2025 Life Insurance Options for U.S. Veterans: VA, Private Plans, and More

Published on July 30, 2025

Emma Carter

Senior Insurance Editor

Emma Carter is a senior insurance editor with 12 years in P&C publishing and agency work; she simplifies policy details for everyday readers.

Life Insurance Options for U.S. Veterans: VA, Private Plans, and More (2025 Expert Guide)

For millions of U.S. veterans, transitioning from military to civilian life brings many financial decisions—none more important than securing reliable life insurance. Fortunately, today’s market offers a wide variety of life insurance options for U.S. veterans, including VA-backed plans, private coverage, and even policies from veteran organizations.

In this guide, we break down every major option available in 2025 to help you make an informed, confident choice about your family's financial future.

Why Veterans Need Life Insurance

Transitioning from Active Duty to Civilian Life

After separation, coverage from Servicemembers' Group Life Insurance (SGLI) ends. Veterans must then find new insurance that protects their families and aligns with civilian income and lifestyle.

Protecting Family and Final Expenses

Life insurance can:

- Replace lost income

- Cover funeral costs (average $7,000–$12,000)

- Pay off debts like mortgages or student loans

- Fund children’s education or care

Filling Gaps in VA Benefits

While VA benefits are generous, they may not cover every veteran's needs. VA life insurance plans are often limited in coverage or eligibility. Supplementing them with private or group policies may be necessary.

Understanding VA Life Insurance Programs

Overview of VA Insurance Options

As of 2025, the U.S. Department of Veterans Affairs offers:

- SGLI – For active duty, Guard, and Reserve members

- VGLI – Term insurance for veterans

- VALife – Whole life coverage for disabled veterans

- S-DVI (Service-Disabled Veterans Insurance) – Now closed to new applicants

Who Qualifies for VA Insurance

Eligibility varies by program, but generally includes:

- Veterans with honorable discharge

- Those with service-connected disabilities (for VALife)

- Those transitioning from SGLI within 1 year + 120 days (for VGLI)

Recent Changes in VA Life Insurance (2023–2025 Updates)

- VALife launched January 2023 for easier access to permanent coverage

- VGLI premiums reduced up to 17% in mid-2025

- SGLI premiums reduced to just $25/month for $500K coverage

Servicemembers’ Group Life Insurance (SGLI)

Coverage Features and Limits

- Up to $500,000 in term coverage

- Automatic coverage unless declined

- Includes Traumatic Injury Protection (TSGLI) rider

Premium Costs and Enrollment

- $0.05 per $1,000 of coverage

- Total monthly cost: $25 for full coverage + $1 for TSGLI

What Happens After Discharge?

Coverage ends 120 days post-separation. Veterans can convert it to VGLI or a private policy (without medical exam if done quickly).

Veterans’ Group Life Insurance (VGLI)

How to Convert from SGLI to VGLI

Apply within 1 year and 120 days of separation. If you apply within 240 days, no health exam is required.

Benefits of VGLI Coverage

- Renewable every 5 years for life

- Matches your SGLI amount

- No medical exam if converted within window

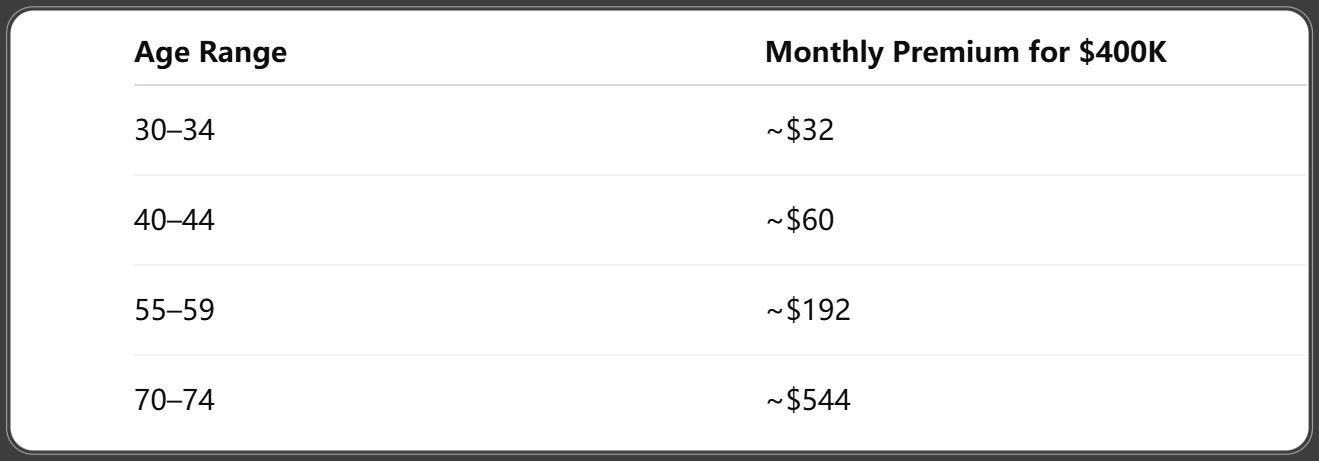

Premiums Based on Age

S&P Global Market Intelligence. (2025, July 30). 2025 US Insurance Investments Market Report: The power of the private markets. Retrieved July 30, 2025.

Discounts apply starting July 2025, reducing rates by 2–17%.

VA Life (VALife) – The New Guaranteed Acceptance Option

What Is VALife?

A whole life insurance policy launched in 2023 for veterans with service-connected disabilities. It requires no medical exam and guarantees approval if eligible.

Eligibility and Coverage Amounts

- Veterans age 18–80 with service-connected disabilities

- Coverage amounts: $10K, $20K, $30K, or $40K

- Premiums are age-based and fixed for life

Pros and Cons of VALife

Pros:

- No medical exam

- Permanent coverage

- Affordable, predictable premiums

Cons:

- 2-year waiting period for full benefits

- Maximum coverage capped at $40,000

Service-Disabled Veterans Insurance (S-DVI)

Who Is Eligible

Previously available to veterans with service-connected disabilities who applied within two years of receiving a disability rating.

How It Differs from Other VA Plans

- Offered term or whole life options

- Allowed waiver of premiums for totally disabled vets

Options After S-DVI Closure in 2023

- No new applications accepted after December 31, 2022

- Existing S-DVI policyholders may apply for VALife without canceling current policy (through end of 2025)

Comparing VA Life Insurance to Private Market Options

Term vs Whole Life in the Private Sector

- Term Life: Affordable, expires after 10–30 years

- Whole Life: Lifetime coverage, builds cash value

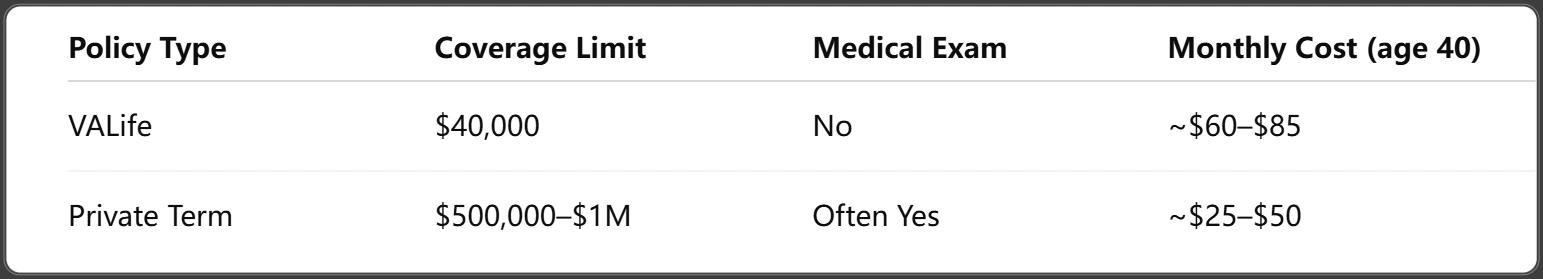

Price and Coverage Differences

Private insurers can offer higher limits (up to several million), but may require a medical exam.

Deloitte. (2025, early). Global Insurance Outlook (including group life insurance Q1 2024) [Web article]. Retrieved 2025.

Flexibility and Customization

Private plans allow:

- Riders for disability, children, accidental death

- Flexible term lengths and benefit amounts

- Option to ladder policies for savings

Private Life Insurance Plans for Veterans

Top Private Insurers Offering Veteran Discounts

- USAA

- Navy Mutual

- New York Life (via AARP)

- Ethos, Ladder, and Haven Life

No-Exam Life Insurance Options

Perfect for veterans who want coverage without a hassle. Offered by:

- Bestow

- Fabric

- AIG Direct

- USBA

Policy Features to Look For

- Guaranteed renewal

- Convertible to whole life

- Accelerated death benefits

- Terminal illness riders

Group Life Insurance from Veteran Organizations

VFW, American Legion, and Others

These organizations offer members access to group life insurance plans—often without medical exams and at competitive rates.

Features of Group Coverage

- Lower premiums

- Limited underwriting

- Ideal for supplemental coverage

Pros and Limitations

Pros:

- Easy to qualify

- Community support

Cons:

- Lower coverage limits

- Not always portable if you leave the group

Factors to Consider When Choosing a Policy

Age and Health Status

Older vets or those with disabilities may benefit more from guaranteed issue or VA-based plans.

Financial Needs and Family Size

Larger families may need more coverage for income replacement and child care.

Duration of Coverage Needed

- Use term for temporary coverage (e.g., until retirement)

- Use whole life for legacy planning or lifelong dependents

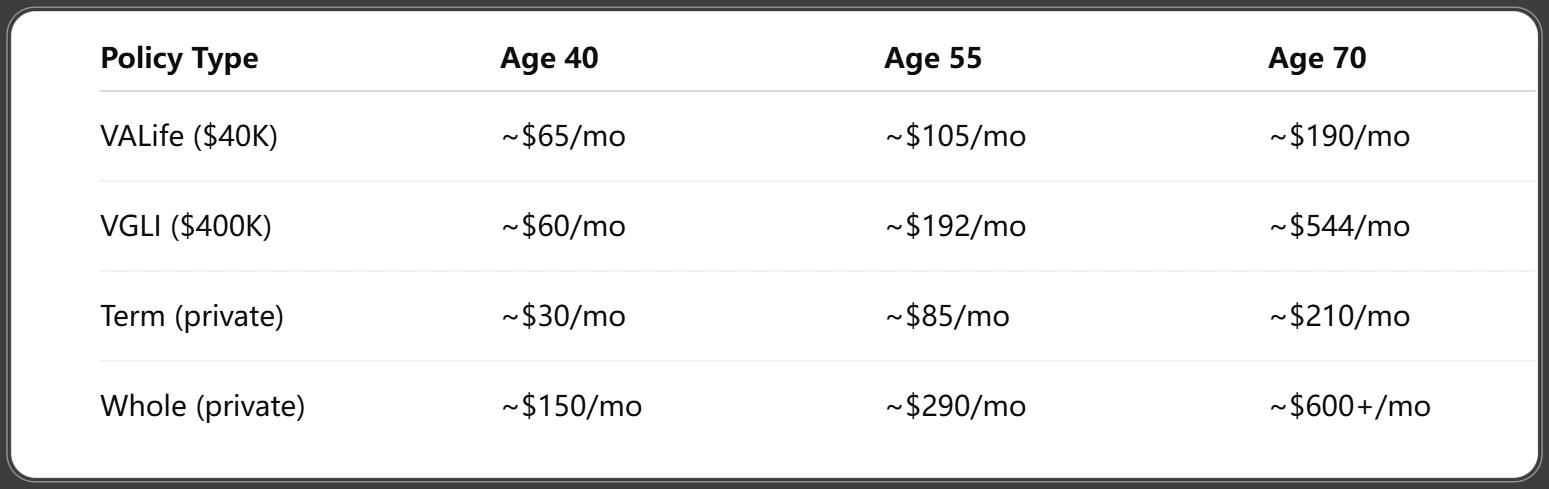

Cost of Life Insurance for Veterans (2025 Estimates)

Reuters. (2025, July 23). Globe Life's second-quarter profit rises on strong underwriting. Retrieved July 23, 2025.

Tips to Lower Monthly Costs

- Apply early (younger = cheaper)

- Consider a no-exam term policy

- Use a mix of VA and private options

- Compare quotes from 3+ insurers

How to Apply for Veteran Life Insurance

Applying Through VA.gov

- Easy, online portal: www.va.gov/life-insurance

- Required: service history, disability rating (if applicable), payment info

Applying Through Private Providers

- Use sites like Policygenius, USAA, or Haven Life

- May require a brief medical questionnaire or paramedical exam

Required Documents and Timeline

- DD-214 (proof of service)

- Identification

- Health history

- Application takes 15–45 minutes

Frequently Asked Questions

Can I have VA and private life insurance together?

Yes. Many veterans use both for comprehensive coverage.

Is VGLI renewable for life?

Yes, but premiums increase every 5 years based on age.

Can I be denied private insurance as a disabled vet?

Yes, but many no-exam policies are still available.

What is the deadline to convert SGLI to VGLI?

1 year and 120 days from separation. To avoid a health review, apply within 240 days.

Does life insurance affect VA pension benefits?

No. Life insurance benefits are not counted as income or assets.

How do I name a beneficiary on VA policies?

Log in to VA.gov or use the paper forms included in your policy packet.

Conclusion: Choosing the Best Life Insurance as a Veteran

Your service to the country earned you options and respect—and that includes choosing the right life insurance. From VA-administered policies like SGLI, VGLI, and VALife to private and group plans, veterans have more choices than ever in 2025.

Whether your priority is affordability, permanent coverage, or maximum protection for your loved ones, the right policy is within reach.

You Might Also Like

Can You Get Life Insurance Without an SSN in the U.S.? 7 Legal Loopholes You Should Know

Jul 30, 2025What Is No-Lapse Life Insurance? 12 Key Facts to Know Before You Buy

Jul 30, 202510 Crucial Facts About Life Insurance for New and Expecting Parents

Jul 30, 20252025 Term Life Insurance Explained: Pros, Cons & Cost Guide

Jul 30, 2025Whole Life Insurance 101: Is It Right for You?(2025)

Jul 30, 2025