Top 10 Best Health Insurance for Self Employed 2025: Affordable & Trusted Plans

Published on July 31, 2025

Alex Thompson

Insurance Data Analyst & Content Strategist

Alex Thompson analyzes insurer data and market trends to produce objective rate comparisons, annual cost studies, and interactive saving guides.

Top 10 Best Health Insurance for Self Employed 2025: Affordable & Trusted Plans

Introduction to Health Insurance for the Self-Employed

Why Health Insurance is Crucial in 2025

As the freelance economy grows, more people are stepping away from traditional 9-to-5 jobs and becoming their own bosses. This shift comes with great freedom—but also with new responsibilities. One of the most important? Finding the best health insurance for self employed 2025.

In 2025, healthcare costs are expected to rise again. Medical emergencies, ongoing treatments, and even routine check-ups can lead to financial strain without proper coverage. That’s why securing a reliable insurance plan isn’t optional—it’s essential.

Challenges Self-Employed Professionals Face

Self-employed workers don’t have access to employer-sponsored insurance, which usually covers a large chunk of the premium. That means they must navigate a sea of confusing terms, fluctuating premiums, and varying coverage levels—all while managing their businesses.

Common hurdles include:

- High monthly premiums

- Unpredictable out-of-pocket costs

- Lack of group coverage discounts

- Limited access to employer-negotiated networks

Thankfully, there are excellent options available in 2025 designed specifically for the self-employed.

Key Features to Look for in a Health Plan

Coverage Options

Start by considering what your policy actually covers:

- Inpatient & outpatient services

- Prescription drugs

- Preventive care & screenings

- Mental health services

- Specialist visits

A good plan balances these without overwhelming your budget.

Deductibles and Premiums

Look for a healthy balance between deductibles (how much you pay before insurance kicks in) and monthly premiums. Some plans may offer low monthly premiums but have very high deductibles, which could hurt during a medical emergency.

Network Size and Accessibility

Check if your preferred doctors, clinics, or hospitals are in-network. Plans with broader networks give you more flexibility, especially if you travel or relocate often.

Top 10 Health Insurance Providers for Self-Employed in 2025

Here's a rundown of the top choices this year based on affordability, network strength, and customer satisfaction.

1. Blue Cross Blue Shield

With nationwide coverage and flexible plans, BCBS is a top pick for freelancers who want reliable care anywhere in the U.S.

2. UnitedHealthcare

Known for robust network coverage and comprehensive digital health tools, UHC is great for tech-savvy solopreneurs.

3. Kaiser Permanente

Ideal for those in regions where Kaiser operates, it offers excellent integrated care and top-rated customer service.

4. Oscar Health

This startup disruptor offers user-friendly interfaces and affordable plans tailored for younger self-employed professionals.

5. Cigna

Offers strong international and domestic coverage, great for digital nomads and travel bloggers.

6. Aetna

A great balance of cost and benefits, with a focus on preventive care and wellness programs.

7. Molina Healthcare

Affordable ACA-compliant plans with strong availability in several states.

8. Ambetter

Competitive pricing and accessible care, especially for individuals and families in the South and Midwest.

9. National General

Perfect for short-term or temporary coverage—great for freelancers between gigs.

10. Freelancers Union (in partnership with Oscar)

Tailored health plans and group benefits designed specifically for independent workers.

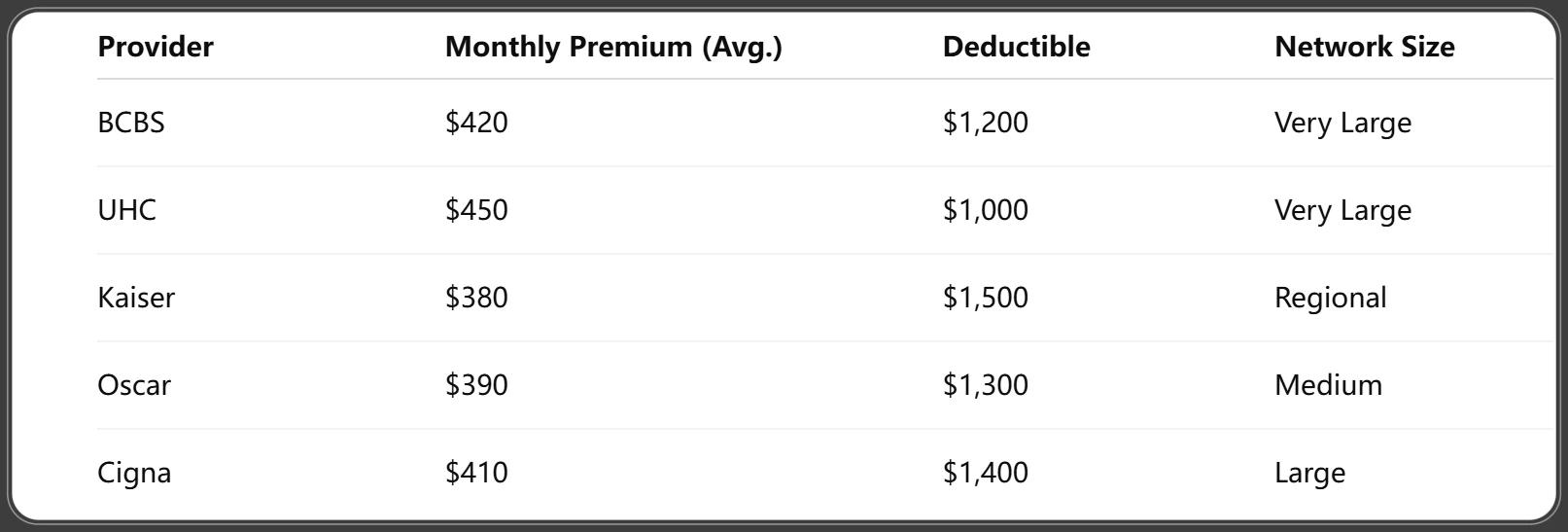

Comparison of Health Insurance Plans

Monthly Premiums Comparison Table

Washington Post. (2025, August 8). The price increases that should cause Americans more alarm. Retrieved August 8, 2025.

Out-of-Pocket Costs

Watch for hidden fees like:

- Co-payments

- Co-insurance percentages

- Emergency room surcharges

Best for Families vs Individuals

- Best for Families: UnitedHealthcare, Blue Cross Blue Shield

- Best for Individuals: Oscar Health, Freelancers Union

How to Choose the Right Plan for Your Needs

Evaluating Your Medical Needs

Do you:

- Visit doctors frequently?

- Take prescription medications?

- Need mental health support?

If yes, prioritize comprehensive coverage. If not, a high-deductible, low-premium plan may suffice.

Budget Planning

Don’t just look at monthly premiums. Consider:

- Deductibles

- Co-pays

- Prescription costs

- Emergency fund capacity

Using Online Comparison Tools

Sites like HealthCare.gov, eHealth, and PolicyGenius make it easier to compare plans based on your ZIP code, income, and coverage needs.

Government Assistance and ACA Options

Affordable Care Act Benefits

Under the ACA, many self-employed people qualify for subsidies based on income. In 2025, new legislation has extended and increased these subsidies.

HealthCare.gov for Freelancers

You can buy plans through the federal marketplace with options including:

- Bronze, Silver, Gold, Platinum tiers

- Subsidy calculators

- Customer support for freelancers

Medicaid & CHIP

If your income is low or inconsistent, you may qualify for Medicaid or your children may qualify for CHIP, depending on your state.

Tax Benefits for Self-Employed Health Insurance

Self-Employed Health Insurance Deduction

You can deduct 100% of your health insurance premiums from your taxable income if you:

- Show a net profit

- Aren’t eligible for employer-sponsored coverage elsewhere

HSA (Health Savings Account) Perks

Pairing a high-deductible health plan (HDHP) with an HSA lets you:

- Save money tax-free

- Use it for medical expenses

- Roll over unused funds yearly

Short-Term and Catastrophic Health Plans

When Short-Term Plans Make Sense

Best for:

- Those between jobs

- Young, healthy freelancers

- Waiting for ACA enrollment windows

Pros and Cons of Catastrophic Coverage

Pros:

- Ultra-low premiums

- Emergency coverage

Cons:

- High deductibles

- Limited routine care coverage

Group Health Insurance Options for Freelancers

Associations & Cooperatives

Join trade groups or professional networks that offer group rates, such as:

- National Association for the Self-Employed (NASE)

- Local chambers of commerce

Freelancers Union and Similar Networks

The Freelancers Union provides:

- Affordable group plans

- Legal resources

- Member discounts

Telehealth and Virtual Care Trends in 2025

Insurers That Prioritize Telemedicine

- Oscar Health

- Kaiser Permanente

- Cigna

These insurers offer 24/7 virtual doctor visits, often for $0 co-pay.

Virtual Care Accessibility

Increased rural coverage and mental health access are standout benefits for remote workers and digital nomads.

International Health Insurance for Digital Nomads

Global Coverage Options

- Cigna Global

- SafetyWing

- IMG Global

These offer flexible plans that cover multiple countries, including emergency evacuations.

Nomad-Friendly Providers

Look for:

- Online claims

- 24/7 support

- No home-country restrictions

Real-Life Case Studies and Testimonials

Case Study: A Freelancer in California

Maria, a freelance web designer, chose a Silver ACA plan through Blue Shield CA with subsidies that cut her premium by 40%.

Case Study: Digital Nomad in Thailand

Jake uses SafetyWing for international coverage while working remotely from Asia. He pays under $50/month for emergency and basic care.

Common Mistakes to Avoid When Buying Health Insurance

Ignoring Hidden Costs

Some freelancers choose the lowest premium but end up paying more later due to:

- High deductibles

- Prescription exclusions

Overlooking Mental Health Coverage

Mental health support is vital. Make sure your plan includes:

- Therapy

- Psychiatry

- Substance abuse care

FAQs about Best Health Insurance for Self Employed 2025

1. Can I get health insurance if I have pre-existing conditions?

Yes, all ACA-compliant plans cover pre-existing conditions with no extra charges.

2. Is there a penalty for not having health insurance in 2025?

Some states still enforce penalties. Check your state’s law for details.

3. Can I change my plan mid-year?

Only during Special Enrollment Periods (e.g., major life events like marriage or moving).

4. Is health insurance tax deductible for freelancers?

Yes, premiums are deductible if you're self-employed and not eligible for employer coverage.

5. What if I work part-time and freelance?

You can still apply for self-employed insurance if your freelance income is significant.

6. What's the cheapest option for basic coverage?

Short-term or Bronze ACA plans often have the lowest premiums.

Conclusion and Final Recommendations

Summary of Best Options

For most self-employed individuals, ACA-compliant plans through HealthCare.gov, or tailored policies from Oscar Health, Cigna, and Freelancers Union, provide a reliable mix of affordability and coverage.

Expert Tip for Peace of Mind

Always evaluate your medical needs annually and explore new plans each open enrollment. The best health insurance for self employed 2025 is one that evolves with you.

You Might Also Like

Top 10 Affordable Health Insurance for Students 2025

Jul 31, 2025Open Enrollment 2025 Dates: Key Deadlines, Updates & What You Must Know

Jul 31, 2025Revealed: The Average Cost of Health Insurance 2025 & How to Save Big

Jul 31, 2025Top 5 Providers Who Offer Short Term Health Insurance in 2025

Jul 31, 20252025 Shocking Truth: What is a Deductible in Health Insurance?

Jul 31, 2025