What Is Car Insurance and How Does It Work in the U.S.?

Published on July 1, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

Introduction

If you've ever looked at a car insurance policy and thought, "Do I really need all this?" — you're not alone. Car insurance can feel like a maze of terms, coverages, and legal requirements. But whether you're getting your first car or switching providers, understanding the core parts of car insurance can save you hundreds each year — and protect you in ways you didn’t know you needed.

In this guide, we break it all down with real-world tips and no fluff.

What Exactly Is Car Insurance?

Car insurance is a financial agreement that protects you from high out-of-pocket costs if you’re involved in an accident, your car is stolen, or even damaged by weather or vandalism. Instead of paying all at once for costly repairs or lawsuits, you pay a monthly premium and let your insurance company handle covered losses.

In most U.S. states (except New Hampshire and Virginia), liability insurance is legally required to drive.

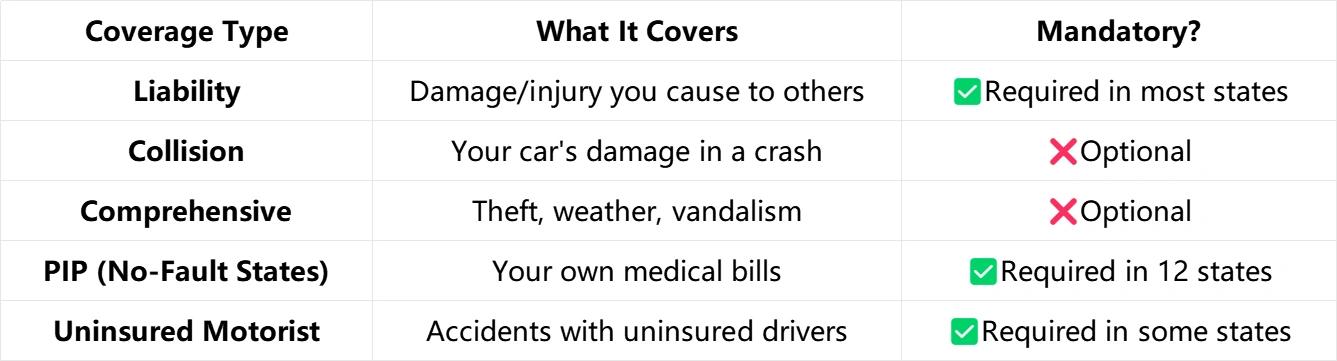

Types of Coverage – What You May (or May Not) Need

AgencyChecklists.com. (2025, March 17). NAIC 2025 Market Share: Top 25 Private Passenger Auto Insurers [Web report].

💡 Real Tip: If your car is older than 10 years and fully paid off, you may not need collision or comprehensive — consider switching to liability-only to save hundreds annually.

How It Actually Works in Real Life

Let’s say you rear-end someone. Here's what typically happens:

- You file a claim with your insurer.

- They assess the damage (sometimes via photos).

- You pay your deductible — say, $500.

- Your insurance covers the rest (e.g., $3,000 repair bill).

🚗 Your Rate Might Change: Accidents often increase your premium unless you have accident forgiveness.

What Affects Your Car Insurance Price?

- Location: Urban areas have more accidents and theft → higher rates

- Driving History: Clean record? You get better prices

- Vehicle Type: A sports car costs more to insure than a sedan

- Credit Score: Yes, in most states, it impacts your rate

- Annual Mileage: The more you drive, the higher the risk

🛠️ Tip: If you drive under 8,000 miles/year, ask your insurer about low-mileage discounts or usage-based policies.

Choosing the Right Policy (Without the Overwhelm)

- Know your state's legal minimum (e.g., California requires 15/30/5 coverage)

- Compare at least 3 providers (GEICO, Progressive, State Farm, etc.)

- Understand your risk – if you drive for Uber or live in a flood-prone area, standard coverage may not be enough

- Bundle wisely – combine home + auto = major savings

Common Mistakes to Avoid

- ❌ Buying just the minimum — it won’t cover your car

- ❌ Skipping Uninsured Motorist — over 1 in 8 U.S. drivers are uninsured

- ❌ Not shopping around each renewal — prices change every 6–12 months

FAQs – Quick Answers to Real Questions

Q: Is car insurance legally required in every state?

No. New Hampshire and Virginia have exceptions, but you’ll still be financially liable if you cause an accident.

Want to know exactly what your state requires? Check out the minimum car insurance requirements for all 50 states here.

Q: Can I get a policy online instantly?

Yes. Most major insurers offer instant quotes and same-day coverage within 10–15 minutes.

Q: Does my rate go up if I file a claim?

Often yes — unless it’s not your fault or you have accident forgiveness.

Conclusion

Car insurance doesn’t have to be confusing. Think of it as a safety net — one that varies depending on where you live, what you drive, and how much risk you're willing to take. By understanding how it works and avoiding common traps, you can protect your wallet and your wheels.

You Might Also Like

2025 SR‑22 Car Insurance Explained: Requirements, Costs, and Expert Tips

Jul 28, 2025Understanding Non‑Owner Car Insurance in the US: An Ultimate Guide

Jul 28, 20256 Proven Ways to Lower Your Car Insurance Premium in 2025

Jul 10, 2025Top 7 Ways to Save Money on Car Insurance in 2025

Jul 8, 2025Minimum Car Insurance Requirements by State (2025 Guide)

Jul 8, 2025