Home Insurance for Condos 2025: Expert Guide with Top Tips & Cost-Saving Strategies

Published on August 8, 2025

Sarah Patel

Homeowners & Property Insurance Expert.

Sarah Patel is a property underwriter-turned-writer with 10 years in the field; she focuses on flood, wildfire, and replacement-cost planning for homeowners.

Home Insurance for Condos 2025: Expert Guide with Top Tips & Cost-Saving Strategies

Home insurance for condos 2025 is more important than ever, as rising repair costs, inflation, and updated regulations shape how condo owners protect their property. Whether you’re a first-time condo buyer or a seasoned owner, understanding the latest changes in coverage, costs, and claims can help you safeguard your investment without overpaying.

Understanding Condo Home Insurance in 2025

Definition and Purpose of Condo Insurance

Condo insurance, often called HO-6 insurance, is designed to protect the interior of your unit, your belongings, and your liability in case of accidents. Unlike traditional homeowners insurance, which covers the entire building, condo insurance works alongside your condominium association’s master policy to provide complete protection.

How Condo Insurance Differs from Homeowners Insurance

While homeowners insurance covers the entire structure and land, condo insurance typically covers only the “walls-in” — everything from the drywall inward. The exterior, common areas, and shared structures are usually covered by the HOA’s master policy.

Key Changes in Condo Insurance Policies in 2025

In 2025, insurers have adjusted policies to account for:

- Higher repair and replacement costs due to inflation

- Stricter HOA insurance requirements

- Expanded natural disaster coverage in high-risk regions

- Digital claims processing for faster reimbursements

Types of Condo Home Insurance Coverage

Building Property Coverage

Covers the interior structure of your condo, including walls, flooring, and built-in fixtures.

Personal Property Coverage

Protects your furniture, clothing, electronics, and other belongings against theft, fire, and covered disasters.

Liability Protection

Covers legal expenses if someone is injured inside your condo or if you accidentally damage someone else’s property.

Loss Assessment Coverage

Helps pay your share of costs if the condo association’s insurance isn’t enough to cover a loss in common areas.

Additional Living Expenses (ALE)

Pays for temporary housing and related costs if your condo becomes uninhabitable due to a covered event.

What’s New in Condo Insurance Regulations for 2025

Government Guidelines and Legal Requirements

Some states now require specific coverage for floods or earthquakes if your condo is in a high-risk zone.

HOA Policy Changes Affecting Owners

Many HOAs have reduced their master policy coverage, pushing more responsibility — and costs — onto unit owners.

How to Determine the Right Coverage for Your Condo

Evaluating Your Condo Association’s Master Policy

Before buying your own policy, request a copy of your HOA’s master insurance policy. This document tells you exactly what the association covers — often either:

- Bare walls coverage: Covers only the structure and common areas.

- Single-entity coverage: Includes basic fixtures but excludes upgrades you make.

- All-in coverage: Covers nearly everything except your personal belongings.

Knowing your HOA’s coverage prevents you from paying for duplicate protection.

Calculating Coverage for Upgrades and Renovations

If you’ve upgraded kitchen cabinets, installed hardwood flooring, or remodeled bathrooms, you’ll want enough coverage to restore these improvements after a loss. Keep receipts, photos, and contractor invoices to document the value.

Factoring in Regional Risks (Floods, Earthquakes, Hurricanes)

Standard condo policies usually exclude flood and earthquake coverage. If you live in a risk-prone area, you’ll need separate policies or endorsements. For instance, Florida condo owners often add hurricane coverage, while California residents consider earthquake insurance.

Cost of Condo Home Insurance in 2025

Average Premiums by State

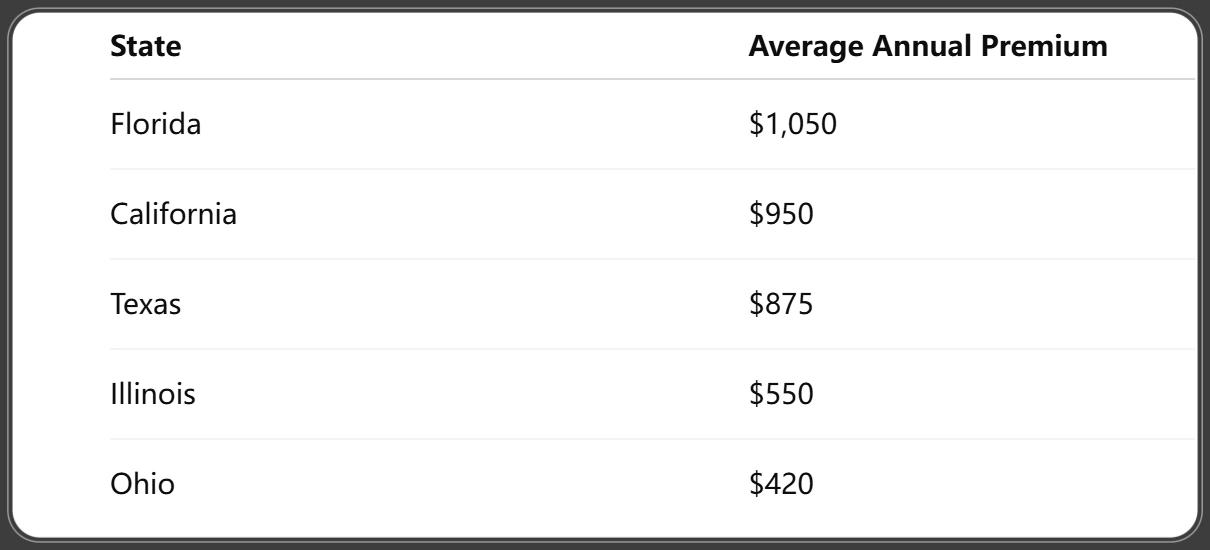

In 2025, the average cost for condo insurance in the U.S. ranges from $350 to $1,200 annually, depending on location and coverage limits. High-cost states include Florida, Louisiana, and California due to natural disaster risks.

Factors That Influence Costs

- Location & climate risks

- Building age and construction type

- Personal property value

- Deductible amount

- Claims history

Ways to Reduce Your Condo Insurance Premiums

- Bundle your condo insurance with auto or life insurance.

- Install security systems and fire alarms.

- Choose a higher deductible if you can afford the out-of-pocket expense.

- Maintain a clean claims record.

Common Mistakes Condo Owners Make with Insurance

Overlapping Coverage with HOA

Some owners unknowingly pay for coverage their HOA already provides. Always compare your policy to the master policy.

Underestimating Personal Property Value

Many owners undervalue their belongings. Conduct a home inventory using an app to ensure you’re fully protected.

Ignoring Loss Assessment Coverage

If a shared roof is damaged and HOA coverage falls short, you could be billed thousands without loss assessment coverage.

How to File a Condo Insurance Claim in 2025

Step-by-Step Claim Process

- Document the damage with photos and videos.

- Contact your insurance provider as soon as possible.

- Provide receipts and inventory lists for damaged items.

- Meet with the adjuster to review the claim.

- Follow up regularly to ensure timely processing.

Tips to Speed Up Claim Approval

- Submit all requested documents in one package.

- Use digital claim filing when available.

- Keep communication professional and prompt.

Comparing Top Condo Insurance Providers in 2025

Best for Budget-Friendly Coverage – State Farm

Known for competitive rates and bundling discounts.

Best for Comprehensive Protection – Allstate

Offers extended replacement cost and additional endorsements.

Best for High-Risk Areas – USAA (for eligible members)

Provides exceptional coverage for military families in disaster-prone regions.

Expert Tips for Choosing the Right Condo Insurance

Reading the Fine Print

Understand what’s excluded — such as floods or mold — before you sign.

Understanding Deductibles

A higher deductible means lower premiums but higher out-of-pocket costs in a claim.

Bundling Insurance Policies for Discounts

Combining condo, auto, and even life insurance can yield significant savings.

Frequently Asked Questions About Condo Insurance 2025

1. Is condo insurance mandatory in 2025?

Not by law, but most mortgage lenders and HOAs require it.

2. How much condo insurance do I really need?

It depends on your HOA’s master policy and your personal property value.

3. Does condo insurance cover flooding?

No, you’ll need a separate flood policy through FEMA or private insurers.

4. What is the difference between HO-6 and HO-3 insurance?

HO-6 is for condos, HO-3 is for single-family homes.

5. How often should I review my condo insurance?

At least once a year, or after major renovations or purchases.

6. Can I switch condo insurance providers mid-year?

Yes, but check for cancellation fees or refund policies.

Conclusion: Protecting Your Condo Investment in 2025

In 2025, home insurance for condos is more than just a formality — it’s a financial safeguard against unexpected costs. By understanding your HOA’s master policy, choosing the right coverage for your needs, and staying informed about changes in regulations, you can protect your investment without overspending.

For more detailed guidance, the National Association of Insurance Commissioners (NAIC) provides up-to-date resources on condo insurance laws and consumer rights.

You Might Also Like

Home Insurance for Pools 2025: 12 Must-Know Changes & Tips to Save Money

Aug 8, 2025Home Insurance for Dogs 2025: The Ultimate Guide to Coverage, Costs & Benefits

Aug 8, 2025Home Insurance for Mobile Homes 2025: 10 Expert Tips for Affordable & Reliable Coverage

Aug 8, 2025Home Insurance for New Construction 2025: Essential Guide with Expert Tips & Cost Insights

Aug 8, 2025Best & Affordable Home Insurance for Vacant Homes 2025

Aug 7, 2025