Guaranteed Issue Life Insurance 2025: 18 Essential Facts You Must Know

Published on August 5, 2025

Emma Carter

Senior Insurance Editor

Emma Carter is a senior insurance editor with 12 years in P&C publishing and agency work; she simplifies policy details for everyday readers.

What Is Guaranteed Issue Life Insurance?

In 2025, guaranteed issue life insurance remains one of the most accessible coverage options for people who might otherwise be denied a policy. This type of insurance provides automatic acceptance with no medical exam or health questions required.

Basic Definition and How It Works

Guaranteed issue life insurance is a type of whole life policy designed for people who:

- Are in poor health.

- Have been denied traditional policies.

- Need end-of-life financial protection.

It guarantees:

- Coverage regardless of health history.

- Fixed monthly premiums.

- A modest death benefit, usually between $2,000–$25,000.

No-Medical Exam Advantage

You don’t need:

- Blood tests.

- Physicals.

- Doctor statements.

This makes it especially helpful for seniors or high-risk applicants.

Guaranteed Acceptance Explained

As long as you meet the age requirements (usually 50–80 years old), your application is automatically approved. It’s that simple—no underwriting delays, no questions, no rejections.

Who Should Consider Guaranteed Issue Life Insurance in 2025?

Seniors Over 50 or 60

Older adults often find it hard to qualify for traditional life insurance. Guaranteed issue offers them:

- A way to pay for funeral costs.

- A way to leave a small legacy.

- Peace of mind.

People with Pre-existing Conditions

If you’ve had:

- Heart disease

- Cancer

- Stroke

- Kidney failure

…you might be declined elsewhere. Guaranteed issue accepts all of these cases, without penalty.

High-Risk Individuals (e.g., COPD, Terminal Illness)

Even if you have:

- Chronic obstructive pulmonary disease (COPD)

- ALS

- Or other critical conditions

…you can still get covered—though with some limitations (like a graded benefit period, explained below).

Key Benefits of Guaranteed Issue Policies in 2025

Immediate Eligibility

There’s no waiting to be approved. Coverage can start as soon as the first payment is made.

Fixed Premiums

Your monthly cost:

- Never increases as you age.

- Stays consistent, even if your health declines later.

No Health Questions Asked

Insurers don’t look at your medical records. There’s no discrimination based on:

- Lifestyle.

- BMI.

- Mental or physical health.

Limitations and Drawbacks to Know

While guaranteed issue life insurance offers accessibility, it’s not without its downsides. Understanding the fine print can help you avoid surprises.

Lower Coverage Amounts

Most guaranteed issue policies cap coverage at $25,000, which may not be enough for:

- Income replacement.

- Mortgage payoff.

- Full estate planning.

These policies are best suited for final expenses, like:

- Funeral costs.

- Medical bills.

- Small debts.

Waiting Periods for Full Payout

Almost all policies include a graded death benefit period—typically the first 2 to 3 years. If the policyholder passes away during this time:

- Only the premiums paid (plus interest) are refunded.

- The full death benefit is only paid out after the waiting period ends.

- Accidental deaths are usually covered immediately.

Higher Premium Costs Compared to Term Life

Guaranteed issue policies cost more for less coverage because insurers take on more risk. You might pay:

- $50–$150/month for a $10,000–$20,000 benefit.

- More if you're older or purchase add-ons.

Policy Features to Look For in 2025

In a crowded insurance market, these features can add value to your guaranteed issue policy.

Graded Death Benefit Period

Understand the timeline for full coverage:

- Most policies pay full benefits after 24–36 months.

- Death by accident may be exempt from the wait.

Check your contract carefully.

Optional Riders (e.g., Accidental Death)

Enhance your policy with add-ons such as:

- Accidental death benefit (doubles payout).

- Terminal illness rider (early access to benefit).

- Waiver of premium (in case of disability).

Return of Premium Clauses

If you outlive the policy (some end at age 100), some insurers offer to:

- Refund your premiums.

- Add interest or bonus payouts.

This can be a nice “safety net” for long-term buyers.

Cost of Guaranteed Issue Life Insurance in 2025

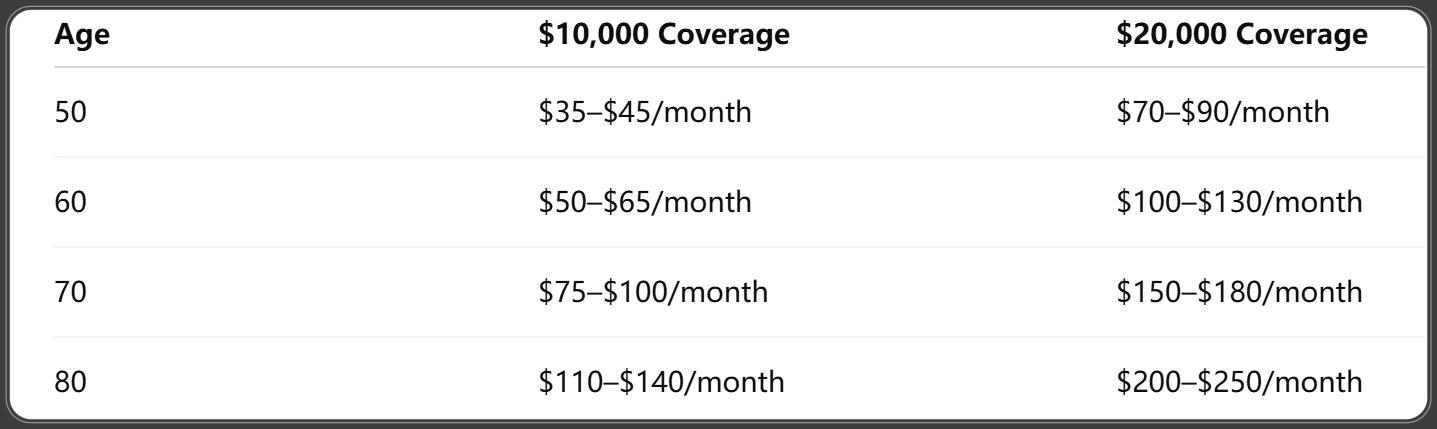

Premiums depend on your age, gender, and benefit amount, but here's what to expect.

Monthly Premium Estimates by Age

LIMRA. (2025). U.S. Individual Life Insurance – Overall Life Sales, First Quarter 2025 [PDF report]. Retrieved March/April 2025.

Note: Men typically pay slightly more due to higher statistical mortality.

Factors That Affect Pricing

While no medical info is required, these still impact cost:

- Age

- Gender

- State of residence

- Policy size

- Add-on riders

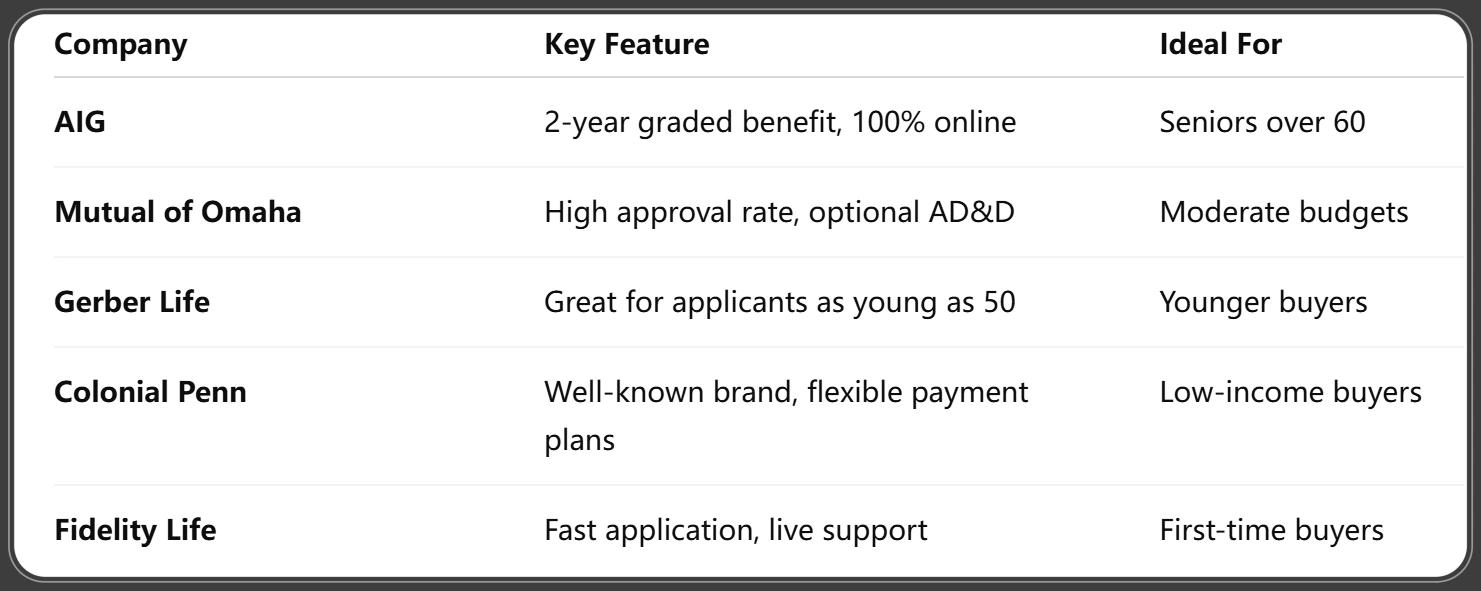

Best Guaranteed Issue Life Insurance Companies in 2025

These providers offer the best mix of pricing, service, and reliability.

Top 5 Providers by Customer Ratings

CSG Actuarial. (2025, February 21). Life Insurance Facts and Statistics 2025. Retrieved February 21, 2025.

Best for Seniors

Mutual of Omaha and AIG consistently earn high marks for:

- Ease of enrollment.

- Reliable customer service.

- Transparent policy options.

Best No-Exam Policy for High-Risk Applicants

Gerber Life and Fidelity Life approve even those with:

- Recent hospitalizations.

- Terminal illnesses.

- Long-standing chronic conditions.

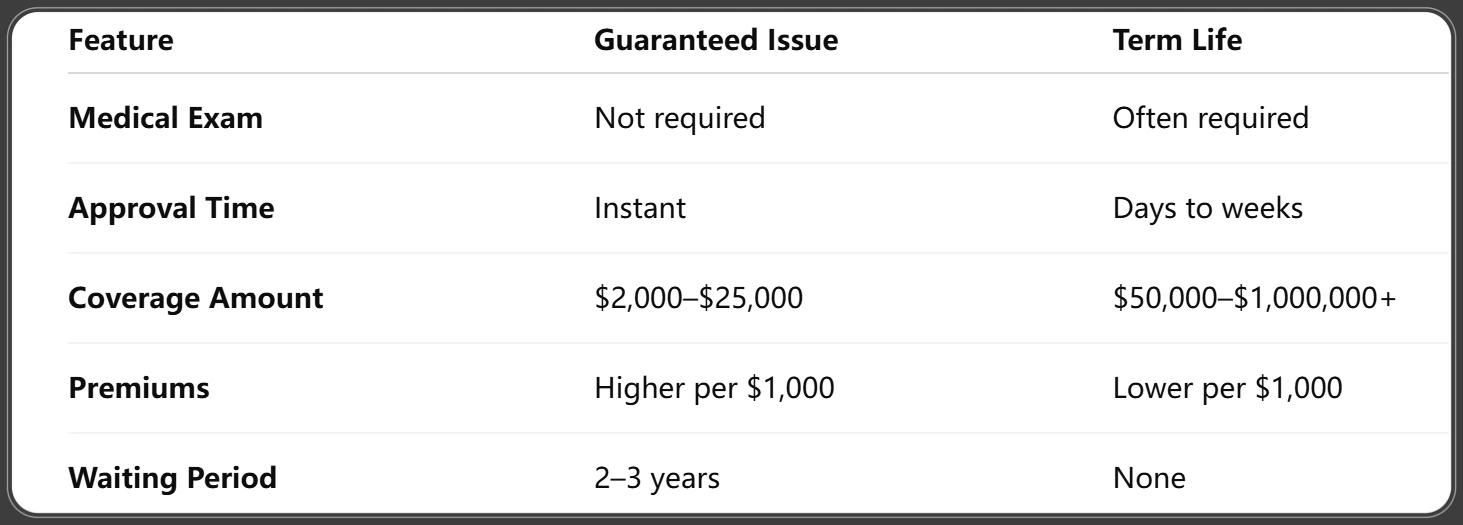

How Guaranteed Issue Compares to Other Life Insurance Types

If you're considering guaranteed issue life insurance in 2025, it's important to understand how it stacks up against other policy types.

Guaranteed Issue vs. Term Life

LIMRA. (2025, January 8). What’s Ahead for the U.S. Individual Life Insurance Market in 2025? [Web article]. Retrieved January 8, 2025.

Verdict: If you're healthy and under 65, term life offers more coverage for less. If you've been declined before or have serious health issues, guaranteed issue is your fallback.

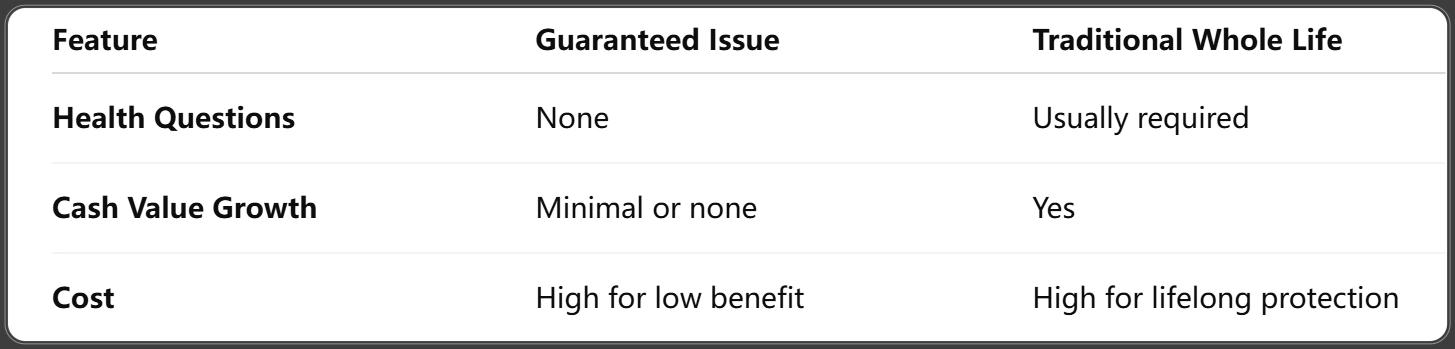

Guaranteed Issue vs. Whole Life

IAIS. (2025, June 9). Global Insurance Market Report (Mid-Year Update) [PDF]. Retrieved June 9, 2025.

Verdict: Whole life offers stronger long-term value if you qualify. Guaranteed issue is simpler but limited.

Guaranteed Issue vs. Simplified Issue

Simplified issue life insurance asks a few health questions but still avoids medical exams.

- Faster approval than traditional policies.

- Higher coverage than guaranteed issue.

- Lower premiums if you’re in decent health.

Verdict: Go with simplified issue if you can answer “no” to basic health questions.

Application Process in 2025: What to Expect

The 2025 guaranteed issue process is streamlined and digital-first.

How to Apply Online or by Phone

Most insurers offer:

- Online forms that take under 10 minutes.

- Phone agents to walk you through the process.

- Email confirmation once approved.

Documents You’ll Need

Typically just:

- Government-issued ID

- Social Security number

- Banking info for premium payments

No medical records or exam scheduling required.

When Does Coverage Begin?

- Coverage begins immediately once your first premium is paid.

- Full benefits kick in after the graded benefit period (usually 2 years).

What Happens If You Die During the Waiting Period?

This is one of the most important aspects of guaranteed issue policies.

Return of Premium + Interest

If you pass away from natural causes within the first 2–3 years:

- Your family receives a refund of premiums paid.

- Some insurers include interest (5–10%).

Exceptions to the Rule

If death is caused by an accident (car crash, fall, etc.), the full death benefit may be paid out immediately—even within the waiting period. Always confirm with the insurer.

State Regulations and Updates in 2025

State laws may affect:

- Premium caps

- Coverage availability

- Waiting period rules

States with Special Rules for Guaranteed Issue

Some states (e.g., New York, California) require:

- More consumer disclosures.

- Shorter waiting periods.

- Strict insurer licensing.

Always verify your state’s Department of Insurance for accurate rules.

Medicaid and SSI Considerations

A guaranteed issue policy may:

- Count as an asset under Medicaid rules.

- Impact SSI eligibility if the face value exceeds certain limits.

Consider naming a funeral home as the beneficiary or placing the policy in an irrevocable funeral trust to shield it.

Tips to Avoid Scams or Overpriced Policies

How to Verify Insurer Licensing

Use the NAIC (National Association of Insurance Commissioners) website to:

- Look up insurer credentials.

- File complaints or verify consumer protections.

Red Flags to Watch For in 2025

Avoid insurers that:

- Promise “double your money” with no details.

- Refuse to share policy documents.

- Use aggressive sales tactics or cold calls.

Understanding Policy Fine Print

Before signing:

- Check for the graded death benefit clause.

- Confirm the monthly premium and payout amount.

- Know the policy’s expiration age (some end at age 100).

FAQs About Guaranteed Issue Life Insurance 2025

1. Is guaranteed issue life insurance worth it?

Yes—if you're unable to qualify for other types due to health. It provides peace of mind and covers final expenses.

2. Can I get this policy if I have cancer or a terminal illness?

Yes. There are no medical exams or health questions, making it ideal for high-risk individuals.

3. What’s the waiting period for a payout?

Usually 2 years, though some policies may be shorter. Accidental deaths are often covered immediately.

4. How much coverage can I get?

Most providers offer $2,000 to $25,000, with some going up to $50,000 under special circumstances.

5. Can my premiums go up over time?

No. Premiums are fixed for the life of the policy.

6. What if I live past age 100?

Some policies end at that age, while others offer extended or lifetime protection. Always check the contract.

Conclusion: Is Guaranteed Issue Life Insurance Right for You?

Guaranteed issue life insurance in 2025 offers a lifeline to those who’ve been shut out of traditional coverage. It’s not perfect—it comes with higher costs and limited benefits—but for many, it’s the only way to secure peace of mind.

Choose it if:

- You've been declined for other policies.

- You're over 50 with health issues.

- You need simple, fast approval for end-of-life expenses.

Avoid it if:

- You're in good health (you’ll find better options elsewhere).

- You need large-scale coverage for income replacement.

Take the next step today:

- Compare rates online.

- Read the fine print.

- Secure a policy that fits your needs.

You Might Also Like

Life Insurance Medical Exam 2025: 20 Insider Tips for Faster Approval & Better Rates

Aug 5, 2025Life Insurance for Millennials 2025: 19 Smart Moves to Secure Your Future

Aug 5, 2025Life Insurance Tax Implications 2025: 17 Key Rules & Smart Strategies to Save More

Aug 5, 202521 Smart Life Insurance Renewal Tips 2025 for Better Coverage & Savings

Aug 5, 2025Life Insurance for Diabetics in 2025: What You Qualify For & How to Get Approved Fast

Jul 30, 2025