Pennsylvania Health Insurance Guide 2025: Your Keystone State Coverage Roadmap

Published on July 24, 2025

🐴 Pennsylvania Health Insurance Guide 2025: Your Keystone State Coverage Roadmap

Introduction

From Philadelphia’s busy streets to Pittsburgh’s neighborhoods, finding the right health insurance in Pennsylvania matters. Whether you’re choosing a Covered Pennsylvania Marketplace plan, enrolling in Medicaid or CHIP, bridging gaps with short‑term coverage, or maximizing employer‑sponsored HDHP & HSA benefits, this guide delivers local insights, plan comparisons, and money‑saving strategies to help you and your family get covered without overpaying.

You’ll discover how to:

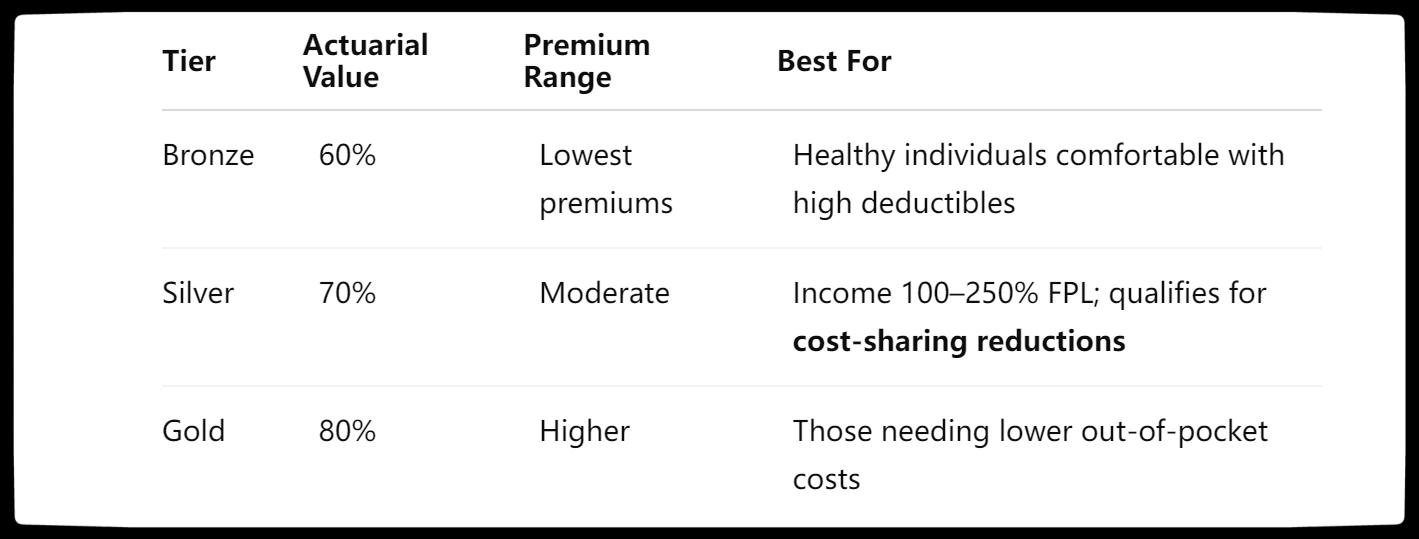

- Differentiate Marketplace Bronze, Silver & Gold tiers and subsidy rules

- Verify Pennsylvania Medicaid and CHIP enrollment steps

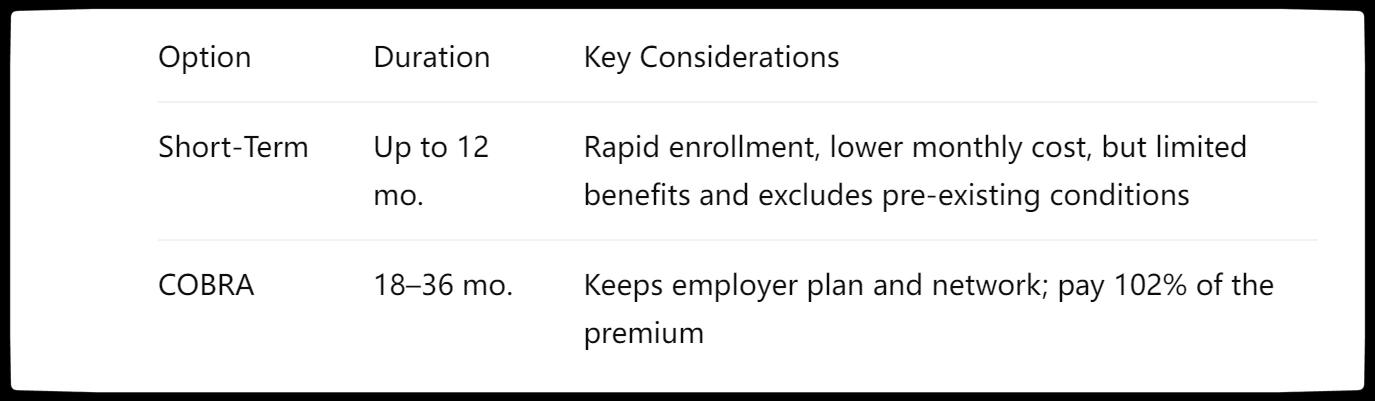

- Compare short‑term health insurance Pennsylvania with COBRA continuation

- Enhance employer plans with HDHP & HSA tax advantages

- Apply five actionable tips to reduce your Pennsylvania health insurance costs

1. Marketplace Plans: Bronze vs. Silver vs. Gold

- Silver plans: Unlock deeper cost‑sharing subsidies, reducing deductibles and copays for incomes between 100–250% of the Federal Poverty Level.

- Enrollment Window: November 1, 2024 – January 31, 2025.

Action Step: Visit HealthCare.gov to view Pennsylvania ACA health insurance quotes and estimate your premium tax credit.

2. Pennsylvania Medicaid & CHIP Essentials

- Medicaid eligibility: Covers adults up to 138% FPL (about $20,120/year for an individual) and higher limits for children and pregnant women.

- CHIP (Healthy Beginnings): Extends coverage to children in families up to 400% FPL.

- How to apply: Use COMPASS.pa.gov for online enrollment or visit your local county assistance office for in‑person support.

Pro Tip: Update income and household changes immediately to prevent coverage lapses and maintain Pennsylvania Medicaid benefits.

3. Short‑Term Coverage vs. COBRA

- Short‑term health insurance Pennsylvania: Best for temporary gaps but often lacks preventive care and pre‑existing coverage.

- COBRA continuation: Offers seamless care continuity with your employer’s plan at full cost plus a small admin fee.

4. Employer‑Sponsored Plans & HSA Optimization

- Plan types: PPO, HMO, and High‑Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs).

- HSA benefits: Triple tax advantage—pre-tax contributions, tax-free growth, and tax-free qualified withdrawals.

- 2025 HSA limits: $4,150 individual; $8,300 family.

Actionable Tip: Automate maximum HSA contributions via payroll to build a tax‑advantaged healthcare fund and lower taxable income.

5. Five Tips for Affordable PA Coverage

- Maximize Subsidies: Use accurate income data to secure the highest ACA tax credits.

- Compare Early: Shop multiple carriers on HealthCare.gov before enrollment deadlines to find the best networks and rates.

- Stay In‑Network: Choose in‑network providers to reduce copays and coinsurance.

- Utilize Telehealth: Take advantage of $0 telehealth visits for non‑urgent care.

- Bundle Policies: Combine health with dental or vision plans for potential multi‑line discounts.

Implement these tips to achieve cheap health insurance in Pennsylvania without sacrificing quality of care.

Conclusion

Securing the right health insurance in Pennsylvania in 2025 means balancing Marketplace options, Medicaid/CHIP eligibility, gap‑coverage solutions, and employer benefits. By following this guide’s local tips and strategies, you can confidently choose an affordable plan that meets your Keystone State needs.

You Might Also Like:

What Is Health Insurance and How Does It Work in the U.S.?

How the "One Big Beautiful Bill Act" Transforms ACA Health Insurance in 2025

7 Smart Tips to Save Money on Health Insurance in 2025

PPO vs HMO: Which Health Insurance Plan Is Right for You?

Health Insurance in 2025: What You Need to Know Before You Enroll