2025 Term Life Insurance Explained: Pros, Cons & Cost Guide

Published on July 30, 2025

Emma Carter

Senior Insurance Editor

Emma Carter is a senior insurance editor with 12 years in P&C publishing and agency work; she simplifies policy details for everyday readers.

Term Life Insurance Explained: Pros, Cons & Cost Guide (2025 Buyer’s Edition)

When it comes to protecting your loved ones financially, term life insurance is often the go-to solution for its simplicity, affordability, and effectiveness. But is it the right choice for you?

In this complete 2025 guide, we break down term life insurance, including how it works, who it’s best for, its benefits and drawbacks, and what you can expect to pay—so you can make a confident decision.

What Is Term Life Insurance?

Simple Definition

Term life insurance is a policy that provides coverage for a set period of time—usually 10, 20, or 30 years. If you pass away during the term, your beneficiary receives the death benefit. If you outlive the term, the policy expires and no payout is made.

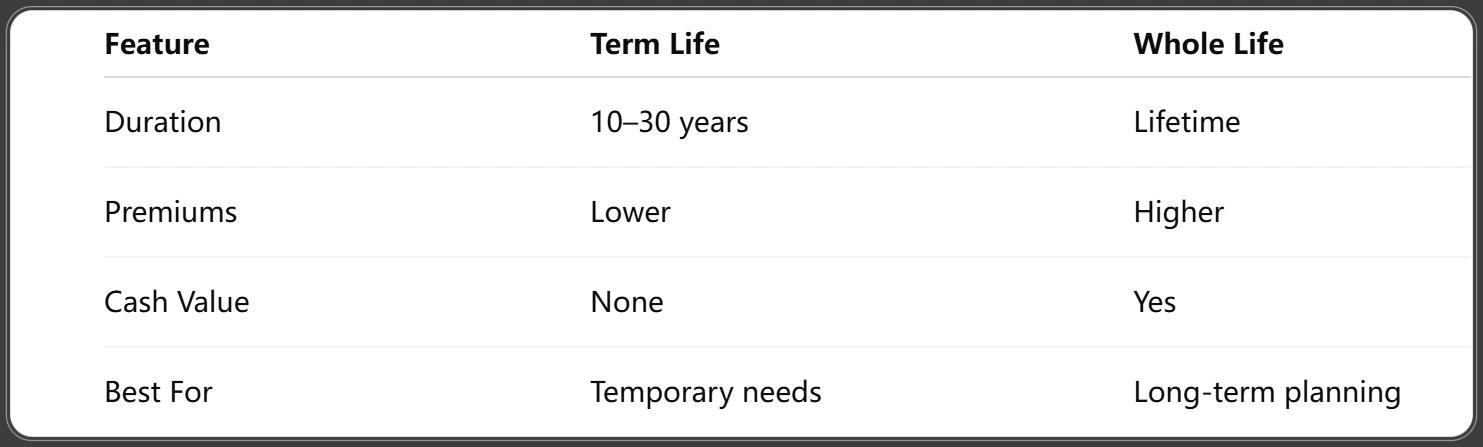

How It Differs from Permanent Life Insurance

- Term Life: Temporary coverage, no cash value, lower premiums.

- Permanent Life (e.g., Whole Life): Lifetime coverage, cash value buildup, higher premiums.

Term Length Options

Most providers offer:

- 10-Year Term: For short-term obligations or older applicants

- 20-Year Term: Most common for young families

- 30-Year Term: Ideal if you want to cover a mortgage or raise children

How Term Life Insurance Works

Premium Payments and Death Benefit

You pay a fixed monthly premium. If you die within the term, your beneficiary receives a tax-free lump sum—often used for funeral costs, debts, or income replacement.

What Happens at the End of the Term

If you’re still alive:

- The policy expires, and no benefit is paid

- Some plans offer renewal or conversion options

Renewable and Convertible Options

- Renewable Term: You can extend the policy year-by-year (often at a higher rate)

- Convertible Term: You can convert to permanent life without a medical exam

Advantages of Term Life Insurance

Affordable Premiums

Term life is often 5–10 times cheaper than whole life, especially for young, healthy individuals.

Simple and Easy to Understand

No investment accounts or complicated clauses—just pure protection.

Ideal for Temporary Financial Needs

Perfect for:

- Covering a mortgage

- Raising children

- Paying off debts

- Protecting income during working years

Drawbacks of Term Life Insurance

No Cash Value

You don’t build savings or investment value with term life—it's "use it or lose it."

Coverage Ends After Term

Outlive the term? You’ll need a new policy, which may cost more due to age or health issues.

Costly to Renew Later in Life

Premiums skyrocket if you renew after age 50 or 60. Many prefer switching to whole life or locking in early.

Who Should Consider Term Life Insurance?

Young Families and Parents

Protects children and a spouse from financial hardship if the breadwinner dies unexpectedly.

Homeowners with Mortgages

Matches the length of your mortgage so your family won’t lose the home.

Business Owners and Key Employees

Often used to fund buy-sell agreements or cover the loss of a key team member.

Comparing Term Life to Other Insurance Types

Term vs Whole Life

ACLI. (2025). Life Insurers Fact Book [Web resource]. Retrieved 2025.

Term vs Universal Life

Universal life offers more flexibility but is more complex and expensive.

Term Life vs Group Life Coverage

Group life from your job is limited, often not portable, and not enough. Personal term coverage ensures full protection.

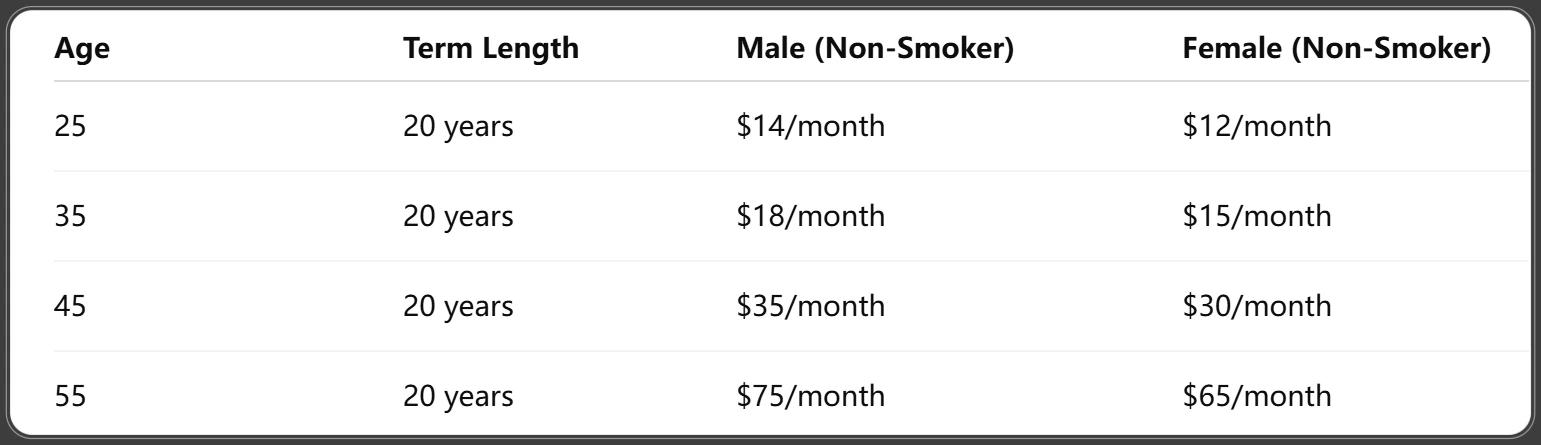

Cost of Term Life Insurance (2025 Data)

Sample Monthly Premiums by Age and Gender

S&P Global Market Intelligence. (2025, July 30). 2025 US Insurance Investments Market Report: The power of the private markets. Retrieved July 30, 2025.

Factors That Affect Term Life Costs

- Age

- Health

- Gender

- Tobacco use

- Term length and coverage amount

Smoker vs Non-Smoker Premium Comparison

Smokers can pay 2–3x more than non-smokers for the same policy. Quitting smoking for 12 months may lower rates.

How to Choose the Right Term Length and Coverage Amount

Matching Term to Life Milestones

Choose a term that aligns with:

- Your children becoming adults

- Mortgage payoff date

- Planned retirement

Income Replacement Calculations

Use the 10x–15x rule: Multiply your annual income by 10–15 to find ideal coverage.

Online Tools and Calculators

Sites like Policygenius, NerdWallet, and Ladder offer free calculators for accurate estimates.

Can You Get Term Life Without a Medical Exam?

No-Exam Term Life Options

Many insurers now offer instant approval or no-exam term life if you’re under 60 and healthy.

Pros and Cons of Skipping the Exam

Pros:

- Faster approval

- Convenient

Cons:

- May be more expensive

- Lower coverage limits (e.g., $500,000 max)

Best Companies Offering No-Exam Policies

- Haven Life

- Bestow

- Ethos

- Fabric

Top Term Life Insurance Providers in 2025

Haven Life

- Backed by MassMutual

- Fast online applications

- Affordable rates

Banner Life

- Competitive pricing

- Long-term experience in term insurance

Protective Life

- Known for flexible options

- Strong financial ratings

Ladder

- Adjustable coverage

- Digital-first experience

Bestow

- 100% online process

- Instant decisions for healthy applicants

Applying for Term Life Insurance: Step-by-Step

1. Get a Quote

Use online tools to compare rates instantly.

2. Complete the Application

Answer questions about your health, lifestyle, and finances.

3. Underwriting and Approval

Some policies require a medical exam; others don’t.

4. Activating Your Policy

Once approved, pay your first premium to activate coverage.

Common Mistakes to Avoid with Term Life Insurance

Underestimating Your Coverage Needs

Avoid low-ball estimates that won’t fully protect your family.

Choosing the Wrong Term Length

Pick a term that covers your family until your obligations end, not before.

Forgetting to Name or Update Beneficiaries

Outdated beneficiaries can cause legal headaches—review annually.

Frequently Asked Questions

What happens if I outlive my term?

The policy ends, and no benefit is paid. Consider renewal, conversion, or buying another policy.

Can I convert term to whole life later?

Yes—many term policies include a conversion option within the first 10 years.

Is term life insurance worth it?

Yes, especially if you want affordable, temporary protection during key life stages.

What’s the best age to buy?

The younger you are, the cheaper the premiums. Buying early locks in low rates.

Will my rates increase over time?

Not during the term. After the term ends, renewal rates jump sharply.

Can I cancel anytime?

Yes, you can cancel your policy without penalty. However, you’ll lose coverage immediately.

Conclusion: Is Term Life Insurance Right for You?

Term life insurance is an excellent choice if you need straightforward, budget-friendly protection for a specific period. It won’t build savings like whole life, but it will give your loved ones financial stability when they need it most.

If you're starting a family, buying a home, or protecting income during your prime earning years, term life is one of the smartest moves you can make.

You Might Also Like

Can You Get Life Insurance Without an SSN in the U.S.? 7 Legal Loopholes You Should Know

Jul 30, 2025What Is No-Lapse Life Insurance? 12 Key Facts to Know Before You Buy

Jul 30, 202510 Crucial Facts About Life Insurance for New and Expecting Parents

Jul 30, 20252025 Life Insurance Options for U.S. Veterans: VA, Private Plans, and More

Jul 30, 2025Whole Life Insurance 101: Is It Right for You?(2025)

Jul 30, 2025