Minimum Car Insurance Requirements by State (2025 Guide)

Published on July 8, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

Minimum Car Insurance Requirements by State (2025 Guide)

Why Knowing Your State's Minimum Auto Insurance Is Essential

Every state in the U.S. has different laws outlining the minimum car insurance coverage drivers must carry. If you're caught driving without meeting these legal minimums, you risk:

- Fines and penalties

- License suspension

- Higher future insurance rates

- Personal liability in the event of an accident

Understanding your state’s minimum auto liability insurance requirements helps you stay on the road legally and avoid serious financial consequences.

Common Types of Required Car Insurance Coverage

Most states require at least these two types of liability insurance:

✅ Bodily Injury Liability (BI)

- Covers medical expenses and lost wages for others when you’re at fault

- Often written as per-person/per-accident limits (e.g., $25,000/$50,000)

✅ Property Damage Liability (PD)

- Pays for repairs or replacement of vehicles or property you damage in an accident

🟡 Required or Optional in Some States:

- Personal Injury Protection (PIP) — covers your own medical bills, required in no-fault states

- Uninsured/Underinsured Motorist Coverage (UM/UIM) — protects you from drivers without insurance

- Medical Payments (MedPay) — similar to PIP, but usually optional and simpler

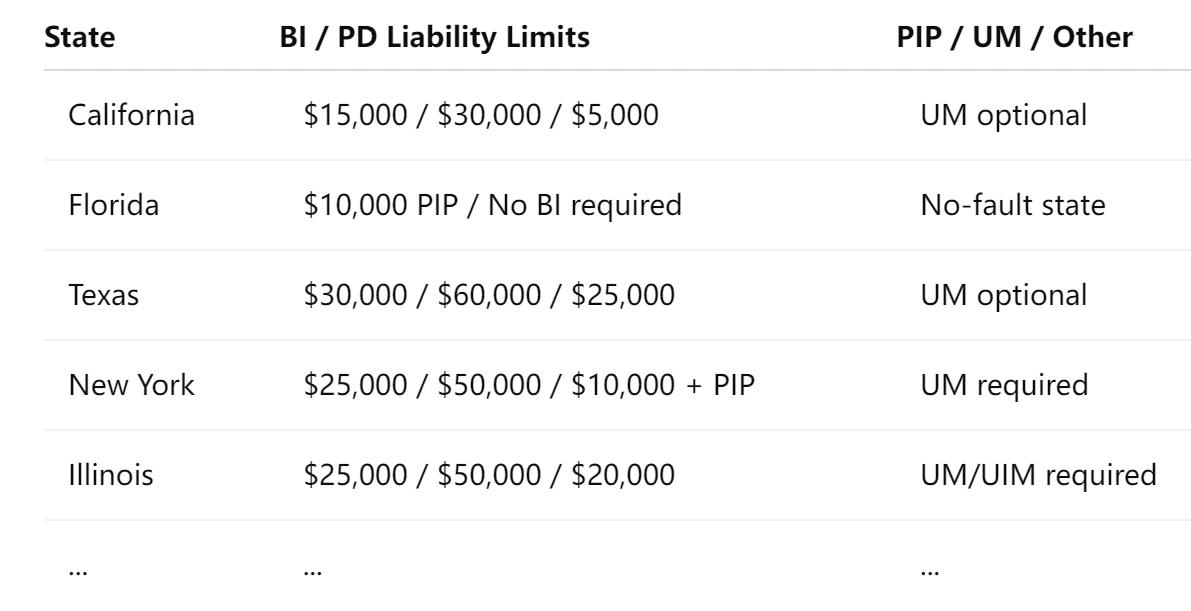

Minimum Auto Insurance Requirements by State in 2025

The chart below outlines the 2025 state minimum car insurance limits for liability and other mandated coverages:

National Association of Insurance Commissioners. (2025). Auto Insurance Database Average Premium Supplement for 2023 [Press release]. Retrieved July 8, 2025.

📌 Tip: These limits are the legal minimums. Many experts recommend increasing them for better financial protection.

Is Only Carrying the Minimum Insurance a Smart Choice?

While carrying just the minimum coverage is cheaper and legal, it might not be enough after a serious accident.

👍 Benefits:

- Meets state requirements

- Lower monthly premiums

⚠️ Risks:

- Insufficient to cover large medical or repair bills

- Leaves you personally liable for damages beyond your policy limits

Example:

If you cause a $90,000 accident and your state’s minimum BI coverage is $25,000 per person, you may be sued for the remaining $65,000.

That's why many drivers choose to upgrade to full coverage auto insurance or raise liability limits to better protect their assets.

Frequently Asked Questions

❓ What happens if I drive without insurance?

You may face fines, points on your license, vehicle impoundment, and even jail time depending on your state.

❓ Is full coverage required if I finance or lease a car?

Yes. Lenders typically require both collision and comprehensive insurance to protect their interest.

❓ Can I still save money while meeting state minimums?

Yes. To reduce your premiums without sacrificing compliance:

- Compare auto insurance quotes regularly

- Ask about multi-policy, safe driver, and low-mileage discounts

- Choose higher deductibles if you can afford them

Final Thoughts

Knowing your state’s required car insurance coverage ensures legal driving — but minimum doesn’t always mean adequate.

You should:

- Confirm your state’s 2025 liability requirements

- Understand your financial risk with only minimum limits

- Shop for policies that balance legal compliance with real protection

Smart drivers don’t just ask “what’s the legal minimum” — they ask “what’s the right amount of coverage for me?”

You Might Also Like

2025 SR‑22 Car Insurance Explained: Requirements, Costs, and Expert Tips

Jul 28, 2025Understanding Non‑Owner Car Insurance in the US: An Ultimate Guide

Jul 28, 20256 Proven Ways to Lower Your Car Insurance Premium in 2025

Jul 10, 2025Top 7 Ways to Save Money on Car Insurance in 2025

Jul 8, 2025What Is Car Insurance and How Does It Work in the U.S.?

Jul 1, 2025