Top-Rated Home Insurance for Historic Homes 2025: Expert Tips & Must-Know Facts

Published on August 7, 2025

Sarah Patel

Homeowners & Property Insurance Expert.

Sarah Patel is a property underwriter-turned-writer with 10 years in the field; she focuses on flood, wildfire, and replacement-cost planning for homeowners.

Owning a historic home is more than just living in a building—it’s preserving a piece of architectural and cultural heritage. But when it comes to home insurance for historic homes 2025, things aren’t so simple. These iconic properties come with unique risks, higher replacement costs, and complex legal obligations. In this guide, we’ll cover everything you need to know to protect your investment with the right insurance.

Understanding Historic Homes and Their Insurance Needs

What Qualifies as a Historic Home in 2025?

A home is generally considered “historic” if it’s at least 50 years old and retains its original structure or design elements. However, in 2025, the criteria have expanded to include homes listed on national, state, or local historic registries. Some local governments even grant historic designation to architecturally significant buildings less than 50 years old if they meet cultural benchmarks.

Why Standard Home Insurance Doesn’t Always Work

Standard policies—like HO-3—typically cover modern homes using replacement cost calculations based on current building practices. But historic homes often feature:

- Outdated electrical or plumbing systems

- Custom woodwork and antique fixtures

- Non-standard materials like horsehair plaster or slate roofs

These elements make the cost and process of repairs significantly more complicated, which standard policies usually don't account for.

Key Challenges in Insuring Historic Properties

Cost of Rebuilding with Original Materials

One of the most daunting challenges in insuring historic properties is the cost of authentic restoration. You may need to source rare materials or hire skilled artisans to recreate period-accurate features. This can easily double or triple your repair bill.

Limited Contractor Availability and Expertise

Not every contractor is equipped to handle preservation-grade work. Insurance companies often limit payouts based on available labor, which can create problems when you need specialists.

Risk Factors: Age, Structure, and Maintenance

Older homes often face greater risks such as:

- Increased fire hazard from outdated wiring

- Water damage from old roofing or pipes

- Foundation or structural issues

These risks raise insurance premiums or even limit your options with mainstream insurers.

Types of Insurance Coverage for Historic Homes

HO-3 vs. HO-8: Which Policy Fits Best?

- HO-3: Standard policy for modern homes; may fall short on older properties.

- HO-8: Designed for older homes; covers repairs using functional replacement cost rather than exact replication.

For true historic preservation, you may need special endorsements or custom policies.

Guaranteed Replacement Cost Coverage

This add-on ensures your insurer pays the full cost of rebuilding your home with materials and craftsmanship matching the original, regardless of inflation or policy limits.

Ordinance or Law Coverage Explained

If a historic home must be upgraded to meet 2025 building codes during a repair, ordinance or law coverage can help pay those costs, which aren't always covered under basic plans.

Top Insurance Providers for Historic Homes in 2025

Best National Providers Offering Historic Home Policies

- Chubb Insurance – Known for high-value and historic property policies

- Amica Mutual – Excellent customer service and custom options

- State Farm – Offers add-ons for vintage home coverage

Specialized Insurers for Vintage and Landmark Properties

- Historic Home Insurance Agency – Focused exclusively on insuring heritage homes

- Fireman’s Fund (Allianz) – Offers detailed coverage for listed properties

These providers understand the nuances of restoration, rare materials, and local preservation laws.

How to Lower Insurance Premiums on Historic Homes

Safety and Structural Upgrades That Help

Installing modern safety systems like smoke detectors, fire sprinklers, and updated electrical wiring can significantly reduce your premiums.

Getting Historic Designation Benefits

Ironically, an official “historic” status might help lower your costs. Some insurers offer discounted rates for properties on a historic registry due to added maintenance oversight and reduced vacancy risks.

Bundling with Other Insurance Products

Combining your home, auto, or umbrella policies under one provider can unlock multi-policy discounts.

Steps to Get the Right Historic Home Insurance in 2025

Home Inspection & Appraisal Essentials

Before insurers can offer a policy, they typically require a thorough home inspection. For historic homes, this process is more detailed and focuses on:

- Structural integrity

- Electrical, plumbing, and roofing conditions

- Historic features like original woodwork, tile, or glass

An appraisal by a certified historic home specialist is often needed to determine the actual replacement cost—especially when using rare or non-standard materials.

Working with a Historic Property Insurance Agent

Partnering with an insurance agent who specializes in historic properties is critical. They understand local and federal guidelines, know how to get accurate valuations, and can help you choose riders or endorsements that protect your home’s authenticity.

Reviewing Policy Limits and Exclusions

Don’t make the mistake of assuming everything is covered. Be sure to:

- Review the replacement cost vs. actual cash value details

- Check whether antique elements like staircases, doors, and moldings are included

- Understand what’s excluded under natural disasters or ordinance upgrades

Key Legal Considerations in 2025

Local Preservation Laws and Impact on Coverage

Historic homes are often protected by local ordinances that restrict modifications. If your insurance doesn’t cover costs associated with these laws, you could be stuck paying for expensive compliance-related repairs out of pocket.

Federal and State Tax Credits for Repairs

In 2025, many state governments and the U.S. federal government offer tax incentives for rehabilitating historic structures. Programs like the Federal Historic Preservation Tax Incentives allow up to 20% tax credit on qualified renovation expenses—savings that can be reinvested into better insurance coverage.

Historic Home Insurance and Climate Risks

Flood, Fire, and Windstorm Coverage for Old Structures

With climate change increasing the frequency of severe weather events, it’s essential that historic homes have:

- Flood Insurance – Required for homes in FEMA flood zones

- Fire Protection – Especially in wildfire-prone states like California

- Windstorm Riders – Critical for coastal homes or hurricane zones

Old buildings are more vulnerable to these events, so standard policies may exclude them unless additional coverage is added.

Mitigating Environmental Damage Risks

Preventive measures like retrofitting windows, reinforcing roofs, and installing sump pumps can reduce risk—and lower premiums. Some insurance companies offer discounts if such measures are certified by contractors or inspectors.

Top 5 Mistakes to Avoid When Insuring a Historic Home

- Underinsuring the Property

- Failing to account for the real cost of specialty materials and skilled labor.

- Assuming Standard Coverage is Enough

- HO-3 policies often lack the nuance needed for heritage homes.

- Skipping Ordinance Coverage

- Ignoring local codes can cost you thousands during a rebuild.

- Overlooking Deductibles and Caps

- A lower premium might mean higher out-of-pocket costs later.

- Not Using a Specialist Agent

- Generalist agents may overlook critical protections for older homes.

Real-Life Case Studies of Insured Historic Homes

Case Study 1: Victorian Mansion in New Orleans

This 1880s mansion required over $750,000 in restoration after hurricane damage. Thanks to guaranteed replacement cost coverage and ordinance add-ons, the owners received full compensation to restore the ornate detailing.

Case Study 2: Colonial Home in Massachusetts

A homeowner’s policy with standard HO-3 left out essential preservation work. After fire damage, they had to pay out-of-pocket for period-accurate woodwork. They later switched to a specialist insurer and saved long-term.

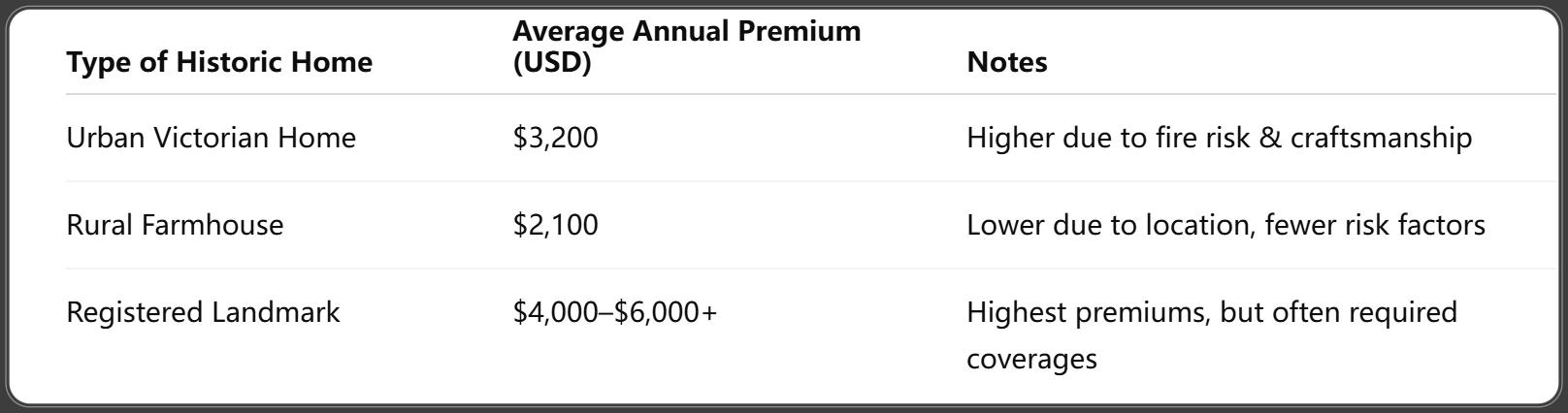

Cost Breakdown: Average Premiums in 2025

Tip: Premiums vary significantly depending on location, condition, and coverage type. Get multiple quotes and consider bundling options.

FAQs: Home Insurance for Historic Homes 2025

1. Can I insure a historic home with a standard insurance company?

Yes, but not all insurers provide sufficient coverage. You may need a policy rider or a specialist provider.

2. What is the best type of policy for a historic home?

An HO-8 policy with add-ons like guaranteed replacement cost and ordinance coverage is often best.

3. Does owning a historic home increase my insurance costs?

Typically, yes. The use of rare materials and skilled labor, plus higher liability, raises premiums.

4. Can I get discounts for renovations or updates?

Absolutely. Upgrading systems like plumbing or installing security systems can reduce your rates.

5. Are tax credits available for maintaining my historic home?

Yes. Many federal and state programs offer tax credits or grants for approved restoration work.

6. Will insurance cover antique furniture or fixtures inside the home?

Only if you add personal property or valuable items coverage. Otherwise, these are not typically included.

Conclusion: Protecting the Past While Planning for the Future

Insuring a historic home in 2025 is more than just ticking boxes—it's a strategic effort to preserve history while safeguarding your future. With the right policy, expert guidance, and a little planning, you can enjoy peace of mind knowing your investment is protected, even in the face of disaster or deterioration.

Whether you're living in a century-old Victorian or a registered landmark estate, understanding your coverage options will help you avoid costly mistakes and maintain the legacy of your home for generations to come.

You Might Also Like

Home Insurance for Mobile Homes 2025: 10 Expert Tips for Affordable & Reliable Coverage

Aug 8, 2025Home Insurance for New Construction 2025: Essential Guide with Expert Tips & Cost Insights

Aug 8, 2025Best & Affordable Home Insurance for Vacant Homes 2025

Aug 7, 2025Best Guide to Home Insurance for Solar Panels 2025: Protect Your Investment Smartly

Aug 7, 2025Best Home Insurance for Wildfire Areas 2025 – Top Picks, Rates & FAQs

Aug 7, 2025