Life Insurance for Millennials 2025: 19 Smart Moves to Secure Your Future

Published on August 5, 2025

Emma Carter

Senior Insurance Editor

Emma Carter is a senior insurance editor with 12 years in P&C publishing and agency work; she simplifies policy details for everyday readers.

Why Millennials Are Now Prioritizing Life Insurance

For years, millennials were labeled the generation that postponed everything—homeownership, marriage, even life insurance. But in 2025, that’s changing. More millennials are embracing life insurance as a cornerstone of smart financial planning.

Shifting Financial Mindsets in 2025

Millennials, now in their late 20s to early 40s, are navigating:

- Mortgage payments.

- Family responsibilities.

- Freelance income streams.

With these life changes, financial responsibility becomes more urgent, and life insurance provides peace of mind and practical protection.

Post-COVID Legacy Planning

The pandemic sparked a mindset shift. Many millennials realized how fragile life can be and began planning for:

- Long-term illness.

- Unexpected death.

- Family protection.

Life insurance fits into this renewed desire to leave a legacy, even if it’s just ensuring loved ones aren’t burdened with debt.

Rising Cost of Living and Future Security

In an era of economic uncertainty and inflation, life insurance offers financial stability, ensuring that families, partners, or even business ventures aren’t left vulnerable.

Common Myths Millennials Believe About Life Insurance

“I’m Too Young to Need It”

Actually, your youth is your biggest advantage. The younger and healthier you are, the lower your premiums will be for the same level of coverage.

“It’s Too Expensive”

In 2025, policies start as low as $8–$15/month for healthy millennials. That’s less than the cost of a few coffee runs.

“My Job Coverage Is Enough”

Employer-sponsored life insurance usually offers 1x–2x your salary, which is rarely enough if you:

- Have debt.

- Support a family.

- Plan long-term financial goals.

What Makes Life Insurance in 2025 Different?

Today’s policies are far more flexible, transparent, and personalized.

AI Underwriting and Instant Approval

Forget the weeks of waiting. Now, thanks to AI and big data, many insurers can:

- Approve you in minutes.

- Eliminate the need for medical exams.

- Offer customized policy options instantly.

Customizable and Modular Policies

Millennials love personalization. In 2025, you can:

- Add mental health coverage.

- Include student loan riders.

- Adjust policy terms as your life changes.

Climate-Aligned and ESG Policies

Insurers now allow you to invest your policy’s cash value into ESG (Environmental, Social, and Governance) funds, aligning your financial values with your environmental ones.

Term vs. Whole Life: Which Is Better for Millennials?

Choosing between term and whole life insurance can feel overwhelming, especially with all the new options available in 2025. Here’s how millennials can make the smartest choice based on lifestyle, goals, and budget.

Benefits of Term Life for Budgeting Millennials

Term life insurance is the most popular choice for millennials—and for good reason:

- Affordable premiums (as low as $10/month for basic coverage).

- Coverage for a specific period (e.g., 10, 20, or 30 years).

- Ideal for protecting loved ones during your most financially vulnerable years—like when paying off student loans, mortgages, or raising kids.

It’s best for:

- Budget-conscious individuals.

- People with temporary financial obligations.

- Young families or new homeowners.

When Whole Life Makes Sense

Whole life insurance covers you for life and builds cash value, which you can borrow against or withdraw from.

It’s a good fit if you:

- Want to build long-term wealth.

- Need estate planning tools.

- Can afford higher premiums for the benefit of lifetime coverage and a guaranteed payout.

Hybrid and Universal Life Policies

In 2025, newer hybrid and universal life policies offer:

- Flexible premiums and death benefits.

- Investment options within your policy.

- Add-ons like long-term care and disability riders.

They’re worth exploring if you want more than just protection—and are ready to treat your policy as part of a broader financial strategy.

How Much Life Insurance Do Millennials Really Need?

There’s no one-size-fits-all answer, but here’s a solid approach.

Factors to Consider (Debt, Dependents, Income)

Start by accounting for:

- Student loans and personal debts (especially if co-signed).

- Income replacement (aim for 5–10x your annual income).

- Future expenses (college tuition for kids, mortgage).

Online Calculators and Digital Tools

Use digital insurance platforms that offer:

- AI-driven needs analysis.

- Customized policy suggestions.

- Budget and goal tracking.

Many apps now auto-adjust coverage as you hit life milestones.

Avoiding Under or Over-Insurance

Too little coverage? Your family may struggle financially.

Too much? You’ll pay unnecessary premiums.

The goal: protect what matters most, not pay for what you don’t need.

Top Features Millennials Should Look for in 2025

Millennials in 2025 want more than basic policies—they want value, flexibility, and relevance.

Mental Health and Wellness Add-ons

Some insurers offer:

- Free therapy sessions.

- Premium discounts for mental health check-ins.

- Integration with wellness apps like Calm or Headspace.

Student Loan Protection Riders

This rider ensures your remaining student debt is paid off if you pass away, protecting your co-signers or loved ones.

Cash Value and Investment Options

If you’re leaning toward permanent coverage, check if:

- You can allocate funds to ESG investments.

- There are flexible withdrawal or loan features.

- The policy offers dividend payments or growth-linked performance.

Affordable Life Insurance Options for Millennials

There’s no need to break the bank to get great coverage.

No-Exam and Instant-Issue Policies

Millennials love convenience. These policies:

- Require no medical exams.

- Offer instant approvals.

- Use AI to determine risk based on lifestyle and digital health records.

Employer-Based Supplemental Coverage

While employer life insurance is rarely enough on its own, many companies now offer:

- Supplemental voluntary policies.

- Group rates for family members.

- Portability options if you change jobs.

Budgeting for Premiums Under $25/Month

Most healthy millennials under 35 can get:

- $250K to $500K term coverage for under $25/month.

- Policy discounts by bundling with renters or auto insurance.

Digital Insurance Platforms: Insurtech for Millennials

Welcome to the age of digital-first insurance. Millennials expect speed, simplicity, and transparency—and 2025 delivers.

Best Apps and Websites in 2025

Top-rated platforms include:

- Haven Life

- Ladder

- Fabric

- Ethos

These platforms offer:

- Quick quotes.

- Personalized recommendations.

- No paper documents.

Comparing Policies with AI

AI-powered bots now:

- Compare dozens of providers in real-time.

- Adjust recommendations based on lifestyle factors (like diet, activity levels, or mental health).

- Track your coverage needs as your income changes.

Managing Policies from Your Phone

With app-based policy management, you can:

- Adjust coverage.

- Update beneficiaries.

- Pay premiums or take loans—all from your phone.

Life Insurance and Family Planning

As millennials step into parenthood and long-term partnerships, life insurance becomes a crucial part of family protection and legacy planning.

Coverage for Young Parents

Raising a child in 2025 costs more than ever. Life insurance ensures your children and partner:

- Have financial stability if you’re gone.

- Can continue their education and lifestyle.

- Won’t struggle with funeral or housing costs.

Even stay-at-home parents should be covered. Their contributions (childcare, homemaking) hold significant economic value.

Buying a Policy Before Starting a Family

It’s smart to buy coverage before becoming a parent, especially because:

- Premiums are cheaper when you’re younger and healthier.

- You’ll already have protection in place when life gets busy.

- Unexpected complications during pregnancy can impact eligibility.

Naming Children as Contingent Beneficiaries

Minor children can’t directly receive life insurance payouts, so:

- Name a trusted adult or legal guardian as the primary or contingent beneficiary.

- Set up a trust to manage the benefit until they reach adulthood.

- Consult with an estate attorney to ensure your wishes are enforceable.

Life Insurance and Side Hustles or Freelancers

Freelancers, gig workers, and solopreneurs face unique risks—without the safety net of employer-sponsored benefits.

Why Self-Employed Millennials Need Private Coverage

Unlike W-2 employees, you’re 100% responsible for your financial future:

- No employer life insurance.

- No disability safety net.

- Income may fluctuate—life insurance provides continuity for your family or business.

Income Replacement Strategies

Term life policies are ideal for:

- Covering 5–10x your average annual income.

- Replacing lost revenue for dependents or business partners.

- Ensuring clients and contracts aren’t left in limbo if you pass away suddenly.

Tip: Choose a convertible policy, so you can switch to permanent coverage if your finances allow later on.

The Role of Life Insurance in Millennial Financial Planning

Life insurance doesn’t compete with financial goals—it supports and strengthens them.

Pairing Life Insurance with Retirement Plans

Permanent life insurance can:

- Supplement your Roth IRA or 401(k).

- Act as a backup source of tax-free retirement income.

- Help you access emergency funds without triggering early withdrawal penalties.

Some policies include living benefits, letting you draw from the death benefit if diagnosed with a critical or terminal illness.

Building Wealth Through Permanent Policies

Whole and universal life policies build cash value, which grows tax-deferred and can be:

- Borrowed against.

- Used for a home down payment.

- Tapped in retirement.

Used wisely, it’s like a hidden financial engine under your broader financial plan.

Climate-Conscious Millennials and Ethical Insurance Options

Sustainability matters to this generation—and now, insurers are listening.

ESG-Focused Policy Investments

Some providers invest the cash value portion of your policy in:

- Green energy projects

- Social impact bonds

- Sustainable companies

Look for companies offering ESG-compliant portfolios and transparent reports on how your premiums are used.

Insurers with Carbon-Neutral Portfolios

A few forward-thinking providers now aim for net-zero emissions by 2030. They:

- Offset their own operational carbon footprint.

- Fund climate action through reforestation or renewable energy projects.

- Allow you to align your insurance with your values.

Life Insurance and Mental Health in 2025

With mental health no longer taboo, insurers are adapting—offering more compassionate underwriting and even support programs.

Policies That Cover Mental Health Conditions

While coverage used to be denied for those with mental health diagnoses, many insurers now:

- Accept applicants with anxiety, depression, or ADHD.

- Assess risk based on treatment stability and history.

- Provide customized premiums, not blanket rejections.

Wellness Programs That Reduce Premiums

In 2025, wellness incentives include:

- Lower premiums for regular therapy or mindfulness app use.

- Points systems that reward healthy habits (sleep, exercise, nutrition).

- Integration with mental health platforms like BetterHelp or Calm.

Mistakes Millennials Make When Buying Life Insurance

Waiting Too Long to Apply

Every year you wait, you:

- Risk developing health issues.

- Increase your premiums.

- Reduce your insurability.

Start early—even a small policy is better than none.

Choosing the Cheapest Without Coverage Review

Low premiums are great, but make sure your policy actually covers:

- Your debts.

- Your dependents.

- Your future needs.

Use calculators and speak to a licensed agent if unsure.

Not Reviewing Every 2–3 Years

Your life evolves. So should your policy. Review when you:

- Get married or divorced.

- Buy property.

- Have kids or start a business.

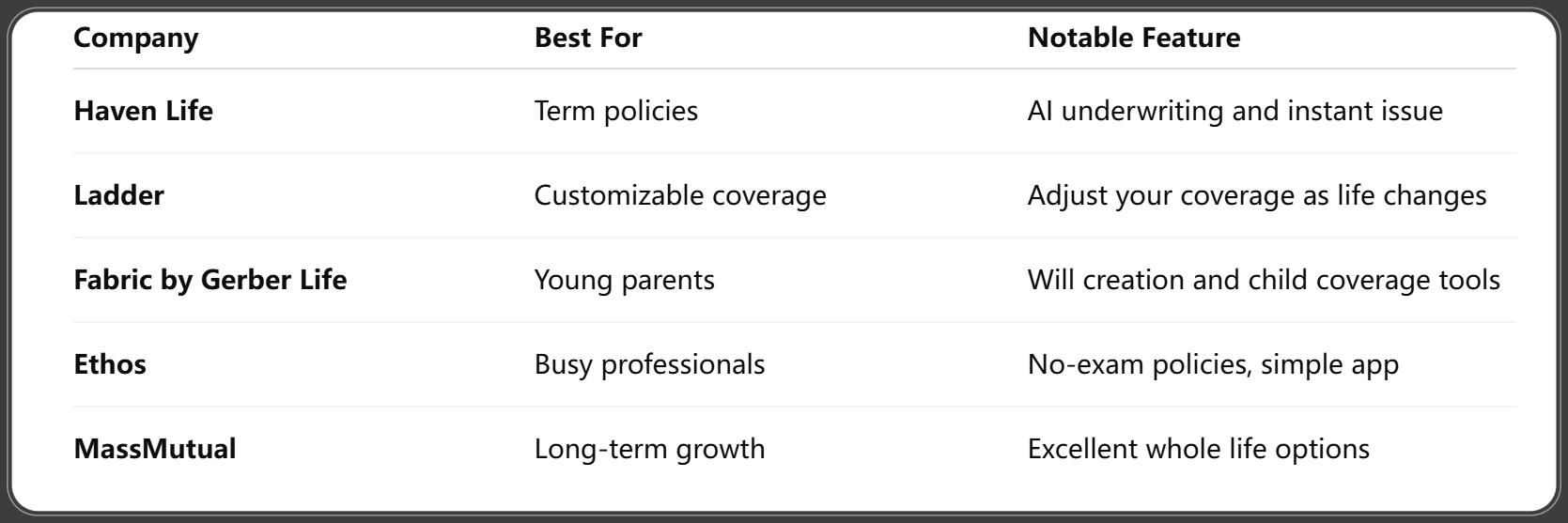

Best Life Insurance Companies for Millennials in 2025

Here are top-rated providers based on affordability, tech, and customization:

Bankrate. (2025, June 27). Life Insurance Facts and Statistics 2025. Retrieved June 27, 2025.

FAQs About Life Insurance for Millennials 2025

1. Do I need life insurance if I’m single with no kids?

Yes—especially if you have student debt, aging parents, or co-signed loans.

2. Can I get life insurance with a mental health diagnosis?

Absolutely. Many 2025 insurers evaluate stability over stigma and may still approve you.

3. What happens if I change jobs or careers?

That’s why you need private coverage—employer life insurance usually ends when you leave.

4. Is term life better than whole life?

For most millennials, yes. It’s affordable and effective. But whole life can build long-term wealth if you’re financially ready.

5. Can I manage everything from an app?

Yes. The best insurtech platforms let you buy, manage, and even adjust your policy entirely online.

6. What if I miss a premium payment?

Most policies offer a grace period (usually 30 days). Beyond that, your coverage may lapse—so always set up autopay.

Final Thoughts: Millennial Guide to Smarter Coverage in 2025

Life insurance isn’t just for parents or the wealthy—it’s a smart, forward-thinking financial move for every millennial. In 2025, it’s more affordable, customizable, and values-driven than ever before.

To recap:

- Start now, not later.

- Choose policies that fit your lifestyle and budget.

- Revisit your plan every few years.

By securing the right coverage today, you’re protecting your future self—and everyone you care about.

You Might Also Like

Life Insurance Medical Exam 2025: 20 Insider Tips for Faster Approval & Better Rates

Aug 5, 2025Guaranteed Issue Life Insurance 2025: 18 Essential Facts You Must Know

Aug 5, 2025Life Insurance Tax Implications 2025: 17 Key Rules & Smart Strategies to Save More

Aug 5, 202521 Smart Life Insurance Renewal Tips 2025 for Better Coverage & Savings

Aug 5, 2025Life Insurance for Diabetics in 2025: What You Qualify For & How to Get Approved Fast

Jul 30, 2025