Top 10 Affordable Health Insurance for Students 2025

Published on July 31, 2025

Alex Thompson

Insurance Data Analyst & Content Strategist

Alex Thompson analyzes insurer data and market trends to produce objective rate comparisons, annual cost studies, and interactive saving guides.

Affordable Health Insurance for Students 2025

Introduction to Student Health Insurance in 2025

In 2025, the importance of affordable health insurance for students has never been greater. Rising medical costs, ongoing mental health challenges, and the uncertainty of life after high school or college make proper coverage a top priority for anyone enrolled in a post-secondary program.

Why Health Insurance Matters for Students

Students often experience stress, irregular schedules, and exposure to new environments — all of which can affect their physical and mental health. Whether it’s a sports injury, a sudden illness, or needing therapy sessions, insurance ensures students won’t face overwhelming bills.

Rising Costs and the Need for Coverage

Healthcare costs have steadily risen over the past decade. In 2025, the average ER visit can cost anywhere from $1,200 to $3,000 without insurance. Even basic doctor visits can strain a student’s budget. That’s why finding an affordable, tailored plan is crucial.

Key Features of Student Health Insurance Plans

Most student-focused plans are designed to offer coverage that balances affordability with the essentials young adults need.

Age Eligibility and Dependents

Typically, students aged 18-26 qualify for student health plans. Many can stay on a parent’s plan until age 26, but others — especially independent or international students — need standalone coverage.

Coverage for Pre-Existing Conditions

Under the Affordable Care Act (ACA), all marketplace plans are required to cover pre-existing conditions. This remains a vital protection for students managing chronic illnesses or previous diagnoses.

Mental Health and Wellness Services

Increased awareness around mental health has led to broader coverage for counseling, therapy, and even psychiatric medications — now standard in most student health policies.

Types of Affordable Student Health Insurance

There’s no one-size-fits-all solution, but here are the most common and budget-friendly options:

School-Sponsored Health Plans

Many universities offer tailored insurance policies with access to campus health centers. These are often comprehensive and competitively priced, especially when part of a student’s tuition package.

Medicaid and CHIP for Low-Income Students

In states that expanded Medicaid, many students may qualify based on income alone. The Children's Health Insurance Program (CHIP) is another option for younger college attendees from qualifying families.

Short-Term and Catastrophic Plans

Short-term insurance is a temporary, low-cost option. It offers limited coverage but can be a good fit between jobs or semesters. Catastrophic plans offer bare-bones protection with very low monthly premiums but high deductibles.

Marketplace Plans (ACA-Compliant)

Plans purchased through HealthCare.gov or state exchanges offer full ACA protection and can be subsidized based on income. Students under a certain income threshold can qualify for very low-cost bronze or silver plans.

Cost Comparison of Health Plans in 2025

Understanding the true cost of health insurance goes beyond just premiums.

Average Premiums for Students

In 2025, premiums range from $80–$250/month depending on the type of plan and location.

Deductibles, Copays, and Out-of-Pocket Costs

A low monthly premium may mean higher deductibles. Most student plans include $15–$30 copays for basic services and annual out-of-pocket limits between $2,000–$7,000.

Tips to Maximize Benefits on a Budget

- Choose in-network providers

- Use campus clinics when possible

- Stick with generic medications

- Take advantage of free annual checkups and mental health screenings

Best Health Insurance Providers for Students 2025

Finding the right insurer can make a significant difference in your healthcare experience. In 2025, several providers stand out for offering affordable, student-focused plans with comprehensive benefits.

Blue Cross Blue Shield

With coverage in all 50 states, Blue Cross Blue Shield offers student health plans through many colleges. Their PPO networks are expansive, making it easy for students to find nearby doctors and hospitals.

UnitedHealthcare StudentResources

Specifically tailored to higher education institutions, UnitedHealthcare offers customizable plans that often include telehealth, prescription coverage, and mental health services at no extra cost.

Kaiser Permanente

Kaiser’s integrated care model combines insurance with healthcare delivery, which works well for students who want convenience. They offer low-premium plans with robust preventive care services in several states.

Aetna Student Health

Partnering with over 200 universities, Aetna provides dedicated student plans with strong benefits for mental health, urgent care, and prescriptions. Their plans are particularly strong in urban areas and college towns.

How to Choose the Right Student Health Plan

Choosing wisely can save students thousands of dollars and ensure they receive quality care when they need it.

Assessing Your Healthcare Needs

Students should consider:

- Frequency of medical visits

- Existing prescriptions or treatments

- Risk of sports injuries or mental health needs

Comparing Plans and Networks

Always review:

- In-network providers near campus

- Emergency room vs. urgent care coverage

- Access to specialists

Checking Prescription and Specialist Coverage

Some plans have limited formularies or require pre-approval for specialist visits. Be sure to check:

- Tier levels for medications

- Psychiatric care or therapy limits

- Lab work and diagnostic imaging coverage

Tips to Lower Health Insurance Costs as a Student

Lowering your health insurance costs without compromising coverage is possible if you apply these strategies:

Use Preventive Services

Annual check-ups, vaccines, and screenings are often covered at 100% under ACA-compliant plans. Preventing illness is far cheaper than treating it.

Access Campus Clinics

Most schools include access to a student health center, which can offer:

- Free or low-cost doctor visits

- Mental health counseling

- Diagnostic testing and prescriptions

Apply for Subsidies and Tax Credits

Marketplace plans offer premium subsidies based on income. Students working part-time or declaring low earnings often qualify for:

- Premium tax credits

- Cost-sharing reductions

Health Insurance for International Students

Students studying in the U.S. on F-1 or J-1 visas must meet specific health insurance requirements.

Visa Requirements for Health Insurance

The U.S. State Department mandates that J-1 visa holders carry specific minimum insurance coverage, including:

- Medical benefits of at least $100,000 per accident or illness

- Emergency evacuation and repatriation of remains

Best Plans for F-1 and J-1 Visa Holders

Providers like ISO Student Health Insurance, IMG, and StudentSecure offer customized international student plans that comply with visa rules and university policies.

Tips for Using Insurance Abroad

- Always carry your insurance ID

- Know where to find in-network care

- Use telehealth for non-urgent issues

What’s New in 2025 for Student Health Insurance?

This year brings several upgrades to student-focused healthcare services.

Telehealth Expansion and Digital Services

Telehealth is now standard in nearly all plans, often with no copay. Features include:

- 24/7 virtual urgent care

- Mental health therapy sessions

- Online prescription renewals

Mental Health Benefits

Plans now offer up to 20+ therapy visits per year, including virtual group therapy. Some include wellness apps like Headspace or Calm as part of their benefits.

AI and Personalized Wellness Programs

AI-powered health coaches, chatbots, and symptom checkers help students monitor their health, track goals, and reduce unnecessary visits to clinics.

State-by-State Guide to Student Health Insurance

Medicaid Expansion States

In 2025, 40+ states have expanded Medicaid. If you're a low-income student, states like California, New York, and Illinois offer free or low-cost coverage.

States with Student Subsidies

States like Massachusetts, Connecticut, and Vermont offer special subsidies and lower premium thresholds for full-time students.

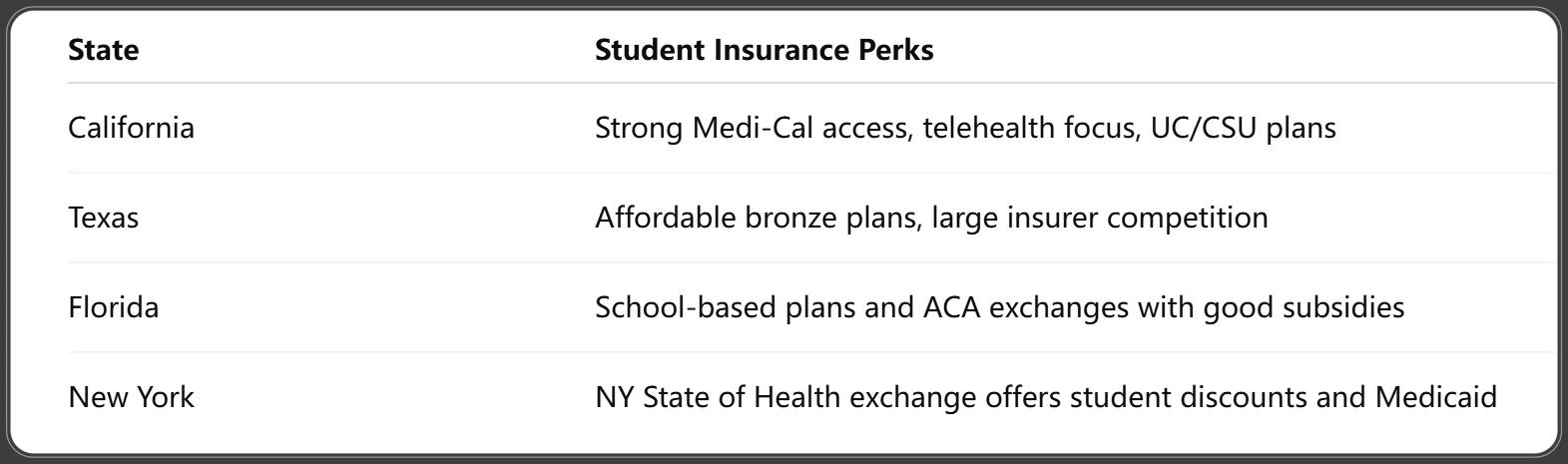

California, Texas, Florida, New York Highlights

Investopedia. (2025, July). Health insurance premiums are rising in 35 states-Is yours one of them? Retrieved July 2025.

Financial Aid and Health Insurance Integration

Can FAFSA Cover Health Insurance?

While FAFSA doesn’t directly cover insurance, it can increase your financial aid award. Some schools allow excess funds to pay for school-sponsored health plans.

Linking University Aid to Coverage

If your university offers grants or scholarships for healthcare, ensure you opt into their coverage during enrollment.

Work-Study and On-Campus Jobs with Benefits

Many on-campus jobs now provide partial health benefits or access to free clinics. Check with your school's HR or student services.

Enrollment Process for Student Health Plans

Open Enrollment Dates for 2025

Marketplace open enrollment typically runs from November 1 to January 15. Some states extend deadlines, so check local exchanges.

Special Enrollment for Life Events

Students may qualify for special enrollment if they:

- Lose coverage from parents

- Move to a new state

- Experience a change in income

Required Documents and Portals

You’ll need:

- Proof of school enrollment

- Proof of income (if applying for subsidies)

- Legal ID (passport or driver’s license)

Common Pitfalls to Avoid When Buying Insurance

Ignoring Network Limitations

Out-of-network care is often not covered. Always check which hospitals and doctors are included.

Skipping the Fine Print

Review the full summary of benefits to understand exclusions like:

- Pre-existing condition waiting periods (non-ACA plans)

- Therapy session limits

- Prescription exclusions

Failing to Compare Quotes

Even within the same exchange or school, plan prices can vary significantly. Use comparison tools or a broker if needed.

FAQs About Affordable Health Insurance for Students 2025

1. Can I stay on my parent’s health insurance plan as a student in 2025?

Yes, you can stay on a parent’s plan until age 26, even if you are not living with them or are financially independent.

2. What is the best affordable insurance for full-time college students?

University-sponsored plans or subsidized ACA marketplace plans often offer the best coverage-to-cost ratio.

3. How much does student health insurance typically cost in 2025?

Costs range from $80–$250/month depending on location, type of plan, and coverage level.

4. Are mental health services included in student insurance?

Yes, most ACA-compliant and university plans now include mental health services such as therapy and counseling.

5. Can international students get health insurance in the U.S.?

Yes, through specialized plans from companies like ISO, IMG, and StudentSecure, which meet visa and university requirements.

6. Do part-time students qualify for health insurance?

Some plans require full-time status, but part-time students can still access marketplace or Medicaid options based on income.

Conclusion

In 2025, securing affordable health insurance for students isn't just smart—it's essential. With a wide range of options, from school-sponsored plans to marketplace coverage and Medicaid, there’s something for every budget and need. Prioritize your well-being and make the most of the healthcare resources available to you today. Your future self will thank you.

You Might Also Like

Health Insurance Waiting Period 2025: What You Must Know Before Enrolling

Jul 31, 2025How to Appeal Health Insurance Denial 2025: Step-by-Step Guide to Win Your Case

Jul 31, 2025Open Enrollment 2025 Dates: Key Deadlines, Updates & What You Must Know

Jul 31, 2025Top 10 Best Health Insurance for Self Employed 2025: Affordable & Trusted Plans

Jul 31, 2025Revealed: The Average Cost of Health Insurance 2025 & How to Save Big

Jul 31, 2025