Best & Affordable Home Insurance for Vacant Homes 2025

Published on August 7, 2025

Sarah Patel

Homeowners & Property Insurance Expert.

Sarah Patel is a property underwriter-turned-writer with 10 years in the field; she focuses on flood, wildfire, and replacement-cost planning for homeowners.

Introduction to Vacant Home Insurance in 2025

As more people shift lifestyles, travel extensively, or invest in property, the number of vacant homes is climbing. In 2025, having the right home insurance for vacant homes is more important than ever. Standard homeowners insurance doesn’t always offer protection for properties left empty for long periods. That’s where vacant home insurance steps in.

Whether you're renovating, in between tenants, or just haven’t moved in yet, this type of coverage is tailored to reduce risks that come with an unattended home. Insurance companies have adapted to new market conditions, offering flexible, tech-driven solutions to meet these rising needs.

What Qualifies as a Vacant Home in 2025?

Insurance companies often draw a fine line between a vacant and unoccupied home. A vacant home typically means there are no personal belongings and no one living there. Meanwhile, an unoccupied home may still have furniture and utilities running, but no one is residing full-time.

In 2025, most insurers define a home as "vacant" if it remains uninhabited for more than 30-60 consecutive days, depending on the policy. It's essential to inform your insurer of prolonged absence to avoid coverage denial.

Risks Associated with Vacant Homes

Leaving a property empty increases the likelihood of:

- Theft and Vandalism – Empty homes are easy targets for break-ins and graffiti.

- Weather Damage – No one to spot leaks, frozen pipes, or roof damage.

- Fires – Unnoticed electrical issues or natural events can escalate quickly.

- Liability Claims – If someone gets injured on the property, you're still responsible.

Vacant home insurance in 2025 accounts for these risks, offering tailored protection.

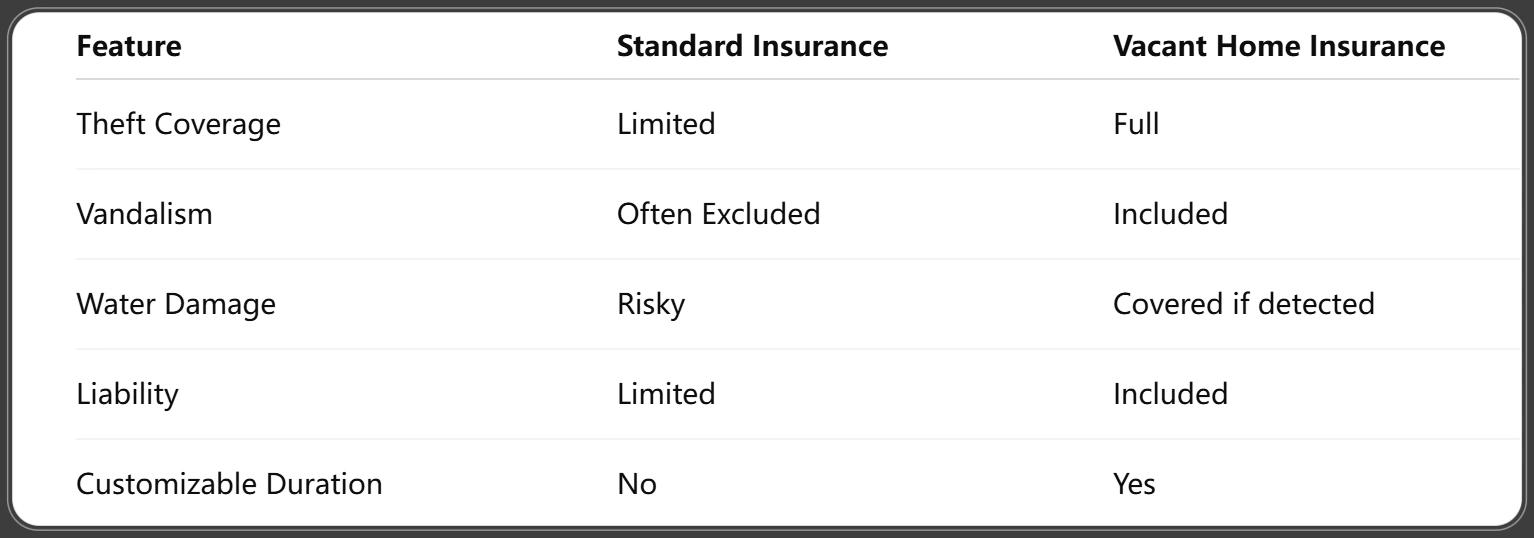

Standard Homeowners Insurance vs. Vacant Home Insurance

Most standard home insurance policies become void or limited if the house is vacant for too long. Here's how the two compare:

As you can see, dedicated insurance for vacant homes offers comprehensive peace of mind.

Why Regular Insurance Policies May Be Voided

Most standard home insurance agreements contain occupancy clauses. These clauses usually state that coverage may lapse or become void if the property is left vacant for a certain number of days—commonly 30 or 60.

Failure to notify your provider could lead to:

- Denied claims

- Policy cancellation

- Breach of contract penalties

To avoid these problems, it's critical to either inform your insurer or switch to a vacant home policy before leaving.

Features of Vacant Home Insurance Policies

Policies in 2025 come with a host of tailored benefits:

- Property Damage Protection: From weather, fire, and vandalism.

- Liability Insurance: Covers accidents or injuries on-site.

- Theft Coverage: Includes theft of building materials and appliances.

- Optional Add-ons: Flood insurance, earthquake coverage, or mold protection.

Policies are often available in 3-month, 6-month, or 12-month terms, offering flexibility based on your situation.

Who Needs Vacant Home Insurance?

This type of insurance is ideal for:

- Landlords between tenants

- Homeowners undergoing major renovations

- Families moving to a new home but haven't sold the old one

- Estate managers or inheritors of a property

- People with seasonal or second homes

If your property will be uninhabited for more than a month, this coverage is worth considering.

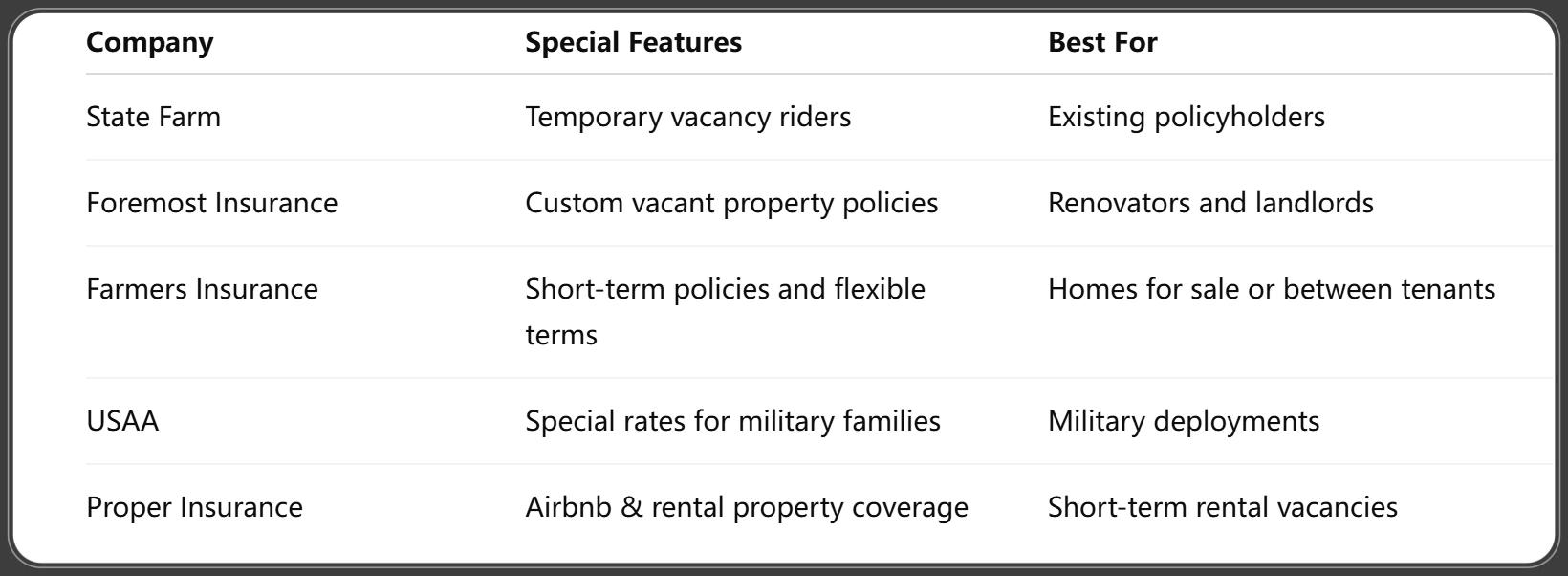

Best Insurance Companies for Vacant Homes in 2025

Choosing the right provider for home insurance for vacant homes 2025 is crucial. Some insurers specialize in this niche, offering customized plans and competitive rates. Here are a few top-rated options based on customer reviews, pricing, and policy flexibility:

Be sure to compare quotes, policy terms, and coverage levels before choosing a provider.

Cost of Vacant Home Insurance in 2025

In 2025, the average cost of vacant home insurance ranges between $800 and $2,500 annually, depending on various factors such as:

- Location and crime rates

- Property value and condition

- Length of vacancy

- Type and amount of coverage

- Security features (e.g., cameras, alarms)

Some companies offer month-to-month policies, while others may offer discounts for bundling with auto or umbrella insurance.

How to Get Affordable Vacant Home Insurance

To lower your premium without sacrificing coverage, consider these tips:

- Install Security Features: Alarms, cameras, and smart locks can reduce your risk profile.

- Perform Regular Maintenance: Keep the property in good condition to avoid costly damage claims.

- Bundle Insurance Policies: Some providers offer discounts when you purchase multiple policies.

- Limit Vacancy Time: If possible, have someone stay in the home periodically.

- Compare Quotes: Always shop around to find the most cost-effective policy.

Even minor upgrades like motion-sensor lights or remote surveillance can significantly impact your rate.

Tips to Protect Your Vacant Property

Keeping your vacant home secure doesn’t stop at insurance. Take proactive measures to protect your investment:

- Secure all entry points – Windows, doors, garages.

- Schedule regular inspections – Hire a property manager or trusted friend to check weekly.

- Maintain the exterior – Overgrown lawns and piled-up mail can attract trouble.

- Use smart home devices – Monitor your property remotely.

These measures not only keep your property safe but may also earn you premium discounts.

How to File a Claim for a Vacant Home

Filing a claim for a vacant home involves a few extra steps. Here's a simple guide:

- Notify Your Insurance Provider Immediately.

- Document the Damage – Take photos/videos as soon as possible.

- File a Police Report – Especially important in cases of theft or vandalism.

- Keep Maintenance Records – Proves you took steps to prevent damage.

- Work with Adjusters – Be present and transparent during inspections.

Avoid delays or false statements, as vacant home claims are scrutinized more than standard claims.

Legal Considerations for Vacant Property Insurance

Vacant homes can be subject to local regulations, especially in high-risk areas or HOA-managed communities. Some things to check:

- Local ordinances: Some municipalities may require regular maintenance of empty properties.

- Permit requirements: Renovations may require approval and insurance.

- HOA rules: Vacant properties may violate community guidelines.

Being legally compliant can prevent fines and additional risks.

Common Exclusions in Vacant Home Policies

Not everything is covered. Most vacant home policies exclude:

- Neglect or lack of maintenance

- Flood damage (often requires separate policy)

- Pest infestations

- Wear and tear

- Illegal activity

Make sure you understand the exclusions so you're not caught off guard during a claim.

Policy Duration Options in 2025

Depending on your situation, you can choose from:

- Short-term policies: 3 to 6 months, ideal for renovations or pending sales.

- Long-term policies: 12+ months for inherited or investment properties.

- Flexible policies: Pay-as-you-go options tied to property monitoring devices.

Some providers even let you pause coverage if the home becomes occupied again.

Innovations in Vacant Property Insurance

2025 has brought some high-tech updates to vacant home insurance:

- Smart Discounts: Get reduced premiums for using smart cameras or leak detectors.

- Usage-Based Coverage: Pay only for the duration your home is vacant.

- AI-Powered Risk Analysis: Helps insurers tailor coverage to real-time threats.

These innovations not only enhance security but also lower costs for tech-savvy homeowners.

Frequently Asked Questions

1. Is vacant home insurance required by law?

No, but mortgage lenders may require it if your property is financed and left empty for a prolonged period.

2. How long can a house be vacant before insurance is affected?

Typically, after 30–60 days, your regular home insurance may no longer be valid.

3. Can I cancel vacant home insurance once someone moves in?

Yes, just inform your insurer, and they may switch you to a standard homeowners policy.

4. Is vandalism covered by vacant home insurance?

Yes, most vacant policies cover vandalism and theft, unlike standard policies.

5. Do I need a separate policy for renovations?

Yes, if major renovations are happening, you might need a builder’s risk or renovation endorsement.

6. What happens if I forget to notify my insurer about a vacancy?

Your claim could be denied, and the policy might be void. Always keep your insurer informed.

Conclusion: Choosing the Right Protection in 2025

Leaving a home vacant doesn’t mean leaving it vulnerable. With home insurance for vacant homes 2025, you can sleep easy knowing your property is protected against theft, weather damage, and liability. As housing trends continue to evolve, so must your approach to insurance. Take time to research, compare, and secure the right policy that fits your needs.

You Might Also Like

Home Insurance for Mobile Homes 2025: 10 Expert Tips for Affordable & Reliable Coverage

Aug 8, 2025Home Insurance for New Construction 2025: Essential Guide with Expert Tips & Cost Insights

Aug 8, 2025Best Guide to Home Insurance for Solar Panels 2025: Protect Your Investment Smartly

Aug 7, 2025Best Home Insurance for Wildfire Areas 2025 – Top Picks, Rates & FAQs

Aug 7, 2025Top-Rated Home Insurance for Historic Homes 2025: Expert Tips & Must-Know Facts

Aug 7, 2025