North Carolina Health Insurance Guide 2025: Coverage That Fits Your Tar Heel Lifestyle

Published on July 24, 2025

🏞️ North Carolina Health Insurance Guide 2025: Coverage That Fits Your Tar Heel Lifestyle

Introduction

Whether you live in Charlotte’s fast-paced city center, Raleigh’s tech corridors, or the scenic mountains around Asheville, finding the right health insurance in North Carolina can save you hundreds each year. This guide cuts through the complexity of ACA Marketplace options, Medicaid & Health Choice programs, short‑term coverage, COBRA continuation, and employer-sponsored HDHP & HSA strategies—empowering you to choose a plan that fits your healthcare needs and your budget.

You’ll learn how to:

- Navigate Bronze, Silver & Gold plan differences and subsidy qualifications

- Qualify and enroll for North Carolina Medicaid or NC Health Choice (CHIP)

- Decide if short‑term health insurance North Carolina or COBRA continuation makes sense

- Leverage HDHP & HSA features to maximize tax savings and lower out-of-pocket costs

- Apply five expert strategies to reduce your premium and find affordable health insurance in North Carolina

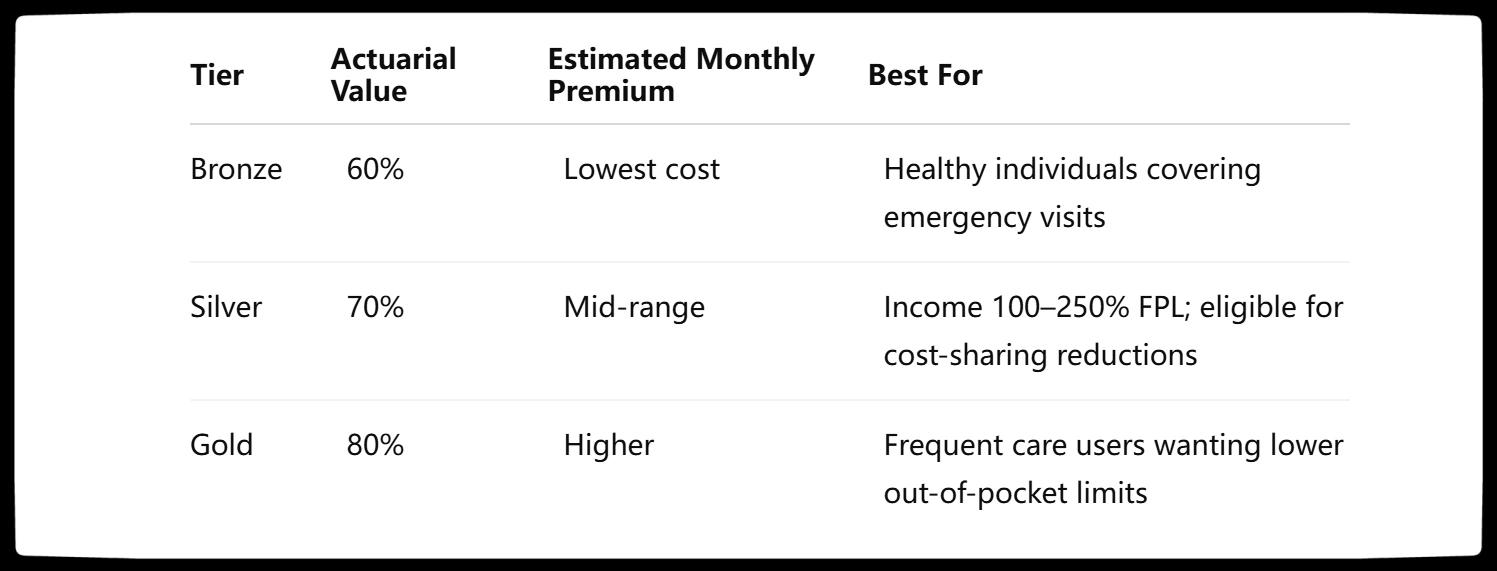

1. Marketplace Plans: Bronze, Silver & Gold

- Silver plans: If your income is 100–250% of the Federal Poverty Level, cost-sharing reductions can cut deductibles by up to 94%, making Silver the most cost-effective choice.

- Open Enrollment: November 1, 2024 to January 31, 2025.

Action: Compare North Carolina ACA health insurance quotes on HealthCare.gov to see specific premium estimates and subsidy amounts.

2. North Carolina Medicaid & NC Health Choice (CHIP)

- Medicaid eligibility: Adults earning up to 138% FPL (approximately $20,000/year) gain access to full Medicaid benefits.

- NC Health Choice: Covers children and pregnant individuals in families up to 200% FPL.

- Enroll/renew: Visit the NC Medicaid portal or call your local Department of Social Services for assistance.

Tip: Report any income changes or household updates within 10 days to maintain uninterrupted North Carolina Medicaid or Health Choice coverage.

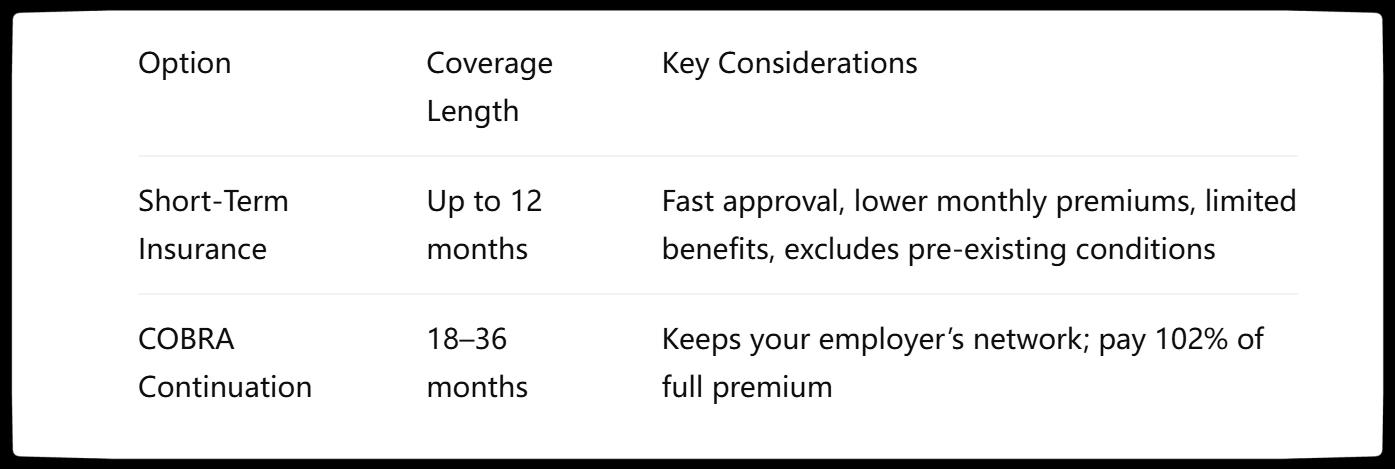

3. Short‑Term Health Insurance vs. COBRA

- Short‑term health insurance North Carolina: Ideal gap coverage but may not cover prescription drugs or preventive care.

- COBRA continuation: Offers seamless coverage continuity under your employer’s plan, ensuring no network changes but at higher cost.

4. Employer‑Sponsored HDHP & HSA Strategies

- HDHP & HSA advantages: High‑deductible plans paired with HSAs give you a triple tax advantage—pre-tax contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

- 2025 HSA contribution limits: $4,150 individual; $8,300 family.

- Strategy: Automate monthly payroll deposits to maximize HSA funding, then use those savings for out-of-pocket costs, reducing your overall healthcare spending.

5. Five Expert Tactics for Affordable Coverage

- Maximize Subsidies: Accurately report your 2025 income to lock in the largest ACA premium tax credits.

- Shop Early: Compare plans and provider networks before open enrollment ends to secure the best rates.

- Stay In‑Network: Using in-network doctors and hospitals can lower copays and coinsurance significantly.

- Use Telehealth: Leverage $0 telehealth visits for minor ailments to avoid office copays.

- Bundle Policies: Combine health, dental, and vision coverage for potential multi-policy discounts.

These tactics will help you secure cheap health insurance in North Carolina while maintaining comprehensive benefits.

Conclusion

Finding the right health insurance in North Carolina for 2025 means balancing cost, coverage, and convenience. By understanding Marketplace tiers, Medicaid/CHIP eligibility, gap coverage options, and employer benefits—and applying these expert tactics—you can confidently select an affordable plan tailored to your Tar Heel State lifestyle.

You Might Also Like:

What Is Health Insurance and How Does It Work in the U.S.?

How the "One Big Beautiful Bill Act" Transforms ACA Health Insurance in 2025

7 Smart Tips to Save Money on Health Insurance in 2025

PPO vs HMO: Which Health Insurance Plan Is Right for You?

Health Insurance in 2025: What You Need to Know Before You Enroll