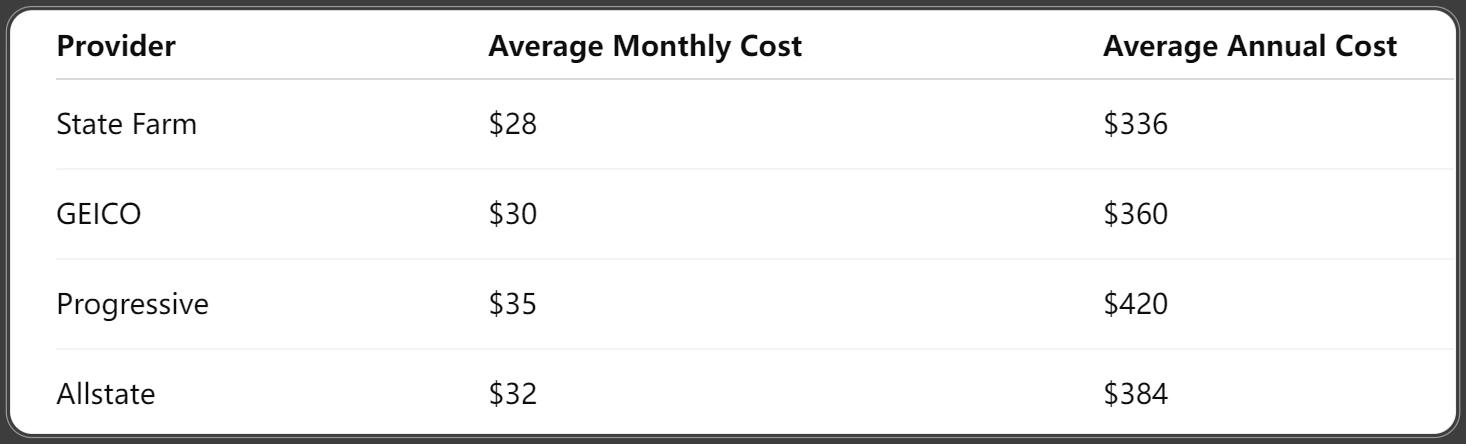

Average Monthly and Annual Rates

ValuePenguin (LendingTree). (2025, July 8). State of Auto Insurance in 2025 [Web report].

City vs. Rural Pricing Differences

Urban areas like New York and Los Angeles can see premiums 40% higher than rural locations.

How to Save Money on Rideshare Insurance

Bundling with Other Policies

Combine rideshare coverage with home or renters insurance for multi-policy discounts.

Choosing Higher Deductibles

A higher deductible can reduce monthly costs but increases out-of-pocket expenses after a claim.

Safe Driving Discounts

Using telematics programs that track driving behavior can earn significant savings.

State Laws Affecting Rideshare Insurance in 2025

States with Strictest Requirements

- California

- New York

- Illinois

These states require proof of rideshare-specific insurance for driver approval.

States with Flexible Rules

- Texas

- Florida

- Nevada

These states allow personal policies with rideshare endorsements.

Common Mistakes Rideshare Drivers Make with Insurance

Relying Only on Platform Coverage

Platform insurance protects passengers more than drivers.

Not Reporting Commercial Use to Insurer

Failing to disclose rideshare activity can lead to policy cancellation.

Choosing Inadequate Liability Limits

High-value accident claims can exceed state minimums easily.

Frequently Asked Questions: Rideshare Car Insurance 2025

1. Do I need separate rideshare insurance if I already have full coverage?

Yes — personal full coverage doesn’t apply during commercial rideshare activity.

2. Which company offers the cheapest rideshare insurance?

State Farm and GEICO often provide the most competitive rates in 2025.

3. Does Uber provide collision coverage?

Only if you have collision coverage on your personal policy.

4. Can rideshare insurance cover multiple platforms?

Yes, most policies extend to Uber, Lyft, and delivery apps like DoorDash.

5. Do I need rideshare coverage for part-time driving?

Yes — even a single trip without proper coverage can be financially risky.

6. Is rideshare insurance tax-deductible?

Yes, as a business expense for self-employed drivers.

Conclusion: Driving Safely and Fully Covered in 2025

In 2025, car insurance for rideshare drivers is no longer optional — it’s essential for financial protection. By choosing the right insurer, understanding coverage gaps, and taking advantage of discounts, you can drive confidently while maximizing earnings.

For the latest insurance requirements by state, visit the Insurance Information Institute.

You Might Also Like

Car Insurance for Luxury Cars 2025: Best Coverage & Cost-Saving Tips

Aug 15, 2025Car Insurance for Salvage Titles 2025: Everything You Need to Know

Aug 15, 2025Car Insurance for Snowbirds 2025: Seasonal Driver’s Guide to Coverage

Aug 12, 2025Car Insurance for Immigrants 2025: Complete Guide to Getting Covered in the U.S.

Aug 12, 2025Car Insurance for DUI Drivers 2025: How to Get Coverage After a Conviction

Aug 12, 2025