Maximize Your Savings: 17 Car Insurance Discounts and How to Qualify in 2025

Published on July 28, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

Maximize Your Savings: Car Insurance Discounts and How to Qualify

When it comes to saving money on car insurance, many drivers miss out on hidden opportunities. What if we told you that you could cut your premiums by hundreds of dollars a year—just by asking the right questions or tweaking a few details? This article will teach you how to maximize your savings: car insurance discounts and how to qualify for each one. Whether you're a new driver, a seasoned motorist, or someone looking to switch providers, these insights could lead to serious savings.

Understanding Car Insurance Discounts

What Are Car Insurance Discounts?

Car insurance discounts are reductions in your policy premiums based on your behavior, driving record, vehicle type, or affiliations. They’re offered by nearly every major insurer as a way to reward low-risk customers or incentivize specific actions.

How Discounts Affect Premiums

Discounts don’t usually come off the entire premium but are applied to specific parts like liability, collision, or comprehensive. The impact can still be substantial. A 10% discount on a $1,500 policy could save you $150 annually.

Who Is Eligible for Discounts?

Eligibility varies by provider, but factors may include:

- Clean driving history

- Student or senior status

- Certain vehicle features

- Participation in telematics programs

- Being part of specific organizations

Types of Common Car Insurance Discounts

Good Driver Discount

If you haven’t had an accident or traffic violation in the past 3–5 years, you're likely eligible. Some companies offer up to 25% off for accident-free driving.

Multi-Policy Discount

Bundling car insurance with home, renters, or even life insurance can get you 10–25% off both policies.

Multi-Vehicle Discount

Insuring more than one vehicle with the same company? That’s an easy way to save 10–20%.

Defensive Driving Course Discount

Completing an approved safety course—especially for seniors or teens—can earn discounts and improve your driving skills.

Low Mileage Discount

Drive under 7,500–10,000 miles per year? Some insurers give lower rates to less frequent drivers because they’re considered lower risk.

Vehicle-Based Discounts

Safety Equipment Discounts

Airbags, anti-lock brakes, lane departure warning systems, and more can all qualify your vehicle for discounts.

Anti-Theft Device Discount

If your car is equipped with LoJack, GPS tracking, or factory-installed anti-theft systems, you could see a 5–15% discount on comprehensive coverage.

Hybrid or Electric Vehicle Discount

Some companies reward eco-conscious driving. Owning a hybrid or electric car may reduce your premium by up to 10%.

Driver Profile Discounts

Student Discount (Good Grades)

If you're a high school or college student with a B average (3.0 GPA) or better, insurers often reward your academic responsibility.

Senior Discount

Drivers aged 55 and older may receive lower rates, especially if they complete a defensive driving course.

Military/Veteran Discount

Active-duty service members, veterans, and their families often qualify for special discounts with companies like USAA or GEICO.

Usage-Based Insurance and Telematics Programs

How Telematics Work

Telematics programs involve installing a device or using an app to track your driving habits—speed, braking, time of day, etc. Safe driving can lower your premium significantly.

Pros and Cons of Usage-Based Programs

ProsConsSave up to 30%Privacy concernsCustom pricingRate hikes for bad dataGreat for low-mileage driversRequires consent to monitoring

Best Telematics Apps in 2025

- Progressive Snapshot

- State Farm Drive Safe & Save

- Allstate Drivewise

Membership and Affiliation Discounts

Professional Organization Discounts

Are you a nurse, engineer, or teacher? Many insurers offer exclusive deals through trade unions or professional groups.

Employer or Union Affiliation

Large employers sometimes partner with insurers to offer employee-only discounts. Check your HR portal or benefits coordinator.

Alumni or College Associations

Graduates of certain universities can also receive lower rates—especially Ivy League or tech schools.

Renewal, Loyalty, and Paperless Discounts

Early Renewal Discounts

Renewing your policy 7–14 days before it expires often earns a small discount.

Loyalty or Retention Programs

Long-term customers may be rewarded after 3+ years with consistent renewals.

Going Paperless or Auto-Pay Discounts

Small but easy to qualify for—set up automatic payments or digital statements for a 1–5% discount.

Regional and State-Specific Discounts

Location-Based Premium Differences

Your ZIP code affects your rate. Living in a low-crime or low-traffic area often qualifies you for cheaper insurance.

Special State Programs (e.g., CA Low Cost Auto)

States like California and New Jersey offer programs for low-income drivers who meet certain criteria.

How to Qualify for These Discounts

Tips for Eligibility

- Keep your driving record clean.

- Install recommended vehicle safety features.

- Stay within low-mileage brackets.

- Ask your insurer about overlooked affiliations.

When to Ask for Discounts

- When starting or renewing a policy

- After a major life change (marriage, moving, job change)

- After improving your credit score

How Often to Review Your Discounts

Set a calendar reminder to review your policy every 6–12 months. New discounts may become available.

How to Combine and Stack Multiple Discounts

Rules on Stacking

Most insurers allow you to stack several discounts, although there may be a cap.

Maximizing Discount Value

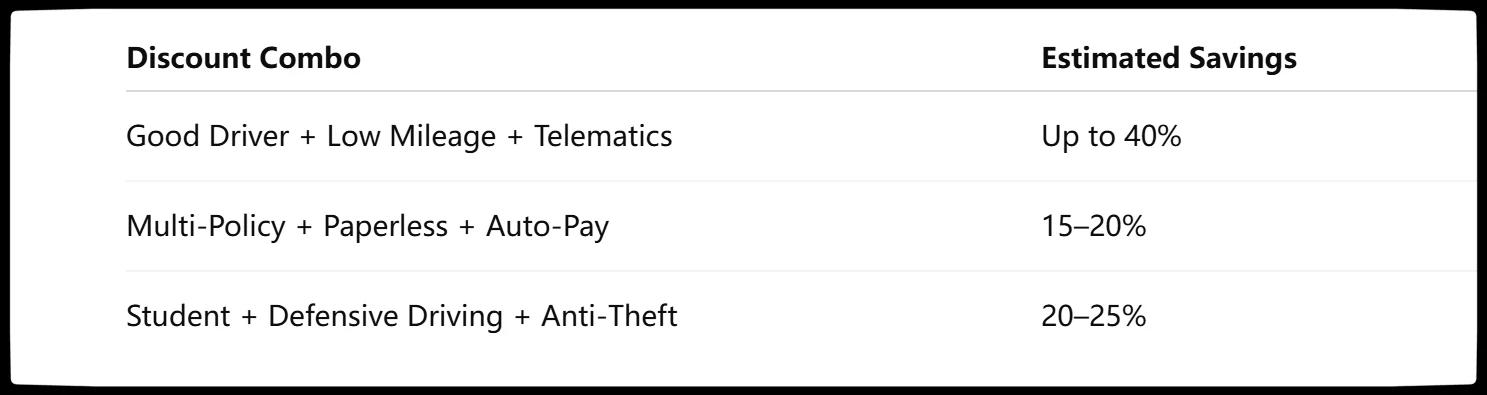

Combine vehicle-based and behavior-based discounts for maximum effect. For example, bundling + good driver + telematics = huge savings.

Common Combinations That Work

LexisNexis Risk Solutions. (2025, June 12). 2025 U.S. Auto Insurance Trends Report [Press release].

Mistakes to Avoid When Seeking Discounts

Not Disclosing Changes in Circumstances

If you moved or changed jobs, you may now qualify for new discounts—or lose old ones.

Failing to Update Policy Information

Incorrect mileage, vehicle usage, or occupation can disqualify you from discounts.

Ignoring Small, Stackable Discounts

Even 2–5% discounts can add up when you stack multiple savings.

Best Insurance Companies for Discounts in 2025

Top Providers for Drivers Under 30

- GEICO

- Progressive

- Nationwide

Best for Seniors

- AARP (through The Hartford)

- State Farm

- Allstate

Best for Families with Multiple Vehicles

- USAA (if eligible)

- Farmers

- Liberty Mutual

Using Insurance Comparison Tools to Find Discounts

Best Websites and Apps for 2025

- The Zebra

- Gabi

- Policygenius

- Compare.com

Pros and Cons of Aggregators

ProsConsOne-click comparisonMay miss hidden discountsBroad provider accessSome may call/email oftenTransparent pricingNot always fully up-to-date

Hidden Discounts Found via Comparison Sites

Some aggregators highlight special promotions, student offers, or state-specific programs you might otherwise miss.

How Discounts Can Change Over Time

Life Events That Impact Discounts

- Getting married

- Moving to a safer area

- New job with remote work

Annual Reassessment Strategy

Review your policy every year to stay current on what you qualify for. Providers change eligibility often.

Policy Reevaluation Triggers

- New vehicle purchase

- Addition of a teen driver

- Major repair or mileage reduction

Frequently Asked Questions

Can I qualify for more than one discount?

Yes! Most drivers qualify for multiple discounts at once, which can be stacked for major savings.

Do I need to reapply for discounts every year?

Some require requalification (like student discounts), while others roll over automatically.

Are all discounts available in every state?

No. Discounts vary by state due to local laws and provider rules.

What’s the biggest discount I can get?

With stacking, you can save up to 40–50% with some insurers—but that’s rare and depends on your profile.

Will using a telematics app increase my rate?

Only if you drive poorly. Many providers promise it won’t increase your rate—only reduce it.

How do I ask my agent about available discounts?

Just say: “Can you walk me through all the discounts I may qualify for?” They’ll usually be happy to help.

Conclusion: Don’t Leave Savings on the Table

There’s no reason to pay more for car insurance than you have to. Whether you’re a student, senior, low-mileage driver, or a parent with three cars in the driveway, there are discounts out there for you. By staying proactive, reviewing your policy often, and asking the right questions, you’ll be well on your way to maximizing your savings—starting today.

You Might Also Like

Compare Car Insurance: A Step‑by‑Step Guide to Finding the Right Policy (Expert 2025 Update)

Jul 29, 20252025 How to Find the Best Car Insurance Near You

Jul 28, 20252025 Car Insurance Guide for Young Drivers: Actionable Tips to Lower Your Rates

Jul 28, 20252025 SR‑22 Car Insurance Explained: Requirements, Costs, and Expert Tips

Jul 28, 2025Understanding Non‑Owner Car Insurance in the US: An Ultimate Guide

Jul 28, 2025