Michigan Health Insurance Guide 2025: Your Buckeye State Coverage Blueprint

Published on July 24, 2025

🍎 Michigan Health Insurance Guide 2025: Your Buckeye State Coverage Blueprint

Introduction

In Michigan—from Detroit’s bustling neighborhoods to Grand Rapids’ suburbs and Lansing’s government district—choosing the right health insurance in Michigan ensures full coverage without overspending. This guide provides Michigan-specific insights on Affordable Care Act Marketplace tiers, Medicaid & MIChild (CHIP) programs, short-term coverage vs. COBRA, and employer-sponsored HDHP & HSA plans, plus five tactical cost-saving strategies.

In this guide, you’ll learn how to:

- Select the optimal Bronze, Silver & Gold Marketplace plan and understand subsidy rules

- Navigate Michigan Medicaid & MIChild enrollment and renewal

- Choose between short-term health insurance Michigan and COBRA continuation

- Maximize tax benefits with HDHP & HSA employer-sponsored plans

- Implement five proven tactics to reduce your Michigan health insurance premiums

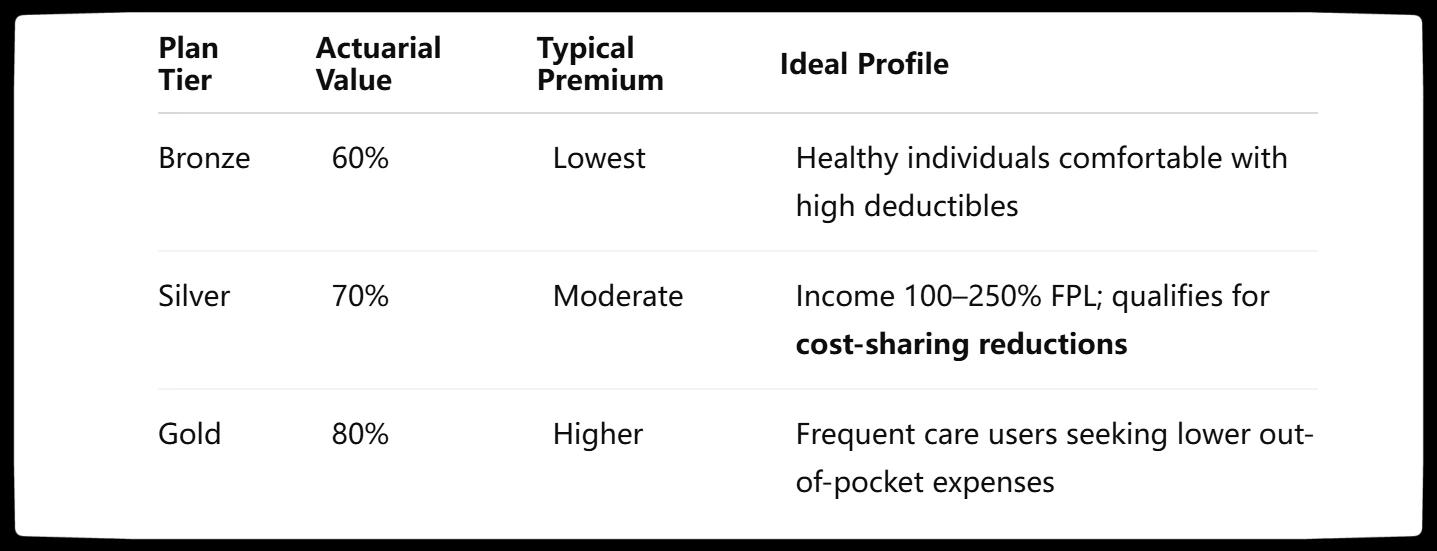

1. ACA Marketplace Plans: Bronze vs. Silver vs. Gold

- Cost-sharing reductions on Silver plans can cut deductibles by up to 94% for incomes 100–250% FPL.

- Enrollment period: November 1, 2024–January 31, 2025.

Next Action: Visit HealthCare.gov to compare Michigan ACA health insurance quotes and estimate your premium tax credit.

2. Michigan Medicaid & MIChild (CHIP)

- Medicaid eligibility: Adults earning up to 138% FPL (approx. $20,120/year); expanded benefits for children, pregnant individuals, and disabled.

- MIChild (CHIP): Covers uninsured minors in families up to 212% FPL.

- Apply or Renew: Use MI Bridges or visit your county MDHHS office.

Quick Tip: Report income, address, or household changes within 10 days to prevent coverage gaps under Michigan Medicaid or MIChild.

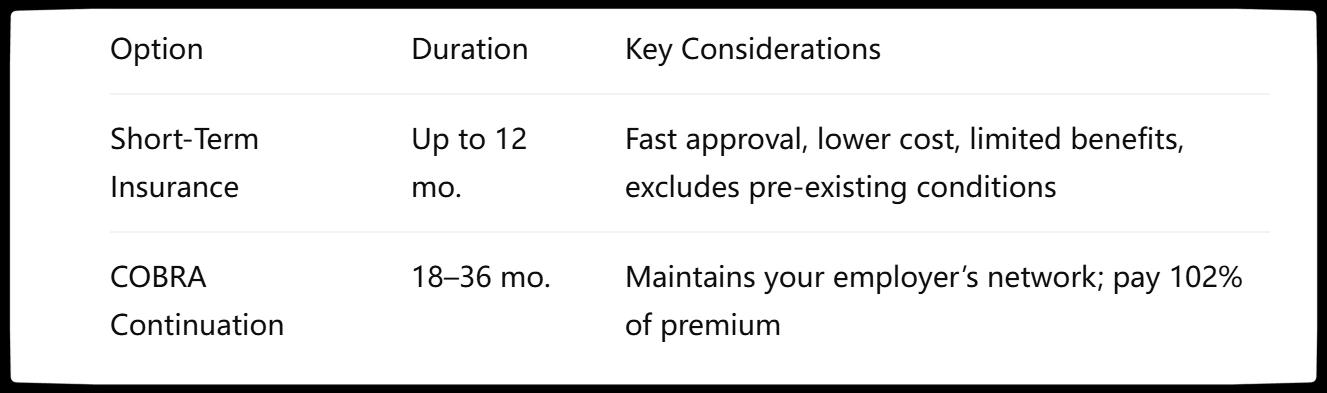

3. Short-Term Coverage vs. COBRA

- Short-term health insurance Michigan bridges brief gaps but often omits preventive care and pre-existing conditions.

- COBRA continuation preserves your existing coverage at full cost, ideal for seamless provider access.

4. Employer HDHP & HSA Optimization

- Plan Options: PPO, HMO, or High-Deductible Health Plan (HDHP) with Health Savings Account (HSA).

- HSA advantages: Pre-tax contributions, tax-free earnings, and tax-free withdrawals for qualified expenses.

- 2025 Contribution Limits: $4,150 individual; $8,300 family.

Pro Tip: Automate maximum HSA contributions via payroll—build a tax-advantaged healthcare fund and lower taxable income.

5. Five Tactics to Lower Your Premium

- Maximize Subsidies: Accurately project your annual income to secure the highest ACA tax credits.

- Shop Early: Compare plans and networks on HealthCare.gov before enrollment closes to lock in competitive rates.

- Stay In-Network: Use plan-specific providers to minimize copays, coinsurance, and balance billing.

- Utilize Telehealth: Leverage $0 telehealth visits for routine care and minor consultations.

- Bundle Policies: Combine health, dental, and vision coverage for potential multi-policy discounts.

Executing these strategies helps you secure affordable health insurance in Michigan without sacrificing coverage quality.

Conclusion

Choosing the right health insurance in Michigan for 2025 means balancing ACA Marketplace options, Medicaid & MIChild eligibility, gap-coverage solutions, and employer benefits. By following this Michigan-focused blueprint and applying targeted tactics, you can confidently secure comprehensive, budget-friendly coverage.

You Might Also Like:

What Is Health Insurance and How Does It Work in the U.S.?

How the "One Big Beautiful Bill Act" Transforms ACA Health Insurance in 2025

7 Smart Tips to Save Money on Health Insurance in 2025

PPO vs HMO: Which Health Insurance Plan Is Right for You?

Health Insurance in 2025: What You Need to Know Before You Enroll