Whole Life Insurance 101: Is It Right for You?(2025)

Published on July 30, 2025

Emma Carter

Senior Insurance Editor

Emma Carter is a senior insurance editor with 12 years in P&C publishing and agency work; she simplifies policy details for everyday readers.

Whole Life Insurance 101: Is It Right for You? (Complete 2025 Breakdown)

Life insurance is a critical component of a strong financial plan—but when it comes to choosing a policy, the options can feel overwhelming. Among them, whole life insurance stands out for its lifetime coverage, predictable premiums, and cash value benefits. But is it the right fit for your needs and goals?

In this comprehensive guide, you'll learn everything you need to know about whole life insurance, how it works, the pros and cons, who should consider it, and how to buy the best policy for your situation in 2025.

What Is Whole Life Insurance?

Definition and Key Components

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as premiums are paid. It also includes a cash value component that grows over time and can be accessed during your lifetime.

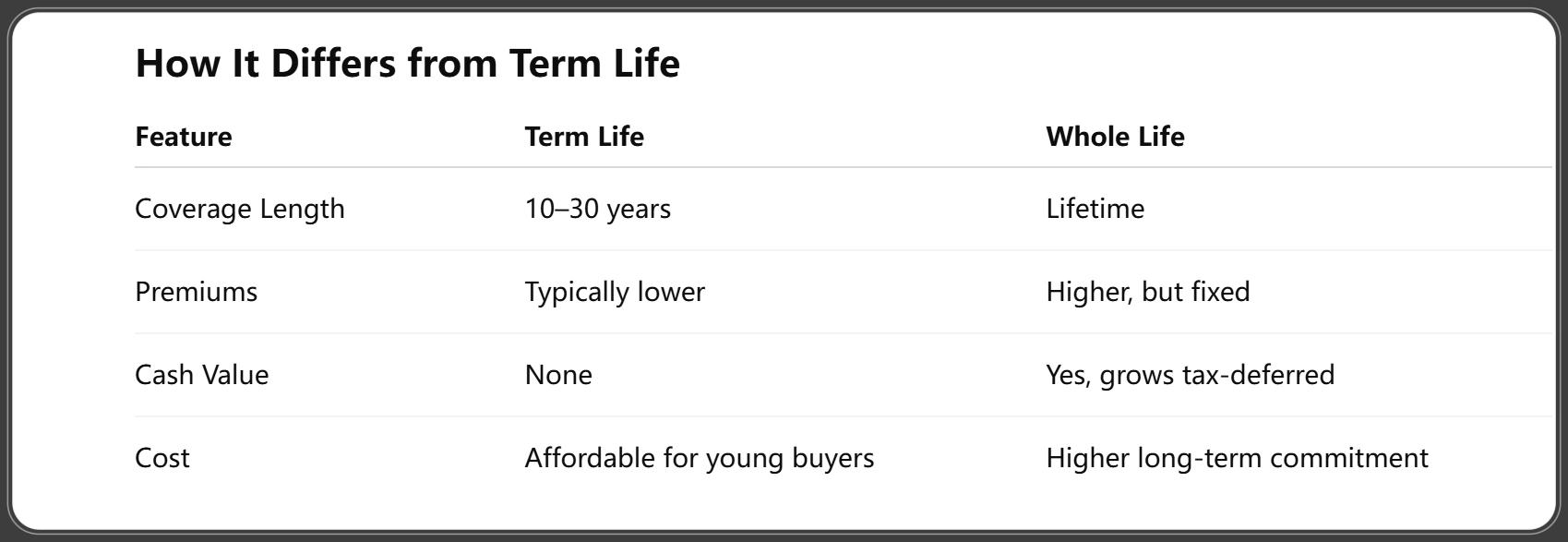

How It Differs from Term Life

IAIS. (2025, June 9). Global Insurance Market Report (Mid-Year Update) [PDF]. Retrieved June 9, 2025.

Common Features

- Fixed Premiums: Your monthly payment never increases

- Cash Value Growth: Grows over time at a guaranteed rate

- Lifetime Coverage: Coverage remains active for life

- Guaranteed Death Benefit: Paid to your beneficiary tax-free

How Does Whole Life Insurance Work?

Premium Payments and Policy Growth

Every time you pay your premium, part goes toward the death benefit, part to administrative costs, and part into the cash value account, which grows over time.

Cash Value Accumulation

Cash value is the savings component of the policy. It:

- Grows at a guaranteed rate

- Is tax-deferred

- Can be borrowed against for emergencies or opportunities

Payouts and Death Benefit Guarantees

When you pass away, your beneficiary receives the death benefit, not the cash value—unless you’ve used riders or structured your policy to include both.

Pros of Whole Life Insurance

Guaranteed Lifetime Coverage

As long as you pay your premiums, your coverage never expires, no matter your age or health condition.

Cash Value Growth and Loans

You can:

- Borrow against your policy tax-free

- Use it for retirement income or emergency expenses

- Repay it with interest, or it will be deducted from your death benefit

Level Premiums and Financial Stability

You’ll always pay the same premium, even as you age or develop health issues—making budgeting easier.

Potential Dividends (from Mutual Companies)

Some companies (e.g., MassMutual, Guardian) pay annual dividends, which you can use to:

- Buy more coverage

- Lower premiums

- Boost cash value

Cons of Whole Life Insurance

Higher Premiums Compared to Term

Whole life insurance can cost 5–10 times more than term life for the same death benefit.

Slower Cash Value Growth in Early Years

Cash value builds slowly at first. It may take several years before you can borrow or withdraw meaningfully.

Complex Structure and Terms

Understanding how cash value, dividends, and riders work requires time and often professional guidance.

Whole Life Insurance vs Other Policy Types

Whole Life vs Term Life

- Term: Cheaper, but temporary

- Whole Life: Costlier, but permanent with cash value

Whole Life vs Universal Life

- Universal Life: Flexible premiums, adjustable death benefit

- Whole Life: Predictable structure, fixed terms

When Whole Life Makes More Sense

- Long-term estate planning

- Lifetime financial protection

- Wealth transfer strategies

Who Should Consider Whole Life Insurance?

High-Income Earners

Helps with:

- Asset diversification

- Tax-free growth and borrowing

- Estate liquidity

Estate Planning and Wealth Transfer

Use it to:

- Avoid estate taxes

- Create inheritance

- Support charitable giving

Parents Funding Future Education

Some parents use cash value for college funding while maintaining life protection.

Those Seeking Long-Term Stability

Whole life suits those who value predictability and are less comfortable with market-based products.

When Whole Life Insurance May Not Be the Best Fit

Young Adults on a Budget

If affordability is key, term life may be more realistic for now.

People Seeking High Investment Returns

Returns on cash value (3–6%) may be lower than other investment options.

Those Needing Temporary Coverage Only

Covering a mortgage or raising kids? Term insurance is usually a better and cheaper choice.

Understanding the Cash Value Component

What Is It and How Is It Built?

Cash value accumulates as part of your premiums go into a savings account. It’s:

- Guaranteed to grow annually

- Tax-deferred

- Accessible while you’re alive

Using Loans vs Withdrawals

- Loans: Don’t trigger taxes but reduce death benefit if unpaid

- Withdrawals: Permanent and may be taxable if exceeding premiums paid

Tax Implications of Cash Value

- Growth is tax-deferred

- Withdrawals above basis may be taxed

- Loans are generally tax-free

How Much Does Whole Life Insurance Cost?

Sample Premiums by Age

LIMRA via EY. (2025). 2025 Global Insurance Outlook – US life insurance new annualized premiums record in 2023 [PDF]. Retrieved early 2025.

Rates based on non-smokers in good health (2025 estimates).

Factors That Affect Pricing

- Age

- Health history

- Gender

- Tobacco use

- Policy size and riders

Budgeting Tips and Alternatives

If full whole life isn’t affordable:

- Start with a smaller death benefit

- Use term + invest the rest strategy

- Revisit whole life later in life

Whole Life Insurance Riders and Add-Ons

Accelerated Death Benefit Rider

Allows you to access a portion of your death benefit early if diagnosed with a terminal illness.

Paid-Up Additions Rider

Use dividends to purchase extra coverage, increasing both death benefit and cash value.

Waiver of Premium Rider

Waives premium payments if you become disabled—keeping your policy active without financial strain.

How to Buy the Right Whole Life Policy

Choosing the Right Insurance Company

Look for:

- Strong financial ratings (AM Best, Moody’s, etc.)

- Competitive dividend history

- Clear customer service and claims process

Deciding on Coverage Amount

Base it on:

- Your long-term financial goals

- Estate tax obligations

- Legacy and charitable plans

Working with a Licensed Agent

A qualified agent can:

- Compare providers

- Recommend suitable riders

- Explain policy illustrations and projections

Best Whole Life Insurance Companies in 2025

MassMutual

- Top-rated mutual company

- Long dividend history

- Comprehensive policy options

Northwestern Mutual

- Offers whole life with strong performance

- Excellent customer satisfaction

Guardian Life

- Known for flexible policies and customizable riders

New York Life

- Offers both participating and non-participating policies

- Great for estate planning

Frequently Asked Questions

Is whole life insurance a good investment?

Not as a primary investment—but it offers guaranteed returns, tax advantages, and peace of mind.

Can I access my cash value anytime?

Yes, but it’s best to borrow, not withdraw, to avoid tax consequences and policy reduction.

What happens if I stop paying premiums?

Your policy may lapse unless it’s paid-up or using dividends to keep it active. Some policies offer non-forfeiture options.

Are dividends guaranteed?

No. Dividends depend on company performance, but many top insurers have paid them consistently for decades.

Can I convert term to whole life?

Yes—many term policies offer a conversion option without a medical exam within a certain timeframe.

What are paid-up additions?

They are small chunks of paid-up insurance purchased with dividends to increase your policy’s death benefit and cash value.

Conclusion: Should You Choose Whole Life Insurance?

Whole life insurance is a powerful tool—but it’s not for everyone. If you're looking for permanent protection, predictable costs, and a built-in savings component, it may be the right choice for you.

That said, its higher cost and complexity mean it's best for those with stable income, long-term goals, or estate planning needs. Speak with a trusted advisor, compare quotes, and take your time understanding the details.

Whole life insurance isn’t just coverage—it’s a commitment to lifelong financial security.

You Might Also Like

Can You Get Life Insurance Without an SSN in the U.S.? 7 Legal Loopholes You Should Know

Jul 30, 2025What Is No-Lapse Life Insurance? 12 Key Facts to Know Before You Buy

Jul 30, 202510 Crucial Facts About Life Insurance for New and Expecting Parents

Jul 30, 20252025 Life Insurance Options for U.S. Veterans: VA, Private Plans, and More

Jul 30, 20252025 Term Life Insurance Explained: Pros, Cons & Cost Guide

Jul 30, 2025