Understanding Non‑Owner Car Insurance in the US: An Ultimate Guide

Published on July 28, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

Understanding Non‑Owner Car Insurance in the US: An Ultimate Guide

Introduction

Driving a rental, borrowing a friend’s car, or complying with an SR‑22 requirement without owning a vehicle? Non owner car insurance is designed for you. Unlike standard auto policies, a non owner auto insurance policy offers liability protection when you’re behind the wheel of a vehicle you don’t own. In this comprehensive guide, you’ll dive deep into:

- Core features of non owner car insurance and eligibility criteria

- State‑specific requirements and SR‑22 non owner insurance mandates

- Step-by-step process to compare non owner auto insurance quotes online

- Leading non owner car insurance companies and their standout offerings

- Five proven tactics to slash your non owner car insurance premiums

By the end, you’ll be equipped to select the ideal policy, satisfy legal mandates, and drive with confidence.

1. Core Coverage & Who Should Buy It

A non owner car insurance policy typically includes:

- Liability coverage: Bodily injury and property damage when you cause an at-fault accident in a non‑owned car

- Personal injury protection (PIP) or medical payments: In some states, optional add-on for immediate medical expense coverage

- SR‑22 filing: Adds an SR‑22 certificate to meet high-risk driver requirements

Ideal candidates:

- Frequent renters lacking CDW (collision damage waiver)

- Drivers borrowing cars regularly without owner-provided insurance

- Individuals suspended or revoked and needing an SR‑22 non owner insurance policy

Skip this policy if you own a car or require comprehensive/collision coverage—non owner policies do not cover vehicle damage.

2. State Mandates & SR‑22 Requirements

State-by-State Variations

- California & New York: Minimum liability limits higher than federal defaults; non‑owner policies accepted.

- Florida & Texas: Continuous coverage proof required—non‑owner policies qualify.

- Illinois & Ohio: SR‑22 non owner insurance recognized to reinstate driving privileges.

SR‑22 Filing

- An SR‑22 non owner insurance attaches a certificate to your liability policy, proving financial responsibility.

- Filing fees range from $15–$50; expect a premium surcharge if you’re high‑risk.

- Maintain SR‑22 status for 3 years (varies by state) to avoid license suspension.

3. Comparing Non‑Owner Auto Insurance Quotes

Follow this process to find the best non owner car insurance providers:

- Gather personal details: Driving history, SR‑22 requirement, desired liability limits

- Use specialized comparison tools: Filter for non‑owner policies on platforms like The Zebra or Insure.com

- Validate coverage minimums: Ensure your quote meets or exceeds your state’s liability requirements (e.g., 25/50/25)

- Analyze provider ratings: AM Best financial strength, J.D. Power customer satisfaction scores

- Confirm SR‑22 support: Not all insurers handle SR‑22—double-check before purchasing

Pro Tip: Obtain quotes from both national giants (GEICO, Progressive) and niche specialists (Dairyland) to uncover competitive rates.

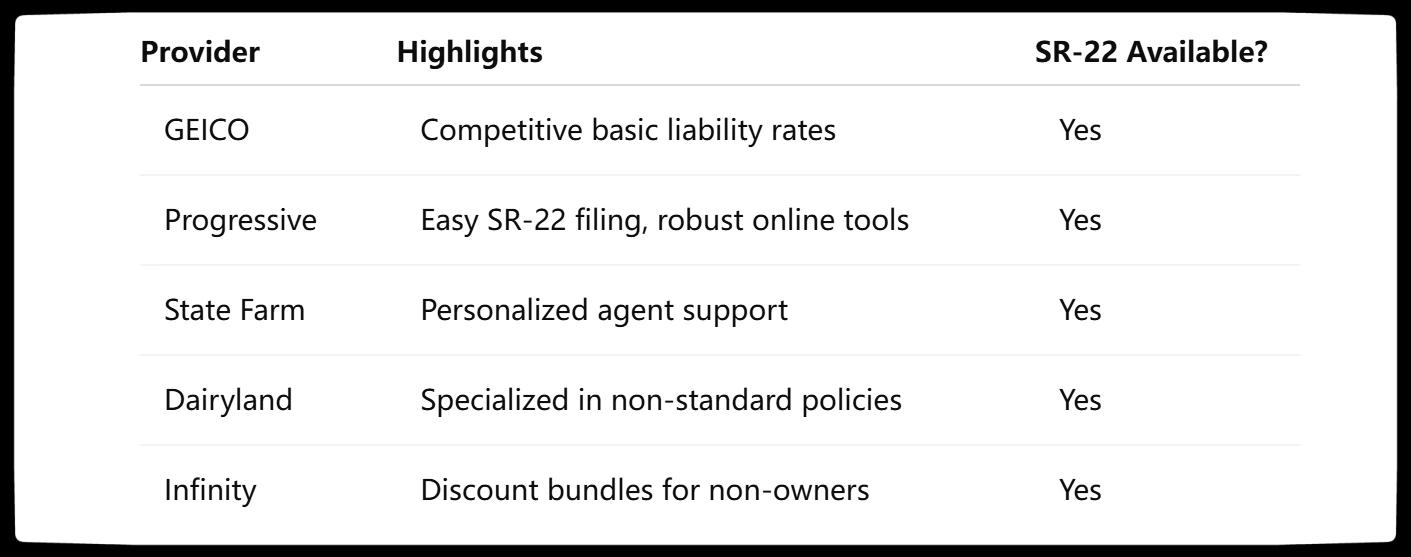

4. Top Non‑Owner Car Insurance Companies

ValuePenguin (LendingTree). (2025, January 7). The State of Auto Insurance in 2025: Rate increases are slowing down in 2025 [Press release].

Selecting a provider:

- Compare quotes side by side for identical coverage limits

- Ask about multi-policy discounts (renters, umbrella insurance)

- Inquire on accident forgiveness or loyalty perks

5. Five Expert Tactics to Lower Your Premium

- Maintain a clean driving record: Avoid accidents and traffic violations for tiered rate reductions

- Opt for higher liability limits: Higher-cost coverage often yields lower per-dollar premiums

- Bundle with other policies: Combine your non-owner policy with renters or umbrella insurance for discounts

- Pay annually, not monthly: Insurers often award a 5–10% discount for lump-sum payments

- Leverage all available discounts: Good driver, defensive driving courses, multi-car family members

Implement these tactics to secure the most budget-friendly non owner auto insurance without sacrificing necessary coverage.

Conclusion

Non owner car insurance is a strategic solution for drivers without a vehicle who require liability protection or face SR‑22 mandates. By understanding policy essentials, navigating state-specific rules, and comparing quotes from top insurers, you can confidently secure affordable coverage that meets both your legal obligations and financial goals.

You Might Also Like

Compare Car Insurance: A Step‑by‑Step Guide to Finding the Right Policy (Expert 2025 Update)

Jul 29, 2025Maximize Your Savings: 17 Car Insurance Discounts and How to Qualify in 2025

Jul 28, 20252025 How to Find the Best Car Insurance Near You

Jul 28, 20252025 Car Insurance Guide for Young Drivers: Actionable Tips to Lower Your Rates

Jul 28, 20252025 SR‑22 Car Insurance Explained: Requirements, Costs, and Expert Tips

Jul 28, 2025