Revealed: The Average Cost of Health Insurance 2025 & How to Save Big

Published on July 31, 2025

Alex Thompson

Insurance Data Analyst & Content Strategist

Alex Thompson analyzes insurer data and market trends to produce objective rate comparisons, annual cost studies, and interactive saving guides.

Average Cost of Health Insurance 2025: What You Need to Know

The rising cost of healthcare is a major concern for millions of Americans. If you're budgeting for the new year or exploring your insurance options, understanding the average cost of health insurance in 2025 is essential. Whether you're self-employed, changing jobs, or shopping on the ACA Marketplace, this guide will help you make sense of pricing trends—and find smart ways to save.

Understanding Health Insurance Pricing

What Determines Your Health Insurance Cost

Health insurance premiums aren’t one-size-fits-all. Several key factors influence how much you'll pay, including:

- Age and location

- Type of coverage (individual, family, employer-sponsored)

- Health status and tobacco use

- Chosen metal tier (for ACA plans)

- Eligibility for subsidies

Types of Health Plans and Pricing Differences

Health plans come in several categories:

- Individual/Family Plans: Bought through ACA exchanges or private insurers.

- Group Plans: Offered by employers, often with shared costs.

- Catastrophic Plans: Low-premium, high-deductible coverage for those under 30 or with hardship exemptions.

Each comes with a different cost structure and coverage benefits.

Average Monthly Premiums by Coverage Type

Individual Plans

In 2025, the national average monthly premium for an individual ACA plan is projected to be around $560–$610 without subsidies. This includes all metal tiers.

Family Plans

For a family of four, the average premium climbs to $1,450–$1,650/month without tax credits, depending on plan and region.

Employer-Sponsored Insurance

On average:

- Employees pay about $120–$160/month for individual coverage.

- Employers cover about 70–80% of the premium.

- Family plans through work cost employees about $500–$600/month, with the rest covered by the employer.

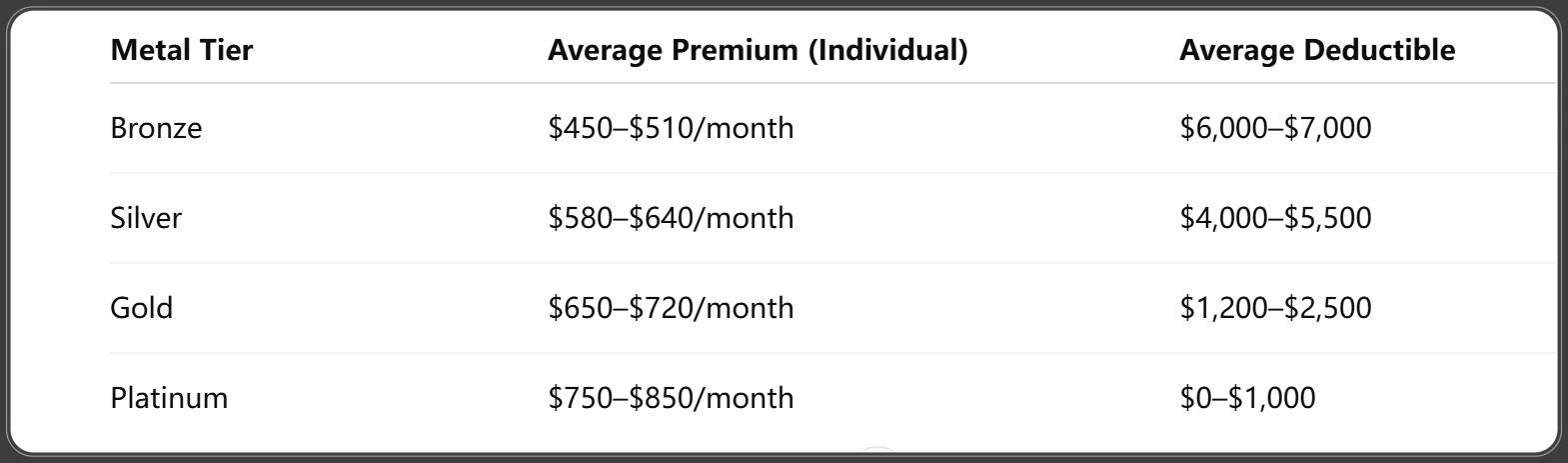

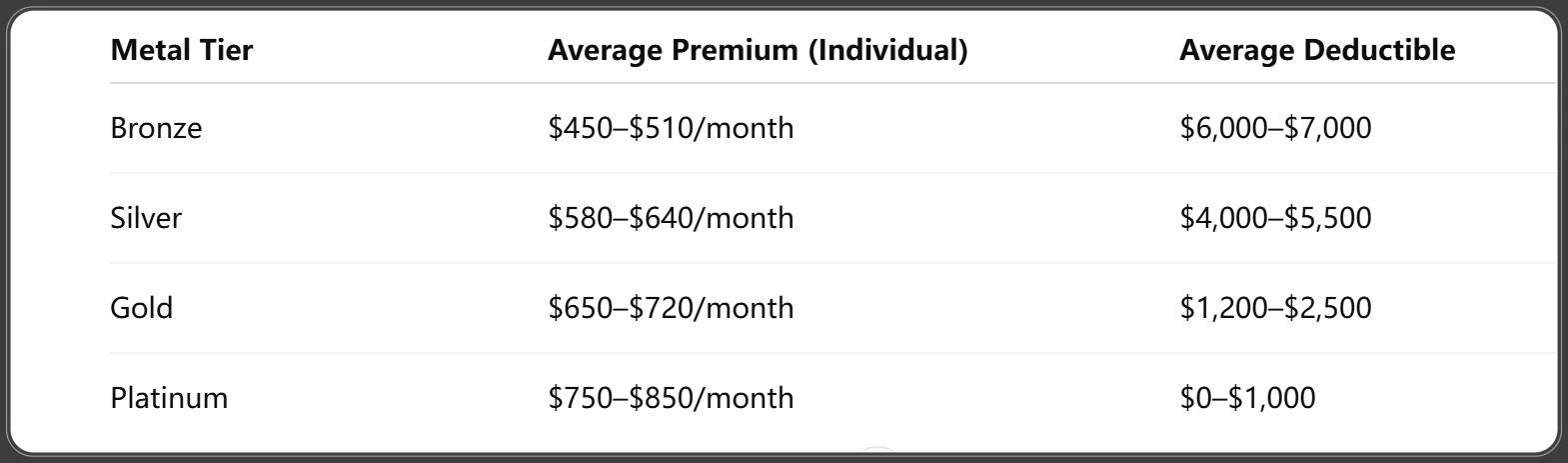

Average Health Insurance Cost by Metal Tier (ACA Plans)

Bronze, Silver, Gold, and Platinum Plans

Here’s what you can expect to pay in 2025 (before subsidies):

Which Metal Tier Offers the Best Value in 2025?

- Silver Plans remain the most popular due to their eligibility for Cost-Sharing Reductions (CSRs) if your income qualifies.

- Gold Plans are gaining popularity for those who use healthcare services frequently.

How Age and Gender Affect Premiums

Average Premiums by Age Bracket

Health insurance premiums typically increase with age due to a higher likelihood of healthcare usage. Here’s an overview of estimated monthly premium averages for individual ACA plans in 2025 (before subsidies):

PwC (PricewaterhouseCoopers). (2025, July 16). Medical cost trend: Behind the numbers. Retrieved July 16, 2025.

Note: ACA plans cannot charge seniors more than three times the premium of a younger adult.

Gender and Rate Differences

Under the ACA, gender cannot be used as a pricing factor for health insurance premiums. Both men and women pay the same base rate. However, women may have more predictable healthcare usage (e.g., maternity, gynecological care), which can influence plan choice, not cost.

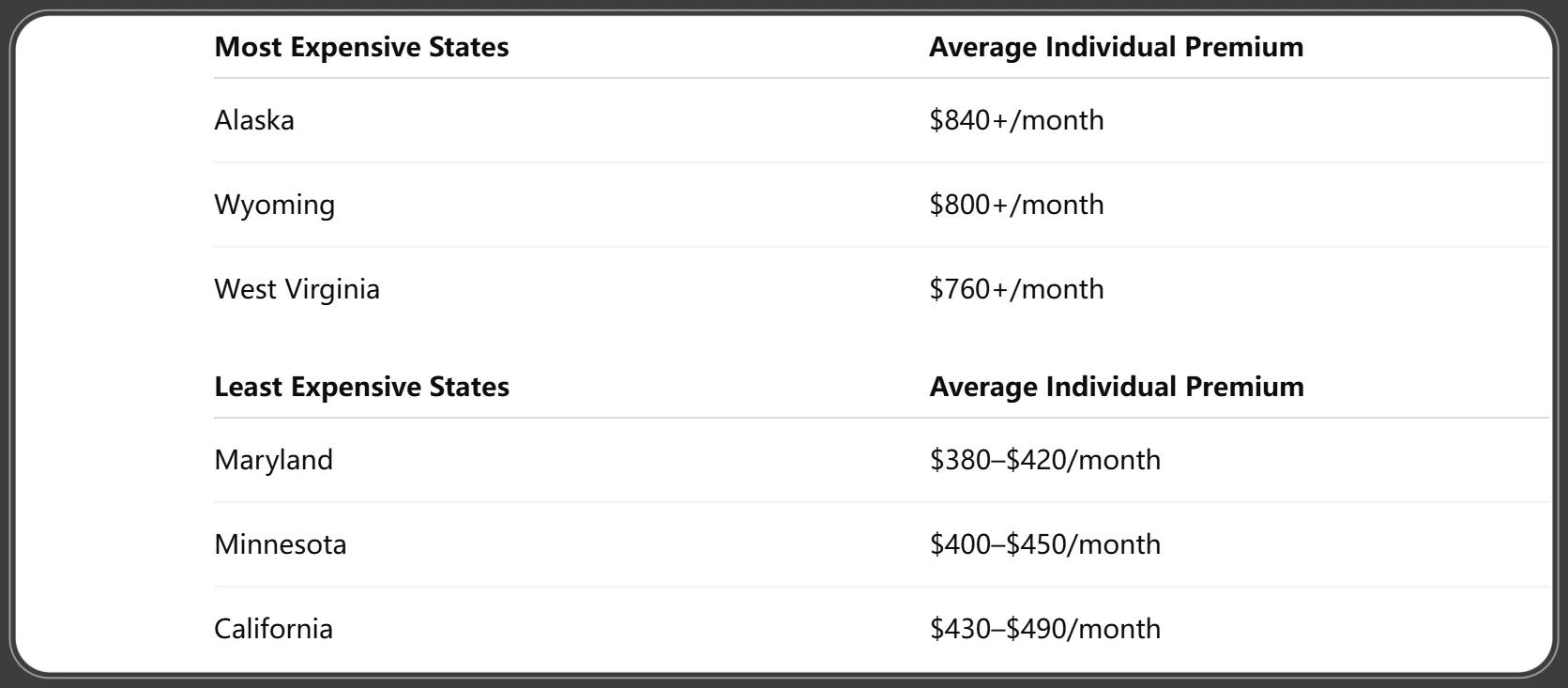

Regional Differences in Health Insurance Costs

Highest and Lowest Cost States in 2025

Health insurance prices vary drastically across states due to local regulations, competition, and healthcare infrastructure. Here's a quick breakdown:

McKinsey & Company. (2025, January 10). What to expect in US healthcare in 2025 and beyond. Retrieved January 10, 2025.

Urban vs. Rural Premium Variation

- Urban areas often have more provider competition, which can lower premiums.

- Rural areas tend to have fewer hospitals and doctors, leading to higher costs and limited plan choices.

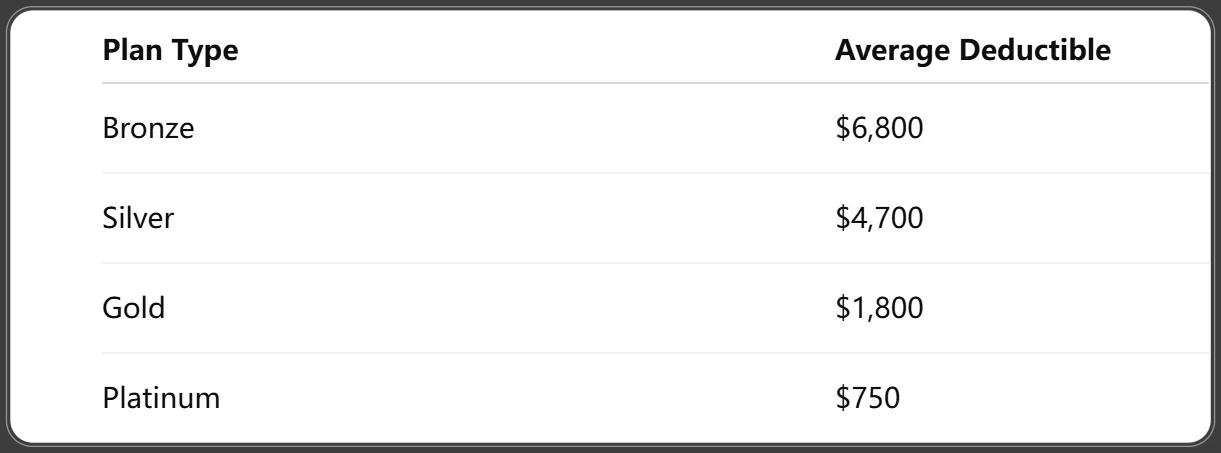

Deductibles, Copays, and Out-of-Pocket Maximums

Average Deductibles by Plan Type

In 2025, these are the average annual deductibles for ACA plans:

PNC Financial Services Group. (2025, April 4). The 2025 Health Insurance Industry Outlook. Retrieved April 4, 2025.

High deductible health plans (HDHPs), which are often Bronze or Catastrophic plans, offer lower premiums but higher upfront costs.

Hidden Costs Beyond Premiums

Besides premiums and deductibles, expect to pay:

- Copays: $20–$75 per visit depending on the service.

- Coinsurance: Typically 20%–40% after your deductible is met.

- Prescription costs: May vary widely, especially for specialty drugs.

The out-of-pocket maximum (OOPM) in 2025 for ACA plans is:

- Individual: $9,450

- Family: $18,900

Impact of Income and Subsidies (ACA Marketplace)

Premium Tax Credits Explained

If you earn between 100%–400% of the federal poverty level (FPL), or even higher under updated ACA rules, you're likely eligible for premium tax credits.

For example, in 2025:

- A single person earning under $58,320 may qualify.

- A family of four earning under $120,000 may qualify.

These tax credits are applied monthly to reduce your premium, often dramatically.

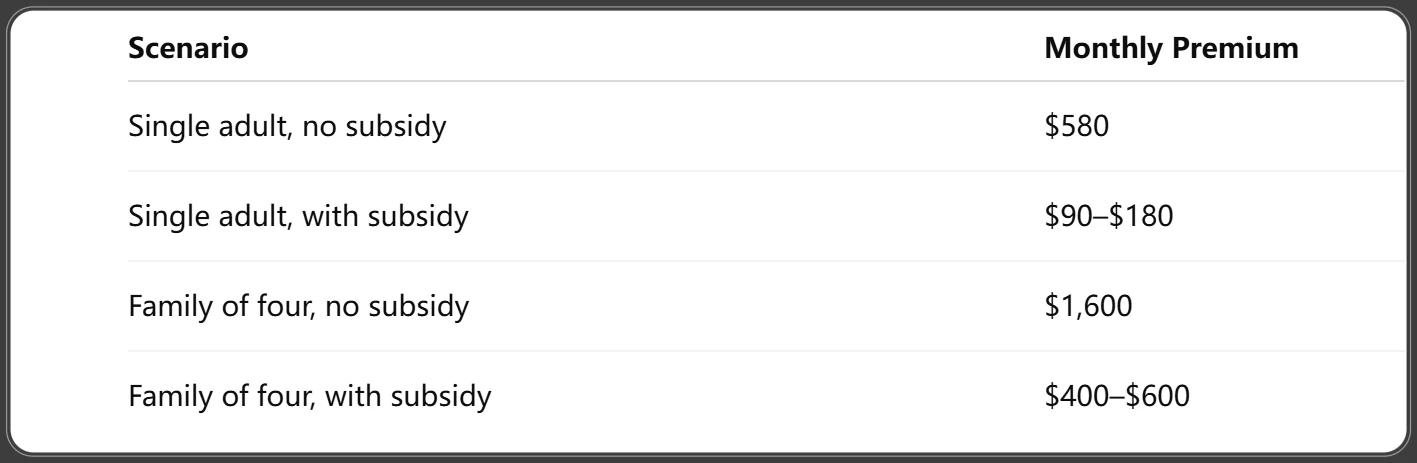

Average Costs With vs. Without Subsidies

Reuters. (2025, September 4). U.S. employee health insurance premiums to rise 6% next year, Mercer says. Retrieved September 4, 2025.

Subsidies can turn a costly ACA plan into an affordable option for middle-income households.

Health Insurance Cost Trends Over the Last 5 Years

2020–2025 Price Increases

Health insurance costs have risen slowly but steadily due to:

- Medical inflation

- Increased drug costs

- Hospital consolidation

- Policy changes

From 2020 to 2025, average premiums have risen:

- Individual plans: About 12% total

- Employer plans: About 16% total

Why Costs Are Rising or Stabilizing

Recent stabilization in some markets is due to:

- More ACA plan participation

- Premium caps from legislation

- Expansion of Medicaid in many states

However, specialty drug pricing and provider shortages may continue to push costs upward in 2025 and beyond.

Special Cases: Short Term and Student Health Plans

Average Cost of Short Term Plans

Short term health insurance, which covers limited periods, often costs $60–$200/month for individuals. These plans:

- Have limited benefits

- Often exclude pre-existing conditions

- Are not ACA-compliant

College & University Health Coverage

Student health plans are usually subsidized by institutions and cost around:

- $100–$250/month

- Coverage often includes basic doctor visits, labs, and emergency care

These can be excellent options for full-time students under 30.

How to Lower Your Health Insurance Costs

Choosing the Right Metal Tier

If you’re healthy and rarely visit doctors, a Bronze or Silver plan may save you money overall—even if the deductible is high.

If you expect regular care or prescriptions, consider Gold or Platinum for lower out-of-pocket expenses.

HSAs and Wellness Discounts

- Health Savings Accounts (HSAs): Available with high-deductible plans; offer tax benefits.

- Wellness Programs: Some insurers offer premium discounts for gym memberships, non-smoking status, or regular checkups.

Compare all benefits—not just premium—to make the best financial decision.

Tools for Comparing and Estimating Your Cost

Online Calculators and Marketplaces

Use trusted tools like:

- Healthcare.gov Plan Finder

- KFF Health Insurance Calculator

- State-run exchanges (e.g., Covered California, NY State of Health)

Consulting Licensed Brokers

A licensed health insurance broker can:

- Help you navigate plans

- Explain costs and subsidies

- Assist with enrollment—at no extra charge to you

FAQs About Average Health Insurance Costs in 2025

What’s the national average for 2025?

Roughly $580/month for individual coverage before subsidies, and $1,600/month for family coverage.

How do employer plans compare to ACA plans?

Employer plans are often cheaper for employees due to shared costs, but can be limited in flexibility.

Are premiums higher for smokers?

Yes. Insurers can charge up to 50% more for tobacco users under federal guidelines.

Can I get insurance cheaper off the marketplace?

Sometimes, but you lose access to premium tax credits, which often makes ACA plans the better deal.

Do children’s premiums cost the same as adults?

No. Children typically cost less, with lower premiums and deductibles.

How does dental/vision affect my cost?

Adding dental or vision raises your monthly premium by $20–$50 per person, depending on provider and coverage.

Conclusion: Plan Ahead for 2025 Health Insurance Costs

Navigating the average cost of health insurance in 2025 can be overwhelming, but armed with the right information, you can make confident, cost-effective decisions. From ACA subsidies to employer-sponsored plans and regional differences, it's never been more important to compare your options carefully.

Take advantage of free tools, speak with experts, and evaluate your health needs honestly—because smart planning today means peace of mind tomorrow.

You Might Also Like

Top 10 Affordable Health Insurance for Students 2025

Jul 31, 2025Open Enrollment 2025 Dates: Key Deadlines, Updates & What You Must Know

Jul 31, 2025Top 10 Best Health Insurance for Self Employed 2025: Affordable & Trusted Plans

Jul 31, 2025Top 5 Providers Who Offer Short Term Health Insurance in 2025

Jul 31, 20252025 Shocking Truth: What is a Deductible in Health Insurance?

Jul 31, 2025