What Is Life Insurance and How Does It Work in the U.S.?

Published on July 2, 2025

Introduction

Life insurance is more than a financial product — it’s a promise of protection. In the United States, where medical and funeral expenses can add up quickly, life insurance helps ensure your loved ones aren't burdened financially after your death. Whether you’re a young parent, a homeowner, or nearing retirement, understanding life insurance is key to long-term financial planning.

In this article, we’ll explain what life insurance is, how it works in practical terms, the major policy types like term and whole life, and how to determine the right amount of coverage for your situation.

What Is Life Insurance?

At its core, life insurance is a contract between you (the policyholder) and an insurance provider. When you pay regular premiums, the insurer promises to pay a designated sum — known as a death benefit — to your chosen beneficiaries when you die.

This payout can be used for:

- Replacing lost income

- Paying off debts (like a mortgage or car loan)

- Covering final expenses (funeral costs, estate taxes)

- Funding future expenses (college tuition, childcare)

Key Terms:

- Policyholder: The person who owns the life insurance policy

- Insured: The individual whose life is covered

- Beneficiary: The person or entity that receives the payout when the insured dies

How Does Life Insurance Work?

Here’s a breakdown of how life insurance functions:

- Apply for Coverage: You complete a health questionnaire or undergo a medical exam.

- Pay Premiums: Premiums can be paid monthly or annually and vary based on age, health, lifestyle, and the coverage amount.

- Maintain the Policy: As long as you continue paying premiums, your coverage remains active.

- Death Benefit Paid: When the insured person passes away, the insurer pays the death benefit to the beneficiaries named in the policy.

Life insurance costs are influenced by multiple factors, including:

- Your age and gender

- Medical history and tobacco use

- Type of policy: term life vs. whole life

- Coverage amount and length of term

Some permanent policies also accumulate cash value, which can be borrowed against or withdrawn.

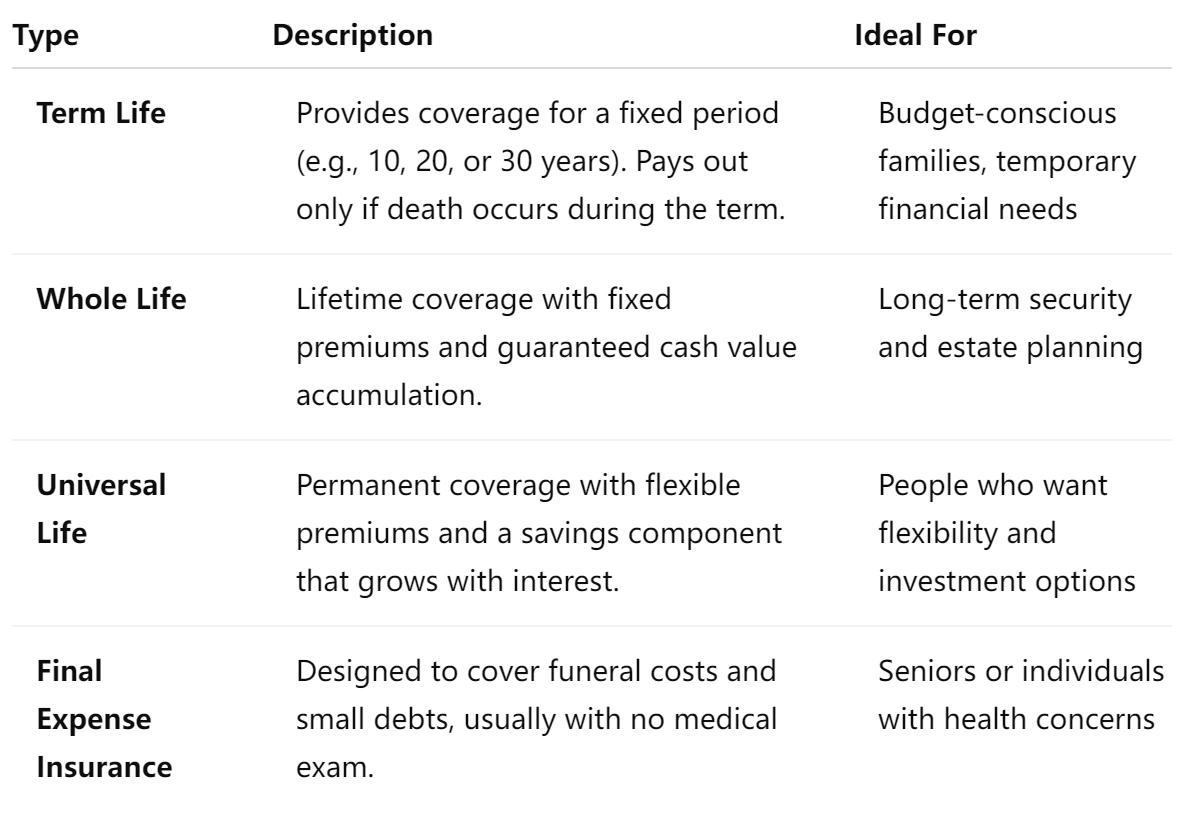

Types of Life Insurance

There are several life insurance options, but most policies fall into two categories: term life insurance and permanent life insurance.

Why Is Life Insurance Important?

Life insurance provides more than peace of mind — it delivers real financial security. Consider these use cases:

- Replacing lost income: Helps dependents maintain their standard of living

- Paying off major debts: Such as mortgages, car loans, or credit cards

- Funding education: Ensures your children’s schooling continues uninterrupted

- Protecting a small business: Business continuity plans often include life insurance

- Covering burial costs: Final expenses in the U.S. average over $7,000

If anyone relies on you financially — a spouse, child, aging parent — life insurance may be essential.

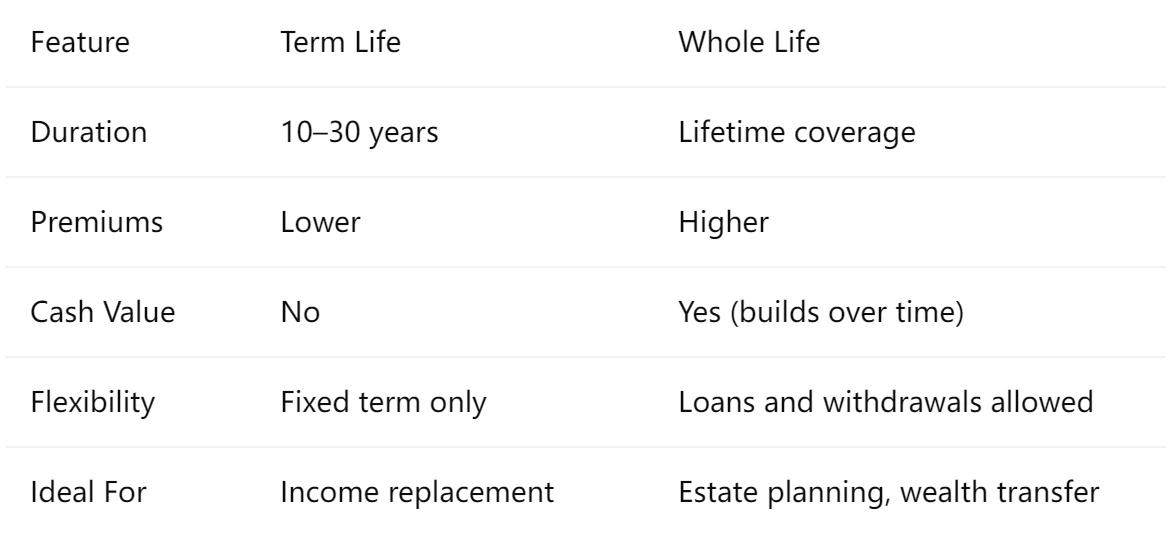

Term Life vs Whole Life Insurance: A Closer Look

Choosing between term life insurance and whole life insurance depends on your goals, budget, and timeline.

Term life is best for young families or those with a limited budget. Whole life suits individuals looking for lifelong coverage and those interested in building a tax-advantaged asset.

Not sure whether to apply for term life or skip the medical exam? Explore the pros and cons of both options here.

How Much Life Insurance Do You Really Need?

One common recommendation is to purchase life insurance equal to 10–15 times your annual income. But that’s just a starting point.

To refine your estimate, consider:

- Outstanding debt (mortgage, loans)

- Future education costs for children

- Your family’s annual living expenses

- Funeral and medical costs

- Savings, retirement, and existing assets

Use an online life insurance needs calculator to get personalized results. Planning for the right amount of coverage ensures your loved ones won’t fall into financial hardship.

Frequently Asked Questions (FAQs)

❓ Is life insurance taxable?

The death benefit is usually not taxable for beneficiaries. However, interest earned on held benefits may be subject to income tax.

❓ Can I buy life insurance without a medical exam?

Yes. Many insurers offer no-exam life insurance policies, such as simplified issue or guaranteed issue coverage. These are generally more expensive and have lower coverage limits.

❓ What happens if I outlive a term life insurance policy?

The policy expires, and no benefit is paid. Some term plans allow you to convert to permanent insurance before expiration.

❓ Is employer-provided life insurance enough?

Typically no. Most group life policies offer only 1–2x your salary, which may be insufficient for long-term needs. Consider purchasing individual coverage.

❓ Can I name multiple beneficiaries?

Yes. You can assign percentages to each beneficiary or designate contingent (backup) beneficiaries.

Conclusion

Life insurance isn’t just about death — it’s about protecting life for those you leave behind. Whether you’re securing your children’s future, paying off debt, or supporting a spouse, the right policy can make all the difference.

When choosing a policy, consider both your immediate financial responsibilities and long-term goals. A well-chosen life insurance policy brings stability, security, and peace of mind.

And remember: the best time to get life insurance is when you’re healthy. The sooner you lock in coverage, the lower your premiums will likely be.