Illinois Health Insurance Guide 2025: Your Prairie State Coverage Blueprint

Published on July 24, 2025

🏙️ Illinois Health Insurance Guide 2025: Your Prairie State Coverage Blueprint

Introduction

Whether you live in Chicago’s bustling neighborhoods or the rural heartlands around Peoria, securing the right health insurance in Illinois keeps you covered without overpaying. This guide offers state-specific insights—ACA Marketplace comparisons, Medicaid & All Kids details, short-term alternatives versus COBRA, plus employer-sponsored HDHP & HSA planning and five proven cost-saving tactics.

You’ll learn to:

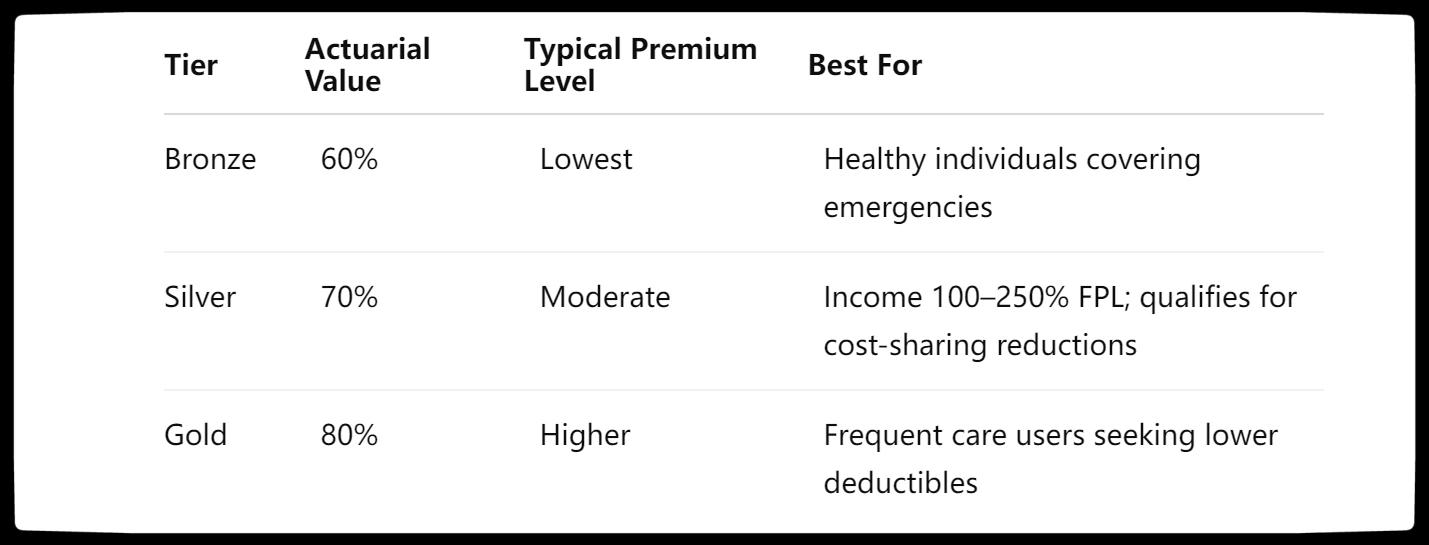

- Weigh Bronze, Silver & Gold plan differences and subsidy thresholds

- Verify Illinois Medicaid and All Kids (CHIP) enrollment steps

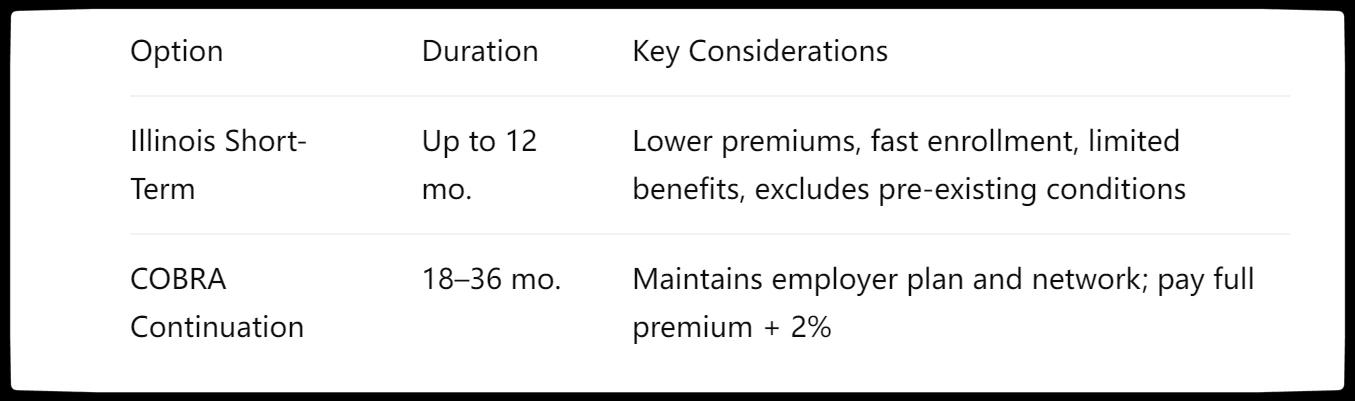

- Choose between Illinois short-term health insurance and COBRA continuation

- Maximize tax advantages with employer-sponsored HDHP & HSA options

- Implement five proven strategies to reduce your Illinois health insurance costs

1. Marketplace Plans: Bronze vs. Silver vs. Gold

- Silver cost-sharing reductions can cut deductibles by up to 94% for incomes between 100–250% FPL.

- Open Enrollment: November 1, 2024 to January 31, 2025.

Action: Compare Illinois ACA health insurance quotes on HealthCare.gov to preview your premium tax credit.

2. Illinois Medicaid & All Kids (CHIP)

- Medicaid eligibility: Adults up to 138% FPL (~$20K/year).

- All Kids (CHIP): Covers children in families up to 318% FPL.

- Enrollment: Apply via ACCESS Illinois portal or county DHS office.

Pro Tip: Report income changes immediately to maintain continuous Illinois Medicaid coverage.

3. Short-Term Insurance vs. COBRA

- Short-term health insurance Illinois fills coverage gaps but lacks preventive care and pre-existing coverage.

- COBRA retains your employer network at full cost for seamless continuity.

4. Employer-Sponsored HDHP & HSA Strategies

- Plan options: PPO, HMO, HDHP with HSA.

- HSA benefits: Triple tax advantage—pre-tax contributions, tax-free growth, tax-free withdrawals for qualified expenses.

- 2025 HSA limits: $4,150 individual; $8,300 family.

Tip: Maximize HSA funding early via payroll deductions to build a tax-advantaged healthcare reserve.

5. Five Cost-Saving Tactics

- Maximize Subsidies: Accurately report income to lock in premium tax credits.

- Shop Early: Compare networks and benefits before enrollment deadlines.

- Stay In-Network: Use plan providers to minimize copays and avoid balance billing.

- Leverage Telehealth: Utilize $0 telehealth visits for routine consultations.

- Bundle Plans: Combine health, dental, and vision for multi-policy discounts.

Applying these steps ensures affordable health insurance in Illinois without compromising care.

Conclusion

Choosing the right health insurance in Illinois involves balancing Marketplace plans, Medicaid & CHIP eligibility, gap coverage solutions, and employer-sponsored benefits. By following this roadmap and leveraging targeted cost-saving tactics, you can secure comprehensive, budget-friendly coverage in 2025.

You Might Also Like:

What Is Health Insurance and How Does It Work in the U.S.?

How the "One Big Beautiful Bill Act" Transforms ACA Health Insurance in 2025

7 Smart Tips to Save Money on Health Insurance in 2025

PPO vs HMO: Which Health Insurance Plan Is Right for You?

Health Insurance in 2025: What You Need to Know Before You Enroll