Life Insurance Medical Exam 2025: 20 Insider Tips for Faster Approval & Better Rates

Published on August 5, 2025

Emma Carter

Senior Insurance Editor

Emma Carter is a senior insurance editor with 12 years in P&C publishing and agency work; she simplifies policy details for everyday readers.

What Is a Life Insurance Medical Exam?

A life insurance medical exam is a routine part of underwriting where the insurer evaluates your current health to:

- Determine your risk level.

- Assign your rate class.

- Set your monthly premium.

It’s like a mini physical, typically done by a licensed paramedical professional.

The Purpose of the Exam

Insurers want to:

- Confirm you’re in the health condition you claimed.

- Screen for chronic illnesses or risk factors.

- Reduce the chances of insuring someone likely to pass away prematurely.

It’s their way of managing risk—and offering the best rates to the healthiest applicants.

Who Needs to Take It in 2025

In 2025, exams are still required for:

- Coverage amounts above $500,000–$1M.

- Applicants over 50 or 60.

- Those with pre-existing conditions.

- People applying for fully underwritten policies with the lowest rates.

What’s Included in a Life Insurance Medical Exam in 2025?

Expect a 15–45 minute session, either at your home or a certified clinic.

Physical Measurements (Height, Weight, BMI)

Basic stats are taken to assess:

- Body Mass Index

- Weight-related risk

- Obesity-linked conditions

Blood Test Panel Explained

Your blood sample is tested for:

- Cholesterol and triglycerides

- Glucose (diabetes screening)

- Liver and kidney function

- Nicotine, THC, and drug use

- HIV/AIDS and infectious diseases

Urine Sample and What It Screens For

Urinalysis helps detect:

- Kidney issues

- Protein levels

- Drug or alcohol traces

EKG, X-rays, or Additional Tests for Seniors or High Coverage

If you’re applying for $1M+ in coverage, you may be asked to undergo:

- Electrocardiogram (EKG)

- Stress tests

- Chest X-rays

How to Prepare for a Life Insurance Medical Exam

Your results directly impact your premiums, so it’s worth preparing. A few smart habits can significantly improve your lab numbers and help you land a better rate class.

5–7 Days Before the Exam

Start preparing at least a week ahead:

- Cut down on salt, sugar, caffeine, and alcohol.

- Eat a heart-healthy diet: lean proteins, fruits, veggies, and whole grains.

- Get regular sleep—lack of rest can spike blood pressure and cortisol.

- Avoid strenuous exercise the day before (it can skew protein levels).

24 Hours Before the Exam

- Hydrate well—drink lots of water to make blood draws easier and reduce concentrations of toxins.

- Avoid red meat and high-fat meals that can increase cholesterol readings.

- No alcohol, tobacco, or caffeine.

- Don’t take decongestants, antihistamines, or NSAIDs unless necessary—they can raise blood pressure or liver enzymes.

What to Do on Exam Day

- Skip breakfast unless otherwise instructed (fasting gives more accurate lab results).

- Bring ID and a list of medications.

- Relax! Try deep breathing if you’re anxious.

- Avoid smoking or energy drinks at least 4–6 hours before the exam.

- Wear short sleeves for easy access to your arm.

Common Disqualifiers and Red Flags

Insurers don’t technically “fail” applicants—they assign risk classifications. But certain results will push you into a more expensive rate class or even result in denial.

High Blood Pressure

A reading above 140/90 mmHg may bump you out of the best pricing tiers, especially if untreated.

Elevated Cholesterol or Glucose

Levels above:

- Total cholesterol: 240 mg/dL+

- Fasting glucose: 126 mg/dL+

...can trigger concern for heart disease or diabetes.

Nicotine, THC, or Drug Traces

Even if you only vape or use occasional cannabis, traces in your system:

- May label you a smoker, tripling your premiums.

- Could lead to a denial if tied to illegal drug use.

Dishonest Health Disclosures

Insurers check medical databases like MIB (Medical Information Bureau). Omitting health history can:

- Cause denial.

- Lead to claim denial down the road.

- Affect your ability to reapply.

What Insurers Are Really Looking For in 2025

Underwriting has advanced. In 2025, insurers use AI-backed scoring systems to assess your full health profile—not just a single data point.

Cardiovascular Risk Factors

They evaluate:

- Resting heart rate.

- Blood pressure trends.

- Family history of heart disease.

Liver and Kidney Function

Enzymes like ALT, AST, and creatinine indicate organ health.

HIV and Cancer Screening

Some insurers perform:

- HIV screening

- PSA tests (for prostate cancer)

- Occasional genetic marker checks (with your consent)

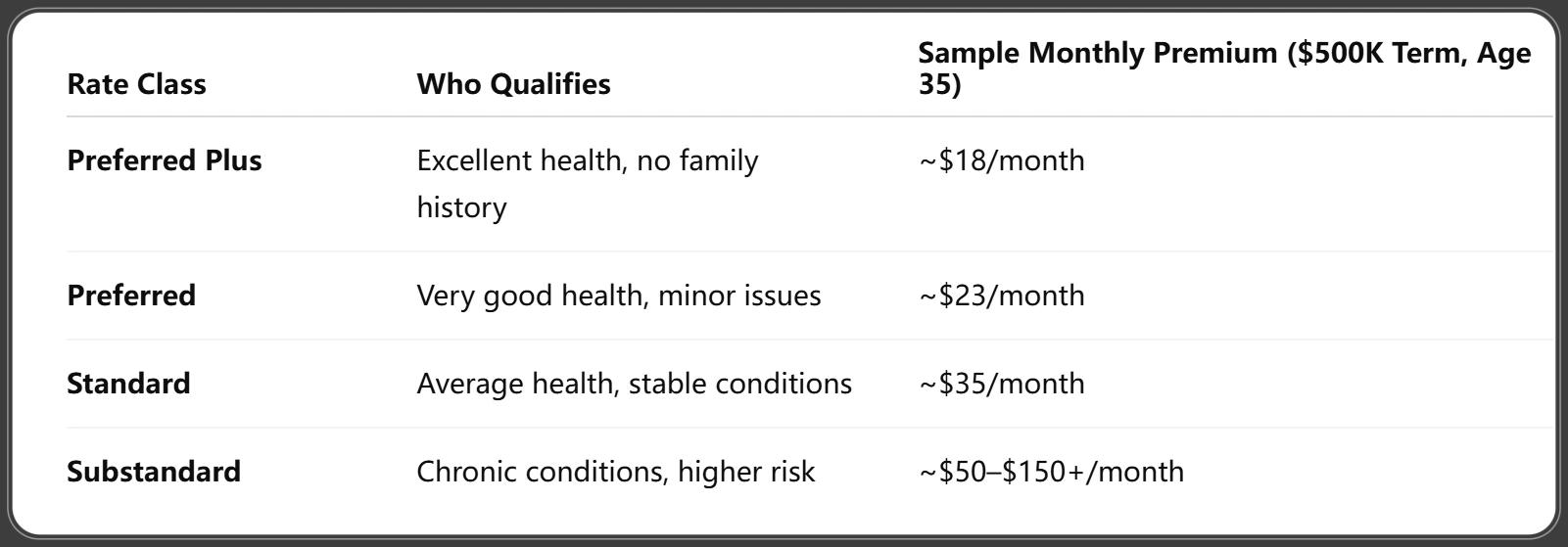

How Your Medical Exam Results Affect Your Premium

Once your exam is complete, your health data is used to assign a rate class, which determines your monthly premium.

Rate Classes (Preferred Plus, Standard, Substandard)

Here’s how it breaks down:

LIMRA. (2025). 2025 Facts About Life Insurance Sheet [Fact sheet]. Retrieved June 2025.

How Results Are Weighted

Some factors carry more weight than others:

- Nicotine use = biggest cost driver.

- Controlled hypertension/diabetes = may still qualify for standard rates.

- BMI > 35 = possible substandard classification.

What Happens If You Fail?

There’s no pass/fail—but if you're denied:

- You can appeal the decision.

- Ask to retest in 6–12 months after improving health.

- Consider no-exam policies (see below).

No Medical Exam Policies in 2025: Alternatives to Know

In 2025, there are more ways than ever to get life insurance without a medical exam. These alternatives can still offer decent coverage—especially for younger, healthier applicants or those who dislike traditional testing.

Simplified Issue Life Insurance

This type of policy:

- Requires only a health questionnaire, no lab work.

- Offers coverage up to $500,000 (varies by age and provider).

- Provides instant or next-day approval in many cases.

Best for:

- Healthy applicants under 60.

- People who want fast coverage.

- Those uncomfortable with medical tests.

Guaranteed Issue Life Insurance

This is a no-questions-asked policy:

- No medical exam.

- No health questions.

- Guaranteed acceptance for people ages 50–80.

However:

- Coverage is usually limited to $2,000–$25,000.

- Comes with a 2-year graded benefit period (limited payout early on).

Best for:

- Seniors or people with serious health conditions.

- Covering final expenses only.

Instant-Approval Online Policies

Digital-first insurers in 2025 use AI and big data to:

- Approve you in minutes.

- Check public health records instead of requiring an exam.

- Offer flexible term coverage with competitive pricing.

Best platforms include:

- Ladder

- Ethos

- Bestow

When a Medical Exam Is Still Required

Despite innovation, some cases still require traditional exams.

High Coverage Requests ($1M+ Policies)

If you’re seeking a large death benefit, expect:

- Full underwriting.

- Paramedical exams.

- Possible EKGs or financial verification.

Suspicious or Incomplete Health Records

If your medical history shows:

- Gaps or conflicting details.

- Prior denials or conditions under investigation.

The insurer may request an exam to verify insurability.

Applications for Seniors Over 65

Most seniors applying for term or permanent coverage will undergo:

- A complete paramedical exam.

- Extra lab work or cardiovascular screening.

Can You Retake the Medical Exam?

Yes—and sometimes it’s the best move financially.

When to Request a Re-exam

Ask for a retest if:

- You’ve lost weight.

- Stopped smoking for 12+ months.

- Controlled a chronic condition (e.g., lowered A1C or blood pressure).

Tip: Some insurers allow one free re-exam per year upon request.

How to Improve Scores Before Reapplying

- Eat clean and hydrate regularly.

- Exercise moderately—but stop intense workouts 1–2 days before.

- Manage stress to lower resting blood pressure.

Cost and Scheduling of the Life Insurance Exam

Who Pays for It?

The insurance company pays, not you. You’re not billed regardless of your results—even if you’re denied coverage.

How to Schedule at Home or Clinic

You’ll receive:

- A call or email from a third-party paramedical service (e.g., ExamOne).

- Options to schedule home visits, clinic appointments, or even employer on-site exams.

Digital Coordination & Same-Day Availability

Many providers now:

- Offer online scheduling portals.

- Provide real-time availability.

- Send reminders and paperwork digitally to speed things up.

Tips to Get the Best Results from Your Exam

Hydration, Sleep, and Diet

- Drink at least 64 oz of water the day before and the morning of.

- Aim for 7–8 hours of sleep to reduce stress and stabilize blood pressure.

- Stick to whole foods and avoid processed junk.

Avoiding Alcohol, Caffeine, and Salt

These substances can:

- Spike blood pressure.

- Raise liver enzymes.

- Throw off lab results.

Avoid all 3 for 24–48 hours pre-exam.

Managing White Coat Syndrome

Nervousness can raise your blood pressure artificially.

- Take deep breaths.

- Ask the examiner to measure at the end of the visit.

- Avoid coffee before the test.

Medical Data Privacy and What Insurers Can Access

Privacy remains a top concern in 2025.

What Insurers Are Legally Allowed to Use

With your permission, insurers can access:

- MIB (Medical Information Bureau) reports.

- Prescription history databases.

- Lab and testing results from your exam.

They cannot access:

- Private mental health notes (unless disclosed).

- Genetic testing (unless specifically authorized).

Your Rights to Exam Results

You have the right to:

- Receive a full copy of your lab results.

- Share them with your doctor.

- Use them for personal health insight.

How to Dispute Inaccurate Results

If a test result appears incorrect:

- Contact the insurer immediately.

- Request a re-test or physician override.

- Provide medical records to support your claim.

FAQs About Life Insurance Medical Exam 2025

1. How long does the exam take?

Most exams take 20–45 minutes, depending on age, coverage amount, and location.

2. Can I eat before the exam?

Fasting is recommended if bloodwork is required, unless instructed otherwise.

3. What if I’m sick during the exam?

Reschedule. A temporary illness can skew results and hurt your rate class.

4. Can I take the exam at home?

Yes—most insurers send a nurse or paramedical technician to your home for convenience.

5. What happens if I’m denied coverage?

You can:

- Request a copy of the report.

- Improve your health and reapply in 6–12 months.

- Consider no-exam policies in the meantime.

6. Will I see the exam results?

Yes. Most providers email or mail you a copy within 7–14 days upon request.

Conclusion: Master Your Life Insurance Medical Exam in 2025

The life insurance medical exam doesn’t have to be intimidating. With the right prep and mindset, it can help you:

- Secure better rates.

- Protect your loved ones affordably.

- Gain valuable insight into your health.

Takeaway action plan:

- 🗓 Schedule your exam early.

- 🥗 Prep 5–7 days in advance.

- 💧 Hydrate, rest, and stay calm.

- 📄 Be honest on your application.

If you're unsure or don’t qualify, remember—no-exam options in 2025 are better than ever.

You Might Also Like

Guaranteed Issue Life Insurance 2025: 18 Essential Facts You Must Know

Aug 5, 2025Life Insurance for Millennials 2025: 19 Smart Moves to Secure Your Future

Aug 5, 2025Life Insurance Tax Implications 2025: 17 Key Rules & Smart Strategies to Save More

Aug 5, 202521 Smart Life Insurance Renewal Tips 2025 for Better Coverage & Savings

Aug 5, 2025Life Insurance for Diabetics in 2025: What You Qualify For & How to Get Approved Fast

Jul 30, 2025